TLDR

- MCD stock closed at $298.77 on Aug. 5, up 3.19% in pre-market after Q2 results

- Global comparable sales rose 3.8%, led by Japan and strong U.S. demand

- Revenue reached $6.84B vs. $6.70B expected, up from $6.49B YoY

- EPS came in at $3.19, beating estimates by $0.05

- Menu hits like McCrispy Chicken Strips and a Minecraft-themed meal boosted traffic

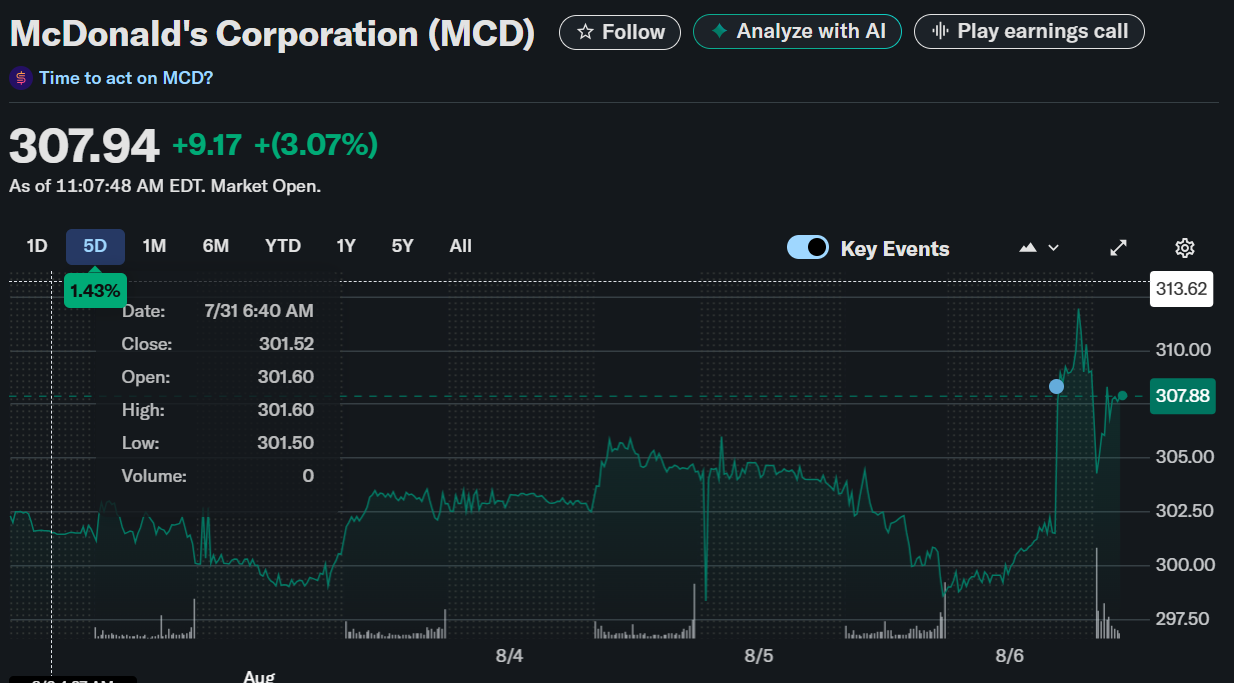

McDonald’s Corporation (NYSE: MCD) reported a strong second quarter on Wednesday, 6th August, helping its stock recover from recent weakness. MCD closed at $298.77 on August 5, down 1.79%, but surged 3.19% to $308.30 in pre-market trading after releasing better-than-expected Q2 earnings.

Global comparable sales increased by 3.8%, beating Bloomberg’s forecast of 2.5%, and reversing a slump from Q1 2025. U.S. same-store sales rose 2.5%, ahead of the 2.3% analyst consensus and a major improvement from the 3.6% drop posted in Q1.

Strong Menu Strategy and Marketing Fuel Growth

Revenue climbed to $6.84 billion, exceeding the $6.70 billion consensus and improving from $6.49 billion a year earlier. Net income reached $2.25 billion, with adjusted EPS at $3.19, up from $2.97 YoY and $0.05 above expectations.

CEO Chris Kempczinski credited “compelling value, standout marketing, and menu innovation” for the recovery. The introduction of McCrispy Chicken Strips in May and the Minecraft Movie Happy Meal in April drove significant traffic gains. The collectible Minecraft figures sold out in under two weeks across 100 countries.

International Momentum

The International Developmental Licensed Markets segment posted same-store sales growth of 5.6%, led by Japan, surpassing the 3.6% estimate. International Operated Markets also beat expectations, rising 4% vs. the 1.8% projected. Sales in the UK, Canada, and France bounced back after a soft Q1.

Restaurants open less than a year saw a 6% increase in sales, while systemwide sales grew 8% (6% in constant currency). McDonald’s said digital loyalty sales hit $9 billion for the quarter.

Profitability & Long-Term Outlook

Operating income increased 11%, or 7% when excluding one-time restructuring charges of $43 million. Diluted EPS was $3.14, rising 12%, but excluding charges, came in at $3.19—a 7% YoY improvement.

Though McDonald’s didn’t update its full-year guidance, Wall Street expects U.S. same-store sales to grow 1.20% and global same-store sales to increase by 1.9%. Analysts like Jefferies’ Andy Barish believe the July Snack Wrap relaunch and $2.99 chicken value deals could push comps back into mid-single-digit growth.

Performance Overview: MCD vs. S&P 500

As of August 5, 2025, McDonald’s stock lags the broader market in several timeframes:

- YTD Return: MCD +4.25% | S&P 500 +7.10%

- 1-Year Return: MCD +13.91% | S&P 500 +21.46%

- 3-Year Return: MCD +23.46% | S&P 500 +51.96%

- 5-Year Return: MCD +68.09% | S&P 500 +89.29%

Despite a weaker performance relative to the S&P 500, McDonald’s consistent dividend and defensive positioning continue to appeal to long-term investors.

Looking Ahead

With Snack Wraps returning in July and increased emphasis on affordable bundles like the $5 Meal Deal, McDonald’s is actively positioning for a stronger rest of 2025. The company remains focused on digital growth, loyalty engagement, and international expansion to keep traffic high amid economic uncertainty.