TLDR

- IBM tops Q2 estimates but stock dips 5% on cautious outlook and margin concerns

- Strong IBM Q2 beats marred by weak guidance, stock drops despite AI growth

- IBM revenue, profit surge; shares fall as investors eye tighter software margins

- AI, cloud drive IBM gains, but conservative outlook rattles market sentiment

- IBM crushes Q2 numbers, yet cautious tone and macro jitters sink after-hours

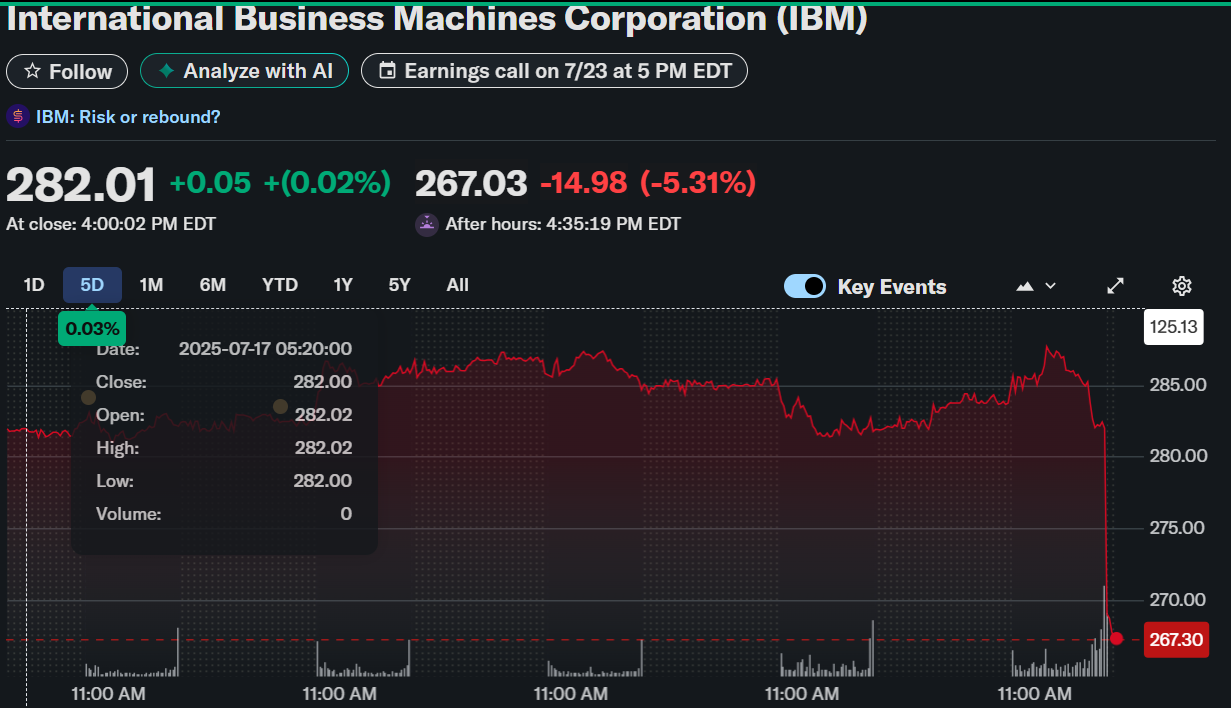

International Business Machines Corporation (IBM) shares dropped over 5% in after-hours of trading, closing at $282.01.

IBM reported strong second-quarter results, surpassing estimates for profit, revenue and cash flow. The company posted adjusted earnings per share of $2.80. Revenue reached $17.0 billion, rising 8% year-over-year and exceeding consensus. IBM also recorded $4.8 billion in free cash flow during the first half of 2025.

Despite solid financials, the market reacted negatively, possibly due to conservative revenue guidance and broader macroeconomic uncertainty. IBM maintained its full-year outlook for at least 5% revenue growth at constant currency. However, some areas of the business showed slower growth when adjusted for currency.

Software Segment Powers Growth but Margins Tighten Slightly

Software revenue grew 10% to $7.4 billion, driven by strong demand for hybrid cloud and automation solutions. Red Hat-led hybrid cloud sales surged 16%, while automation software also rose 16% from the same quarter last year. However, gross margin for software came in at 83.9%, slightly below the expected 84.0%.

$IBM Earnings:

– Revenue of $17.0 billion, up 8 percent, up 5 percent at constant currency

– EPS: $2.80

– Software revenue up 10 percent, up 8 percent at constant currency

– Consulting revenue up 3 percent, flat at constant currency

– Infrastructure revenue up 14 percent, up 11… pic.twitter.com/soAQo73iqQ— AlphaSense (@AlphaSenseInc) July 23, 2025

Data software revenue climbed 9%, with transactional processing growing just 1%, indicating uneven momentum across software units. On a constant currency basis, software revenue increased 8%, highlighting currency tailwinds in the quarter. Segment performance reflected IBM’s focus on expanding enterprise AI offerings and cloud-native platforms.

IBM’s AI-linked business portfolio grew to over $7.5 billion, according to company disclosures. That area combined transactional software revenue, new SaaS contracts, and AI consulting deals. Management emphasized AI and hybrid cloud as central growth pillars, but competition and pricing may pressure margins ahead.

Consulting and Infrastructure See Moderate to Strong Gains

Consulting revenue rose 3% to $5.3 billion, surpassing the $5.16 billion average estimate. Strategy and technology consulting increased by 1%, while intelligent operations improved by 5% year-over-year. Adjusted for currency, overall consulting growth remained flat, indicating mixed demand across sectors.

Infrastructure revenue increased 14% to $4.1 billion, driven by a 70% surge in IBM Z mainframe sales. Hybrid infrastructure rose 21%, although distributed infrastructure dropped 15%, reflecting product lifecycle dynamics. Infrastructure support declined 1%, contributing to a modest drag within the segment.

IBM launched its new z17 mainframe in the quarter, which contributed to the infrastructure spike. That rollout followed the acquisition of Hakkoda, a data and AI consulting firm. These moves align with IBM’s strategy to drive both hardware modernization and cloud migration services.

Cash Flow Strong, Outlook Reaffirmed Despite Market Drop

Free cash flow for the first half of the year reached $4.8 billion, up $300 million year-over-year. IBM generated $1.7 billion in operating cash flow during Q2 alone, slightly below the prior year. Despite this, Q2 free cash flow rose $200 million to $2.8 billion.

The company reaffirmed its 2025 free cash flow projection of over $13.5 billion, up from the April forecast. At the end of the quarter, IBM held $15.5 billion in cash and securities, up $700 million since year-end. Total debt increased to $64.2 billion, including $11.7 billion in financing-related obligations.

IBM declared a quarterly dividend of $1.68 per share, payable on September 10 to shareholders of record as of August 8. The firm has issued uninterrupted quarterly dividends since 1916. Despite the stock drop, management reiterated confidence in execution and capital return plans for the remainder of 2025.