Crypto analysts are turning their attention to Solana, Cardano, and Polkadot as the market prepares for another round of altcoin rotation. At the same time, MAGACOIN FINANCE is drawing attention from traders looking to diversify into fresh assets expected to outperform top-layer tokens this cycle.

Solana Price Prediction: ETF Countdown Brings $300 Target Back in Sight

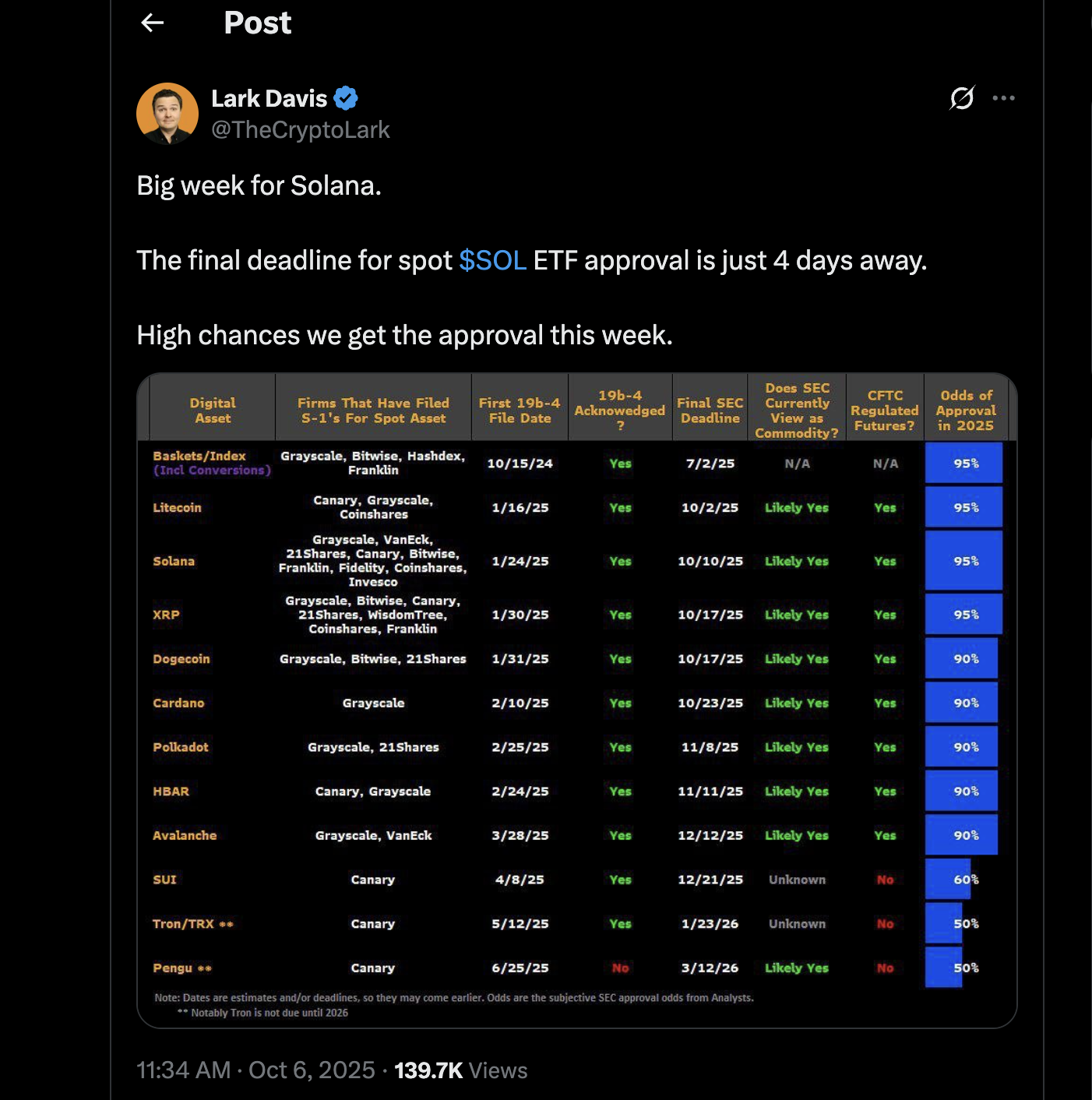

Solana’s ETF countdown has created a wave of excitement, with approval odds now above 90%. The upcoming decision could push the Solana price back toward the much-discussed $300 target, a level analysts say reflects growing institutional interest in the asset.

Analyst Lark Davis wrote on X that the ETF discussion alone has turned Solana into a leading name for Q4. If approved, it would allow more market participants to gain access through regulated products, which often boosts trading volume and visibility.

Adding to the bullish mood, a Nasdaq-listed company recently added $530 million worth of SOL to its treasury. That kind of purchase sends a clear signal of confidence. Data from Coin Bureau also shows record inflows into Solana ETPs, suggesting that demand isn’t slowing down anytime soon.

Market watchers believe a daily close above $240 would open the door for another run to $300. With ETF approval possibly just days away, Solana is now seen as one of the most closely watched assets heading into the final stretch of 2025.

Cardano Price Prediction: ADA Aims to Regain Its Lost Ground

Cardano (ADA) has been under pressure for much of the year, but analysts see signs of recovery. According to analyst Timofei, ADA is forming a structure that resembles Solana’s early 2023 pattern, a setup that led to a massive rally later that year.

The analyst expects Cardano’s price to rebound toward $3 after months of consolidation, calling it a “hidden opportunity” among large-cap assets. ADA’s movement within an expanding pattern since early 2023 has kept traders patient, but many now believe the cycle bottom is close.

Meanwhile, Charles Hoskinson, Cardano’s founder, says Bitcoin DeFi could unlock a new growth phase for ADA. By linking Bitcoin’s large liquidity pool to Cardano’s ecosystem, developers can build cross-chain smart contracts, which could drive higher on-chain activity and volume.

Hoskinson also mentioned plans to bring XRP and real-world asset (RWA) tokenization to Cardano’s platform, aiming for a total value locked (TVL) of up to $15 billion. That would put Cardano back in competition with Solana’s current TVL, closing the performance gap seen over the past year.

Polkadot Price Prediction: ETF Listing and Network Upgrade Fuel Optimism

The 21Shares Polkadot ETF recently appeared on the DTCC list, sparking optimism that a US-listed product could soon follow. This step shows readiness for approval, even if final confirmation from regulators is still pending.

The Polkadot price currently trades near $4.17, but traders are eyeing the $5 level as the key breakout point. Analyst Michaël van de Poppe believes that a weekly close above $5 could trigger a sharp rally toward $6 or even $7 in the short term.

Polkadot’s network upgrades planned for 2025, such as Elastic Scaling and Agile Coretime, are designed to improve performance and developer adoption. The platform’s push toward Ethereum compatibility through PolkaVM also aims to attract more projects to the ecosystem.

Analysts expect the combination of ETF developments and on-chain upgrades to make Polkadot one of the top gainers in the next rotation wave. If the ETF goes live, it could help bridge institutional capital with DOT’s expanding ecosystem.

MAGACOIN FINANCE: Diversification for the Next Wave

As Solana, Cardano, and Polkadot prepare for their next moves, MAGACOIN FINANCE is quietly building a case as the next major diversification play. Analysts suggest it could outperform Solana’s percentage gains during the same period, with some expecting a clean 5x rise once listings go live.

Thousands of traders are already on board, and capital rotation from Bitcoin and Ethereum is expected to hit MAGACOIN FINANCE first. The project’s countdown to listing has added urgency among investors seeking fresh altcoin entries before prices move higher.

Leading analysts note that MAGACOIN FINANCE’s Hashex-verified audit and strong KYC compliance place it among the most investor-safe crypto projects in 2025.

As the listing date draws near, curiosity is turning into action among traders watching for the next big mover.

Final Thoughts: Position Early Before the Next Breakout

Altcoin rotations often happen fast. Traders looking to position ahead of the next wave are now watching Solana’s ETF outcome, Cardano’s DeFi developments, and Polkadot’s upgrade schedule.

For those seeking early exposure to fresh assets, MAGACOIN FINANCE offers a window that may not stay open for long. Visit the official website, follow updates on X, and join the Telegram community to stay ahead of the next breakout:

-

Website: https://magacoinfinance.com

-

X: https://x.com/magacoinfinance

-

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.