After months of bullish sentiment, the crypto market is once again flashing warning signs. The bitcoin price, which had recently touched highs above $120,000, is now struggling to hold above $114,000. Trading volumes are thinning, key indicators are weakening, and macroeconomic risks continue to linger. For investors seeking upside, the spotlight is shifting—and fast.

As analysts issue new alerts about an incoming correction, attention is turning to early-stage projects with higher growth potential and immunity from broader market swings. One sector in particular is gaining momentum: crypto presales.

Bitcoin Price: Support in Danger as Bears Regain Control

According to the latest chart data, bitcoin is now teetering on the edge of a key support zone between $112K and $114K. A decisive break below this area could trigger a deeper correction toward the $105K–$100K levels. The RSI has rolled over from overbought territory, and the lack of strong buy volume raises the risk of a flash sell-off.

Source: Tradingview

As reported, analysts are already sounding alarms about waning momentum and possible liquidation spikes if bearish pressure intensifies. This has led many investors to reduce their BTC exposure, opting instead to explore high-upside alternatives that aren’t tethered to Bitcoin’s price action.

The Flight to Alternatives: Where Smart Capital Is Moving

Historically, when bitcoin price enters a downtrend or stalls, capital rotation occurs—and fast. Altcoins gain traction, and crypto presales in particular become a haven for risk-on investors seeking 10x or even 100x potential.

Presale tokens offer something the open market can’t: early access, fixed entry prices, and strong token incentives. They often move independently from Bitcoin and Ethereum, especially in their early stages, creating a window for asymmetric returns.

And this year, one presale has captured more attention than the rest.

The Last Dwarfs ($TLD) – Best Crypto Presale to Watch Right Now

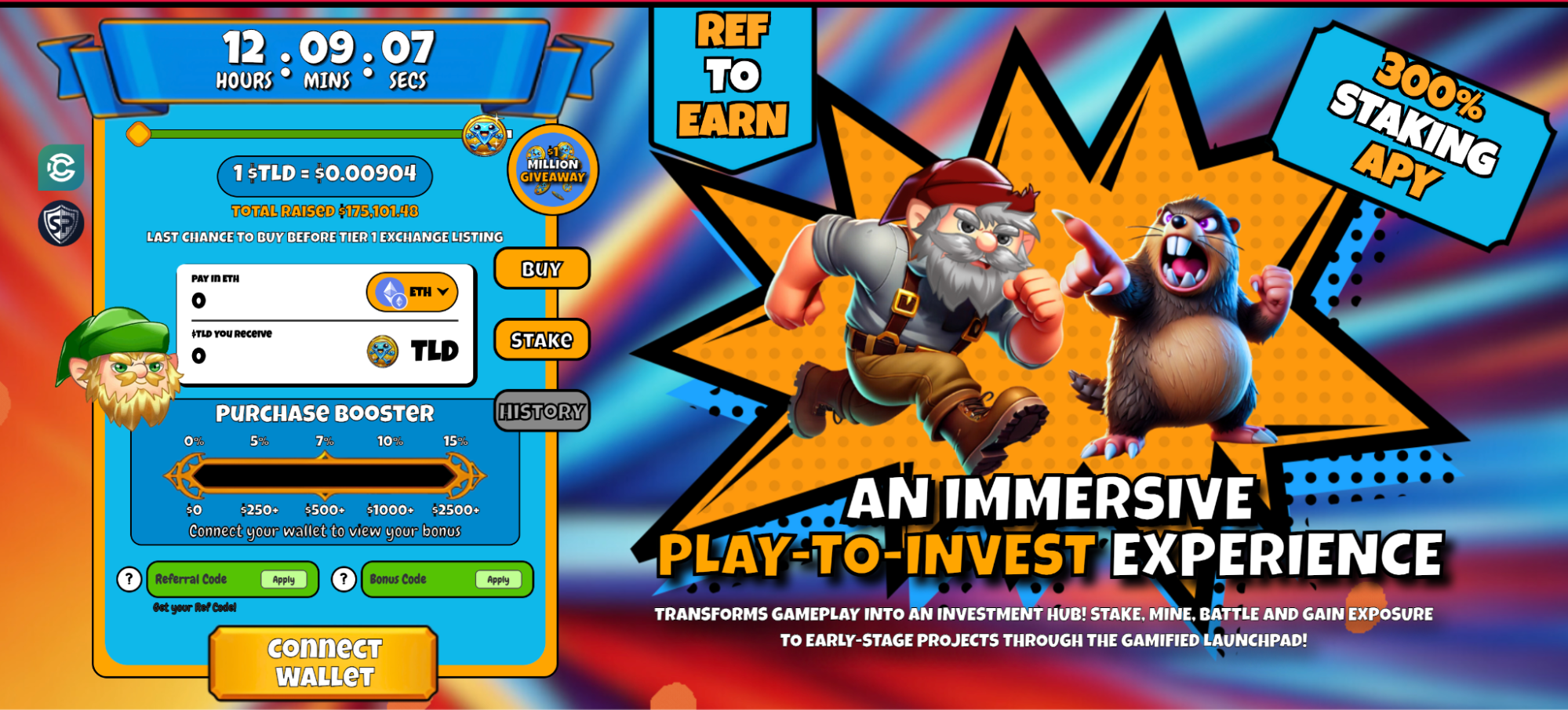

While BTC struggles to maintain support, The Last Dwarfs ($TLD) continues its rapid climb. With the token price increasing daily—now sitting at $0.00958—and staking rewards of up to 300% APY, $TLD is building both momentum and community at record speed.

Unlike passive projects, $TLD introduces a Play-to-Invest model, where players earn tokens through gameplay while accessing a Gamified Launchpad of early-stage crypto deals. It merges gaming, DeFi, and token rewards into one dynamic ecosystem.

Here’s why many call it the best crypto presale of 2025:

- Daily price increases that reward early buyers

- 300% staking APY available from day one

- Ref2Earn bonus: 15% extra tokens per referral

- Over 300,000 users already on board

- Built on the TON blockchain, with seamless Telegram integration

This isn’t just a trend—it’s the start of a new model for investing in crypto. By combining real utility with game-like incentives, $TLD is leading the shift away from speculative volatility and toward sustainable, community-powered growth.

Final Thoughts: What the Bitcoin Price Risk Really Means

A potential bitcoin price collapse might shake the broader market—but it’s also opening the door to smarter plays. With BTC dominance under pressure and altcoins still lagging, presales offer a clear hedge and a fresh opportunity.

The Last Dwarfs ($TLD) is more than just a presale—it’s a full ecosystem that rewards activity, supports early adopters, and grows independently of Bitcoin’s chart. With its token price rising daily and staking at 300% APY, it’s no wonder so many are calling it the best crypto presale to buy right now.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.