TLDRs;

- Intel shares surge over 50% in a month, raising the U.S. government’s stake to $16 billion.

- Government-backed CHIPS Act funding fuels Intel’s rebound, supporting domestic semiconductor manufacturing and strategic foundry operations.

- Private investors including SoftBank and Nvidia invest billions, boosting confidence in Intel’s growth and partnerships.

- CEO Lip Bu-Tan leads Intel recovery, focusing on domestic manufacturing and expanding collaboration with tech partners.

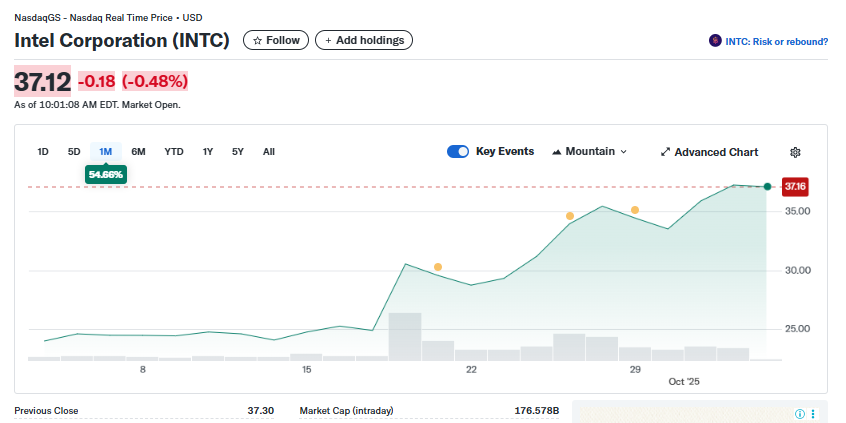

Intel Corporation (NASDAQ: INTC) saw its stock climb 3% on Thursday, marking a remarkable monthly gain of roughly 54%.

The surge pushed shares above $37, dramatically increasing the value of the U.S. government’s 10% stake in the company to approximately $16 billion.

This milestone highlights the growing investor confidence in Intel amid a wave of strategic partnerships and government support.

Trump-Era Investment Boosts Government Holdings

The U.S. government acquired 433.3 million shares in August through an $8.9 billion investment negotiated during the Trump administration.

This 10% equity stake was funded largely through grants provided under the U.S. CHIPS and Science Act, which aims to strengthen domestic semiconductor manufacturing. Intel has already received $2.2 billion from the program and is scheduled to receive an additional $5.7 billion.

A separate initiative will provide another $3.2 billion, underscoring Washington’s commitment to bolstering the company’s foundry operations.

Intel’s resurgence is not solely driven by government support. Private investors, including SoftBank and Nvidia, have recently joined the rally.

In September, Nvidia announced a $5 billion investment to collaborate with Intel on data centers and PC products. Combined with other equity infusions, these strategic partnerships have helped Intel rebound after its shares hit their lowest point in more than a decade earlier this year.

Leadership and Strategic Shifts

Under CEO Lip Bu-Tan, Intel has been executing a series of strategic maneuvers to restore market confidence. Bu-Tan emphasized that the government-backed investment “drives historic investments in a vital industry integral to economic and national security.”

Earlier this year, former CEO Pat Gelsinger departed following a challenging fiscal 2024, which saw Intel’s shares drop 60%. Bu-Tan’s leadership, paired with new partnerships and government support, has pushed the stock to its highest level in 18 months.

Focus on Domestic Manufacturing

A key element of the government’s investment is Intel’s foundry business, which ensures domestic chip production. The deal includes a 5% warrant for the U.S. government if Intel’s foundry ownership dips below 51%, although company executives do not anticipate this occurring.

This emphasis on domestic manufacturing reflects broader industry trends, as major semiconductor companies increasingly prioritize supply chain security over cost optimization. AMD, Apple, and Nvidia have all signaled similar commitments to U.S.-based production, often accepting higher costs for domestic resilience.

Looking Ahead

Intel is also exploring new partnerships, including early discussions with AMD to expand its customer base. These initiatives, combined with government funding and private investment, position Intel to regain its footing as a critical player in both commercial and national security technology markets.

Analysts suggest that continued strategic partnerships and consistent government support could sustain this bullish momentum in the coming months.