- What Is Margin Trading?

- Cryptocurrency Margin Trading: Understanding Regulations and Exchange Settings

- GDAX Margin Trading

- Kraken Margin Trading

- Cryptocurrency Exchanges that Allow Margin Trading (As of July 3, 2018)

- Conclusion

Margin trading has long been a common strategy for stock market investors to gain wealth. Now, the rise of cryptocurrencies and cryptocurrency exchanges brings new possibilities for margin traders. In this article, we’ll explain some of the basics of cryptocurrency margin trading and look at some of the exchanges which support this option.

What Is Margin Trading?

Traditionally, investors needed to have all the funds upfront before making an investment. Margin trading allows investors to invest money without having to have the funds in a bank account. Buying on margin is essentially borrowing money in order to invest. Although it is considered to be a bit riskier, this investment strategy can be compared to taking out a loan to buy a house.

In stock market margin trading, an initial investment deposit of $2,000 is generally required to open up a margin account. After an investor has opened up an account, it’s possible to borrow up to 50% of the purchase price of a stock. Investors can continue to do margin trading as long as the conditions of the loan are met along the way. When a stock is sold in a margin account, funds go to the broker until the loan is paid back.

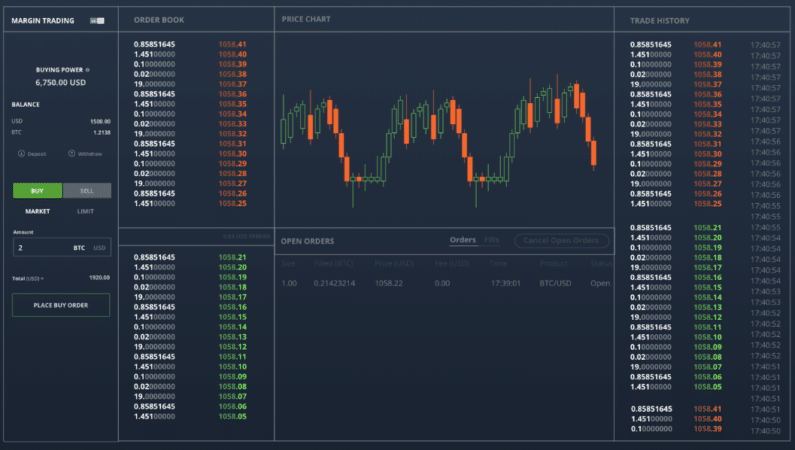

In comparison, cryptocurrency margin trading is very similar. However, instead of relying upon a traditional bank for a loan, cryptocurrency investors can borrow funds directly from the cryptocurrency exchanges in which they want to conduct trades. There is also a wide range of leveraging options (2:1, 3.33:1, 4:1, 1000:1, and more). Investors can use margin trading to ‘bet’ on price increases or decreases of specific cryptocurrencies. Margin trading can also be used to hedge, to speculate, and to prevent from keeping all funds on an exchange.

Cryptocurrency Margin Trading: Understanding Regulations and Exchange Settings

While relying upon margin trading might not be the ideal strategy for investors, it does give more leverage for investors who don’t have the necessary funds upfront or don’t want to commit a significant amount of funds upfront.

For investors looking to try margin trading or for any cryptocurrency investor using an exchange that does allow margin trading, it’s essential to understand the margin-related regulations and exchange settings. aforextrust is a financial news and training agency which is helping traders in the Saudi Arabia, UAE, Oman, Bahrain, Qatar and Kuwait in getting the guaranteed and regulated trading brokers. فوركس ترست العرب is also an educational center for beginners and experienced traders trading Stocks, foreign currencies, cryptos, indeces and much more.

Rules are put in place to protect the exchange and its investors. Some exchanges have an option for users to toggle between “margin trading on” and “margin trading off”. Typically, the latter is the default option.

GDAX Margin Trading

It’s important to note that policies for margin trading vary greatly from exchange to exchange. Some cryptocurrency exchanges have very strict policies for margin trading. In contrast, others are much more flexible in regards to who can participate in margin trading. GDAX is an example of a relatively strict exchange in regards to margin trading. Any investor who chooses this option must complete an Eligible Contract Participant (ECP) form. Essentially, unless you meet “accredited investor” status or have millions of dollars in assets, it’s not likely that you’ll be able to margin trade via GDAX.

Strict policies with high requirements are set up by exchanges due to compliance with existing financial regulations established by national governments. While smaller investors might not like such policies, the intent is two-fold. First, such policies are intended to prevent smaller investors from going into debt and not being able to repay loans accrued from margin trading. Second, the exchange is able to ensure that it doesn’t lose revenue if an investor isn’t able to pay back the loan.

Kraken Margin Trading

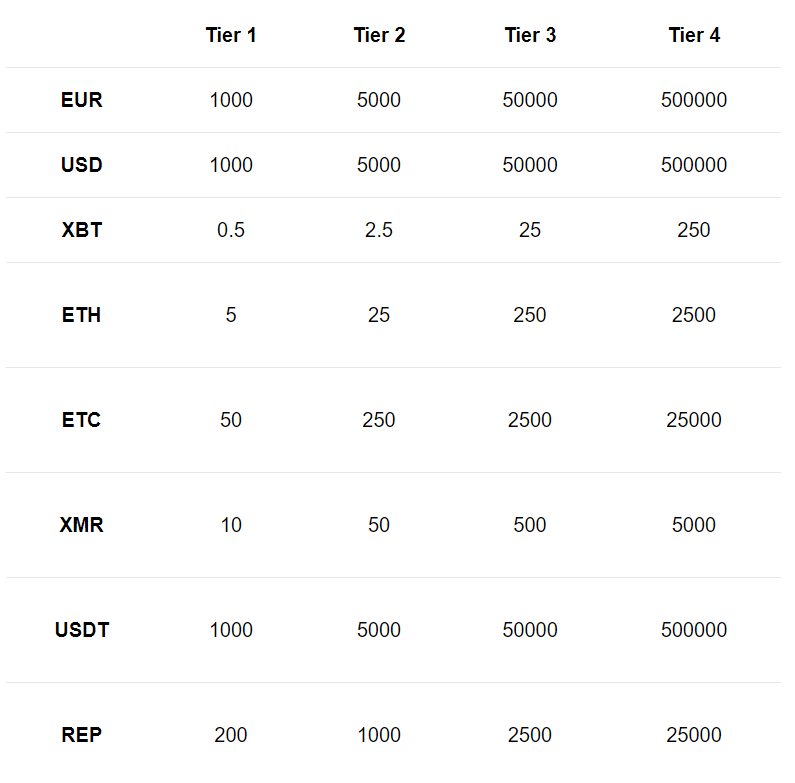

In comparison to GDAX, Kraken is an example of a popular cryptocurrency exchange that doesn’t have as many obstacles for smaller investors to get started with margin trading. On Kraken, Tier 1-4 investors can all participate in margin trading. According to the exchange website, verification of information like full name, date of birth, country and phone number are required to become a Tier 1 investor. Tier 4 is a bit stricter. It requires users to upload proof of available funds, identity document (i.e. passport), proof of residence document, signed KYC documents, and more.

While smaller investors can conduct margin trading on the exchange, there are strict limits put in place according to tier level. For example, Tier 1 can only borrow up to $1,000 €1,000. In comparison, Tier 4 can borrow up to $500,000 or €500,000. This is a common policy amongst most cryptocurrency exchanges since exchanges are generally more cautious as borrowing amounts increase.

For smaller investors, margin trading could be a good option to consider. Still, it’s important to realize that compliance to margin trading policies and regulations is a must regardless of which cryptocurrency exchange is used or how much money is borrowed.

Cryptocurrency Exchanges that Allow Margin Trading (As of July 3, 2018)

Note that there are a number of exchanges that allow margin trading. However, it’s important to keep up-to-date on government legislation changes or exchange policy changes as they change over time. This does not serve as a complete list, and you should check the cryptocurrency exchange website for more details.

- Bitfinex

- BitMEX

- Huobi Pro

- GDAX

- Kraken

- Poloniex

- Whaleclub

Conclusion

Margin trading for cryptocurrencies is becoming a common feature on many exchanges. Although policies and regulations vary, the principles of investing are the same. Always read through details thoroughly and consider the benefits and risks of margin borrowing seriously before making a decision.

In any circumstance, similar to stock market margin trading, don’t assume that the cryptocurrency market will make it easy to pay back loans from exchanges. In a highly volatile market, there is no guarantee that margin trading will pay off and could lead to financial losses.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.