TLDR

- Solana (SOL) dropped 6% in 24 hours but top trader sees opportunity for $500 price target

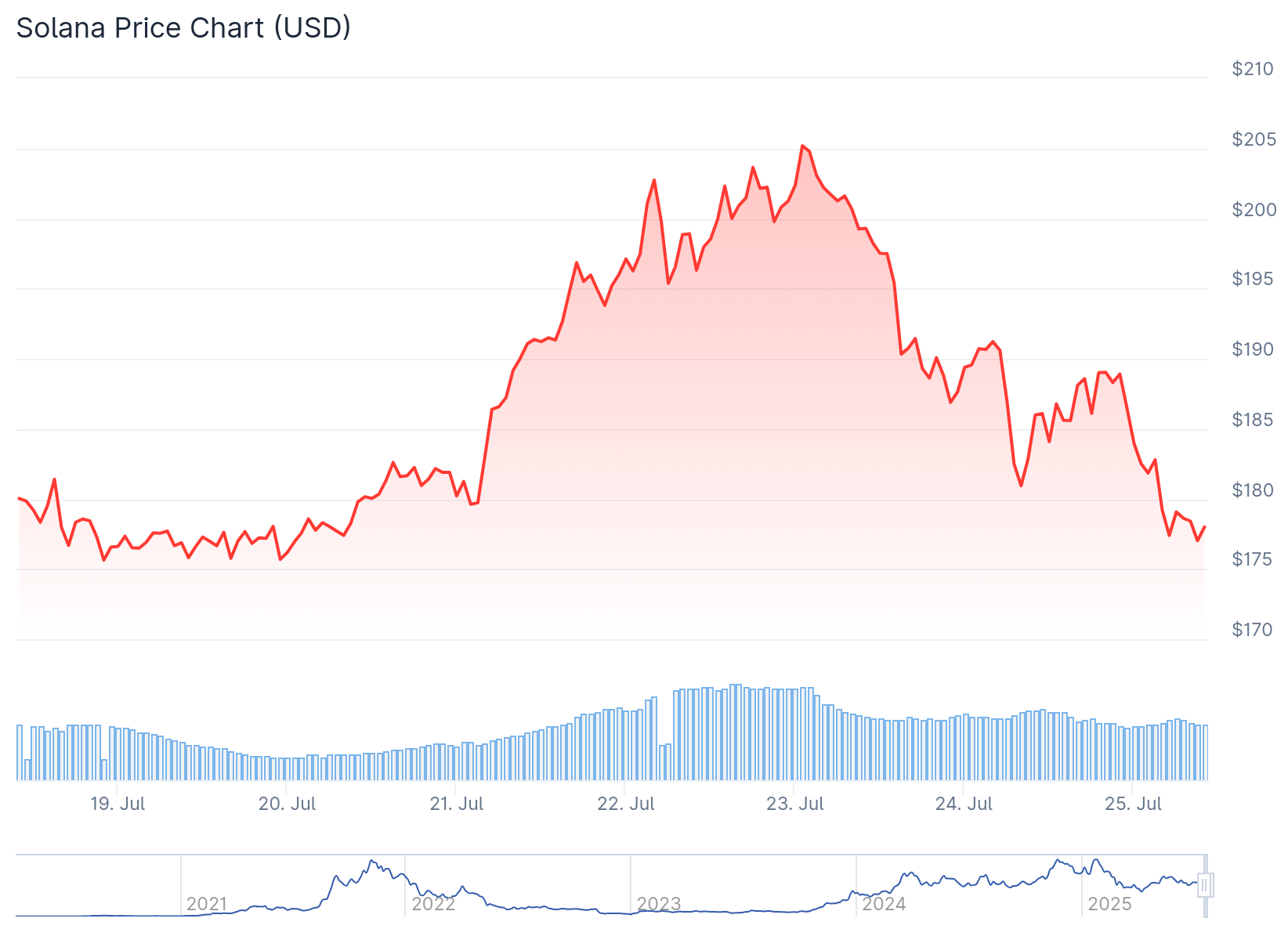

- SOL fell below $180 after failing to hold February high of $205.34 earlier this week

- Over $57 million in positions liquidated with 86.79% being long positions in last 24 hours

- On-chain data shows bearish momentum with negative Taker CVD indicating sell-side dominance

- Class-action lawsuit filed against Pump.Fun and Solana ecosystem adds to bearish pressure

Solana price dropped below $180 on Friday after closing beneath its key support level of $184.13 the previous day. The cryptocurrency extended losses despite earlier bullish predictions from prominent traders.

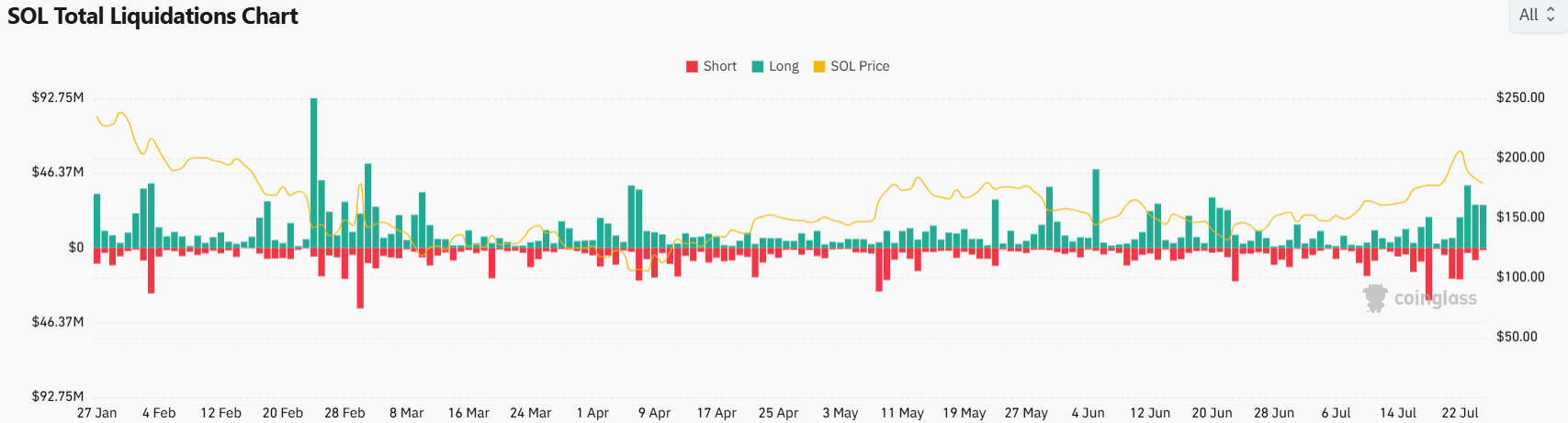

The decline triggered mass liquidations across the market. CoinGlass data shows over $57 million in positions were liquidated in the past 24 hours. Long positions made up 86.79% of these liquidations.

SOL started the week positively, reaching its February 14 high of $205.34 on Tuesday. However, the token failed to maintain this momentum during mid-week trading. The price declined nearly 12% through Thursday.

The sharp fall resulted in $101.38 million in total liquidations from Wednesday to early Friday. This wave of forced selling added pressure to an already declining market.

Technical Indicators Signal Continued Weakness

On-chain data reveals increased selling pressure on Solana. The Taker CVD (Cumulative Volume Delta) for SOL turned negative on Wednesday. This indicator measures the difference between market buy and sell volumes over three months.

-1753422545900.png)

A negative and decreasing CVD suggests bears control the momentum. The current trend indicates sellers dominate the market. If this pattern continues, further price declines could follow.

The Relative Strength Index (RSI) reads 56 on the daily chart. This represents a sharp fall from overbought levels seen on Tuesday. The declining RSI indicates fading bullish momentum.

Moving Average Convergence Divergence (MACD) indicators also point to weakness. The green histogram bars are falling and converging closer together. These signals confirm the weakening bullish trend.

Legal Challenges Add Pressure

A class-action lawsuit filed on Wednesday adds to Solana’s challenges. Law firm Burwick Law filed the suit in the Southern District of New York. The lawsuit targets Pump.Fun, a Solana-based memecoin creator.

The suit also names Solana Labs, Solana Foundation, Jito Labs, and Jito Foundation as defendants. Burwick Law alleges these entities operate an illegal gambling and money transmission scheme.

The firm describes Pump.Fun as a front-facing operation. They claim it operates as part of a broader illegal scheme maintained jointly by the named defendants.

Trader Remains Bullish Despite Decline

Despite current weakness, some traders maintain bullish outlooks. Crypto trader Christiaan, a Bybit partner, sees the dip as a buying opportunity. He believes Solana could reach $500 in the current cycle.

$SOL is ready for a massive pump.

Targeting $400-$450 for this bull run. pic.twitter.com/gYc6AmBBOt

— Christiaan (@ChristiaanDefi) July 21, 2025

His analysis suggests an uptrend could boost prices to $300 initially. After a brief pullback, he expects further gains to $400 and beyond. This would represent a new all-time high for the year.

Key support sits between $168 and $170 according to technical analysis. This former resistance zone may now provide strong support. A bounce from this level could confirm bullish predictions.

If SOL price continues declining, the next support level sits at $160. Breaking this level could lead to further downside pressure.

Meme Coin Strength Contrasts SOL Weakness

Solana-based meme coins have performed well recently despite SOL’s decline. Pudgy Penguins (PENGU) gained over 400% in the past 30 days. Bonk (BONK) and Fartcoin (FARTCOIN) posted gains of 158% and 38% respectively.

This strength in ecosystem tokens contrasts with SOL’s current weakness. The divergence suggests selective interest in Solana-based assets.

For recovery, SOL needs to close above the daily resistance at $184.13. Success here could lead to a test of the next resistance at $205.34. At the time of writing, SOL trades around $178.81.