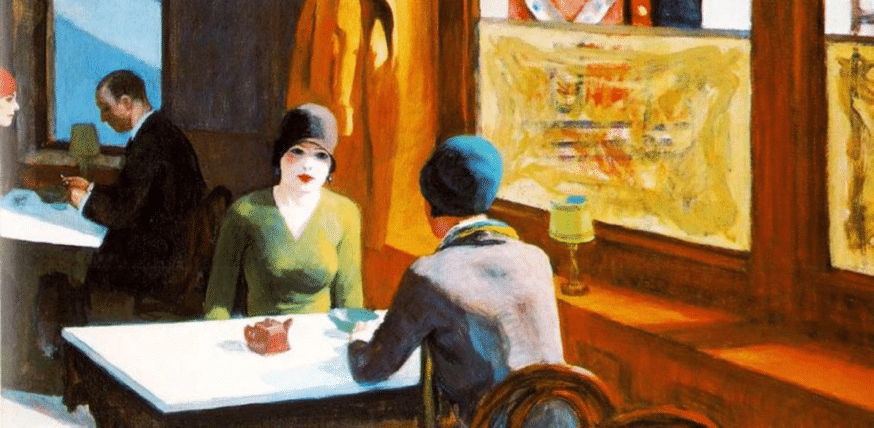

Christie’s, the world’s oldest art auction house, is planning to use blockchain technology to register one of the greatest privately owned collections of American Modernist art. The Barney A. Ebsworth Collection is estimated to exceed $300 million at the auction. The star-studded collection contains American Modernist classics by artists such as Hopper, Sheeler, O’Keeffe, de Kooning, Pollock and more.

The late Barney Ebsworth is considered one of the world’s greatest collectors and served on the boards of several museums including the Seattle Art Museum, the Honolulu Museum of Art, the St. Louis Art Museum, the National Gallery of Art, Washington, and the Smithsonian American Art Museum.

This integration of blockchain is an industry first. The application of blockchain will not only help ensure the provenance of the pieces but is also done in an effort to re-spark buyer confidence in a $63.7 billion art market that has just seen its first year of growth following two years of decline.

The terror of buying fake art has plagued art collectors for centuries. Blockchain finally offers a solution to help verify the authenticity of art and track ownership without the need for expensive and imperfect art appraisals.

The following interview is with Nanne Dekking, the Founder and CEO of the Artory Registry, the art registry collaborating with Christie’s for the iconic Barney A. Ebsworth Collection, and with Richard Entrup, the Chief Information Officer of Christie’s.

Dekking borrows from his previous experience as Vice Chairman and the Worldwide Head of Private Sales at Sotheby’s New York, Vice President of Wildenstein & Co, and founding an eponymous art consultancy firm and gallery in New York.

Prior to Christie’s, Entrup held senior and executive roles at companies such as Disney ABC Television Group, Time Warner, and the MoMA in New York.

How did Christie’s come to partner with Nanne Dekking and Artory over other art and collectable database services?

[Richard – Christie’s] Christie’s carefully researched the emerging vendors in the blockchain technology space. Artory’s team offers an art-centric product offering which closely aligns with our client’s interests. As former art market professionals, their team has an innate understanding of the market, our clients, and future applications of blockchain technology for the auction industry.

Nanne Dekking (CEO Artory) has a distinguished art market background,. Aside from the Artory endeavor, he is currently Chairman of The European Fine Art Fair (TEFAF), so properly understands the particularities of our industry. This was a strong deciding factor on selecting Artory for our pilot. Many other players in the space are tech startups without the art world experience. Artory also has the blockchain technique completely embedded within a unique artwork and searchable database and is not a concept but ready to register a collection as important as the Ebsworth collection.

Nanne, you have a strong background in the art dealing industry through Sotheby’s, and are Chair of The European Fine Art Fair. That seems quite some way away from the blockchain world. How did you come to blockchain as a way of solving the trust and authentication issues in art dealing?

Nanne: After having worked in so many positions in the art market, I realized that the only way to grow the market was to have more transparency. When TEFAF asked me to be Chairman, I knew that it was the umbrella corporation in the art world that could push for more transparency given TEFAF is the art fair with the most transparent and stringent vetting procedures. Transparency is what we believe at Artory as well. With blockchain, there is finally a technology solution to create absolute transparency. The key is working with partners like Christie’s to validate.

Artory is partnering with Christie’s on the sale of the Barney A. Ebsworth Collection. Can you tell us a bit more about the significance of the collection?

[Nanne Dekking – Artory] The Barney A. Ebsworth Collection is considered the greatest privately owned collection of American Modernist art ever to come to market. In addition to being a noteworthy collector, Mr. Ebsworth was interested in innovation, making this collection an ideal first collaboration for the Artory Registry.

Christie’s has a history of embracing technology, including using live streaming, e-commerce and mobile bidding to name a few. Provided the Artory pilot is rewarding, can you tell us how Christie’s looks to use blockchain in the future?

Richard: Christie’s leadership in global sales is reflected and supported by continued investment in digital platforms and initiatives to our clients. It is early days and this is a pilot project for this reason.

What will the collaboration mean for any potential buyers of the artwork from this collection? What will be different for them compared with how they have traditionally purchased artworks?

Nanne: The Ebsworth Collection auction will occur just like any auction we’ve seen before. However, for the first time in history, after a purchase is made, the Christie’s sales rep will follow up with the new owner and give them a Certification Card. This Card then becomes the “key” for a new owner to go to the Artory Registry, use the card to log-in and see their artworks provenance, history, and additional historical documentation, all while remaining completely anonymous to Artory. As the owner of the Digital Artory record, they will always be able to prove ownership.

Can you expand on your saying that the collaboration with Artory “reflects growing interest within our industry to explore the benefits of secure digital registry via blockchain technology.”

Richard: This is indeed a starting point for Blockchain in the auction market, designed to lay the foundation for future adoption of technology. Christie’s have always been supporters of initiatives that increase the transparency around the art market.

One of the potential benefits of Blockchain is that it will, over time, create a central ‘ledger’, of all art market transactions and artworks – when they were exchanged, how much for and their provenance. The certificate relates to the object, not to the owner. This industry-wide ledger will give clients access to consolidated data, thus simplifying the market process and providing them increased confidence and security.

How much of a problem is trust and authenticity in art dealing? To what extent does it affect the size of the market, and the number of transactions?

Nanne: Today’s buyers are more skeptical and risk averse. They want to buy with absolute confidence – over 60% are afraid of buying a fake piece, almost 90% want standardized certificates of authenticity, and over half want better provenance information to support a purchase. Artory was created to be a partner for the art marketplace in addressing these challenges. If we can give more relevant and trusted information of the art market to more people, they can make better decisions. This will subsequently create more buyers in the market, that are better informed.

Using blockchain as a source of trust is only as robust as the quality of the data entered. Can you explain the vetting process applied to art vendors through Artory?

Nanne: The old adage of “Garbage in, Garbage out” is always top of mind for us. At Artory, we are only taking in the highest quality data from the best sources and partners. The process to then “Vet” that this data is accurate and applies to a particular artwork is validated by institutions like Christie’s. We are not the vetting body. We are simply giving access to vetted data, that has been signed off by the experts in the field.

With Bitcoin and many other blockchains, there is a token that drives the blockchain itself, as a reward for the network nodes. Can you tell us more about how the Artory blockchain works?

Nanne: We don’t have our own blockchain but we write on the ethereum blockchain. We do not create or transfer any tokens but we issue digital cryptographic certificates that enable the holder to validate his ownership over an artwork.

Christie’s inaugural Art+Tech Summit featured a talked titled Blockchain – Legal Fact and Fiction. How did blockchain’s legal ambiguity factor into partnering with Artory?

Richard: It is early days for the adoption of blockchain by the art industry. The Christie’s Art+Tech Summit offered a forum that brought together some of the brightest technology thought leaders, facilitating lively conversation on emerging trends and predictions facing the future of our business. We are running this as a pilot and there is no risk or we would not be doing it.

Christie’s will retain all information about the buyer. The certificate relates to the object, not the owner.

For Christie’s, what does a successful pilot program look like? How is Christie’s hoping to measure the success, or not, of this partnership with Artory?

Richard: Christie’s have always been supporters of initiatives that increase the transparency around the art market. As ever, any changes will be led by our clients’ needs. We will consider the future use of Blockchain in our business at the end of the project.

Aside from the partnership with Christie’s, what else is in the pipeline for Artory?

Nanne: We have several exciting features and announcements planned over the coming six months. Our goals in this time are to keep signing collaboration partners, develop more services and features within the Artory Registry, and grow the strength of the database with vetted records. At the end of the day, we want Artory to be the central ledger of all works of Art and Collectible history.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.