Non-fungible tokens are a special type of token that represents a unique asset.

Most of us have heard about digital cash at this point. The rise of Bitcoin has made cryptocurrency mainstream, with Bloomberg and CNBC reporting regularly on the cryptocurrency markets and the prices of these digital coins. However, currency is only one application of the underlying blockchain technology. The most exciting opportunities in blockchain come when you use non-fungible tokens to certify and secure uniqueness and identity. What are non-fungible tokens? In this complete guide, we’ll take a deep dive into the world of non-fungibility, and what it means to create unique digital assets on the blockchain.

NFTs have applications everywhere from video games to fine art to movie tickets. They could be the backbone of a new blockchain-powered digital economy. Alongside their fungible, cash-like counterparts, non-fungible tokens open the door to the digitization of assets and data. The result is exciting new markets could open up for digital (and real-world) goods we can’t even imagine yet.

A Complete Guide to Non-Fungible Tokens (NFTs): A Primer on Fungibility

Before we get into non-fungible tokens (NFTs), we need to address the elephant in the room. We need a good definition of fungibility before we can talk about something that’s not fungible. In fact, if you’ve ever used money before, you intuitively know what fungibility is, you just may not know the vocabulary word used to describe it.

Fungibility refers to a currency’s ability to maintain a standard value and uniform acceptance. It generally means that a currency’s history doesn’t affect its value and each piece of that currency is equal in value to every other piece. The $20 bill in your pocket is just as valuable as the $20 bill in mine. If we take them to the store, the shop owner will accept them equally, even if yours was printed in 2018 and mine in 1980. Even if your $20 bill was used in a drug deal before you received it or came from Satan himself, the bill is still valuable at the store. That’s the power of fungibility.

A currency without fungibility is unstable and likely to collapse. Imagine if you had to investigate the history of every dollar bill before you accepted it. Or, consider a world where some $20 bills are more valuable than others. That would be insanity and economically unfeasible. Fungibility is essential to any currency, be it the dollar or Bitcoin.

Why Would I Use a Non-Fungible Token (NFT)?

Non-fungible tokens are blockchain assets that are designed to not be equal. You might think that doesn’t make much sense, and if we were talking about currencies you’d be right. However, blockchain tokens can represent more than just currency. In fact, the possibilities of blockchain assets are nearly endless.

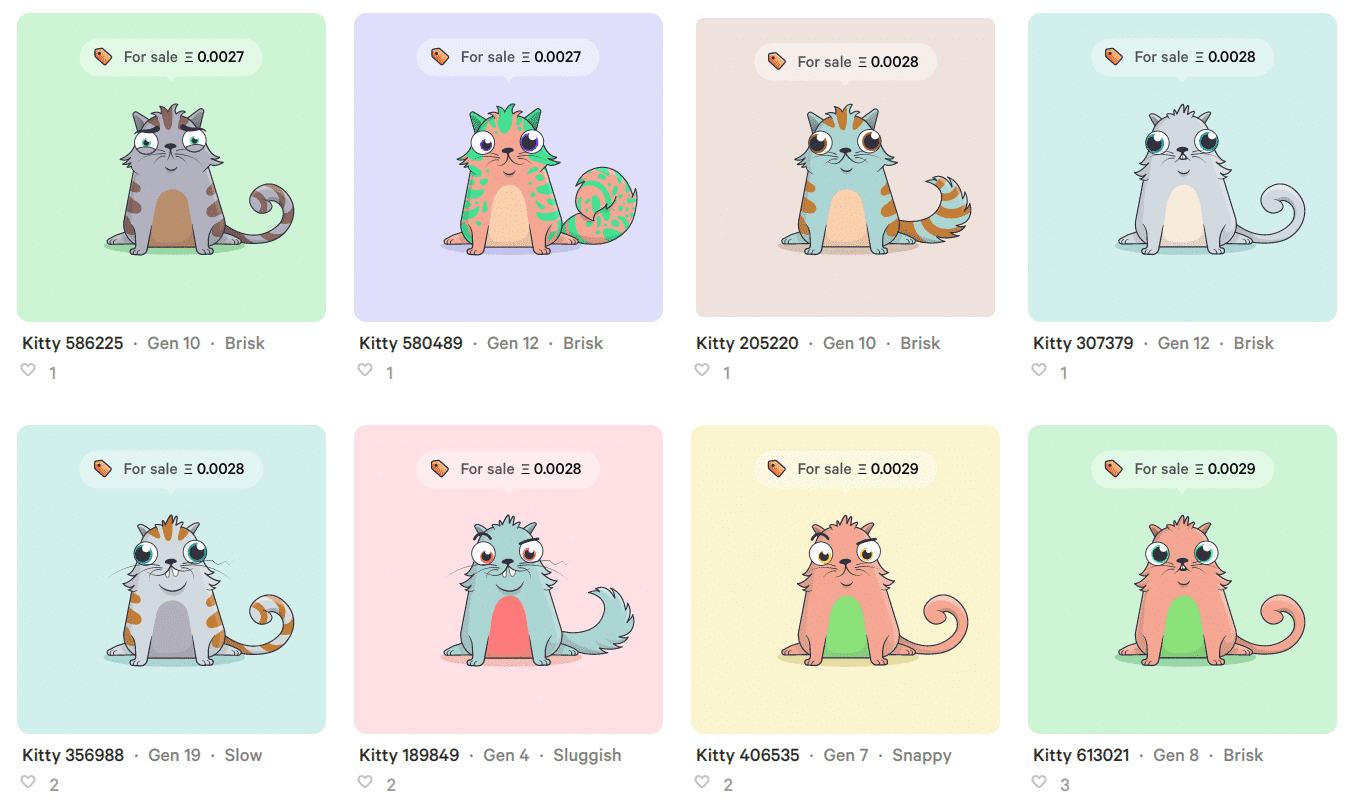

NFTs work essentially as a database entry for any type of good. Perhaps the easiest example is the most popular NFT in blockchain history, CryptoKitties. There are thousands of CryptoKitties in existence, but they are not created equal. Each is unique, has its own name, eye color, fur color, fur pattern, facial expression, and special features. When you buy a CryptoKitty, you are gaining ownership of a non-fungible token that corresponds with that kitty. Some kitties are more valuable than others, and you can buy and sell your CryptoKitty NFTs for varying amounts of fungible tokens like Ether, depending on the rarity of your NFT.

In order to understand the power of non-fungible tokens for blockchain-based asset and identity security, it’s helpful to think through a few more examples of how NFTs work.

1. Collectibles

We’ve already looked at one example of collectibles secured by an NFT, CryptoKitties. But the collectibles market extends in all sorts of directions. One major avenue is art collecting. Paintings and sculptures could be verified and authenticated by experts before creating a non-fungible token for a given piece of art. When the owner wants to sell the piece of art, they can simply list the non-fungible token on an auction as proof that the asset is real and they’re the true owner.

This kind of certification digitizes the process of provenance and prevents forgery and fraud in the art world because the ownership of art assets exists on the blockchain. The same could be done for baseball cards, stamps, jewelry, autographed guitars, or any collectible item you could imagine. The security of the blockchain guarantees the legitimacy of the transaction.

2. Online Gaming

NFTs are revolutionizing the world of gaming. Often, characters in games acquire tradeable items like weapons, clothing, and even property. Creating non-fungible tokens for these assets makes them tradeable for in-game tokens or even real-world cash. As a result, entire online digital economies for fictionalized goods have appeared. Decentraland is the project closest to the cutting edge of in-game blockchain economies, and they’re testing a complete game built around blockchain, AI, and 3D interaction with a digital world.

Traditional multiplayer video games and even casinos are getting in on the non-fungible token craze as well. They realize that blockchain tokens allow players (and companies) to extract real-world value from playing an online game. That makes for powerful economics as the market for gaming content continues to expand.

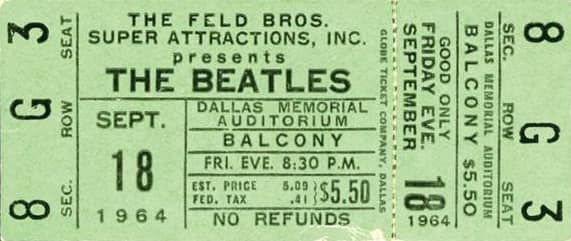

3. Tickets

If I have a ticket to see Barcelona play Manchester United and you have a ticket to your local high school basketball game, those are both similar items, but they have wildly different values. Both will grant admission to an event at a certain time and place, but they are hardly transferable. This is the essence of an NFT. It standardizes ownership of a certain category of asset, but the assets within that category can have very different market values. Ticket sales are a great opportunity for NFTs to revolutionize an industry.

4. Identity & Certification

Things start to get really interesting when we consider identity and the role NFTs can play in verifying personhood. You could receive a nontradable digital token as your birth certificate, as your passport, and as your driver’s license. Of course, you wouldn’t be able to trade these tokens, but they would be able to interact and verify with the proper authorities. You could also share this information voluntarily with employers, doctors, or anyone else who needs your personal info.

Maybe you could receive your university diploma as a digital token. Alternatively, you could ask to see your doctor’s verified NFT that they completed medical school, exams, and residency. In addition, data that companies would normally collect about you, like your browsing history or shopping preferences, could be tokenized and then kept private or sold at auction to make money from the personal economic data you create.

[thrive_leads id=’5219′]

ERC-721: The Standard for Uniqueness

By far, the most popular type of NFT is based on Ethereum’s ERC-721 token standard. The standard codifies the creation of a non-fungible token and guides developers through the process of setting up the smart contract that powers it. A standard is important because it means the tokens play nice with one another and with the Ethereum network. This is especially important when it comes to transfers and creating marketplaces for buying, selling, and trading NFTs. The creation of ERC-721 tokens has exploded over the past year with the huge wave of digital collectibles and game-based assets coming online.

ERC-721 is the most popular, but it’s not the only type of NFT. Counterparty also allows for the creation of non-fungible tokens but powered by the Bitcoin blockchain source code instead of Ethereum. There are other smaller projects and related services that work alongside Ethereum or Counterparty to create unique assets in specific niches, like Codex for fine art or Bitcrystals for gaming.

How to Trade NFTs & Where to Store NFTs

Buying and owning NFTs isn’t like typical cryptocurrency trading. In order to purchase a digital collectible or tokenized asset, you’ll likely need a digital currency like Ether, although individual sellers may accept cash or trade.

You’ll also need someone to transact with. Since each token is unique, there aren’t exchanges for NFTs. Instead, there are marketplaces that connect individual buyers with individual sellers. You’ll have to work out a price with the person selling the token. Then, you can purchase it directly from them.

If you buy an ERC-721 token it will go to your Ethereum wallet address just like an ERC-20 token. However, viewing it in a wallet client won’t tell you anything about its value, only that you hold it. Its value comes from whatever system the token is a part of. So, a CryptoKitty NFT is linked to a drawing of a kitty with certain attributes, and that kitty can be listed on the open market should you choose to sell.

The Non-Fungible Token Future

Once you start thinking about the possibilities of non-fungible assets, it’s difficult to find a theoretical limit to the things NFTs could digitize. It’s more than crypto art tokens– NFTs could represent your identity, qualifications, real-world property, and all sorts of digital collectibles, all existing on the blockchain. These tokens are capable of being stored, showed, shared, or sold.

NFTs make it possible to transact and do instant business with anyone in the world, and companies can manage entire inventories using digital tokens. NFTs are the foundation for the future economy given a few years and a lot of work developing the ecosystem.