TLDRs;

- Nio’s ES8 SUV launch marks a strategic pivot from premium pricing to mass market affordability.

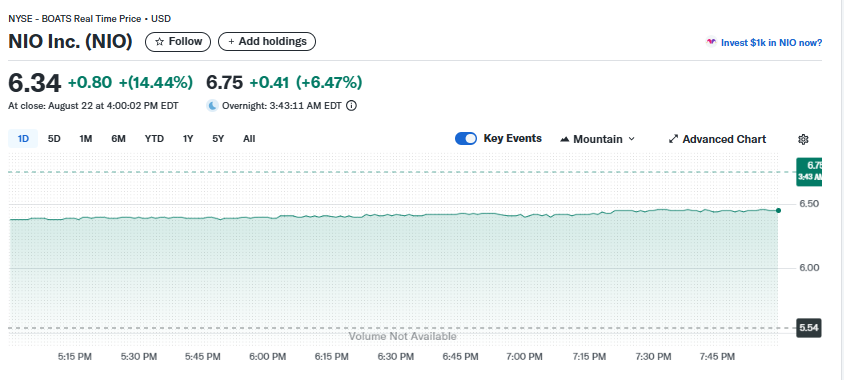

- The stock jumped 14.44%, extending a seven-day rally, as investors welcomed Nio’s competitive positioning.

- Battery subscription plans are reducing upfront costs, making EVs more accessible to Chinese consumers.

- Nio’s BaaS model not only aids adoption but also provides sustainable recurring revenue for the company.

Nio Inc. (NYSE: NIO) saw its shares soar 14.44% on August 22, 2025, following the unveiling of its latest ES8 SUV. The rally marks the company’s seventh consecutive day of gains, reinforcing renewed investor optimism around the Chinese electric vehicle (EV) maker.

The surge came after Nio announced competitive pricing and a battery subscription plan designed to ease consumer adoption in China’s increasingly crowded EV market.

The Hong Kong-listed shares of Nio also mirrored the rise, climbing nearly 14.84% during trading on August 25. The momentum reflects growing confidence that Nio’s latest strategy could reshape its position against both domestic rivals like BYD and international challengers such as Tesla.

ES8 Targets Mass Market Pricing

The newly launched ES8 SUV represents a shift in Nio’s approach. Priced at 308,800 yuan (approximately $43,000) under a battery subscription plan, it is one of the company’s most affordable models yet.

This places it well below the typical premium range of Nio’s SUVs, historically priced between 338,000 yuan and 768,000 yuan.

Deliveries of the new ES8 are expected to begin in late September, and early demand signals suggest the SUV could play a pivotal role in expanding Nio’s customer base. By targeting the broader mass market, Nio is following a broader industry trend where EV manufacturers are cutting costs and reducing prices to capture larger market share.

Battery Subscription Model Gains Traction

At the center of Nio’s strategy is its Battery-as-a-Service (BaaS) model, which has quickly become a key differentiator in the EV market. Instead of paying the full cost of the battery upfront, customers pay a monthly fee to lease the battery.

This setup allows them to swap or upgrade batteries more easily, lowering the entry barrier for buyers who might be deterred by high upfront costs.

Analysts note that this approach not only benefits consumers but also provides Nio with a recurring revenue stream. The company has invested heavily in this model, filing more than 3,000 patent applications related to battery technology since 2020. With China accounting for roughly 60% of global EV sales, the ability to reduce upfront costs while improving customer flexibility could position Nio as a long-term leader in the sector.

Competitive Pressures Intensify in China’s EV Market

Nio’s move comes amid an intense EV price war in China. Industry giant BYD has implemented its own sweeping price cuts across several models, while Tesla continues to adjust pricing to remain competitive.

This has created a high-stakes environment where even traditionally premium brands are being forced to explore mass market strategies.

Nio has also diversified its brand portfolio to appeal to different customer groups. Its Onvo brand targets the mainstream market, while Firefly focuses on younger, urban buyers. These initiatives highlight the company’s recognition that broadening its consumer reach is essential for survival and growth in the world’s largest EV market.