- How Does PancakeSwap Work?

- Who Are The Founders Of PancakeSwap? (History Of PancakeSwap)

- What Is the CAKE Token And How Can You Farm It?

- How to Farm the CAKE Token: A Quick and Easy Guide

- Is the PancakeSwap Lottery Feature Legit?

- Syrup Pools, CAKE Farming And…. NFTs!

- How Does PancakeSwap Compare To Other Decentralized Exchanges?

- Final Thoughts: Is PancakeSwap The DEX Of The Future?

PancakeSwap is the world’s third most popular decentralized cryptocurrency exchange providing users with fast transactions and low fees of 0.25%.

The exchange lets you sell and buy BEP 20 tokens–a token developed from the Binance Smart Chain Blockchain (BNB chain) platform. PancakeSwap hosts a range of unique features, including a liquidity pool and staking rewards, a lottery system, and the ability to swap tokens without an intermediary.

The majority of DEXs are built on the Ethereum network, which is known for slower transaction times and higher fees. This can make trading cryptocurrency a little more expensive and a lot more stressful.

PancakeSwap is an alternative, offering users several lucrative opportunities to keep them on the platform.

In this PakecakeSwap guide, we’ll cover how PancakeSwap works, the founders of the exchange, how you can farm its native token, CAKE, its lottery perks, and how it compares to other decentralized exchanges.

How Does PancakeSwap Work?

The PancakeSwap exchange is an automated market maker (AMM) that helps remove intermediaries from the trading process. Instead of relying on a counterparty to provide liquidity, its programming defines the price of crypto and provides liquidity in the form of a liquidity pool.

This pool consists of funds deposited by investors, which are then turned into smart contracts to offer liquidity. For buyers, this means they no longer need to wait to be matched with a seller but can instead deposit their current cryptocurrency into the pool and withdraw the crypto they want.

For example, if an investor wants to trade their Binance USD (BUSD) with CAKE (PancakeSwaps native token), they can use a BUSD/CAKE pool to deposit BUSD and receive CAKE based on the exchange rate at the time of the transaction.

Users can also earn rewards from PancakeSwap as a liquidity provider. Liquidity providers can deposit tokens into a liquidity pool to earn a share of the trading fees. Each trader pays a fee of 0.25%, of which 0.17% is added to the liquidity pool and shared amongst providers. The greater the liquidity you offer, the more rewards you can earn.

PancakeSwap also lets users generate rewards through CAKE farming, in which a user deposits liquidity pool tokens to earn CAKE–we’ll go into greater detail on how you can do this later in this article.

A unique feature of PancakeSwap is its daily lottery draw, which requires an entry fee of $5 worth of CAKE. The draw works much like a traditional lottery, in which players must match their numbers to win.

The winning pools come from three sources:

- Ticket costs

- Rollover prizes

- Cake treasury

The rewards start with general ticket costs combined with CAKE tokens from the treasury. An average of 35,000 CAKE is added from the treasury each week (10,000 CAKE every other round), and the funds are rolled over if nobody wins.

This unique feature not available on any other decentralized exchange showcases PancakeSwap’s fun and friendly approach to trading.

Who Are The Founders Of PancakeSwap? (History Of PancakeSwap)

PancakeSwap was created as a fork of SushiSwap in September 2020, using an almost identical code but instead being built on the BNB chain.

The founding team is anonymous, however, it’s believed that the team consists of over a dozen members– referred to as chefs. Two of these members are known as Hops and Thumper, though their identities remain unknown.

Despite being almost identical to SushiSwap, PancakeSwap has several advantages, including faster transactions and a lower swap fee of 0.2% (the industry average is 0.3%). It also offers several additional features, such as yield farming across other protocols, initial farm offerings (IFOs), and its daily lottery.

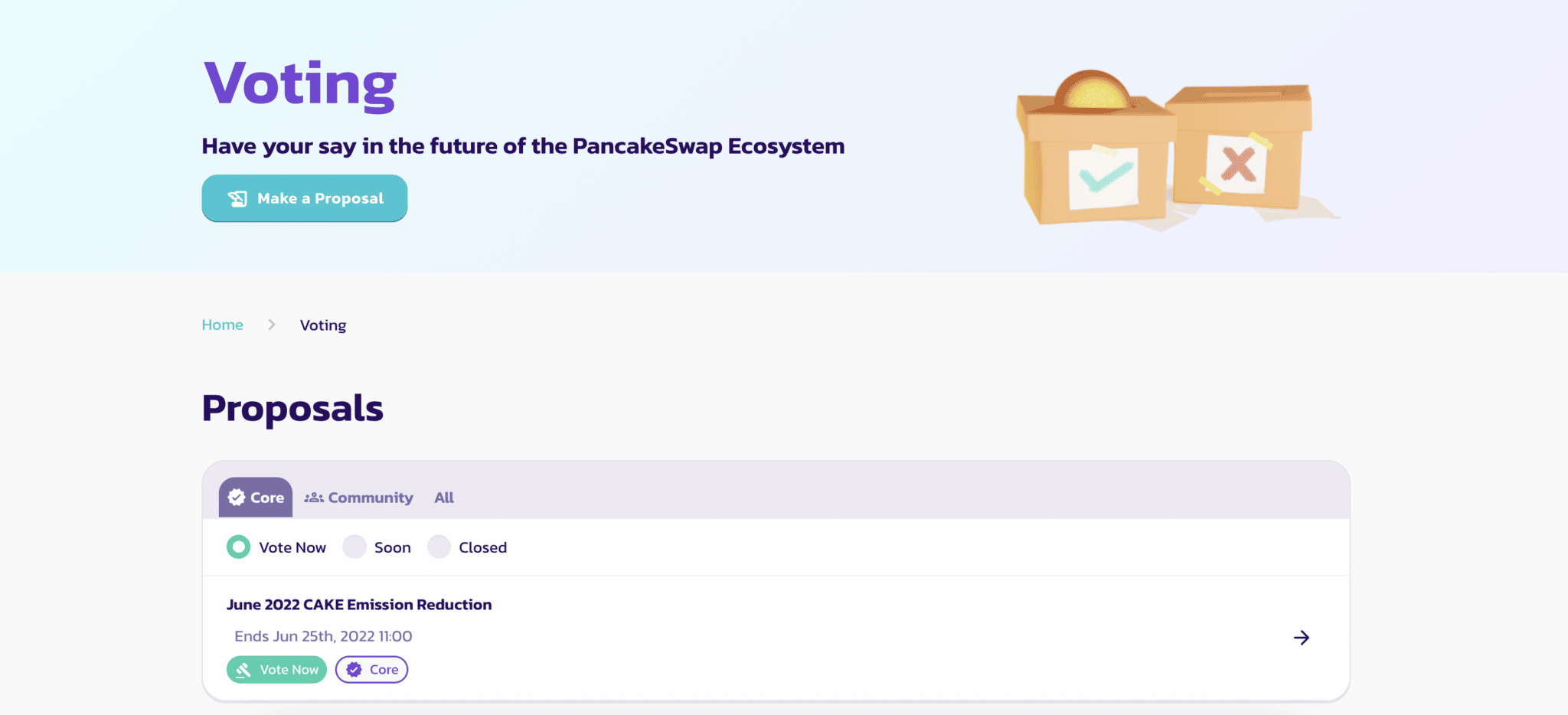

Although founded by an anonymous team, PancakeSwap is governed by its community. CAKE holders can use PancakeSwap’s voting portal to discuss and vote on a range of governance decisions, as well as create their own proposals.

This feature is available to all CAKE holders, with voting power being proportional to the number of tokens a user holds. The more you own, the more power you have.

What Is the CAKE Token And How Can You Farm It?

If you’ve come here to learn how to grow chocolate pastries on a tree, we have bad news for you… You won’t find any chocolate cake here!

CAKE is a BEP20 token launched on the Binance Smart Chain. It incentivizes PancakeSwap users to provide liquidity on the DEX, earning rewards for locking up their tokens.

As of June 2022, one CAKE token is worth $3.24 and has a trading volume of $144,809,842. It has a total supply of 750,000,000 CAKE with 148,603,636 tokens in supply and is ranked the 69th largest cryptocurrency on the planet with a market cap of $481,653,827.

How to Farm the CAKE Token: A Quick and Easy Guide

First, you need to start by adding liquidity to PancakeSwap.

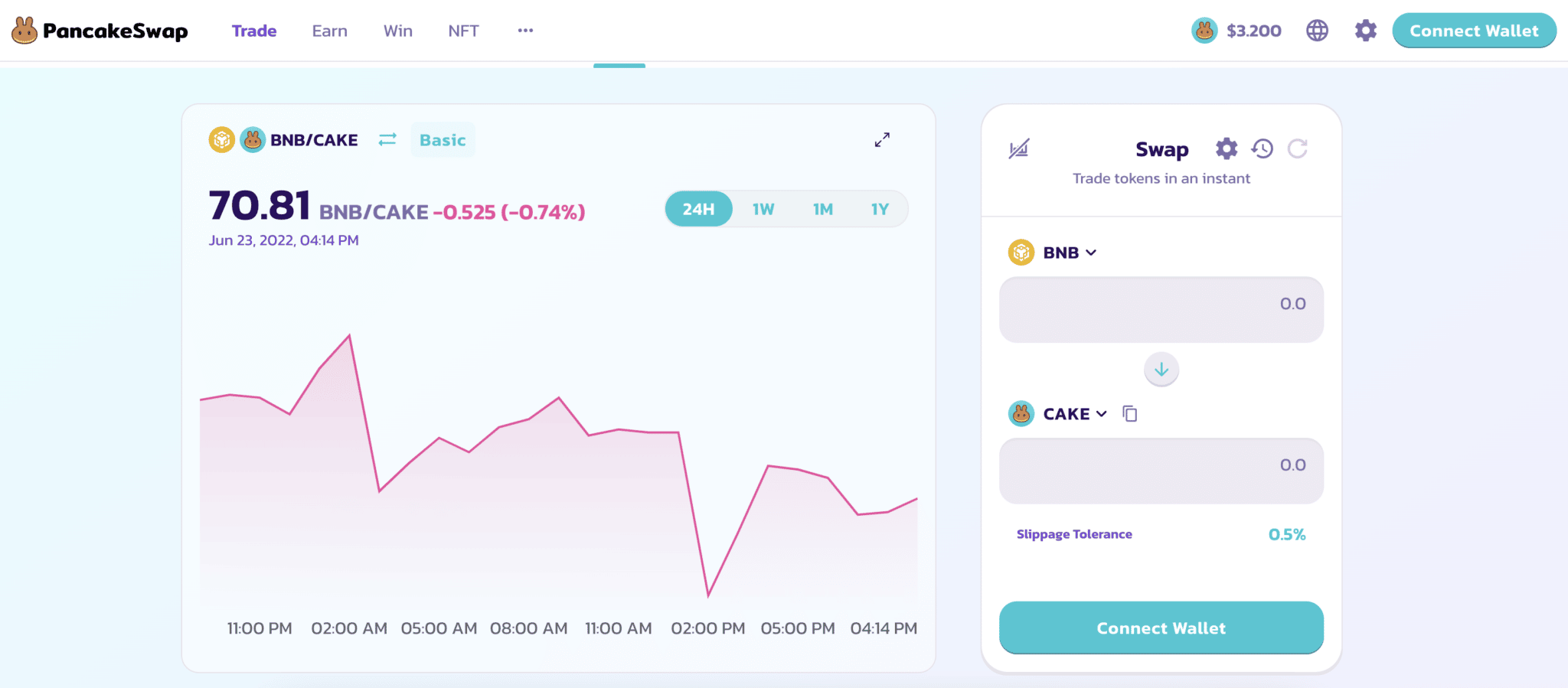

1. Start by connecting your wallet to PancakeSwap using the Connect Wallet button in the top right corner.

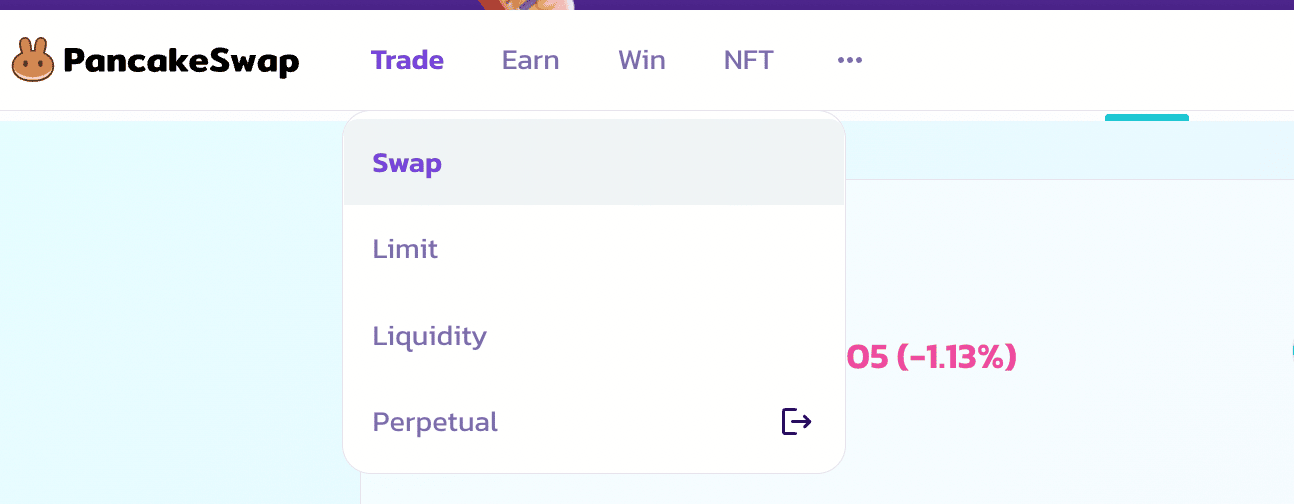

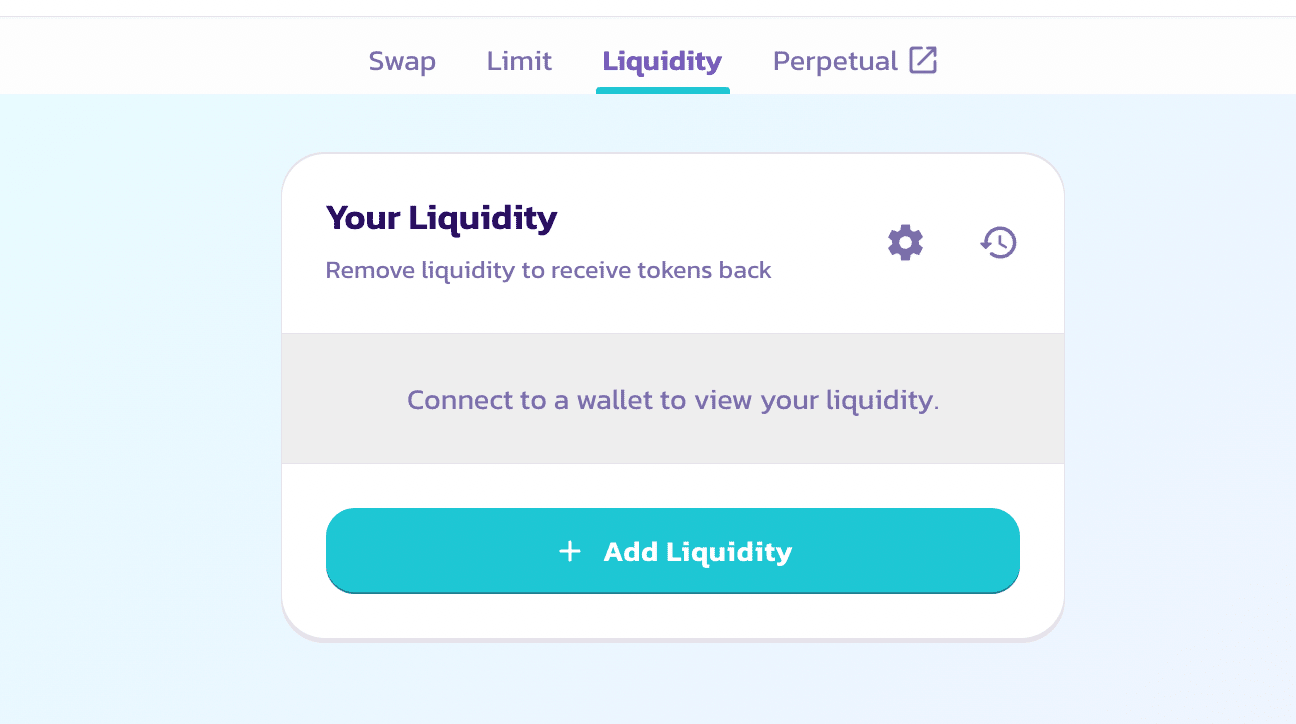

2. Once connected, go to the Trade tab and click Liquidity.

3. You’ll be directed to the Liquidity page, where you can click Add Liquidity and choose the token pair you want to deposit. You’ll need to deposit both tokens based on the ratio provided on the site.

4. After choosing the pair, you’ll need to sign the transaction from your wallet, and you’ll receive liquidity provider (LP) tokens based on your share of the liquidity pool.

That’s the first step over with! Now you can actually start farming by depositing your LP tokens in a farm to receive CAKE tokens.

Farms are similar to liquidity pools and let you earn interest in your holdings. Here’s how you can start farming on PancakeSwap.

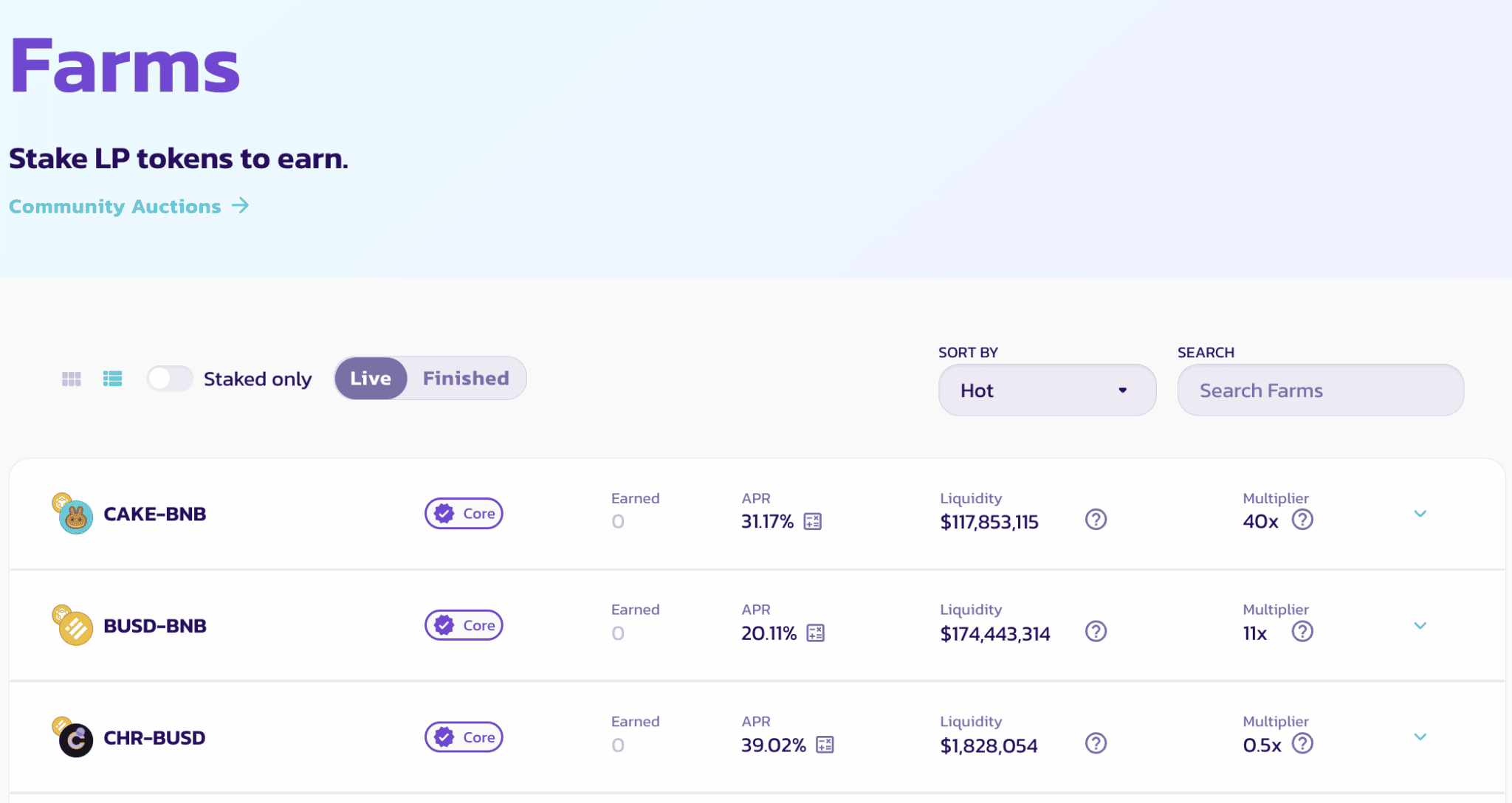

5. Head to the PancakeSwap homepage, click on the Earn tab and choose the Farms option.

6. You’ll be transferred to a page where all available farms are listed.

7. Choose a farm that’s compatible with your LP tokens. You’ll also be able to look at the annual percentage rate (APR) offered.

8. After choosing a farm, click Enable. You’ll then need to confirm the transaction in your wallet.

9. Upon confirming, the Enable button will switch to Stake LP. Click this and choose the number of tokens you want to stake

Almost there now, we promise!

10. Click Confirm and confirm the transaction in your wallet.

11. Once completed, your staked LP balance will show how much you have on the farm.

12. You’ll be able to withdraw your earnings at any point. Simply click Harvest, and PancakeSwap will return your tokens.

And that’s it! Now you’re farming CAKE and will earn rewards based on the farm you’ve chosen.

If you don’t want to farm CAKE, you can buy it on any of the following exchanges:

- Binance

- VCC Exchange

- BKEX

- KuCoin

- MXC.COM

Once purchased, you can store your cake with MetaMask, Binance Smart Wallet, or Trust Wallet.

Is the PancakeSwap Lottery Feature Legit?

We briefly mentioned PancakeSwaps Lottery above, but let’s explore what it is and how it works.

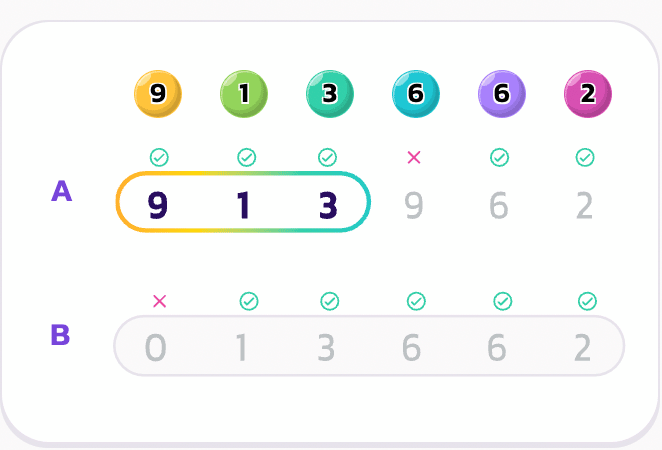

The PancakeSwap lottery is a daily event. To win, players must hold a winning four-digit combination that’s made up of numbers between 1 to 14. For example, 4-8-9-12.

A random combination is created for each lottery ticket purchased, and 50% of the lottery pool is awarded to players who have a winning combination. This combination must be in the same order as shown below.

If a player hasn’t got a matching ticket, they can still earn rewards if two or more numbers match those in the winning ticket- though they must be in the same position as the winning combination.

If nobody wins, the prize money is rolled over to the next day, increasing the overall pool for the next group of players.

Syrup Pools, CAKE Farming And…. NFTs!

As well as the Pancake Swap Exchange, users can invest in non-fungible tokens (NFTs) using PancakeSwap’s new NFT store. The store is home to BNB Chain-based NFTs, including Pancake Squad, Gamester Apes, and BornBadBoys. Although not as popular as NFT stores such as OpenSea, these collections have a value of over $1 million, with many NFTs selling for over $1000 each.

How Does PancakeSwap Compare To Other Decentralized Exchanges?

Despite being a relatively new addition to the market, PancakeSwap is already the third most popular DEX in the world.

It hosts by far the largest number of markets with over 3798 options to choose from. The closest to this is Uniswap V3, with 613 markets. Other competitors such as Curve Finance and dYdX are significantly smaller with 59 and 10 markets.

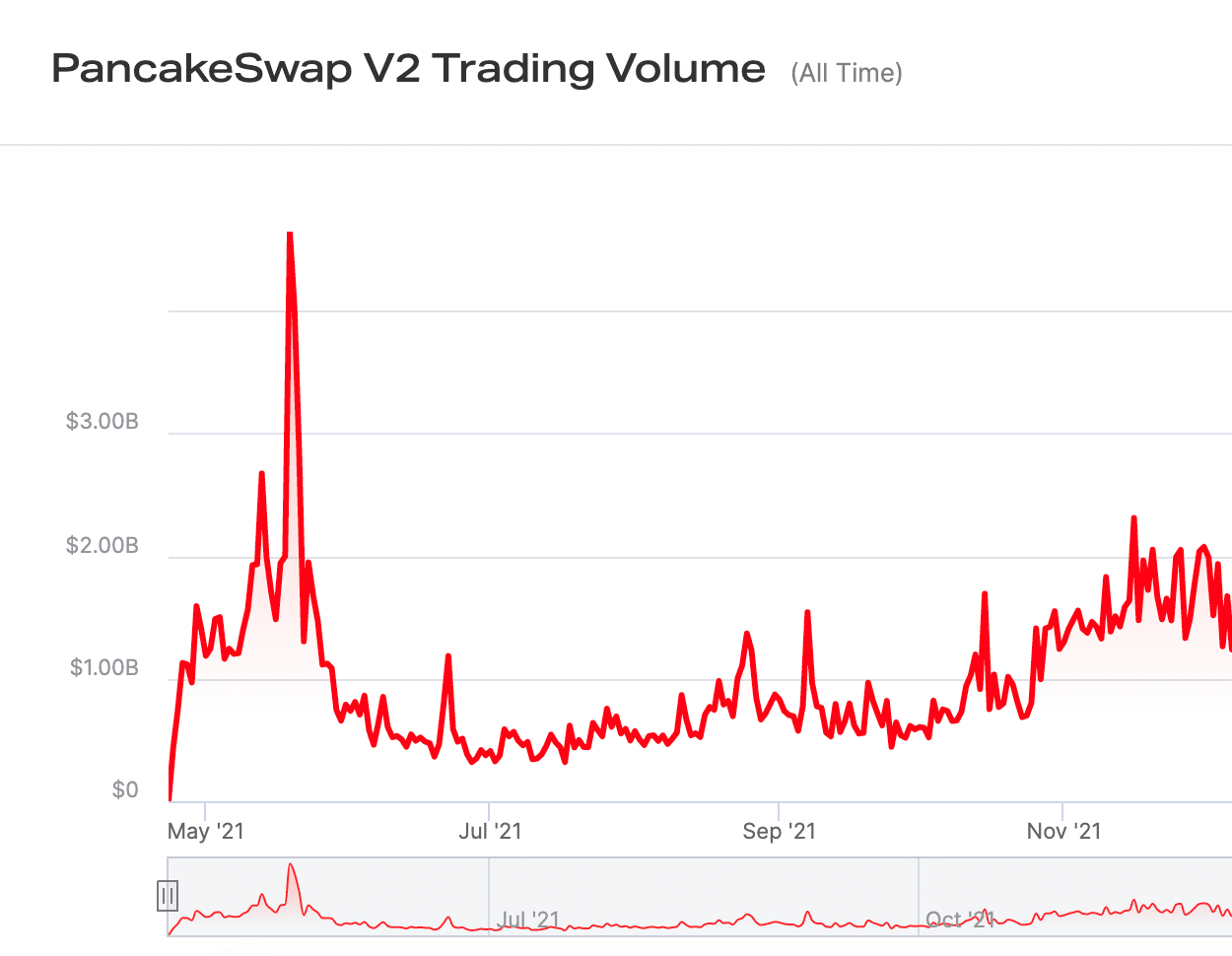

In terms of trading volume, PancakeSwap ranks third in the world with an average volume of $944,910,070. Although this is smaller than Uniswap ($2,852,303,427) and dYdX ($1,978,182,884), the overall volume traded on PancakeSwap is steadily growing, while Uniswap and dYdX are on the decline.

Final Thoughts: Is PancakeSwap The DEX Of The Future?

PancakeSwap allows investors to enjoy trading with lower fees and faster transaction times while providing them with several innovative features not available elsewhere in the market.

Investors can be liquidity providers, CAKE farmers, or NFT traders. Or, they can go full degen and play in the projects lottery feature.

With so many features, it’s no surprise that PancakeSwap has become one of the most popular DEXs in less than two years, currently ranking as the third most popular option.

Although the team behind the project remains anonymous, their governance system allows the Pancake Swap Exchange users to determine the future of the platform. This allows them to adapt the platform based on what users say, instead of dictating what is best for the project.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.