TLDR

- Metaplanet plans 210K BTC buy by 2027, shares fall 7.65% on bold move

- Metaplanet dives deep into Bitcoin, raising ¥555B via preferred shares

- Bitcoin bet backfires short-term as Metaplanet stock drops nearly 8%

- Metaplanet eyes 210K BTC with no-vote preferred shares to fund growth

- Metaplanet’s Bitcoin blitz: ¥555B raise targets crypto dominance by 2027

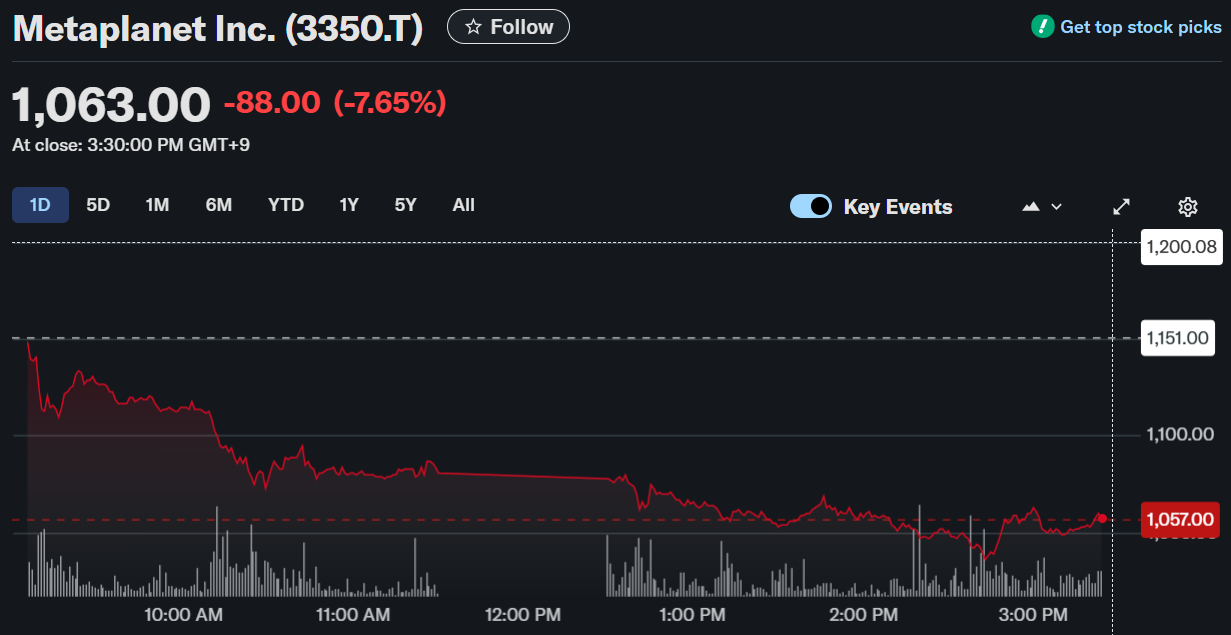

Metaplanet Inc. (3350.T) shares fell 7.65% to ¥1,063 after the company unveiled plans to expand its Bitcoin strategy.

The company aims to acquire 210,000 BTC by 2027 through a large-scale preferred share issuance. Although market reaction was negative, the plan highlights one of the most aggressive corporate approaches to digital assets.

Preferred Shares Financing Strategy

The company confirmed plans to raise 555 billion yen through perpetual preferred shares structured into two separate classes. Class A will operate like corporate bonds, offering dividends up to 6% and priority in liquidation. Class B will carry conversion rights into common stock, creating flexibility while diversifying risk profiles.

*Metaplanet Announces EGM Agenda: Proposes Authorization of Perpetual Preferred Stock—Class A (Senior, Non-Convertible) and Class B (Convertible); Files ¥555 Billion Shelf Registration for Potential Issuance* pic.twitter.com/3rYog0IpGY

— Metaplanet Inc. (@Metaplanet_JP) August 1, 2025

Metaplanet emphasized that neither class will carry voting rights, protecting control while widening financing options. Both classes will support capital flexibility across two years following shareholder approval. The offering requires regulatory clearance, and listing approval for preferred shares remains under consideration.

The strategy allows the company to secure stable funding while limiting dilution of common stock. The structure also creates appeal for income-seeking participants. However, fixed dividends remain dependent on performance and market conditions, exposing holders to potential suspension during financial stress.

Aggressive Bitcoin Accumulation

Metaplanet expanded its Bitcoin reserves rapidly since introducing its treasury strategy in December 2024. The firm grew holdings from less than 4,000 BTC in March to more than 17,000 BTC by July. Recent acquisitions included 780 BTC in July at an average price above $119,000 per coin.

The company plans to quadruple these reserves further, with the long-term goal set at 210,000 BTC by 2027. Funding so far relied on bond redemptions and stock acquisition rights, which substantially diluted existing shares. The preferred share issuance now seeks to replace shorter-term methods with permanent financing.

CEO Simon Gerovich highlighted proof-of-reserves to build trust, distinguishing the company’s approach from other corporate Bitcoin treasuries. Transparency positioned Metaplanet as a challenger to MicroStrategy, which remains the largest corporate holder. The strategy underscores its ambition to be a leading digital asset institution.

Market and Regulatory Context

Share trading volume surged in recent months as activity around Metaplanet’s digital asset strategy intensified. The company reported trading turnover of nearly 1.9 trillion yen in June, almost double the prior month. Substantial volume indicated heightened interest, but the recent share drop reflected market hesitation.

Global corporate treasuries hold more than $100 billion in digital assets, with Bitcoin accounting for the majority. Competitors such as Strategy also introduced Bitcoin-backed financing, showing rising corporate appetite despite volatility. If accumulation continues, market forecasts suggest Bitcoin could climb toward $132,000 by late 2025.

Regulatory developments remain critical, especially as Europe enforces MiCA and MiFID II, while Asia presents fragmented frameworks. These rules shape compliance for Bitcoin-backed instruments and future capital raises. Metaplanet’s proposal will face scrutiny as oversight expands across major financial markets.