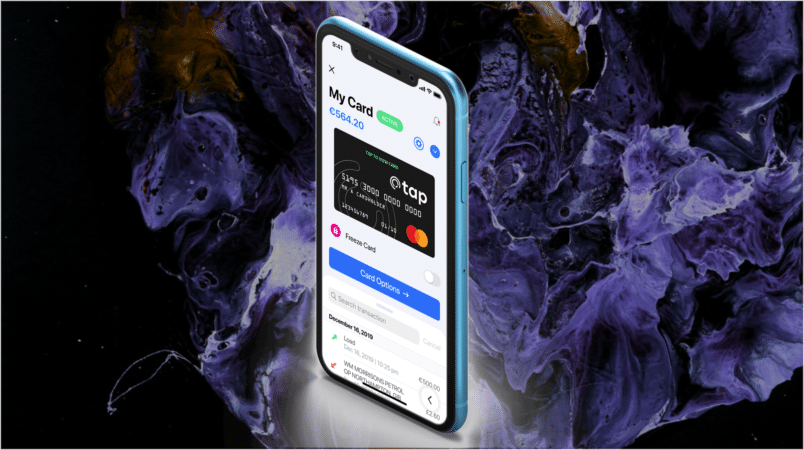

Gibraltar, December 22th 2019 – Tap is on a mission to become the world’s best unified cryptocurrency banking solution. Currently, it is a one-stop-shop crypto app that includes an aggregated crypto exchange (the combination of several exchanges to deliver optimum prices), safe cryptocurrency storage through insured custodianship, a payment card and all the traditional alt-banking features.

The listing on Bittrex is part of a coordinated mass rollout of the Tap Project:

- December 19th: Tap released an MTO on the STP network

- December 20th: Tap hit the Google Play store.

- December 22nd: Tap will hit the iStore

- December 23rd: Tap will be listed on Bittrex and is expected to finalize the in-principle approval requirements for a full DLT authorization.

According to the press release, there are roughly 42 million cryptocurrency wallet users, with a monthly increase of about 735k per month (Q2 2019 – Q3 2019). Tap aims to position itself as the best unified and trusted banking solution by offering several features that seek to offer both convenience and peace of mind. These features include: easy on/off ramps from fiat to crypto with integrated fiat banking and one-touch exchange to crypto, safe storage through its partnership with BitGo (who provides cold wallets with a $100M cold storage insurance), and with a DLT in-principal approval by the Gibraltar Financial Services Commission, and the use of multiple exchanges allows tap to deliver competitive prices and no FX charges on the TAP payments card allowing global travel without customary punitive banking charges.

Arsen, the founder of Tap, said: “From the beginning, we always wanted to separate ourselves from other crypto projects by combining the listing of the token with a ready to go product. We chose Bittrex as the exchange to list our token as we have always seen them as genuine exchange and trusted with real crypto adopters as customers”

Tap’s full DLT authorization by the Gibraltar Financial Services Commission puts it one step closer to its goal of becoming the only regulated and unified cryptocurrency banking solution with multiple exchanges in a single app.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.