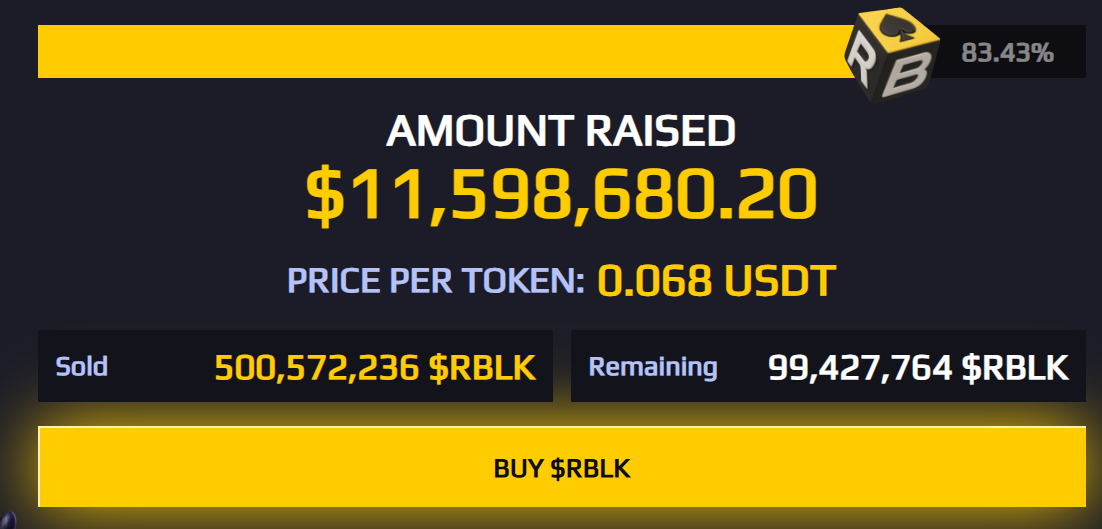

Crypto markets are shifting as Solana steadies around the $200 level while fresh attention turns to Rollblock, a rising altcoin making waves with early success. Its presale has already pulled in $11.6 million, fueling expectations of a potential 500% surge as adoption grows.

With Solana drawing institutional focus through upgrades and scalability, traders are widening their scope. Rollblock’s blend of traction and scarcity now positions it as a standout candidate on watchlists heading into 2025.

Rollblock Emerges as a Top Watchlist Altcoin With 25x Prospects.

Rollblock (RBLK) is gaining fast traction as traders seek new opportunities beyond the familiar names in crypto. Its presale has already raised $11.6 million, while the platform itself has processed over $15 million in wagers, showing that adoption is not just hype but tied to real-world use. This kind of demand at an early stage has put Rollblock firmly on investor watchlists heading into 2025.

What separates Rollblock from countless short-lived projects is its foundation of credibility and transparency. Operating under an Anjouan Gaming license and fully audited by SolidProof, it gives investors rare clarity in a space often clouded by uncertainty.

What separates Rollblock from countless short-lived projects is its foundation of credibility and transparency. Operating under an Anjouan Gaming license and fully audited by SolidProof, it gives investors rare clarity in a space often clouded by uncertainty.

The tokenomics are equally appealing. Each week, 30% of platform revenue is directed into buybacks. Most tokens are burned permanently, while the rest support staking pools with yields reaching up to 30% APY.

The tokenomics are equally appealing. Each week, 30% of platform revenue is directed into buybacks. Most tokens are burned permanently, while the rest support staking pools with yields reaching up to 30% APY.

Key factors fueling Rollblock’s momentum include:

- $11.6M raised in presale, showing strong early demand

- Fully audited and licensed operations that build trust.

- Weekly buybacks driving a deflationary token supply

- A growing iGaming ecosystem with sportsbook integration

Analysts argue this model could help the token achieve lasting value growth, especially as supply becomes scarcer. With a current price of $0.068, Rollblock is positioning itself as an altcoin with the potential to deliver strong returns, possibly 25x by next year.

Solana Price Stabilizes Near $200 Ahead of Key Developments

The price of Solana has stabilized around the $ 200 mark, currently trading at $214.91, after reaching highs of $218 earlier in September. The chart indicates that Solana has been trading above essential moving averages, where the 30-day line at $196 and the 60-day line at $185 are solid support levels.

The fixed support indicates that the traders are encircling the $200 area rather than rushing frantically on each side of the market. Trading volume fell to $3.04 billion in the past 24 hours, and momentum decreased relative to the summer rally. Nonetheless, the broader perspective is justified by new network improvements and institutional concern.

The throughput of Solana is now equal to all-time Ethereum throughput, making it the center of scalability attention. Analysts are optimistically cautious. The $200 zone is viewed by many as a launchpad, and short-term goals of between 220 and 230 should volume resume.

On the downside, holding above $190 is considered crucial to sustain momentum. Longer term, the potential ETF approval and Nasdaq debut of SOL Strategies add weight to predictions of a climb toward $250 and beyond in 2025.

Rollblock Poised to Rival Solana’s Momentum

With $11.6 million already secured in presale and strong adoption from its iGaming platform, Rollblock is shaping up as more than just another token launch. Its deflationary model and steady growth potential could put it in direct competition with larger players like Solana as 2025 unfolds. While Solana holds its ground near $200, Rollblock’s rising traction positions it as a serious contender in the evolving crypto market.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.