Simply put, merged mining (also known as Auxiliary Proof-of-Work) is the process of mining two different cryptocurrencies at the same time. Some projects have opted to implement this mining process early on in an attempt to increase security as the network grows. As demonstrated by the recent 51% attacks, having substantial hashing power on a blockchain’s system is no joke.

Merged mining may just be the solution to shield young networks from those attacks before they’ve garnered enough hashing power on their own. In this article, you’ll learn exactly how merged mining works, its advantages/disadvantages, and which projects have adopted it into their code.

How does Merged Mining work?

First and foremost, cryptocurrencies that participate in merged mining must share the same hashing algorithm. Popular algorithms include SHA-256 (Bitcoin), Scrypt (Litecoin), and Equihash (Zcash). This connection enables miners to build blocks on both chains using the same hashing calculation to secure them.

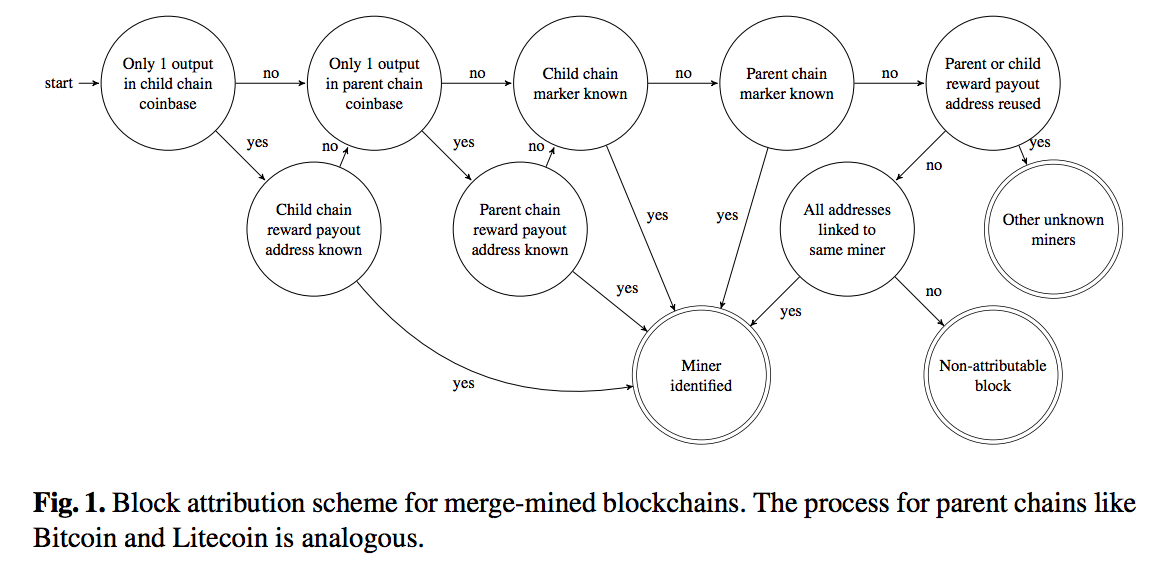

Additionally, every merged mining scenario has a parent chain and an auxiliary chain. The parent chain contains the actual mining and doesn’t need to know about the auxiliary chain or the auxiliary chain’s mining. The auxiliary chain is the blockchain that’s “piggybacking” off the parent chain. Unlike the parent chain, this chain needs additional development work so it can register that the mining from the parent chain is valid.

The Process

Let’s walk through a general example of the merged mining process for two blockchains as if you’re the miner. The two chains you’re mining are ParentChain and AuxiliaryChain.

Before mining, you assemble a set of transactions for each chain. The AuxiliaryChain set includes the associated transactions on the chain. The ParentChain set, however, contains the standard transactions on the chain plus a transaction containing the hash of the AuxiliaryChain block you just created. Now, on to mining.

As mentioned above, ParentChain and AuxiliaryChain use the same hashing function. And AuxiliaryChain developers have built the network to allow for merged mining. These two components enable you to solve the hashing functions on both chains simultaneously without exerting more computing power.

When mining both chains, two main scenarios could arise:

- You solve the hash at ParentChain’s difficulty level.

- You solve the hash at AuxiliaryChain’s difficulty level.

Ideally, and for the sake of this example’s simplicity, the difficulty level of ParentChain will always be higher than AuxiliaryChain’s difficulty level.

Scenario 1: You finish creating the ParentChain block and send it to the ParentChain network. Because you solved the ParentChain hash at a difficulty that’s greater than AuxiliaryChain, you also mine an AuxiliaryChain block, receiving both rewards.

Scenario 2: You finish creating the AuxiliaryChain block, inserting the block header and hash of the ParentChain block. The AuxiliaryChain accepts this block because it includes proof that you completed the work after the AuxiliaryChain block header and transactions. The proof being the ParentChain hash and header. You receive the AuxiliaryChain miner reward.

Pros and Cons

Merged mining has some definite advantages. There’s no doubt about it. But there’s a reason (or several) that more teams aren’t implementing it into their projects. Let’s look at the positives first.

The Pros

Merged mining requires no additional computing power. Because miners are solving for both hashing functions simultaneously, their computing power remains the same. They’re just submitting their proof of work to two different recipients.

Auxiliary chains receive increased hashing power. Smaller blockchain projects can use merged mining to tap into the hashing power of a larger parent chain. Ideally, miners would have no issue in switching to merged mining because they receive increased rewards for the same amount of work. Therefore, this type of mining could be a reliable way for emerging blockchains to protect themselves against 51% attacks as they scale.

The parent chain is unaffected. The parent chain needs no additional work to participate in merged mining. And the only additions to its blockchain are the auxiliary chain hashes that are added to its transaction tree.

The Cons

Merged mining is complex to set-up. Although merged mining has its benefits, many teams don’t believe that the additional network security is worth the time it takes to implement.

It requires additional work for miners. To participate in merged mining, you need to run additional coin daemons as well as administrate the new blockchains. This extra work can be especially time-consuming for pool operators who have a lot more moving parts than just a single miner.

Projects Using Merged Mining

Surprisingly, there aren’t many projects that have implemented merged mining. Here are a few of the more notable ones that have:

Namecoin

Namecoin was the first cryptocurrency to fork from Bitcoin as well as the first to have merged mining. Because both use the SHA-256 hash, the developers chose to latch onto Bitcoin as the parent chain. The project has since become relatively inactive.

Dogecoin

The Dogecoin community was split when the developers finally decided to begin merged mining with Litecoin. You can still check out the AMA Reddit thread where Charlie Lee answers questions from the community and makes a case for the merged mining partnership.

Elastos

A younger blockchain project, Elastos, also has merged mining with Bitcoin. The Elastos network includes sidechains that the team claims will benefit from the distributed trust that mining strategy provides.

The Future of Merged Mining

It’s not perfect but merged mining could be a good way for smaller blockchains to gain some notoriety and protect themselves against a hashing takeover. The upside potential is there, but so far, the additional work has turned off the majority of development teams.

With an increasing number of attackers preying on blockchains with low network hash rates, we could start to see the community sentiment shift in favor of this unique consensus mechanism. It’s difficult to say, but the switch to merged mining may have been a key factor in Dogecoin growing into the resilient, meme-filled cryptocurrency we know and love today.

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.