ICO Review: Solve.Care

Solve.Care is offering a global blockchain solution for the coordination, administration, and payments systems in healthcare.

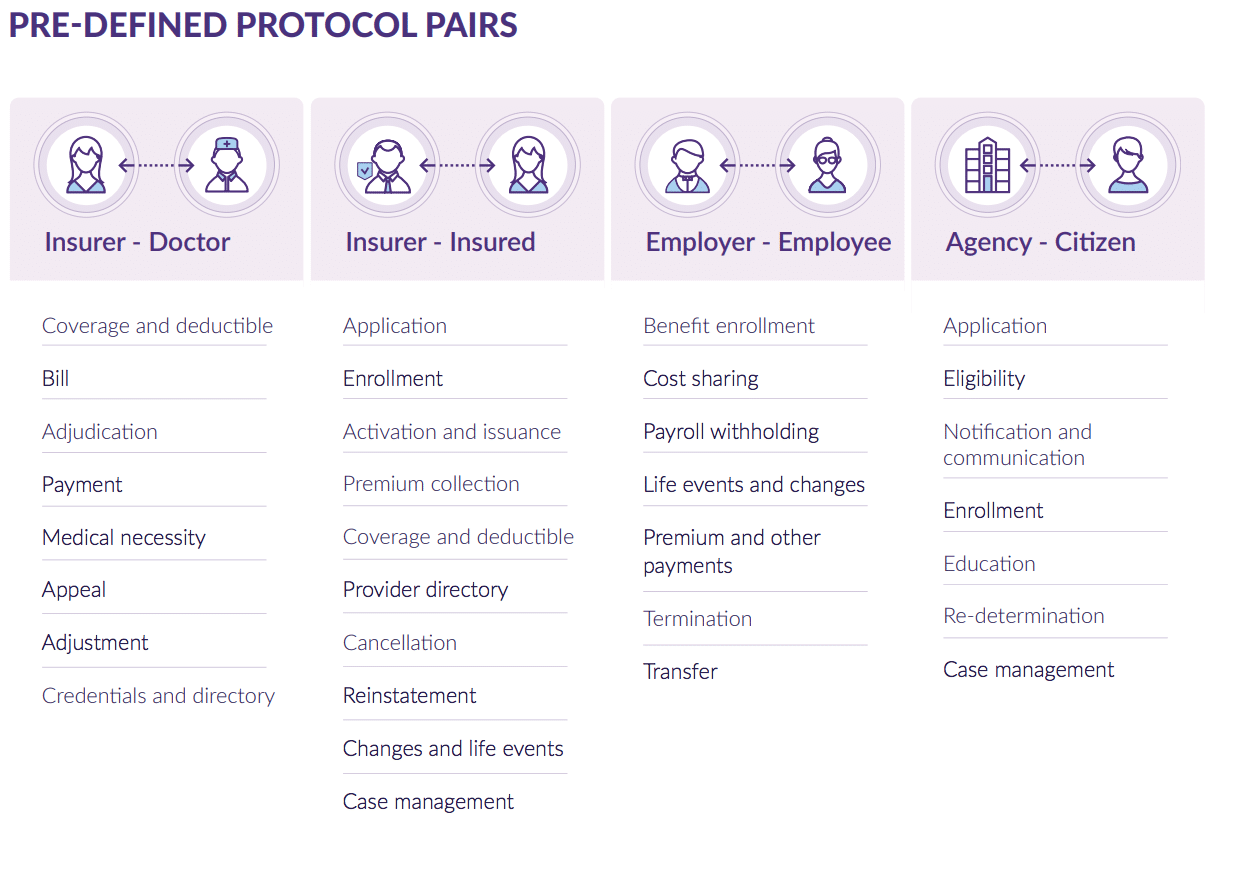

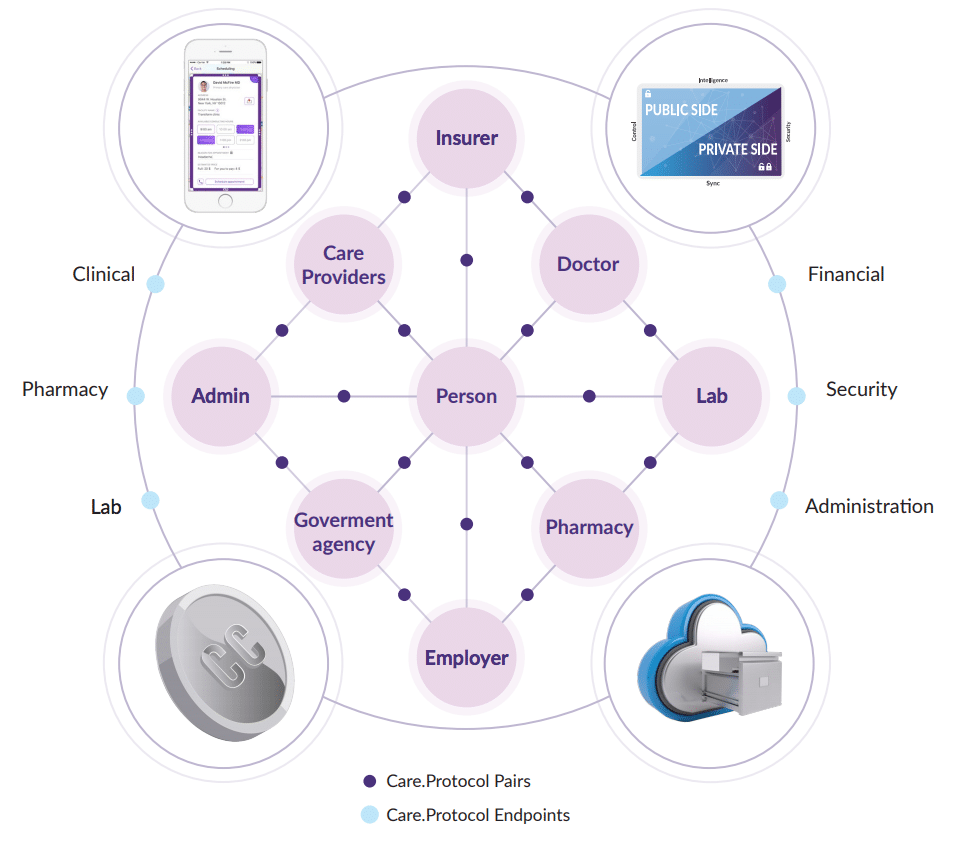

The Solve.Care platform aims to facilitate the direct interaction between consumers, insurers, and service providers to reduce costs, streamline payments, and ultimately improve health care access. Anyone from patients and employers to insurers and government agencies can make healthcare payments through the platforms.

The project will use blockchain to eliminate the bulk of healthcare costs by removing duplication, inefficiency, waste, abuse, and fraud from the system.

The Solve.Care whitepaper is fairly thorough and it’s recommended you give it a good read if you are considering investing or are otherwise curious about how a substantial issue in the healthcare industry can be solved. This review will go over just a few of the core components of the project.

The Opportunity

Nothing to see here. The healthcare industry is perfect and there is NOTHING wrong with it. Anyone and everyone in the world can receive access to affordable healthcare with zero issues or bank-breaking insurance policies.

Unfortunately, we know this to be false. Solve.Care is looking to address a massive problem in a gargantuan industry.

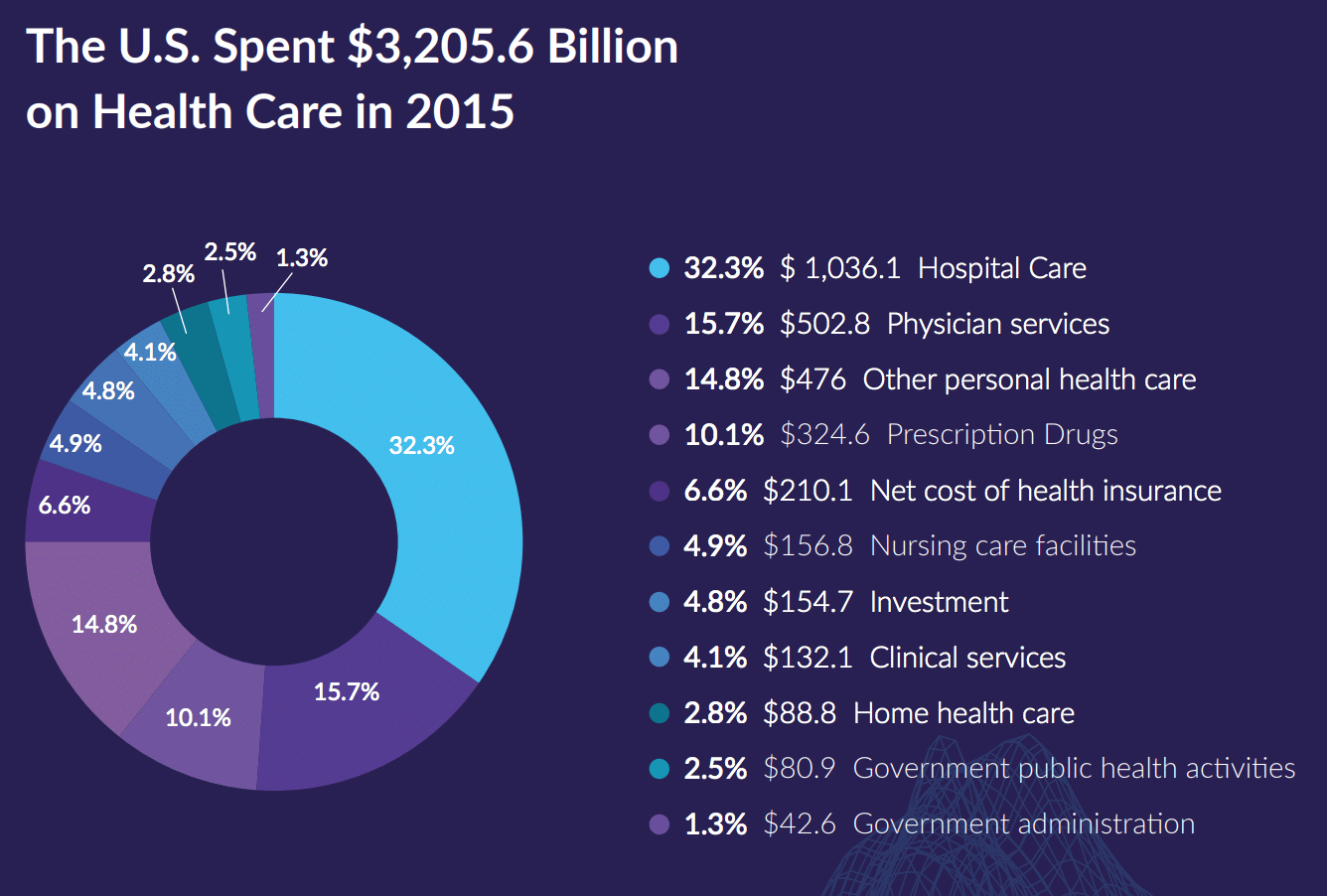

The Solve.Care white paper estimates that healthcare administration costs range from 7% to 30% of total healthcare spending, the bulk of which is the result of inefficient processes, effort duplications, and data system silos.

These inefficient processes are born out of poor communication and coordination between all 3 parties (consumer, provider, and insurance company). Nearly 15-25% of all money spent on benefits ends up getting spent on IT, administrative processes, and duplication of effort. Since it’s so hard to track these systems, it’s also incredibly difficult to keep track of waste and abuse, as well as preventing fraud.

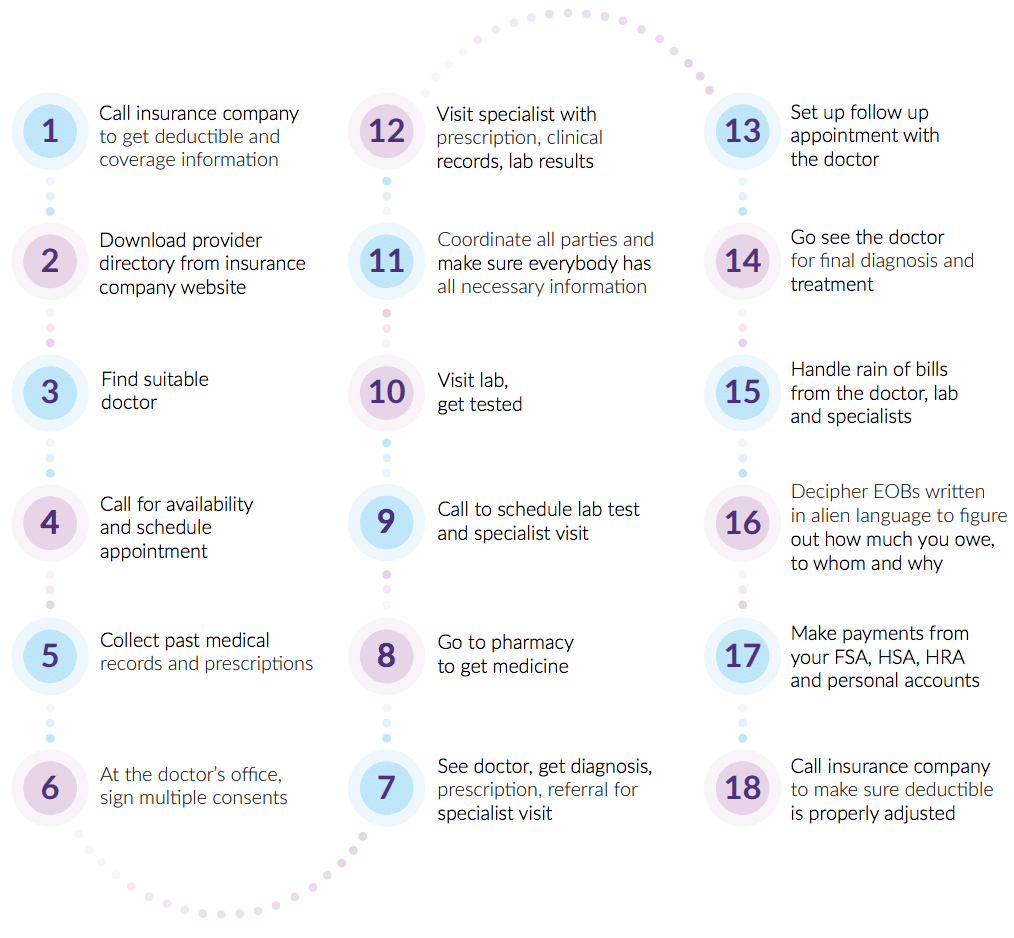

Solve.Care states it can perform the current healthcare administration tasks at 3% of the total spend via blockchain. Executing the current administration tasks more efficiently is no surprise, especially when looking at the complicated linear process of finding a doctor to settling the insurance claims.

The Solve.Care platform would connect everyone in a much more efficient network. If it can pull off the daunting task of effectively simplifying the current insurance-healthcare process, Solve.Care will be providing a huge service to the end consumers.

With an addressable market size of over $100 billion in the United States alone, the healthcare industry is ripe for the taking by blockchain projects like Solve.Care.

The Products

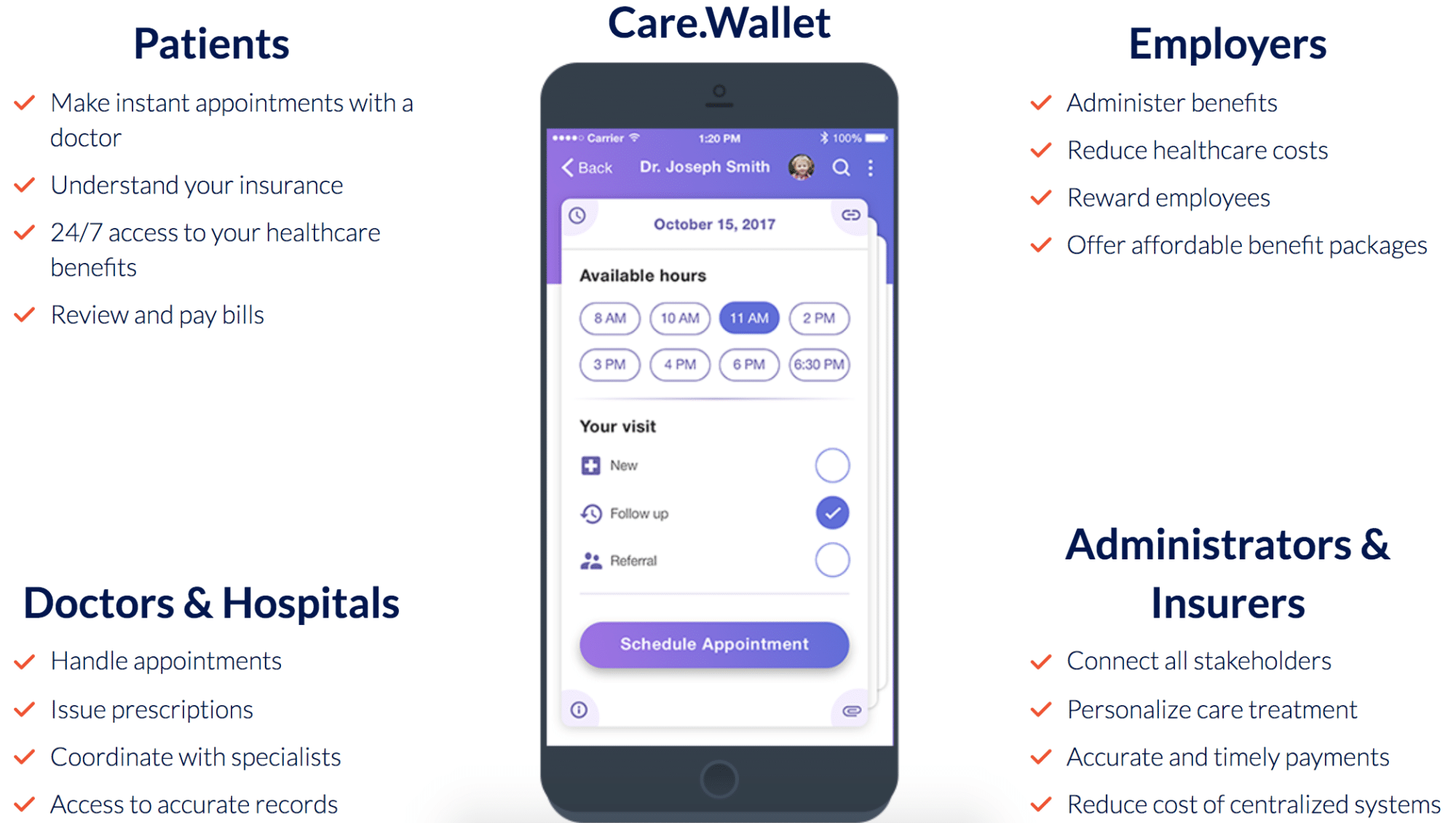

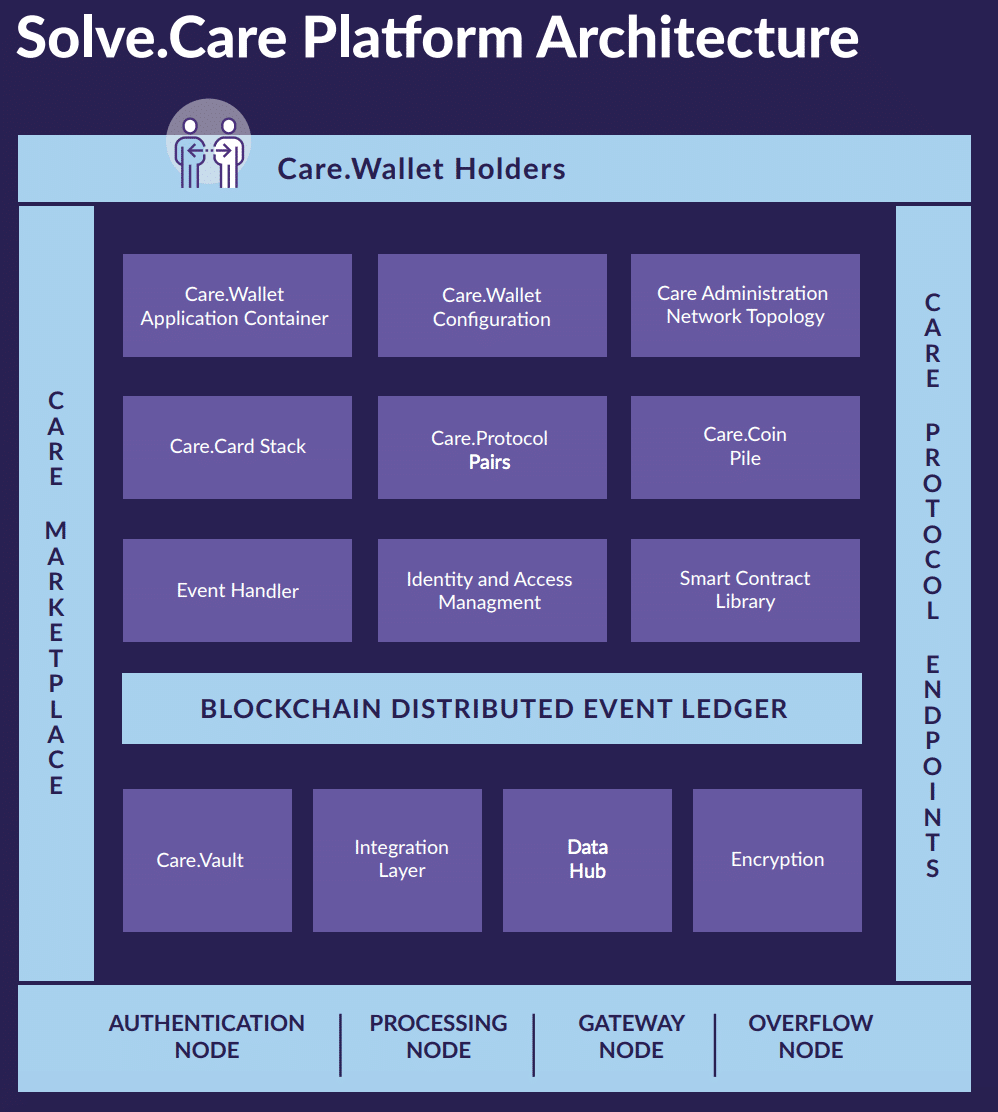

Solve.Care is offering a suite of products and integrations that power the system. The most front-facing component is their Care.Wallet, which is a user-friendly blockchain-based app that helps providers and patients communicate and manage care delivery.

A focal point of the platform is the Care.Wallet, which allows provides a distinct benefit for all parties (outlined above).

The Patient portal allows users to instantly make appointments with doctors, which at the very least solves a major pain point.

How Will Solve.Care Make Money?

A common theme that forms the bedrock of many an ICO is some altruistic “we bring power to the people via blockchain” component. This sounds great, in theory, but it provides very little incentive for the parent company to actually fulfil its mission.

Solve.Care aims to collect revenue from four different buckets:

- Client revenue: platform fees for subscriptions, licenses, transactions, and processing, and service fees for configuration, extension, and integration.

- Subscriber revenue: Subscription fees for wallets and cards directly paid by subscriber or sponsors and transaction fees for payments and other fee based actions.

- Marketplace revenue: revenue from community offerings on the marketplace is shared with publishers and the Solve.Care foundation. Community published pairs, end-points, cards, and apps generate recurring revenue.

- Partner revenue: certain markets will require Solve.Care to be used inside an existing ecosystem. Custom configurations and revenue sharing models with applicable ecosystem partners.

The Team

The 50+ member team has deep domain expertise in health and human services, care coordination, benefit administration, and development. In early 2017, Solve.Care acquired a Ukraine-based software development company called Ukrsoft.

Pradeep Goel (CEO) has deep experience in health and human services, finance, and technology. He has worn many hats included CEO, COO, CIO, and CTO at several tech companies and his experiences span 25 years. Pradeep help design and build several public programs such as Medicaid, Children health insurance, Medicare, SNAP, TANF, mental health and many others.

Vadym Vorobiov (CTO) has spent over a decade in the Health and Human Services sector helping build and deploy enterprise systems for commercial organizations and governments.

Dr. David Randall, Ph.D. (Senior Policy Advisor) is a Resident Scholar with the American Research and Policy Institute in Washington, DC. His experiences include being a former top insurance regulator, healthcare lobbyist, legislative staff member, and executive with a handful of insurance companies. He has authored over two dozen peer-reviewed journal articles, commentaries, and book chapters on health care entitlements, health care financing systems, and health information technology.

Token Distribution

The CAN token is needed for everything from wallet subscriptions and card subscriptions to using the Care.Coin (a stabilized token pegged to a specific currency reserve) for payments.

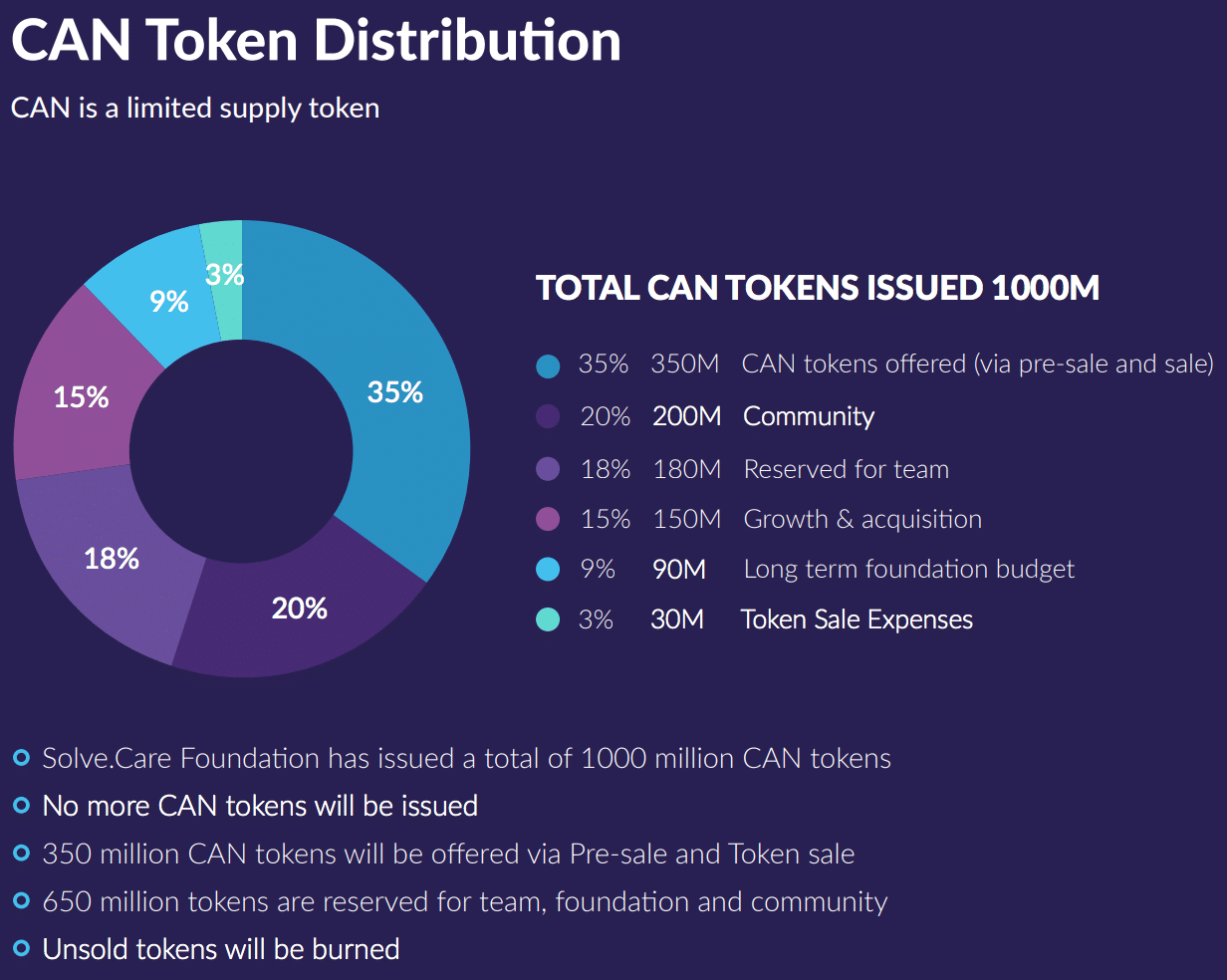

CAN comes in a limited supply, and there will only be 1 billion CAN tokens ever. The pre-sale and token sale will only offer 350 million CAN tokens, with 650 million CAN tokens reserved for the team, foundation, and community. All unsold tokens will be burned.

The tokens will be sold at the rate of $0.10/CAN.

The token sale ends 4/30/2018.

So, with about 35% of the tokens in the open market and 65% going towards the team, you’ve got an interesting dynamic for the project’s growth. Growing a project of this magnitude will take time and money, so it inherently makes sense to reserve the bulk of tokens to finance Solve.Care’s endeavors.

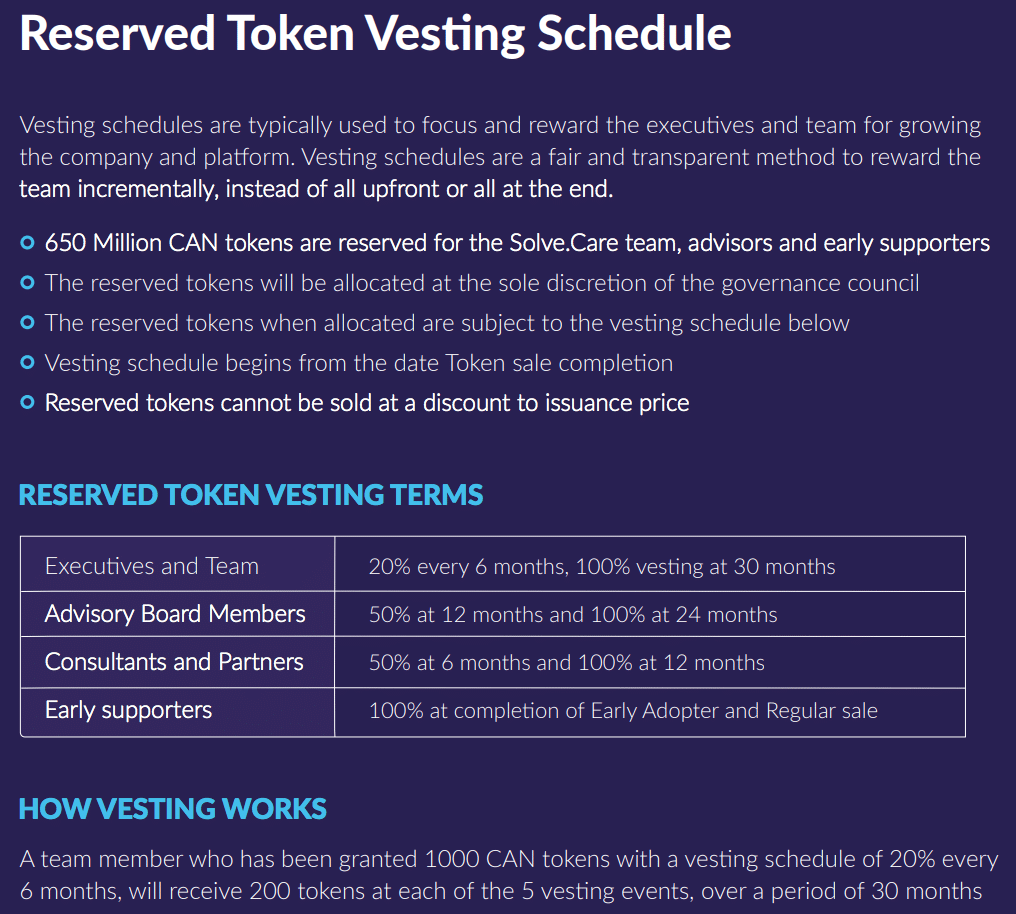

The whitepaper aims to address any concerns for executives, team members, or advisors from dumping their tokens by creating a reserved token vesting schedule. This avoids an unfair upfront payment and keeps team incentives aligned for vesting schedule benchmarks.

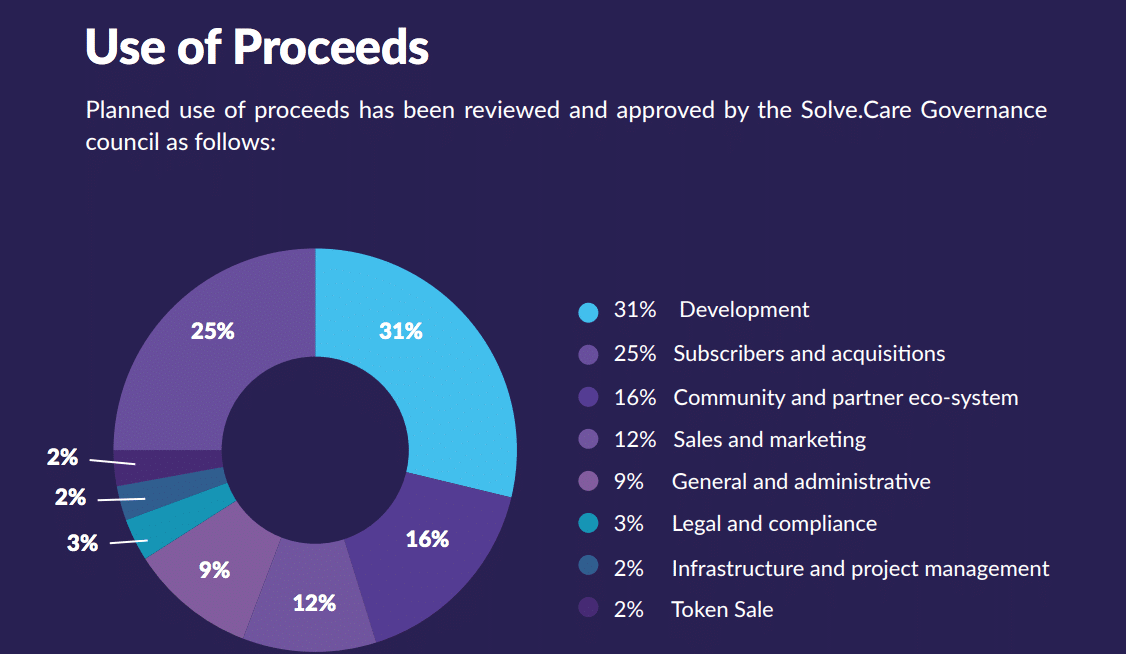

The project will allocate the bulk of their tokens to development, and subscribers and acquisitions.

Final Thoughts

As with virtually every other ICO, we’ll need to see progress in developments, user growth, and revenue before being able to judge the success of the project.

The healthcare space is ripe for disruption. The countless blockchain projects attempting to establish themselves will potentially optimize a system that desperately needs it.

The Solve.Care token sale ends April 30th, 2018.

To read more about the Solve.Care project, check out their whitepaper and site.