The bitcoin mining frenzy is on and miner rigs are once again in high demand following the recent market escalation. It saw the industry emerge from a five-month crypto winter.

According to current Chinese media reports, prices of popular bitcoin processing machines have more than doubled in the past 6 months.

Demand for the devices is allegedly outstripping supply and making it exceptionally hard for mining farm operators to get ahold of new machines. Second-hand miners that were previously only being sold in bulk due to a drop in demand are becoming increasingly expensive.

China is a major crypto mining powerhouse. This makes it highly susceptible to market upheavals. The crypto mining movement in the country has been able to burgeon over the years because of access to cheap electricity and the availability of inexpensive hardware.

Subsequently, Chinese miners control over 70 percent of the bitcoin network hash rate. Miner groups in the country have turned some regions such as the Sichuan province into crypto mining havens due to the abundance of cheap electricity.

There are also reports of miners flocking to Iran to take advantage of subsidized electricity costs.

An Increase in Mining Difficulty Triggers Demand for Miners

The explosion of mining activity has exponentially increased mining-difficulty on the bitcoin network. This is because its system was designed to algorithmically change mining difficulty after every 2016 processed blocks.

Consequently, much more electricity is needed to process a single bitcoin when hash rates are high. Additionally, more miner devices are required to mine a block.

The current average bitcoin mining hash rate is 65 terahashes per second. The network has already hit a record-breaking 79 trillion hashes per second. Analysts predict that 100 TH/s could be reached by the end of the year.

This is forcing miners to augment the number of mining machines in operation to maintain the reward rate.

According to the head of global sales and marketing at Canaan Creative, Steven Mosher, the current demand for mining machines resembles 2017 third-quarter and fourth-quarter markets conditions when it quadrupled.

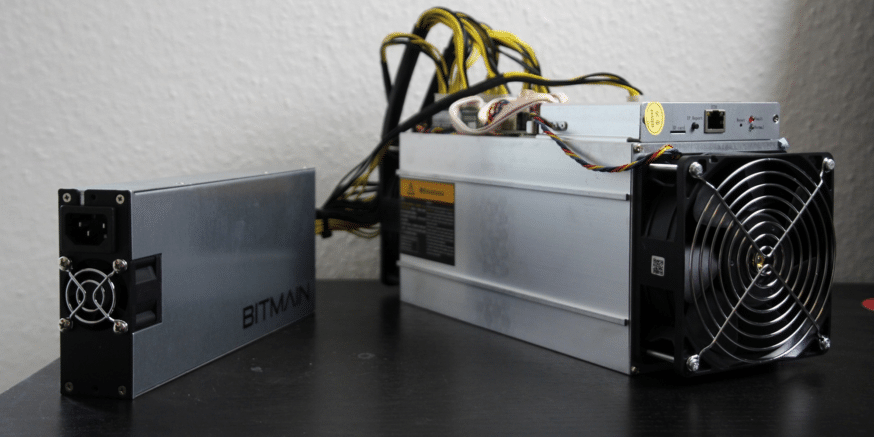

Major cryptocurrency companies are already buying miners by the thousands to scale operations. German-based company, Northern Bitcoin, recently signed a deal with both Bitmain and Canaan to buy 5,000 ASIC machines from the two firms.

MGT Capital Investments also recently announced a 1,100 BTC miner order from Bitmain. The deal involved a shipment of S17 Antminers that have a maximum operational capacity of 56 Th/s.

The companies predict an increase in revenue thanks to the addition of high-capacity miners.

(Featured Image Credit: Pixabay)

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.