TLDR

- Solana (SOL) price recently surged above $200, pushing market cap over $105 billion and ranking among top digital assets

- The REX-Osprey SOL spot ETF reached nearly $100 million in assets within weeks, showing strong institutional demand

- Solana network upgraded with 20% increased block capacity and is considering doubling capacity to 100 million compute units

- Exchange outflows continue as investors move SOL off trading platforms, reducing sell pressure and available supply

- Technical analysis shows potential 40% rally to $275 target if SOL breaks above $218 resistance level

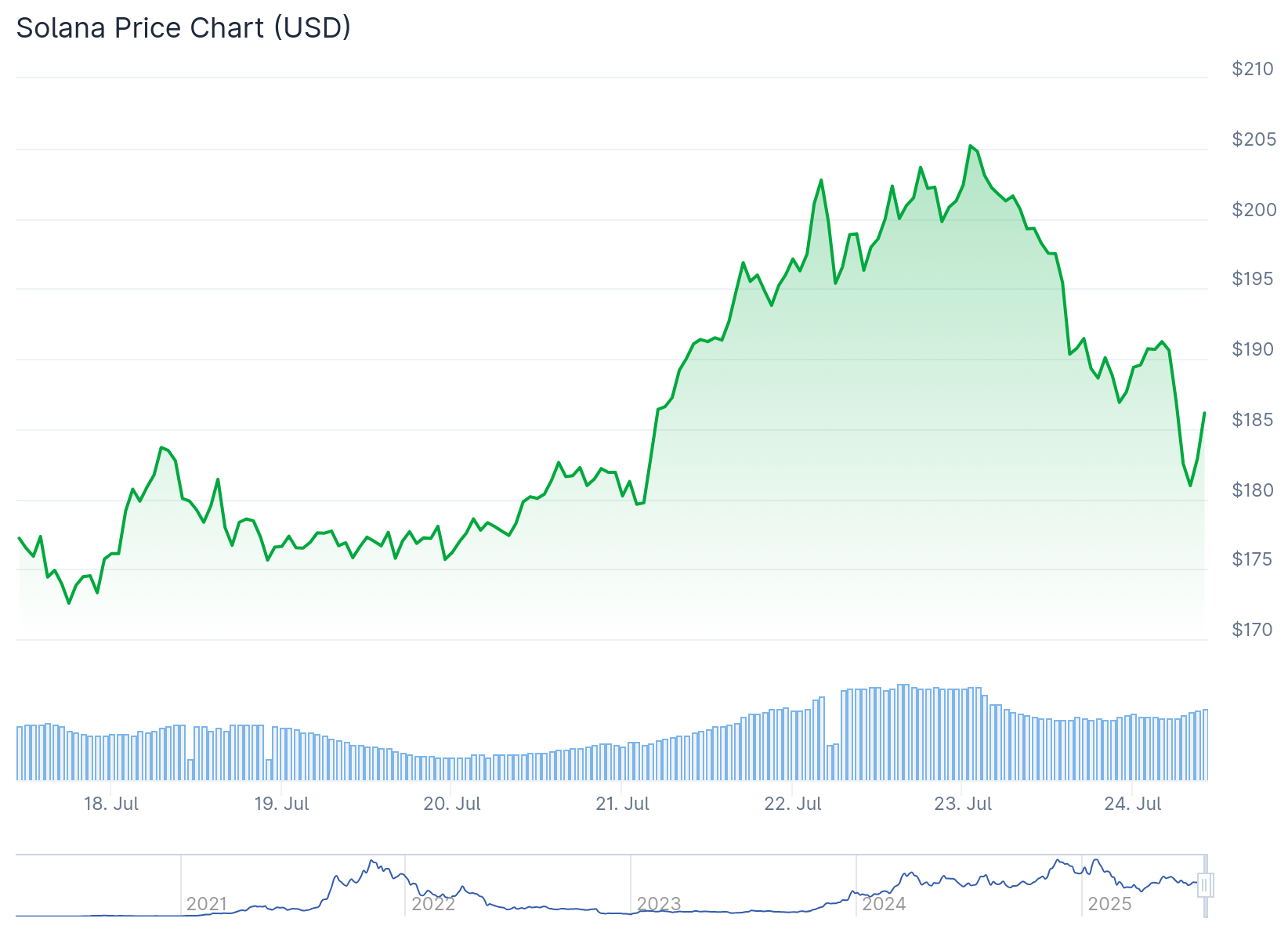

Solana price recently crossed the $200 threshold, pushing its market capitalization beyond $105 billion. This surge places SOL among the top digital assets by value, even surpassing major companies like Intel and Ferrari in global rankings.

The cryptocurrency currently trades around $189 after pulling back from recent highs near $206. The price action shows some consolidation after the initial rally, with traders watching key levels for the next directional move.

Exchange flow data reveals a positive trend for SOL holders. More coins have been leaving exchanges than entering over recent weeks. This pattern typically indicates reduced selling pressure as investors move tokens to cold storage or staking platforms.

The outflow trend has intensified since mid-July, with the negative flow bars on charts growing larger. This reduction in exchange supply occurs while SOL maintains support above $196, even as other major cryptocurrencies like ETH and ADA have declined.

Institutional interest continues to grow through exchange-traded fund products. The REX-Osprey SOL spot ETF has accumulated nearly $100 million in assets within just weeks of its launch. This rapid growth demonstrates mounting institutional demand for Solana exposure.

DeFi Development Corp has accumulated nearly 1 million SOL tokens in its treasury. The accumulation reflects increasing institutional participation and staking activity across the Solana ecosystem.

Network Performance Improvements

Solana’s network infrastructure has received recent upgrades that boost its capabilities. The blockchain increased its block capacity by 20% in a recent update. Developers are now considering a proposal to double block capacity from 60 million to 100 million compute units.

These upgrades target improved throughput and reduced network congestion. Solana’s true transactions per second briefly exceeded 1,600, with current rates maintaining above 1,100 TPS. This performance underscores the blockchain’s scalability advantages.

The total value locked in the Solana ecosystem has crossed $4 billion. Real-world asset tokenization and DeFi applications continue expanding on the platform. MoonPay recently launched Solana staking functionality in its mobile app.

Institutional-grade liquid staking solutions are gaining adoption. Products like LsSOL from Liquid Collective attract interest as speculation grows around potential U.S. ETF approvals for Solana.

Technical Analysis and Price Targets

Futures market data shows healthy sentiment without overheating. The funding rate for SOL sits around 0.0168%, indicating neutral to slightly bullish positioning. This level suggests traders lean optimistic without excessive leverage buildup.

Open interest continues rising, meaning more capital flows into SOL futures markets. The combination of stable funding rates and increasing open interest typically supports continued price appreciation.

Momentum indicators favor continued upside movement. The RSI climbs without showing bearish divergence, indicating genuine strength behind recent price action. The Bull-Bear Power indicator remains firmly positive, showing buyers maintain control over sellers.

Key resistance sits at the $199-$200 psychological level and the 0.786 Fibonacci retracement at $218. A clean break above $218 could unlock a rally toward $275, representing a potential 40% gain from current levels.

Support levels exist at $183 and $168, which previously acted as resistance during earlier moves. These levels could serve as strong floors if price retreats. A break below $183 would weaken the current bullish setup.

The likelihood of a spot Solana ETF approval in the U.S. during 2025 now exceeds 95% according to analyst estimates. Asset managers including VanEck, Grayscale, and Bitwise have entered the application process. Approval could unlock additional institutional capital flows.

Some analysts predict price targets as high as $300 or $500 in a continued bull market. These projections cite ETF momentum and institutional inflows as primary catalysts.