Litecoin vs Bitcoin

Litecoin vs Bitcoin. Which one is better? Everyone from qualified economists to Redditors have been comparing the two since Litecoin came into existence in 2011.

The conversation not only discusses these coins individually and against each other, but also pertains to a more complex debate over what it takes to become a successful cryptocurrency.

Bitcoin is the clear poster-child for the crypto-community. However, Litecoin has developed a user base from those who are skeptical of some aspects of Bitcoin but still strongly believe in the future of cryptos.

While Bitcoin and Litecoin have some slight technical differences, they both set out to accomplish the same thing: transfer value using cryptographic principles. Yet once the two coins face off, it’s clear why Bitcoin has come out the winner.

Litecoin vs Bitcoin: At a Glance

Note: On mobile devices, swipe and scroll table.

[lptw_table id=”1779″ style=”default”]

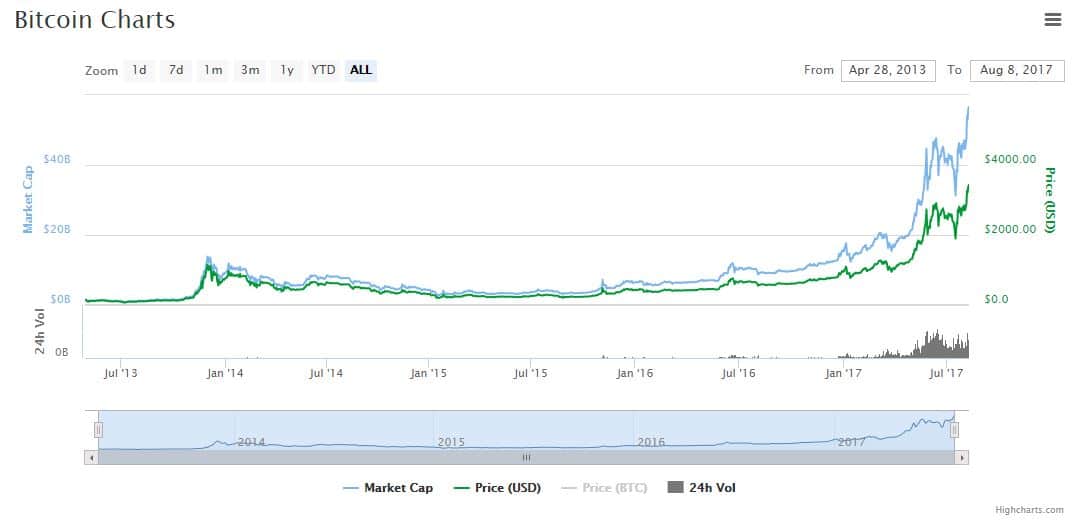

We can compare cryptocurrencies from many angles, but the most popular method is looking at their market capitalization. Market cap is essentially the amount of currency on the market (usually in U.S. dollars). Bitcoin is currently ranked number one with a market cap of over $56 billion, and Litecoin is ranked fifth with a market cap of $2.56 billion. =

You might be thinking, So why are we talking about Litecoin? Its market cap may be a tiny sliver of cake compared to Bitcoin’s $45 billion, but it’s one of the few altcoins with an active user base and legitimate credentials.

(You can view current market caps in the table above to see how they’ve changed since this article was published.)

Litecoin functions like Bitcoin: It is an online payment system that uses cryptocurrency instead of a national currency like U.S, dollars, Bitcoin and Litecoin carry out transactions using bitcoin and Litecoin respectively. As cryptocurrencies, they both garner a similar community and image, as well as rely on similar cryptographic principles.

Bitcoin was released in 2009 as the first cryptocurrency. Litecoin launched only two years later in 2011 but has been sprinting to catch up to Bitcoin ever since.

Litecoin’s developers have stated that their intention was to create a “silver” to Bitcoin’s “gold.” Although Litecoin tech is arguably better than Bitcoin’s, it was born inferior.

Litecoin vs Bitcoin: At Depth

The two cryptos may seem similar, but they are actually quite distinct in their market acceptance and technical mechanics.

In the following four points, we will discuss what makes each crypto distinct. You will come to understand how Litecoin’s arguably superior algorithm will likely forever be subordinate due to Bitcoin’s pervasive network.

1) Bitcoin is Much More Popular

With a market cap roughly 22.5x the size of Litecoin’s, Bitcoin’s overwhelming popularity makes it the obvious choice for the crypto investment community.

According to Google Trends, Litecoin hardly holds a candle to Bitcoin’s search popularity. For scale, 100 indicates the peak popularity a term. A value of 50 means the term is half as popular, and a value of 0 means the term was less than 1% as popular as the peak.

Since cryptos are viewed as inherently risky, Bitcoin seems relatively stable with its extremely high market cap. Sure, Bitcoin’s price can still be incredibly volatile. Yet while a mere $1 billion loss would decimate Litecoin’s market cap in half, Bitcoin would need a crash of $40 billion in market cap for effects to be just as catastrophic.

Despite all this, Litecoin is still fairly relevant in the crypto community.

2) Litecoin Accommodates More Total Coins

Many crypto traders account for the total number of coins each cryptocurrency is programmed to make. Bitcoin is capped at 21 million coins, but Litecoin can make up to 84 million coins.

Both coins technically still have a long ways to go until they hit their cap limits but it remains a concern because of the price volatility expected as the coins reach their maximums. Bitcoin currently has roughly 16.5 million coins in circulation, and Litecoin has about 52 million. This means Bitcoin is currently at 78% of its maximum, and Litecoin is about 61% of its maximum. If Bitcoin nears its maximum coin amount first, then Litecoin may pick up more traction with traders buying into Litecoin to avoid the Bitcoin volatility.

The above point in favor of Litecoin, however, is largely a misunderstanding: Since both Bitcoin and Litecoin can be divided into fractional amounts, the maximum coin shouldn’t impact the value storage of either coin. For example, Bitcoin users can transfer as little as 0.00000001 bitcoins. The ability to accommodate more coins is then kaput.

3) Litecoin Has a Faster Transaction Processing Speed

Bitcoin’s average transaction confirmation time is a little over 9 minutes per transaction, whereas Litecoin’s is roughly 2.5 minutes per transaction. This makes Litecoin’s transactions roughly four times faster than Bitcoin’s, offering an attractive advantage for users who frequently conduct transactions, such as merchants .

Keep in mind that transactions technically occur instantaneously on both Bitcoin and Litecoin networks, but the transaction confirmation by other network participants does take some time. Waiting the full 9 minutes for a Bitcoin transaction or 2.5 minutes for a Litecoin transaction ensures the transaction was valid. Merchants can accept the transactions instantaneously without waiting for a confirmation, but they run the risk of becoming victim to a “double spend” attack.

This seemingly large advantage Litecoin has over Bitcoin, however, is minimized by third-party solutions that make instantaneous transactions more secure.

4) Litecoin’s Cryptographic Algorithm Welcomes Newbies

Long-term cryptocurrency users consider the technical components of Bitcoin’s and Litecoins’ different cryptographic algorithms when comparing the two.

Bitcoin uses the SHA-256 algorithm and Litecoin uses an algorithm called Scrypt. These algorithms determine the “mining” process for new coins. “Miners” confirm the transactions of other users, and are rewarded units of that currency in exchange.

Many consider Bitcoin’s SHA-256 algorithm more complex than Litecoin’s Scrypt, which therefore allows for a higher degree of parallel processing. Bitcoin miners have built sophisticated methods to mine bitcoins at a highly efficient rate. The most dominant method uses ASICs–Application-Specific Integrated Circuits. ASICs are essentially hardware systems (similar to CPUs) created purely to mine bitcoins.

The Bitcoin competition for mining is fierce due to the sheer amount of miners, as well as technical innovations such as the ASICs. New miners struggle to establish themselves without adequate computing power, capital to handle expenses, and the know-how to outcompete experienced competition.

Litecoin was largely created to appeal to miners who could no longer mine Bitcoin because their CPUs couldn’t compete with ASICs. Scrypt is more accessible for new miners. It was designed to be less conducive to custom hardware solutions such as in ASIC-based mining. Scrypt, however, is not immune to the innovation and there is increasingly development that hinders the easy-access mining Scrypt was partially designed for.

Bitcoin Crowned King Thanks to Its Network

While Litecoin’s efforts to make mining more accessible to everyone is a notable gesture that speaks volumes about the Litecoin community, it also pigeonholes itself into a niche. Instead of appealing to a massive community of people to achieve a network to contend with Bitcoin’s, Litecoin focused on minor differentiating factors. Litecoin essentially functions the same as Bitcoin and doesn’t offer enough for users to convert from Bitcoin.

It’s safe to assume that most crypto-traders, those responsible for the large crypto market caps, aren’t valuing tech over substantial profit. Litecoin’s value proposition simply sounds like another altcoin pitch to them. Less tech-savvy adopters hardly know what the mining process is like, let alone the difference between SHA-256 and Scrypt. So while Litecoin’s price has increased significantly over the past few months, it simply isn’t as attractive as Bitcoin’s.

Litecoin additionally took a hard jab in the gut when Ethereum exploded onto the scene in early 2017 and knocked Litecoin down to the #4 market cap position. Ethereum has developed nearly 10x that of Litecoin’s market cap in a short amount of time.

Final Thoughts

Since Litecoin’s purpose initially was to be “silver” to Bitcoin “gold”, it really begs the question of whether it will ever be anything more than Bitcoin’s minion.

Litecoin technically has a superior algorithm but this is largely irrelevant, as Bitcoin’s popularity has cemented it as the gold standard for old and new crypto traders.

When it comes to cryptocurrency adoption, Bitcoin and Litecoin are in the same boat. Think of it this way: Bitcoin and Litecoin are both good guys. But Bitcoin is the main protagonist and Litecoin is the inferior supporting actor. Bitcoin is the Goku, Aragon, and Batman. Litecoin is the Vegeta, Boromir, and Harvey Dent. In the end, Bitcoin will likely end up in every sequel, while Litecoin is killed off due to lack of popularity.

An extensive user network is essential in the crypto community. No matter how hard Harvey Dent altcoins may try, even their technical superiority can’t beat the popularity of the Batman Bitcoin .

Additionally, Bitcoin’s liquidity cannot be overlooked. The fact that cryptocurrencies tend to be very volatile plays a huge role in the minds of new users. Many new users start with Bitcoin because it offers stability and a large preexisting market.

The network effect ultimately determines which cryptos survive and as more users buy into Bitcoin, Litecoin will likely become increasingly obscure. Litecoin’s relevancy is debatable and its recent spikes in price are largely due to the current rise in cryptocurrency prices as a whole.

It’s interesting to theorize situations where Litecoin could overtake Bitcoin. Litecoin loyalists cling to the fact that Litecoin is one of the only high-value value-exchange alternatives. In the unlikely case that any of Bitcoin’s potentially problematic features like its 21 million coin limit remain unaddressed and start to create substantial problems, people could shift towards Litecoin. However, the downfall of Bitcoin–the flagship of the cryptocurrency world–could spell doomsday for the cryptocurrency market at large.