ParaSwap is a multi-chain decentralized exchange (DEX) aggregator on the Ethereum blockchain. ParaSwap is a middle layer that aims to create a better user experience when dealing with various DeFi protocols, ultimately with the goal of facilitating the flow of liquidity in decentralized markets.

Basically, ParaSwap aggregates all the price and data feeds for large decentralized exchanges to offer users the best possible price for swapping between cryptocurrency assets. It largely focuses on ERC-20 tokens.

The principal objective behind ParaSwap is to facilitate speedy trades at the most acceptable price and get ranked as the most preferred exchange aggregator on the Ethereum blockchain.

ParaSwap uses its native token PSP to facilitate its variety of functions.

This guide on ParaSwap explores why investors may prefer to use ParaSwap as their preferred interface with the decentralized finance world.

ParaSwap Features

Typically, DEX aggregators don’t usually provide the liquidity for token swaps on their own– they simply connect users with the DeFi protocol that does.

Through its ParaSwapPool, however, users have access to a confidential market maker pool as its own deconcentrated economic liquidity source. The ParaSwapPool is an integrated liquidity pool financed by private investors with the goal of providing the most competitive rates. Rather than the DeFi protocol receiving the liquidity, ParaSwap essentially front runs it with its own pool.

ParaSwap also utilizes a feature called MultiPath, a pathing mechanism that breaks the tractions across various exchanges. It’s involved in tracking down multiple paths of related token sales, intermediary tokens, and more.

Whenever a transaction occurs in the Ethereum blockchain, a particular share of fees (gas fees) is required to process the proposal. Gas fees generally vary with network activity and transaction size. ParaSwap itself doesn’t charge users for token swaps, but users still have to pay the Ethereum fees. However, ParaSwap does ask for a commission on any exchange facilitated. Decentralized apps integrated with ParaSwap also take a minor commission via a Revenue Sharing contract.

When gas prices are low, ParaSwap facilitates tokenization of the gas price as GST2 Gas tokens. At moments of extreme network traffic, the GST2 gas tokens can be used to reduce the much higher congested gas fees.

PSP, the native token of ParaSwap, is used to facilitate the protocol’s decentralization. Of the total 2 million PSP tokens, around 7.5% are airdropped. About 150 million tokens are present in the primary circulating supply.

Price Impact and ParaSwap

Price impact is the observed fluctuation between the initial tokens swapped at entry and the total tokens received at the destination. Measuring price impact is much easier when the trade happens with high liquidity tokens and fewer liquidity tokens.

Price impact increases with trade size, and ParaSwap aims to keep it under control.

Since cryptocurrencies operate in a free market where the prices fluctuate considerably, slippage occurs. The term “slippage” means the difference between the predicted amount and the obtained amount. Slippage happens when the tractions push the cost to the bottom after submitting the first transaction.

Trading on ParaSwap

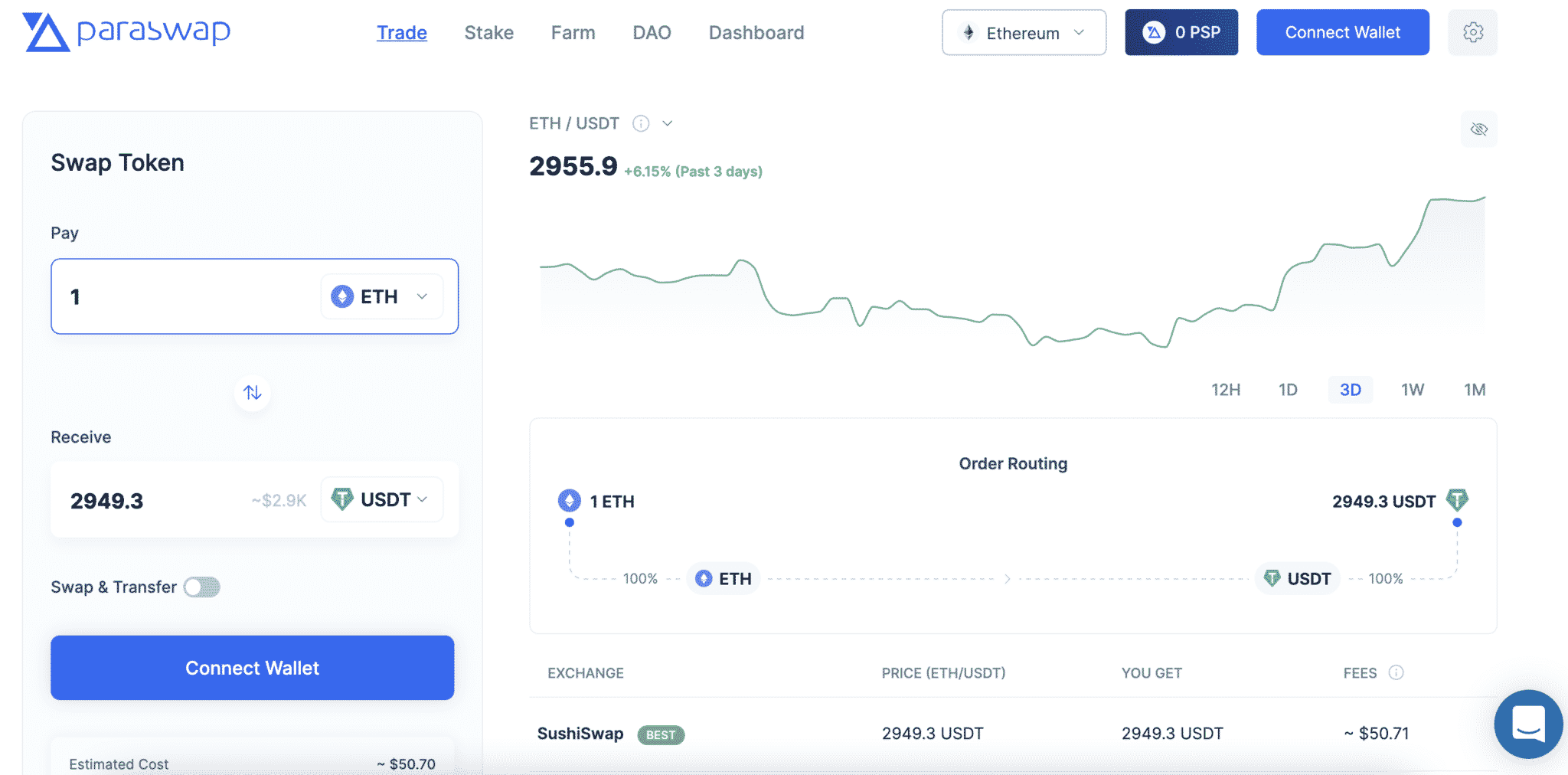

Given the above considerations, the mechanism of trading on ParaSwap is as follows:

- Step 1: The user picks the number of tokens they want to commerce

- Step 2: ParaSwap identifies the best trading price across every decentralized exchange.

- Step 3: ParaSwap provides explicit information to the users about every possible trading route.

- Step 4: The user can select the most appropriate path and start a transaction

- Step 5: After the transaction, the swap is performed, and the traders obtain corresponding tokens.

Final Thoughts: ParaSwap and Its Role in DeFi

Through its routing mechanisms, ParaSwap can be a good choice for DeFi users aiming to get the best possible price on a token swap.

The current DeFi experience leaves much to be desired, but middleware and intermediary products are exploring ways to iterate and innovate in favor of the end customer. With middleware products such as ParaSwap entering the market, the case for DeFi and user adoption is fairly optimistic.

For more information, check out the ParaSwap site and further documentation.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.