- What Is Cryptocurrency?

- What Businesses Use Crypto?

- Advantages of Cryptocurrency For SMEs

- Disadvantages of Cryptocurrency For SMEs

- How You Can Accept Cryptocurrency

- Is Cryptocurrency The Future For Small Businesses?

If you’re wondering whether your small business should accept cryptocurrency, look no further- we’ll walk you through the pros and cons. By the end of this article, you’ll be able to confidently make the call on whether or not accepting crypto is right for your business. Accepting cryptocurrency as a small business comes with a range of benefits including:

- Attracting customers who use crypto.

- Protecting your business from certain fraud.

- Potentially creating an innovative perception for your brand.

With these benefits in mind, it’s no surprise that 36% of US-based small and medium-sized enterprises (SMEs) accept cryptocurrency as a payment. Out of the companies accepting cryptocurrency, 47% have been in business for less than 5 years, and 21% have been around for over two decades. But what can it do for your small business?

If you’re wondering whether your small business should accept cryptocurrency, look no further– we’ll walk you through the pros and cons. By the end of this article, you’ll be able to confidently make the call on whether or not accepting crypto is right for your business.

What Is Cryptocurrency?

Cryptocurrency is a broad term referring to a means of exchange that uses blockchain technology. Cryptocurrency is decentralized in nature, meaning that instead of being managed by a central bank or government, buyers will transfer funds directly to sellers without a middleman.

Being decentralized also changes the way cryptocurrency is stored. In a traditional financial market, the currency is held by an organization (usually a bank) to safeguard it. When making transactions with cryptocurrency, individuals are required to store their own crypto in a private wallet.

Wallet options include centralized exchanges such as Binance and Coinbase, or decentralized extensions such as MetaMask. Physical hardware wallets such as Trezor and Ledger are also great options and significantly more secure than their digital alternatives.

For business owners, cryptocurrency is a new payment method that can be converted into fiat or used for investments. It gives customers a new payment option, and allows for easy cross-country payments.

What Businesses Use Crypto?

Although these companies made headlines once they accepted crypto payments, an estimated 15,174 businesses of all sizes worldwide accept Bitcoin alone, making over 328,370 Bitcoin transactions every day. This number continues to grow yearly, with both investors and business owners slowly accepting cryptocurrency as a legit means of transaction.

So what benefits come from accepting cryptocurrency?

Advantages of Cryptocurrency For SMEs

As cryptocurrency technology continues to innovate, accepting crypto has several benefits over traditional point-of-sale (POS) systems.

Lower Transaction Fees

As a business owner you know how frustrating fees can be. A standard 2-4% fee may not seem like much, but when you have transaction volumes in the thousands, it’ll quickly add up.

Depending on the cryptocurrency accepted, crypto can reduce fees from 2+% to lower than 1% per transaction. For example, payment provider BitPay charges fees of 1% per transaction.

Additional Protection

Did you know that around 80% of all chargebacks are proven to be fraudulent? Due to cryptocurrencies’ decentralized nature, merchants are protected from fraudulent chargebacks. Much like cash payments, all payments are final as they can’t be controlled by a third party.

Increased Payment Convenience

Crypto payments allow small businesses to accept payments from buyers who might not otherwise be able to pay for their products. For example, crypto payments are more accessible for individuals in countries where making a fiat transaction would be too costly or the process too inconvenient. This opens up a new market of customers that would otherwise be locked out due to financial barriers.

Disadvantages of Cryptocurrency For SMEs

Despite its many benefits, cryptocurrency doesn’t come without downsides. Here are some of the disadvantages of accepting cryptocurrency.

Technical Barriers

Technical barriers are one of the greatest factors slowing down cryptocurrency adoption. Despite its benefits, there’s quite a steep learning curve when it comes to using cryptocurrency. For those unaccustomed to digital payments, this is not only daunting but a complete roadblock.

To get started with cryptocurrency, a business owner must set up a digital wallet on a cryptocurrency exchange. From there, they must integrate their wallet with their store to accept payments. This process is a little tricky at first, and you need to put in the time to learn it before accepting crypto payments.

Regulation Uncertainty

The decentralized nature of cryptocurrency is seen as a benefit to many, but it has drawbacks. In fact, cryptocurrency has come under scrutiny in the regulatory landscape, where lawmakers are looking to govern it.

Now, this may look like a good thing for business owners. More regulation means more protection, right? The downside is that new regulations also mean more uncertainty for the future. What may be an acceptable practice now may be problematic in 5 years. This is exacerbated by the taxation rules on cryptocurrency, which are already extremely complex due to cryptocurrency being a relatively new concept.

Cryptocurrency Volatility

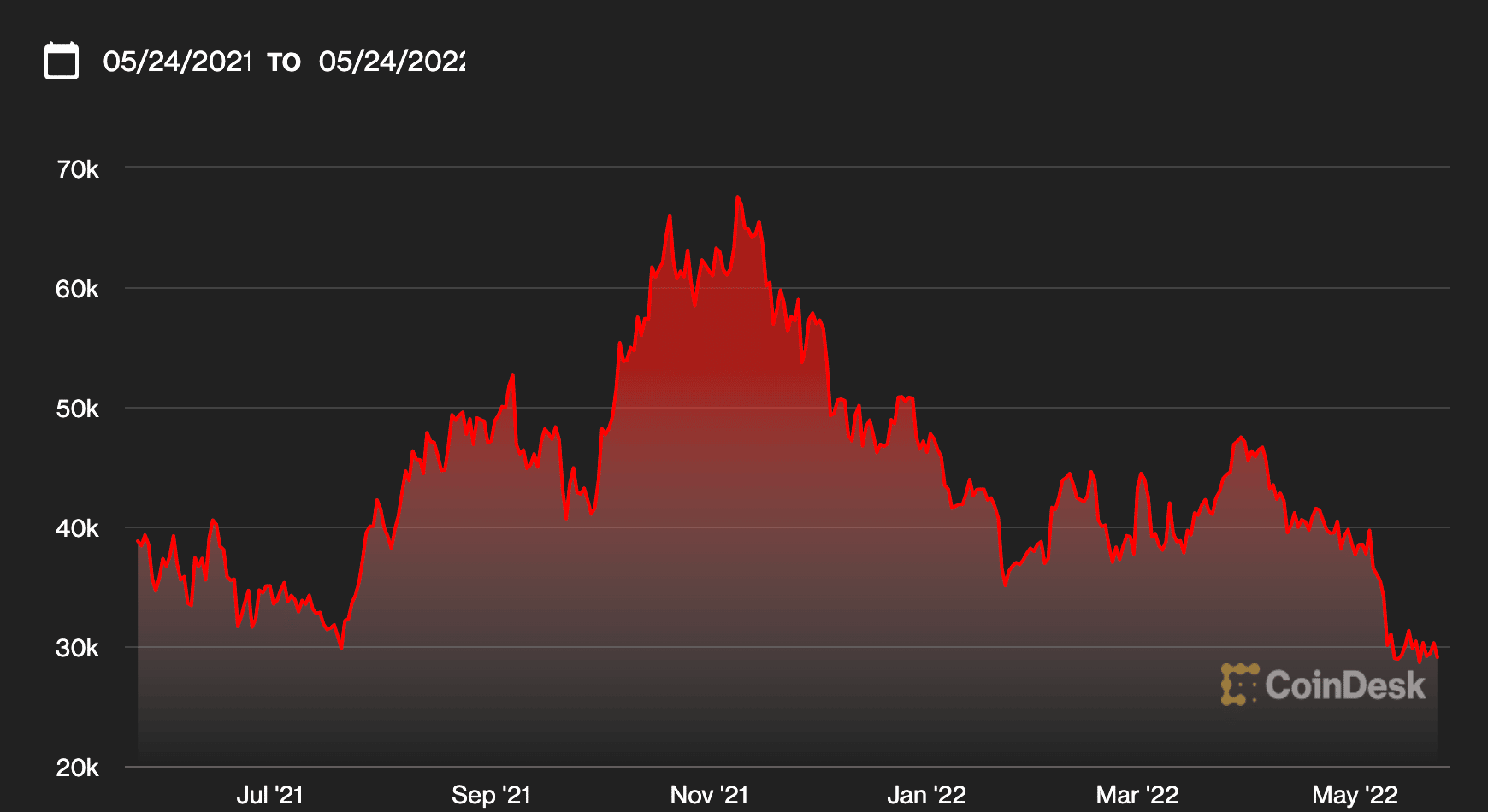

Picture this: You run a store that sells TV’s. In the morning, you sell a top-of-the-line TV for 0.1 Bitcoin. At the time of sale, Bitcoin was worth $60,000. You celebrate and take the day off. The next day Bitcoin is worth $40,000. Your transaction lost 33% of its value overnight. Celebrations are over.

This is a hypothetical situation, but cryptocurrency fluctuations are extremely common. In 2021 alone Bitcoin reached highs of $65,000 and lows of $30,000 per coin. This makes it difficult for business owners to price their products, but also means they’ll need to transfer their cryptocurrency into a more stable alternative quickly and regularly.

Services are available on BitPay and Coinbase that immediately exchange cryptocurrency based on the cryptocurrency’s current cash value. Although this somewhat solves the issue of volatility, it removes options for business owners who want to keep their cryptocurrency for investments.

Security Concerns

As with any new technology, cryptocurrency comes with a number of security risks. Unlike fiat currencies such as the U.S. dollar, cryptocurrencies cannot be insured. This means that if cyber criminals hack a user’s wallet, they have no way of being compensated.

However, advancements are being made to improve crypto security. For example, Coinbase holds less than 2% of a customer’s digital currency online, and all accounts are protected by FDIC insurance. This covers up to $250,000 in losses if Coinbase is hacked.

This sounds great, but it doesn’t cover personal wallet attacks. This makes it a user’s responsibility to protect their personal account and makes them fully liable for any hacks.

How You Can Accept Cryptocurrency

If you’ve done your research and think cryptocurrency payments are a good option for your business, there are a few steps involved to get started.

The process is similar to setting up a new account with your bank, with cryptocurrency terms replacing your traditional financial jargon.

The first thing you’ll need to do is decide how to accept payments. You have two options:

- Using a payment processor

- Accepting manual payments

Using a payment processor is the best option if you have no previous crypto experience. Integrating with a payment processor is a simple setup process that comes with platform support options if you run into any problems. PayPal and BitPay are great options for this.

If you want to control the payments yourself, the process is a little more complex. You’ll need to start by creating a wallet on a cryptocurrency exchange such as Coinbase.

You can do this by signing up for an account. Coinbase will then create a wallet for you that can be used by customers to send payments. From here, you’ll need to add a cryptocurrency payment function to your website. This is usually in the form of a QR code.

Once a crypto payment has been made, you’ll need to withdraw it. You can do this by moving it to another cryptocurrency wallet such as MetaMask if you want to keep your crypto, or by transferring your crypto to your bank account through an exchange for fiat.

Is Cryptocurrency The Future For Small Businesses?

As with any business decision, it’s important to consider your business model, objectives, and customer base before accepting crypto, making sure it’s beneficial for your business.

In just a decade, the cryptocurrency industry has flourished with applications that could revolutionize several global industries; and it can solve several back-room inefficiencies for small businesses.

At first glance, the cryptocurrency appears to be a promising option for both small businesses and their customers. Larger corporations have shown that crypto payments can be made safely and more are adopting crypto payments every day.

For small businesses, it can be used to decrease fees, improve protection from fraud with the blockchain’s final settlement, and increase the accessibility of services overseas, all of which improve the efficiency of your everyday operations. As technology continues to develop, these benefits will continue to grow.

On the other hand, accepting cryptocurrency has some drawbacks. For one, regulatory uncertainty and price volatility could dissuade a small business owner from making accepting crypto a core part of its business.

Nevertheless, with enough research business owners can implement cryptocurrency without having to take too much risk. As the market continues to grow and merchant protections are implemented, cryptocurrency is looking like a promising option for business owners.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.