Solana price prediction models are heating up as analysts eye a $250 target after a massive $306M Galaxy Digital Solana treasury boost. With institutional adoption and Solana blockchain adoption accelerating, investors are seeking the other potential altcoins. Among the emerging projects, MAGACOIN FINANCE stands out, combining DeFi growth, strong tokenomics, and rotation potential, making it a compelling altcoin alongside Solana’s bullish outlook.

Galaxy Digital Fuels Solana Rally

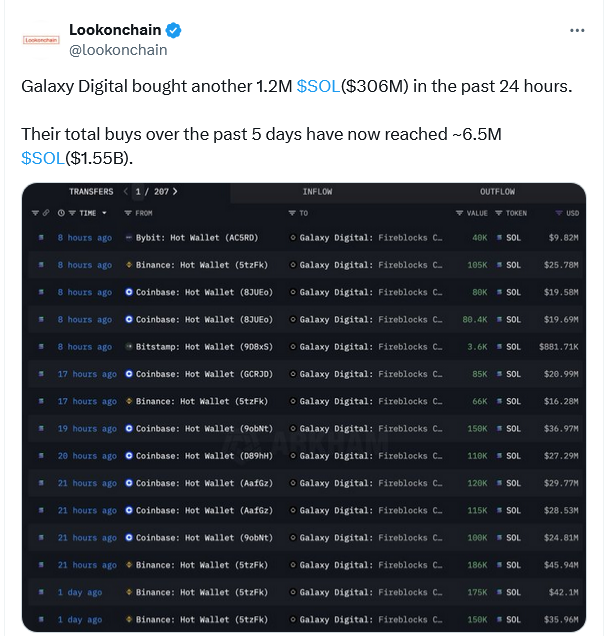

Solana (SOL) continues to dominate headlines as institutional investors ramp up their exposure. Over the past week, Galaxy Digital executed a massive $306 million Solana purchase in a single day, scooping up 1.2 million SOL across exchanges before transferring them to crypto custodian Fireblocks.

On-chain data shows Galaxy’s appetite hasn’t slowed. In just five days, the firm accumulated over 6.5 million SOL tokens, worth approximately $1.55 billion, solidifying its role as one of the most aggressive institutional buyers of Solana. The spree follows Galaxy’s collaboration with Multicoin Capital and Jump Crypto in a $1.65 billion private placement for Forward Industries, a company pivoting to become the largest Solana treasury holder among public firms.

This wave of institutional demand underscores Solana’s growing role as a Layer-1 blockchain powerhouse, capable of processing billions of transactions daily and gaining traction as an alternative to Ethereum.

Solana Price Prediction: $250 in Sight

With institutional adoption accelerating, analysts are zeroing in on a $250 price target for Solana. At its current trading level near $237, SOL has already posted a 17% gain over the past seven days and nearly 30% in the last 30 days.

Several factors support the bullish Solana price forecast:

- Institutional accumulation: Galaxy Digital, DeFi Development Corp, and others continue adding billions in Solana treasury reserves.

- Treasury demand: Over $3–4 billion in Solana treasuries have been raised, reducing circulating supply.

- Rising adoption: Solana’s total value locked (TVL) surged to $12 billion, making it the second-largest DeFi network after Ethereum.

With momentum building, many investors now ask: Will Solana reach $250? Analysts argue the combination of institutional buying and shrinking exchange supply makes this milestone increasingly likely. Some even project further upside, positioning Solana as one of the strongest crypto investment opportunities of 2025.

MAGACOIN FINANCE: A Rising Altcoin

While Solana’s rally commands attention, savvy investors recognize that altcoin rotation often creates outsized returns in emerging projects. One such standout is MAGACOIN FINANCE.

Here’s why MAGACOIN FINANCE is gaining traction:

- Solid Roadmap: Its innovative ecosystem and roadmap mirrors Solana’s appeal, offering strong features to investors.

- Audited Contracts: The project has been audited carefully, ensuring the trust among investors. This has resulted in massive token sale, with its scarce tokenomics pushing the price higher.

For investors aiming to balance exposure between established leaders and high-growth opportunities, MAGACOIN FINANCE offers a compelling complement to Solana’s institutional-driven momentum.

Final Outlook

The Solana price prediction narrative is strengthening as institutional buying surges. Galaxy Digital’s $306 million boost, alongside billions in treasury reserves, places a $250 SOL target firmly in focus.

Yet the story doesn’t end with Solana. As capital rotates into emerging projects, MAGACOIN FINANCE stands out as a high-upside altcoin to watch in Q4 2025. Together, Solana and MAGACOIN FINANCE highlight how institutional validation and smart rotation plays can deliver the next wave of crypto market returns.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.