TLDRs:

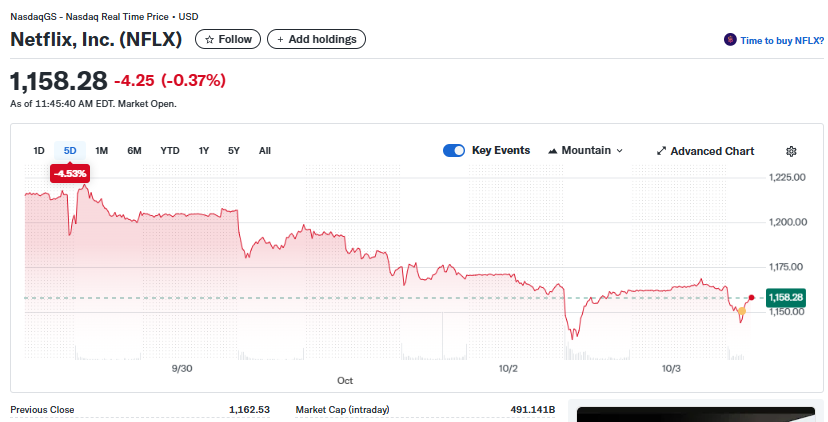

- Elon Musk’s social media boycott pushes Netflix shares down nearly 5% this week.

- Viral backlash over canceled cartoon fuels market volatility for Netflix.

- U.S. Congressman calls for Netflix executives to testify over children’s content.

- Analysts say long-term impact limited, but brand perception now crucial.

Elon Musk has once again set social media abuzz, urging his 227 million followers to cancel their Netflix subscriptions over content aimed at children.

The billionaire’s posts specifically targeted a canceled animated series featuring a transgender character, quickly going viral and igniting a broader backlash. Within 48 hours, Netflix shares fell nearly 5% this week, erasing billions of dollars in market value.

The episode highlights how influential figures can instantly move markets, especially when cultural and financial stakes intersect.

A Cartoon Turns Into a Market Flashpoint

The controversy began when a clip from Netflix’s canceled series Dead End: Paranormal Park resurfaced online. Originally aimed at young viewers, the show featured a transgender character voiced by Zach Barack.

The clip, reposted by a conservative social media account, drew massive attention, prompting Musk to call for a platform-wide boycott.

Cancel Netflix for the health of your kids https://t.co/uPcGiURaCp

— Elon Musk (@elonmusk) October 1, 2025

Musk’s posts included a graphic showing a “transgender agenda” entering a gate labeled “your kids” and urged followers to act. Within hours, the content was shared millions of times, illustrating how quickly old or canceled programming can spark new controversy.

Congressional Scrutiny Adds Pressure

Adding a political dimension, U.S. Congressman Tim Burchett has now called for Netflix executives to testify before Congress. The hearings aim to examine why the platform is allegedly promoting sexualized transgender content for young audiences.

🚨 JUST IN: Congressman Tim Burchett will now have NETFLIX executives testify to Congress about why they are pushing s*xualised transgender shows on young kids. pic.twitter.com/pU361aubZs

CANCEL NETFLIX

"Let's get on it. I'm going to follow up with my folks. They need to be…

— Eric Daugherty (@EricLDaugh) October 2, 2025

This development intensifies pressure on the streaming giant, signaling that the controversy is not just a social media storm but also a potential regulatory and legal concern. For Netflix, the scrutiny compounds the reputational impact of Musk’s boycott and raises questions about how companies manage content for children.

Netflix’s Silence and Market Reaction

Despite the attention, Netflix has not issued a public statement or clarification. The platform, which has faced previous controversies and subscriber challenges, remained quiet, leaving critics to dominate the narrative.

Analysts say the immediate share decline is significant but may not translate into long-term subscriber losses. CNBC commentator Guy Adami noted that some viewers might even subscribe in response to Musk’s call, creating a counter-boycott effect. Wedbush analyst Alicia Reese added that the timing of Musk’s campaign is unlikely to materially affect quarterly revenue.

Nevertheless, the episode underscores how brand perception and social narratives can influence stock prices. Silence can protect a company from inflaming controversy, but it also cedes narrative control to others, including social media influencers and policymakers.

Lessons in Brand and Market Management

Musk’s campaign, paired with congressional attention, demonstrates the growing intersection of culture, politics, and finance. Stock prices are increasingly influenced by social sentiment and perceived corporate values, and companies must recognize that all content, even older shows, can carry financial consequences.

Experts suggest brands prepare rapid-response strategies that account for both reputational and regulatory risks. While Netflix’s silence may avoid immediate confrontation, it also shows that control over the story is now more critical than ever.

For investors, the incident is a reminder that influential figures and political actors can move billions in value within hours, highlighting the delicate balance between content decisions and market performance.