TaxBit was founded by a trio of CPAs, tax attorneys, and software developers with the mission of making it easy to comply with government tax regulations.

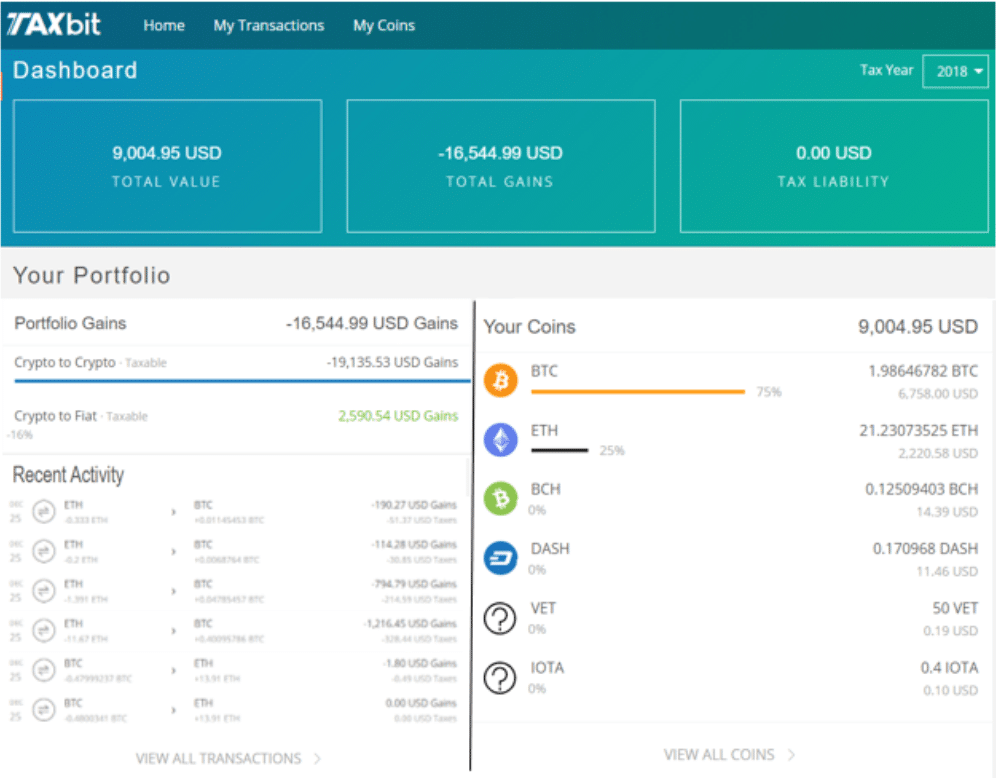

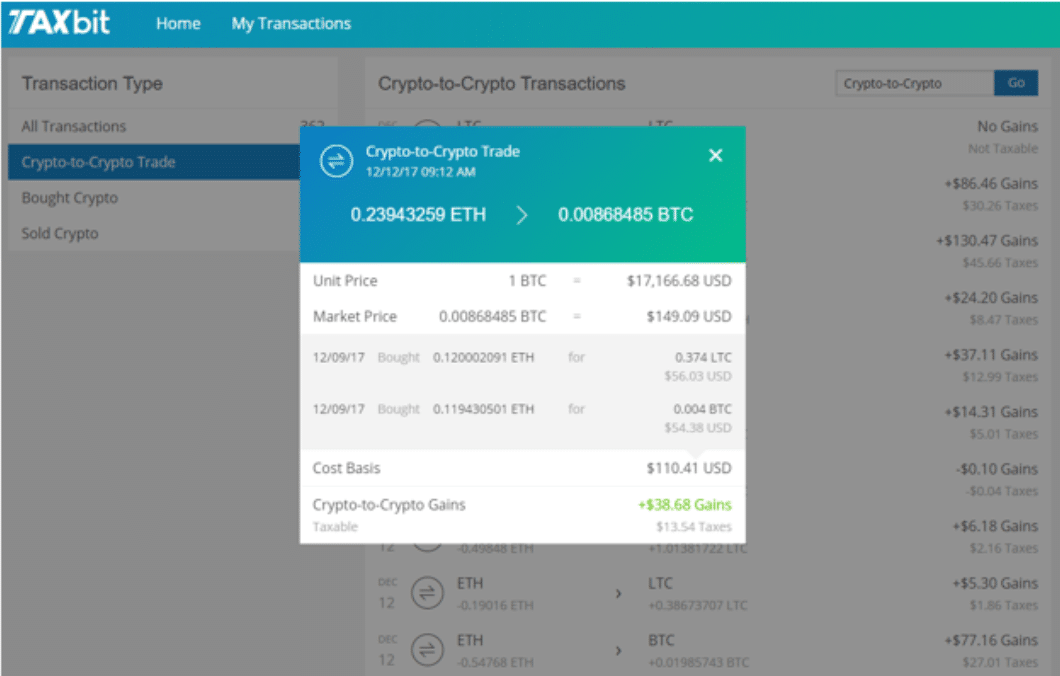

TaxBit connects with users’ exchanges through read-only API keys. Once a user’s exchanges are connected, TaxBit automatically pulls in all of a user’s transactions and runs them through the US tax code rules specific to cryptocurrency.

CPAs and tax attorneys have extensively audited all of the calculations to make sure that not only they are accurate, but that they are legally optimized to provide cryptocurrency traders with the best tax answers possible. Users can instantly see the real-time tax impact of all their cryptocurrency transactions, as well as download their year-end tax forms at the click of a button.

There are few topics less understood and intimidating than taxation as it relates to cryptocurrency.

To add to the anxiety, the IRS has been vocal about the consequences of failing to report cryptocurrency transactions, and news sources such as the Wall Street Journal have published articles with titles such as “Do you own Bitcoin? If so, the IRS is coming for you.” The 2018 tax reform provided clarification around cryptocurrency and taxation, and the IRS released guidance specific to cryptocurrency users mandating that every transaction is reported on a user’s tax return.

The good news is that software can help eliminate the complexity of having to shoulder this heavy burden on one’s own. TaxBit, for example, handles all of the tax complexity on the backend, while users see only a beautiful, intuitive user interface on the frontend.

TaxBit provides users with an audit trail and transaction level detail of how taxes were calculated transaction by transaction. This audit trail gives users peace of mind knowing that they are completely safe in the event of an IRS audit or CPA investigation.

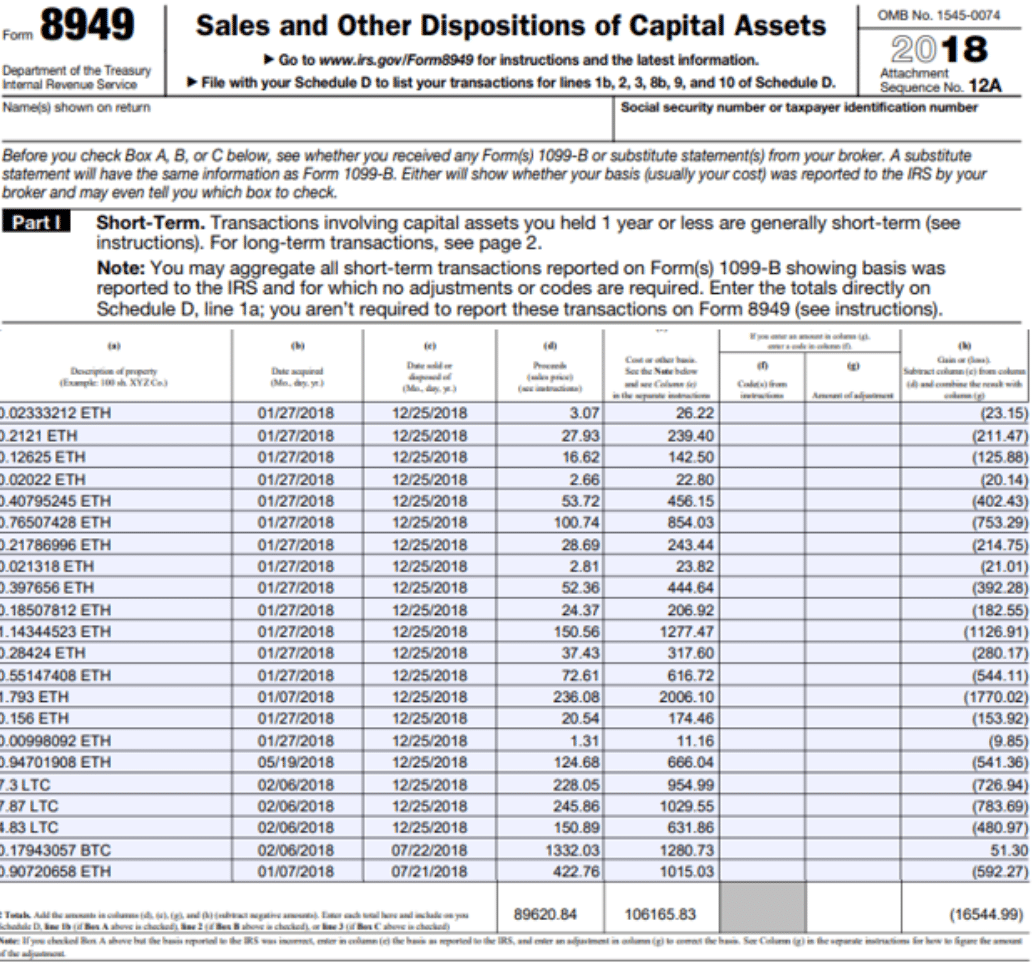

2018 was a tough year for most crypto users, but there’s a silver lining. Investors can still claim their 2018 crypto losses and increase their tax refund.

Taxpayers are allowed to deduct losses up to $3,000 if married and filing jointly, or $1,500 if single, in the year that the loss was incurred, and then they can also carry forward any losses above those limits into future tax years to offset future gains.

Providers like TaxBit can produce the necessary tax forms a user needs to either hand over to their CPA or upload straight into popular tax filing software such as TurboTax, TaxAct, etc. These tax forms are exactly what a user needs in order to report their 2018 losses and increase their tax refund.

“We are thrilled to help thousands of cryptocurrency users easily file their 2018 taxes and increase their tax refund this year,” says Austin Woodward, CPA, and CEO of TaxBit. “TaxBit will automatically pull in all of your crypto transactions, track your cost basis, calculate the taxable gains or losses on each trade, and auto-generate your required crypto tax forms. Last year was a rough year for most crypto investors. TaxBit can ease the pain by helping you report your losses and increase your tax refund this year and possibly reduce your tax liability in future years.”

CoinCentral readers can snag a 10% discount on their 2018 tax plan on TaxBit with this link: www.taxbit.com/invite/CoinCentral

Editor’s’ Note: The above article is a piece of sponsored content. All sponsored content on CoinCentral must adhere to our sponsored content editorial guidelines.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.