What Is QASH?

QASH (pronounced “cash”) is the native currency for the Quoine (pronounced “coin”) Liquid platform. Quoine is a global cryptocurrency firm looking to solve the liquidity problems that have surfaced with crypto investments.

If you’ve been investing in cryptocurrency for a while, you’ve probably experienced these liquidity problems first-hand. Investing in anything outside of the top few coins usually involves multiple exchange accounts, transfers between them, and three-way trades between fiat, Bitcoin/Ethereum, and the coin you want. Cashing out into fiat is just as difficult.

Because a majority of people treat cryptocurrency as an investment, its illiquidity hinders the growth of the entire industry.

In this QASH guide, we’ll be talking about:

- How Does Quoine Liquid Work?

- QASH Token

- Quoine Team & Progress

- Trading

- Where to Buy QASH

- Where to Store QASH

- Conclusion

- Additional QASH Resources

How Does Quoine Liquid Work?

Quoine Liquid brings liquidity to the cryptocurrency space by providing a means for you to easily buy cryptocurrency with and cash-out to fiat.

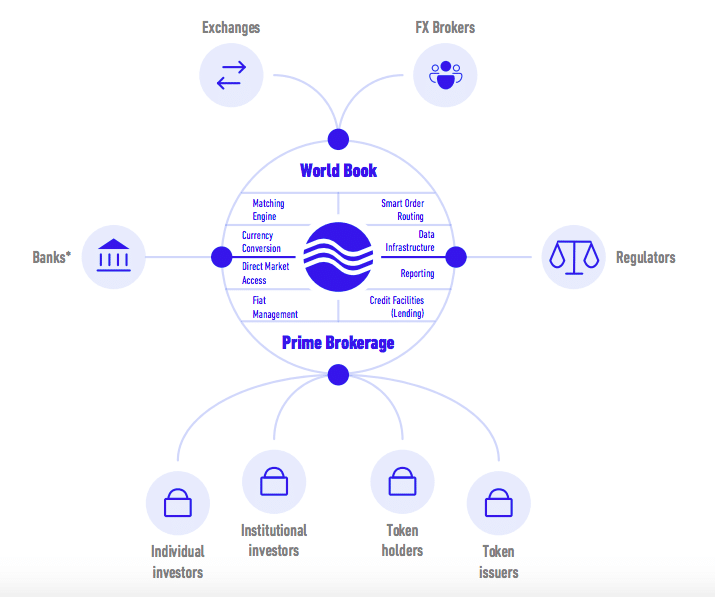

Currently, each crypto exchange has its own level of liquidity that differs between the trading pairs it offers. This creates individual silos that may have great liquidity on one exchange but not on another. The Liquid platform connects these silos into one combined pool to give you the greatest liquidity possible. To do this, Quoine Liquid encompasses two main offerings:

- World Book

- Prime Brokerage

World Book

The Liquid World Book compiles the orders and prices from exchanges around the world into one order book for you to use. This gives any trader, no matter their location, the ability to use the fiat currency of their choice when purchasing or selling crypto. It removes the liquidity silos of separate exchanges and gives more trading power to previously underserved markets.

Using a mixture of an Internal Order Book and an External Aggregate Order Book, Liquid utilizes the foreign exchange (FX) market to create trading pairs for fiat currencies that may not have otherwise existed.

The World Book uses three primary functions to provide the enhanced level of liquidity that Quoine promises:

- Matching Engine (ME)

- Cross Currency Conversion Engine (CCCE)

- Smart Order Routing (SOR)

The ME is an industry leader with the ability to process several million transactions per second. It includes native support for the major token pairings and is built in a way to easily scale and add new pairings as they emerge.

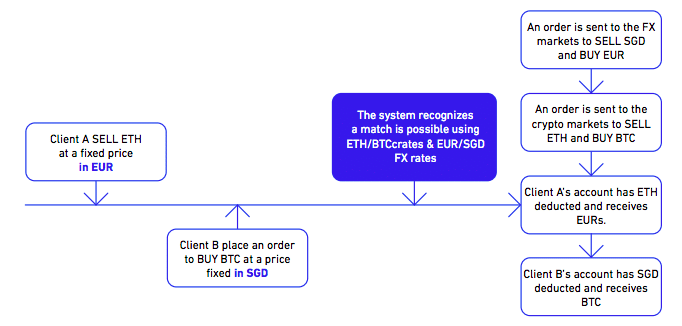

The CCCE powers automated and almost instantaneous conversions between currencies. This is the method behind seemingly impossible trades between users. For example, converting through the CCCE allows someone looking for an ETH/EUR pair to trade with another person in search of BTC/SGD. As this becomes more efficient, the number of possible matches should increase enough to create a completely fluid market.

The SOR technology monitors all major exchanges and externally completes orders that can’t be filled internally from the World Book.

Prime Brokerage

The Prime Brokerage half of the Quoine Liquid platform basically gives you access to the features outlined in the previous World Book section.

With Prime Brokerage, you have direct market access to all exchanges in the World Book without having to create an account on each individual exchange. Furthermore, Quoine has been building partnerships with a network of banks over the last several years to ensure the quick transfer of your fiat funds.

Using Prime Brokerage, you can also extend a credit line and leverage trades using your existing balances.

ICO Market

Since launching, the Liquid team has also added an ICO Market to the exchange. The new area allows you to learn about and contribute to ICOs that the platform hosts. Currently, the ICO Market only contains two ICOs.

QASH Token

QASH is an ERC20 token you use to pay for services on the Liquid platform. Beyond that, QASH holders may also receive discounts, promotional products, and ICO investment opportunities with coins that Quoine helps to launch. The team also emphasizes in their whitepaper that other organizations may use it for their own purposes similar to how some financial institutions use the Ripple XRP token.

The team minted 1,000,000,000 QASH with 350,000,000 (35%) distributed to ICO participants. Of the remaining tokens:

- 300,000,000 QASH (30%) are allocated to the community/ecosystem

- 200,000,000 QASH (20%) belong to the team and shareholders

- 150,000,000 QASH (15%) are held by strategic partners and institutional buyers

By Q2 2019, Quoine will create its own blockchain and migrate all QASH tokens to the new blockchain. At this time, they will also rebrand QASH to Liquid.

[thrive_leads id=’5219′]

Quoine Team & Progress

Mike Kayamori (CEO) and Mario Gomez Lozada (President and CTO) founded Quoine in 2014. Kayamori was previously a Senior Vice President at SoftBank Group and was the Chief Investment Officer of Gungho Asia. Lozada was the CTO of Merrill Lynch in Japan for 11 years before taking the Chief Information Officer role at Credit Suisse Japan.

Quoine is the first cryptocurrency firm in the world to be officially licensed by the Japan Financial Services Agency (FSA). The Liquid platform is actually the result of combining two previous platforms, Quoinex and Qryptos. At one time, those two trading platforms were performing over $12 billion of transactions each year.

The Quoine team is currently working on creating their own blockchain with an alpha release sometime soon. Additionally, a mobile app is in the works. They haven’t specified a launch date for either thing, however.

Competition

Because Quoine enters a few different financial sectors, the company has quite a few competitors. As a credit facility, the company competes with SALT. On the exchange side, there are numerous other businesses like Binance specializing in alternative coins or Gemini and Coinbase focusing on fiat to crypto conversions. Even Robinhood is in the picture now.

The Bancor protocol is the project most similar to Quoine and QASH in that it brings liquidity to all tokens that use the protocol.

Quoine is unique in offering this suite of functionality all through one platform. With roots beginning in 2014, Quoine is one of the oldest competitors as well.

Trading

QASH has had a volatile start since it began trading in November 2017. After the ICO, the price of the coin quickly rose to a high of $1.48 (0.00013 BTC) before slowly falling to about $0.60 (~0.00004 BTC) by the middle of December.

QASH experienced two significant price bumps since then – one in the middle of December after bottoming out and one at the beginning of January. These two spikes don’t appear to have been caused by any news or particular developments, so we can most likely attribute them to the state of the bull market at that time.

QASH has fallen throughout the remainder of 2018 but recently started showing signs of life. The coin rose from its floor of about $0.20 (~0.000035 BTC) in the middle of November and currently sits at just over $0.22 (~0.000055 BTC). Although this is only a 10 percent gain in USD, it’s an almost 60 percent rise in BTC.

Because QASH is a utility token, additional Liquid users and growth of the platform should ideally lead to further price increases. Keep your eye out for future roadmap milestones like the Liquid blockchain release.

Where to Buy QASH

Although you can purchase QASH directly on Liquid, it’s traded with a much higher volume on Huobi. Before exchanging for QASH on Huobi, though, you need to first buy Bitcoin or Ethereum and transfer it over. Check out Gemini or GDAX to get either of the two.

On Liquid, you can mainly use JPY or USD to purchase QASH.

CoinMarketCap includes a full list of exchanges where QASH is available.

[thrive_leads id=‘5219’]

Where to Store QASH

Right now, QASH is an ERC20 token, so you’re able to store it in any wallet with ERC20 token support. MyEtherWallet is the most popular online storage option and a solid wallet that you can use.

If you’re interested in more security (and who isn’t), you should consider purchasing a hardware wallet. Options like the Ledger Nano S are more expensive than their free counterparts but provide you with additional safeguards and peace of mind.

Remember, though, the Quoine team has plans to move QASH onto its own blockchain. When this happens, the wallet you use to store your funds may not support the token anymore. Be aware of any QASH announcements and instructions on what to do when this switch happens.

Conclusion

Quoine is aiming to bring liquidity to cryptocurrency investments through their World Book, Liquid platform, and QASH token. By combining the order books of exchanges from around the world, the Quoine Liquid platform works to ensure that investors have an easy time converting fiat to any cryptocurrency and vice versa.

The team seems to have the experience and business partnerships to be successful, but this is an ambitious project. With an official blockchain launch still in development, the next couple of years will be a make or break period for the company.

If the team continues to accomplish their milestones at the same rate that they have, Quoine will easily change the cryptocurrency industry for the better. The increased liquidity will be good for currencies, great for investors, and amazing for the blockchain industry as a whole.

Editor’s Note: This article was updated by Steven Buchko on 12.04.2018 to reflect the recent changes of the project.