Launched in 2014, Simplex is an EU-based fintech company that is looking to enable merchants, marketplaces, and cryptocurrency platforms to process online payments with complete chargeback coverage and fraud protection.

We connected with Netanel Kabala, Co-Founder & CAO of Simplex. Netanel is a specialist in all aspects of fraud, and before Simplex, Netanel worked at PayPal as a fraud analyst, dealing with user-facing risk platforms and back-end automation.

What are the most significant pain points to tackle in the credit card space?

On a macro scale, fraud and red tape are the biggest issues.

At Simplex, fraud isn’t a problem – our proprietary AI analyzes every transaction using fully automated machine-learning algorithms that effectively eliminate fraud.

Red tape, due to regulatory inefficiency and legal inconsistency, remains a challenge for the industry however. A lot of this is down to operating a digital business in a world whose legal systems are still predicated upon physical borders, and it affects all global businesses, not just payment processors.

Nevertheless, the costs of ensuring compliance across multiple jurisdictions and territories are significant, and are an impediment to launching new products.

How does Simplex differ from the traditional credit card industry?

Firstly, we’re crypto-focused, whereas most credit card companies want nothing to do with cryptocurrency.

Secondly – and this explains why we can deal with crypto and our competitors can’t – our fraud-proof technology protects merchants from the risk of chargebacks.

We’ve also taken great pains to ensure that our compliance is impeccable, and this enables us to show that the crypto industry can be supported in a responsible manner, while satisfying regulators and maintaining the highest due diligence standards.

How does the business make money?

Our revenue is driven by Simplex partners accessing our fraud-proof payment gateway, and by the conversion fees for retail users switching between fiat and crypto using our account service.

Who is the ideal Simplex customer?

Our customer base is very diverse; on the consumer side, we’ve got retail investors seeking a safe way to buy cryptocurrency, while on the enterprise side we support everything from SMEs to the largest cryptocurrency exchanges in the world that integrate our payment gateway.

Businesses seeking a safe way to accept card payments – without introducing risk – and their customers are the primary beneficiaries of Simplex.

Buying cryptocurrency with a credit card often comes with ludicrous rates. How is Simplex’s solution different?

For Simplex to be adopted by major global exchanges, we recognized that we would have to offer competitive rates; competing on security and reputation alone would not be enough.

Keeping fees to a minimum is also how we grow our market share, while making the crypto market more appealing to investors, who can swap in and out of fiat currency without being penalized.

Can you touch on how Simplex use sAI to eliminate fraud while increasing conversion? What’s the actual process behind the scenes?

The AI analyzes each transaction and determines the likelihood of it being fraudulent, based on thousands of data points.

The machine learning algorithm becomes more effective over time, enabling potentially fraudulent transactions to be screened out. This increases conversions while preventing chargebacks, allowing businesses to facilitate fiat-crypto payments with zero risks.

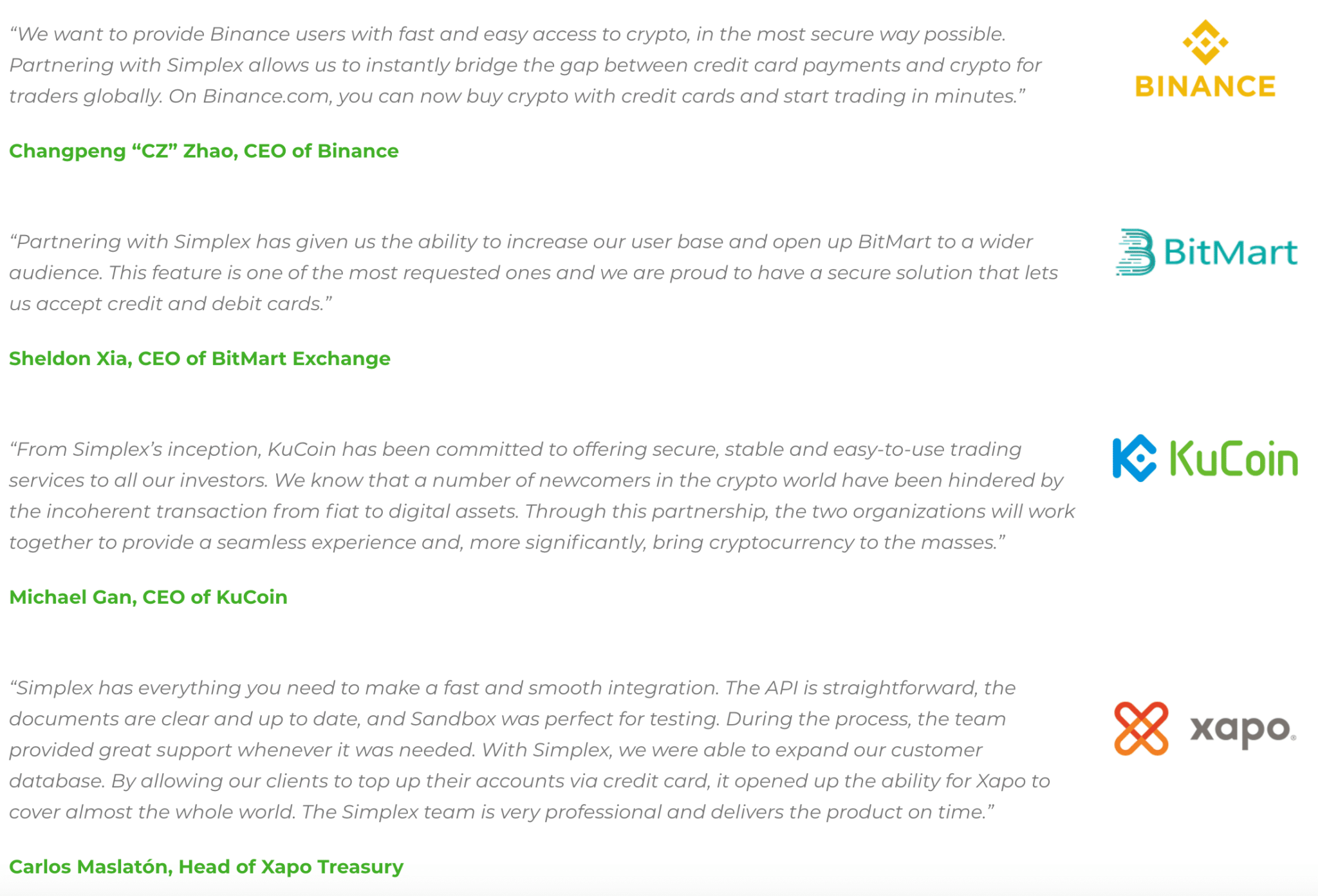

Simplex has a fairly extensive list of partnerships throughout the cryptocurrency space, with companies such as Binance, Bitpay, Huobi, and various others. For the entrepreneurs in our audience, what’s the best way to go about establishing relevant partnerships with similar companies

It’s really a two-step process, one internal and the other external. Before you can think about approaching potential partners, you have to ensure your product is fully optimized, and that the solution you’re presenting is better than the incumbents.

There’s no point in approaching major enterprises while you’re still fixing bugs and refining the UX. With Simplex, we focused on developing a payment gateway that we believed to be the best in class. Only then did we seek to engage in dialogue with companies that could benefit from our solution.

The Israeli startup community seems to have embraced cryptocurrency and blockchain. Can you touch on what it’s like launching and running an international payments company in Israel?

Israel’s reputation for tech excellence doesn’t need restating. We’re a small country, and in Tel Aviv where much of the startup scene is based, everyone knows everyone. This is great for sourcing talent and establishing partnerships as if you can’t solve a particular problem, there’s a good chance that you know someone in your network who can.

At the same time, the insular nature of Israel’s tech community means it’s imperative to tread carefully and work to build bridges, rather than aggressively trying to corner the market at the expense of everyone else. When startups collaborate, they can achieve a greater outcome than could have been attained from working unilaterally.

What’s next for Simplex? What can we expect to see in the next 2-3 years?

We’ve just launched Simplex Account, an online banking account that allows consumers to use their digital assets how and when they want, online and offline. Essentially, it allows them to create a single account and then access it across an array of Simplex partner platforms including exchanges and wallets.

Moving beyond this, we have been working hard on expanding our turnkey crypto payment solution, with new products in the pipeline. Finally, we’re looking to extend the list of countries where we’re licensed to operate, and are working closely with regulators in several jurisdictions to bring this about.

Thank you, Netanel!

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.