What Is Nano?

Nano hopes to become what Bitcoin, at times, struggles to be: an efficient, viable alternative to fiat currencies.

In Nano’s white paper, the cryptocurrency’s development team raises concerns over the practicality of Bitcoin as a common currency. The concerns are as follows:

- Scalability issues have users facing high transaction fees, with a median fee of $10.38.

- Bitcoin’s high computational latency makes for an average transaction time of 164 minutes.

- Bitcoin’s proof of work consensus uses an estimated 27.28TWh annually, an average of 260KWh per transaction.

Using its own block-lattice structure, Nano wants to succeed where Bitcoin has fallen short. The cryptocurrency promises to deliver zero-fee transactions in real time without the same work-intensive overhead and energy consumption as Bitcoin.

If you think this all sounds too good to be true, pinch yourself and keep reading. In this guide we’ll go over:

- How Nano Works

- The Perks of a Block-Lattice Infrastructure

- Trading History

- Where to Buy Nano

- Where to Store Nano

- Nano Past, Present, and Future

- Final Thoughts

- Additional Resources

How Nano Works

Like IOTA, Nano uses a directed acyclic graph (DAG) algorithm, but instead of using DAG for the tangle, the project employs its own novel tech called the block-lattice.

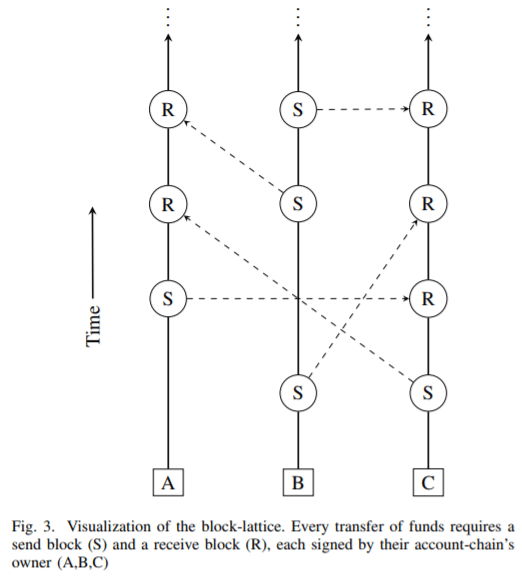

The block-lattice infrastructure operates like a blockchain but with a few key differences. To start, each account on Nano’s protocol has its own blockchain, called an account-chain. Only an account-chain’s user can modify his/her individual chain, and this allows each account-chain to be updated asynchronously of the rest of the block-lattice network.

In effect, this means that you can send and update blocks on your account-chain without relying on the whole network. To achieve this, any funds you send on Nano’s block-lattice require two transactions: a sender transaction and a receiver transaction. In order for a transaction to be settled, the receiving party must sign a block confirming that the funds were received. If only the sending party’s block is signed, a transaction is pended as unsettled. All transactions are sent in User Datagram Protocol (UDP) packets, which keep computing costs low and allow senders to transfer funds even if a receiver is offline.

Block-Lattice Ledger

One of the block-lattice’s more attractive features is how its ledger handles and stores transactions. Each Nano transaction is its own block, and each new block replaces the one before it on its user’s account-chain. In order to maintain a proper account history, new blocks take a record of the account holder’s current balance and factor it into the processing transaction.

To illustrate this, if you were sending NANO to someone, the transaction is verified by taking the difference between the send block and your current balance on the preceding block. On the other end of the transaction, the receive block would then add the amount to its account chain’s preceding block. The end result is a new block that records the updated balance of each user.

Under this system, Nano keeps a record of an account’s balance on its ledger, not a full history of all transactions like traditional distributed ledgers. This means that the Nano network only has to keep a record of each account on its full ledger. Instead of maintaining a record of all prior transactions, the network only stores account balances.

If you haven’t grasped why this may present a solution to Bitcoin’s latency and scalability issues, we’re about to go over some of its benefits below.

The Perks of a Block-Lattice Infrastructure

Improved Latency

Thanks to account-chains, each account and its chain can be updated asynchronously of the entire network. By implementing a dual-transaction mechanism, it’s up to both the receiver and sender of funds to verify a transaction. This eliminates the need for miners entirely and paves the way for instant and feeless transactions.

Scalability Solutions

All transactions on Nano are handled independently from the network’s main chain. They also fit into a single UDP packet and are recorded in their own blocks. Effectively, this does away with blocksize issues because nodes are not responsible for maintaining a comprehensive record of all network transactions. Instead, they only need to store the individual account balances of each account-chain rather than their entire ledger.

With Bitcoin’s traditional distributed ledger, a transaction cannot be cleared until an entire block is built into the blockchain. These blocks act as comprehensive ledgers for the network’s financial information and include Bitcoin’s entire transaction history. As more information is stored, we’ve seen sluggish transaction times and high fees. Nano’s account-chains make for a lightweight infrastructure. And as a result, the block-lattice offers improved scalability compared to legacy blockchains.

Energy Efficiency and Decentralization

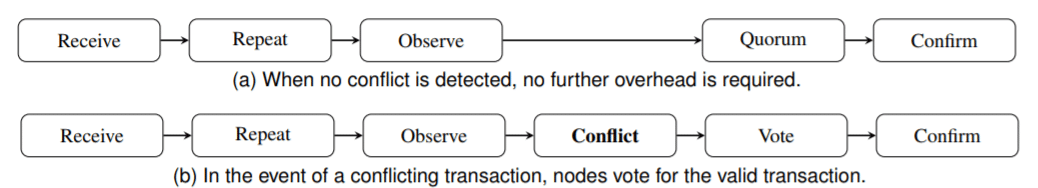

Nano keeps its network secure using a delegated proof of stake model (DPoS) similar to Ark. If any discrepancies arise with conflicting transactions, Nano delegates vote on which transaction to verify as valid. The DPoS offers a number of benefits compared to Bitcoin’s proof of work mechanism.

For one, without miners, Nano safeguards itself from mining attacks and the defacto centralization large mining pools have brought to Bitcoin’s network. Nano delegates hold a stake of its currency, so they are deterred from abusing their power lest they compromise the entire network’s legitimacy and thus their own investment.

Further, because of the block-lattice structure, delegates only need to verify transactions if a problem arises. As a result, running a node on the Nano network consumes much less energy than if the nodes were operating under a proof of work model.

Trading History

Nano had an impressive rise up, from a price standpoint, at the end of 2017. But the coin has since fallen from grace. During the last two weeks of December that year, the Nano price skyrocketed from around $2.30 (~0.000114 BTC) to an all-time high of about $35.00 (~0.00248 BTC). We’ll do the math for you: a jump of over 1,400 percent in half a month.

Unfortunately, the Nano price has quickly and steadily fallen since reaching that high. You can pick some up for just over $0.95 (~0.00024 BTC)

As a cryptocurrency that’s directly competing with Bitcoin, it’s hard to imagine Nano recovering. The success of Bitcoin’s scaling solutions would most likely mean the end of the coin.

Where to Buy Nano

A good chunk of Nano’s trading occurs on Binance with either BTC or ETH. You can find BTC/NANO and ETH/NANO trading pairs with lower volumes on KuCoin and HitBTC, as well.

Where to Store Nano

The coin currently features two online wallet options (NanoWallet, NanoVault) and three mobile options (NanoWalletCompany, Canoe, NanoBlocks).

If you’re looking for additional security, the Ledger Nano S is another great option.

[thrive_leads id=’5219′]

Nano Past, Present, and Future

Since its launch in 2015 and re-branding in early 2018, the Nano team has made concerted efforts to develop their project and keep the community updated with their progress. The less-than-ten-person team is led by Colin LeMahieu, a software engineer with ten years experience under his belt.

In March 2018, the team accomplished an important milestone with their creation of Universal Blocks. Previously, the project used four types of blocks. Universal Blocks consolidate those four types into one block type. This milestone brought improved efficiency, more scalability, and opened up the possibility for several other features.

In April 2018, the team re-structured its long-term roadmap. The web page includes thorough and ever-changing information on Nano’s development in four areas: experience, adoption, wallets, and protocol.

Final Thoughts

Nano could very well provide a working solution to Bitcoin’s scalability and latency issues. It could also significantly cut back on the energy consumption that has come to define proof of work mining.

If cryptocurrency truly wants to become a viable alternative to fiat currency, then we have to stamp out or reconcile the problems Bitcoin presents. If Nano functions as well in practice as it does on paper, you may be buying your pumpkin spiced latte with Nano in the coming years.

Editor’s Note: This article was updated by Steven Buchko on 2.19.19 to reflect the recent changes of the project.

Additional Resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.