- What is Terra (LUNA) and Why Should You Care?

- Terra and the Real (Analog) World: Who Uses UST?

- The Terra Team: Who Made UST and LUNA?

- How Does Terra Work?

- What is UST? Exploring the Stablecoin Terra (UST)

- What is LUNA? Introducing Terra’s Native LUNA Token

- How to Stake LUNA

- The Terra Station, The Wallet for the Terra Network, and Other Terra Tools

- The Terra Ecosystem

- Terra (Luna) Price Predictions

- Doomsday: How Terra UST and Luna Crashed

- Resurgence: Will UST and LUNA Make a Comeback?

- Terra for Developers: The Technical Side of the Moon

- Final Thoughts: Terra, UST, Luna, and Beyond

Terra is a blockchain-based ecosystem with a native algorithmic stablecoin (UST) designed for real-world adoption and a native token (LUNA) used to stabilize UST’s dollar peg; in May 2022, UST and LUNA crashed in price due to UST losing its dollar peg.

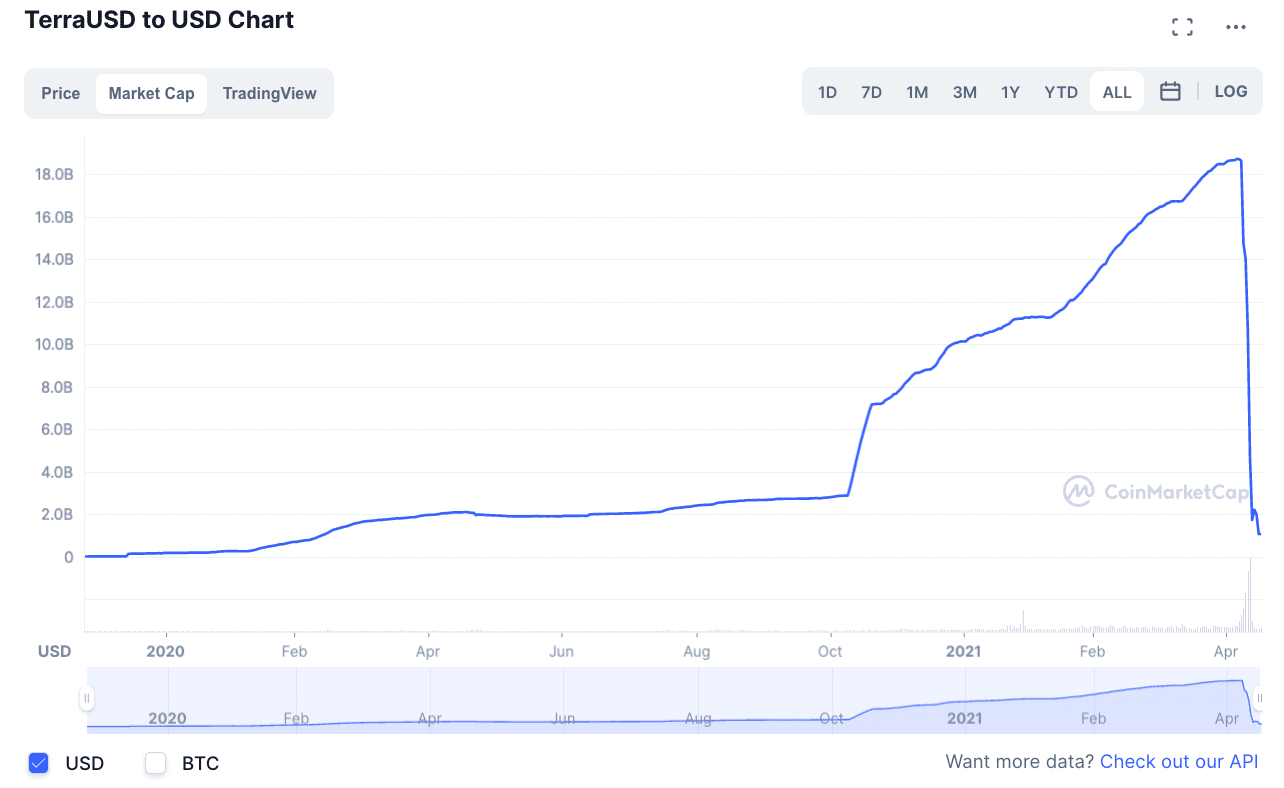

Prior to Terra losing its dollar peg, UST was the third-largest stablecoin by marketcap. UST was controversial in that its value of roughly $18.6 billion was determined algorithmically, rather than by an equivalent fiat deposit.

As we’ll explore below, Terra used its native token LUNA to stabilize UST’s value through various burn mechanisms. The project gained substantial traction and attention in 2021 and 2022 for a few reasons:

- Its two tokens rapidly rose in price. Both UST and LUNA sat in the top 10 market cap coins. UST was at around $18.6 billion; LUNA was around $30 billion.

- Terra aimed to provide significant advantages over traditional payments networks and most cryptocurrencies. UST could offer instant settlement, low fees, and a permissionless, uncensorable, cross-border exchange– all with a stable asset.

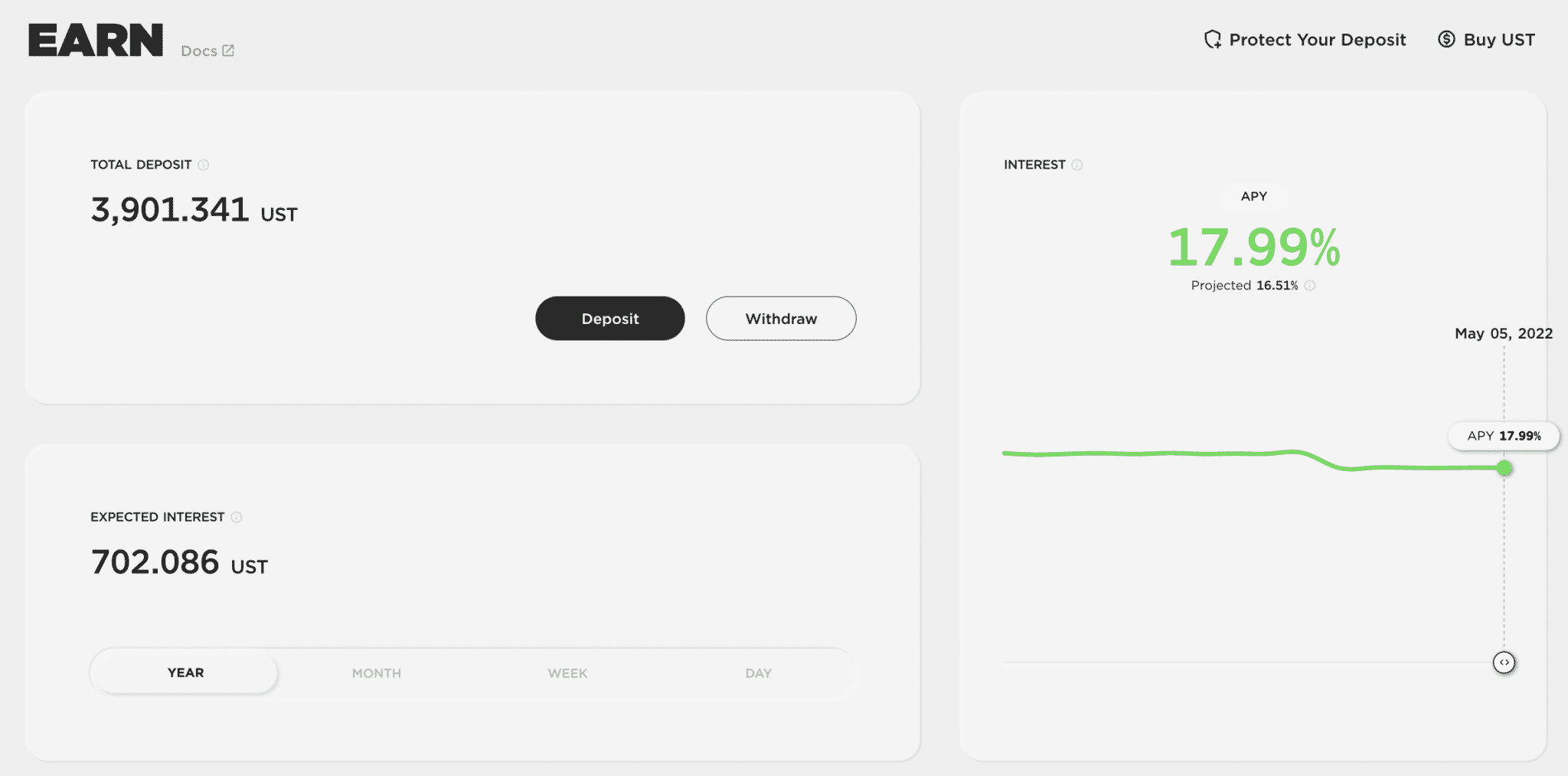

- Anchor Protocol, a dApp, functioned as a decentralized high-yield interest account, offering between 18% to 20% APY on UST.

- Founder Do Kwon emerged as a key figure, orchestrating a $1.6 billion BTC buy for Terra– the project accumulated one of the largest stockpiles of Bitcoin to further support UST.

Today I:

– Watered my plants

– Wrote some emails

– Bought 230M in $BTC

– vacuumed the house

– had some mcdonaldsNow off to walk the dog ????

— Do Kwon ???? (@stablekwon) April 6, 2022

Before we get started on our Terra (UST and LUNA) guide, let’s set the scene: Terra was an ambitious project with a value proposition revolving around a suite of stablecoin products, yield opportunities, and its growing ecosystem of decentralized applications, all of which create utility and demand for UST.

Note that this guide is about 3,600 words, which is about a 12-minute speed read; we advise you not to speed through every section.

We will explore a bird’s eye view of the Terra ecosystem with accompanying deeper dive articles into Luna-related projects, starting with what Terra wanted to accomplish, and how it fit into the modern financial landscape.

Editor’s note: We originally published this guide a week before the UST depeg, which fundamentally changed the project. We’re working on article to explore how exactly UST broke and will update this guide accordingly when they are finished. – AM 5/16/22

What is Terra (LUNA) and Why Should You Care?

Ok, if you’re looking up a guide on Terra, this probably isn’t your first cryptocurrency rabbit hole, and it likely won’t be your last.

In very broad strokes, today’s cryptocurrency innovation largely happens in three primary buckets:

- Bitcoin: BTC is fairly dominant these dates, but a few years ago the competition to be the king of decentralized peer-to-peer currency was rife with forks (LTC, BCH, and so on).

- Ethereum: Worth a collective trillion dollars, Ethereum’s robust ecosystem bustles with developer activity. The top dog also has its pain points– expensive gas fees, network congestion, and so on. Layer2s like Polygon aim to help the network scale.

- 3rd Generation Blockchains Trying to Build a Better Ethereum: Think Solano, Cosmos, Cardano, and Terra.

Terra is unique among other 3rd generation blockchains in that it wasn’t necessarily competing for developers and cryptocurrency native users– it aimed for real-world people.

Terra and the Real (Analog) World: Who Uses UST?

Terra’s founder Do Kwon envisioned a stablecoin product built to compete directly with traditional financial settlement networks on a customer basis, as opposed to building into a cryptocurrency world that tends to build directly for its own crypto-native demographic.

Essentially, building a better Stripe or Paypal with the blockchain.

Thousands of brick-and-mortar, eCommerce, and Web2 merchants require a stable currency to offer their products and services. Rather than forcing them to use a volatile cryptocurrency, Terra offers a dollar-pegged stablecoin with low transaction fees, and is able to offer merchants a faster and more immediate settlement at a fraction of the cost.

Incumbent retail payment applications like Stripe, Square, and PayPal charge around 3% for payment processor fees, whereas Terra’s network transaction fees are around 0.5 to 2%. Further, traditional payments can take days to be “final” whereas the blockchain typically defaults to final settlement, which can take a few minutes or hours.

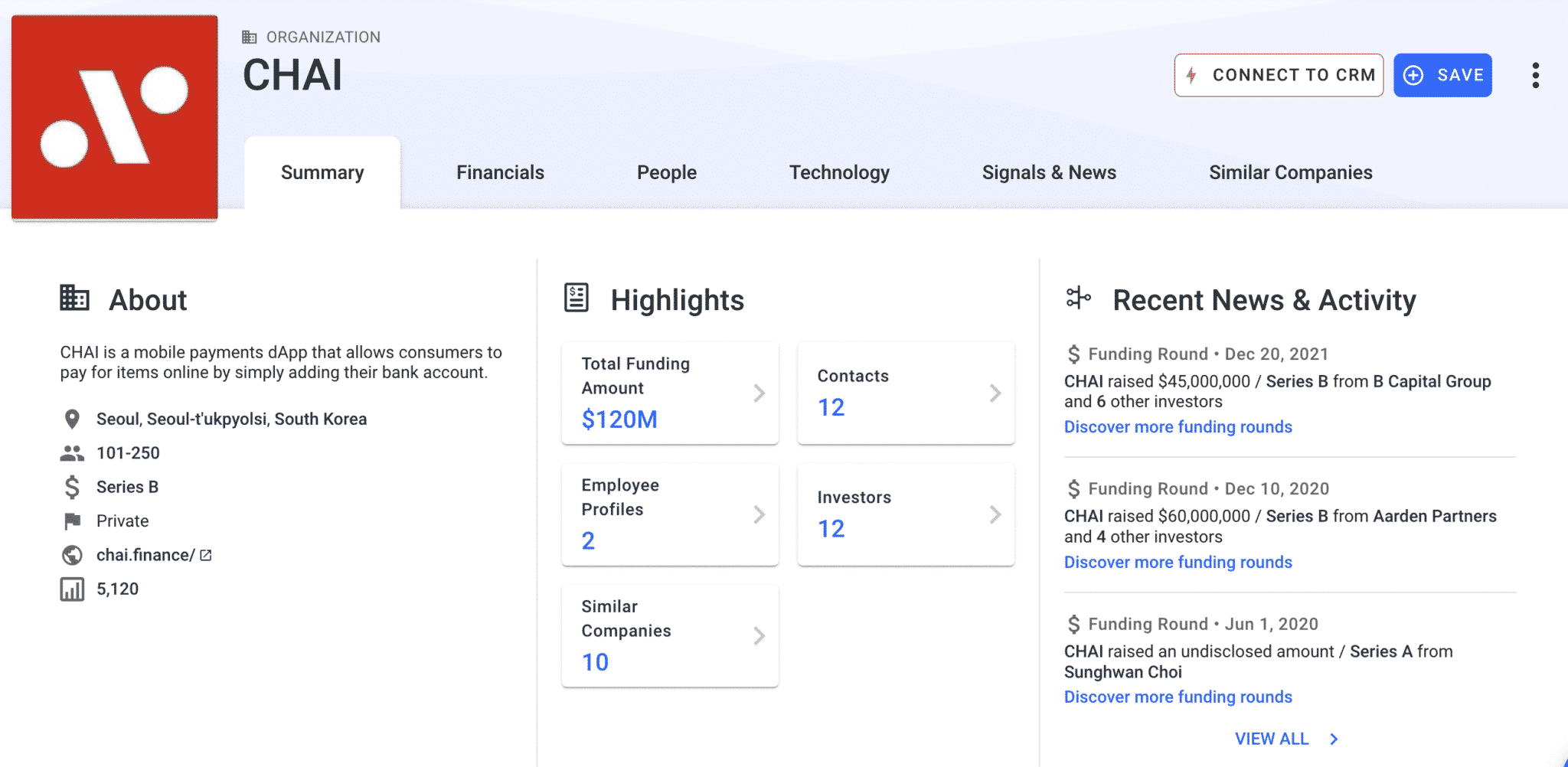

Terraform Labs, Terra’s creator was actually formed to launch a mobile payments app called Chai in early 2018. Targeting the South Korean market, Chai used the blockchain to fluidly swap between fiat and stablecoins:

- Users enter their existing bank, debit/credit cards, and PayPal, and can seamlessly shop online for lower transaction fees than the standard payment providers.

- Merchants got lower fees and faster settlement.

Chai would go on to become one of the most popular South Korean mobile payments companies, attracting over $120 million in investments. The company has since spun out from Terraform Labs and is a growing force in its market and beyond.

As Chai gained traction, Terraform’s founders spun out Terra. Chai laid the groundwork for Terra to imagine a global network of merchants and customers using Terra’s stablecoin product without even knowing they’re using anything blockchain-based.

Whereas other Layer 1 blockchains seem to compete over developer and crypto-native users, Terra aims to facilitate UST consumption through a mix of real-world and cryptocurrency projects.

Terra and the Crypto World

UST was designed to be completely censorship-resistant money, providing users a stable base of exchange to digitally transfer value quickly and for low fees.

Most notably, UST’s value is determined algorithmically. Terra can rapidly spin out tokens that track other fiat currencies like Euros or Japanese Yen, placing the project in strong contention for becoming a very popular international payment method.

It aimed to offer the same decentralized peer-to-peer advantages of a Bitcoin, but with stable value.

Its primary feature is also its most controversial– algorithmic stablecoins are still very new and experimental, and early algorithmic stablecoin projects have ended in ruin– and UST is yet another algorithmic stablecoin to bite the dust. None, however, have achieved the traction and support Terra did, making it a very exciting project to study– even if only from an experimental financial point of view.

The Terra Team: Who Made UST and LUNA?

Terra was created by Terraform Labs, a startup founded by Do Kwon (CEO) and Daniel Shin. Terraform Labs is headquartered in Seoul, South Korea.

Terra launched in January 2018 with the intention of ushering in mass cryptocurrency adoption by making digitally native stable assets pegged to leading fiat currencies such as the U.S. Dollar.

Terraform Labs built and launched the Chai mobile payments app in 2019, which utilized the Terra blockchain in the back-end. Merchants on Chai got faster final settlement times whereas customers received access to a more streamlined payment system. Chai currently boasts over 2.5 million users in South Korea.

Terra has raised $58 million from over 31 organizations such as Coinbase Ventures, Pantera, Hashed, Galaxy Digital (lead), Kinetic Capital, and Arrington XRP Capital.

How Does Terra Work?

Terra uses two tokens, Terra UST (earth) and Luna (moon), to function.

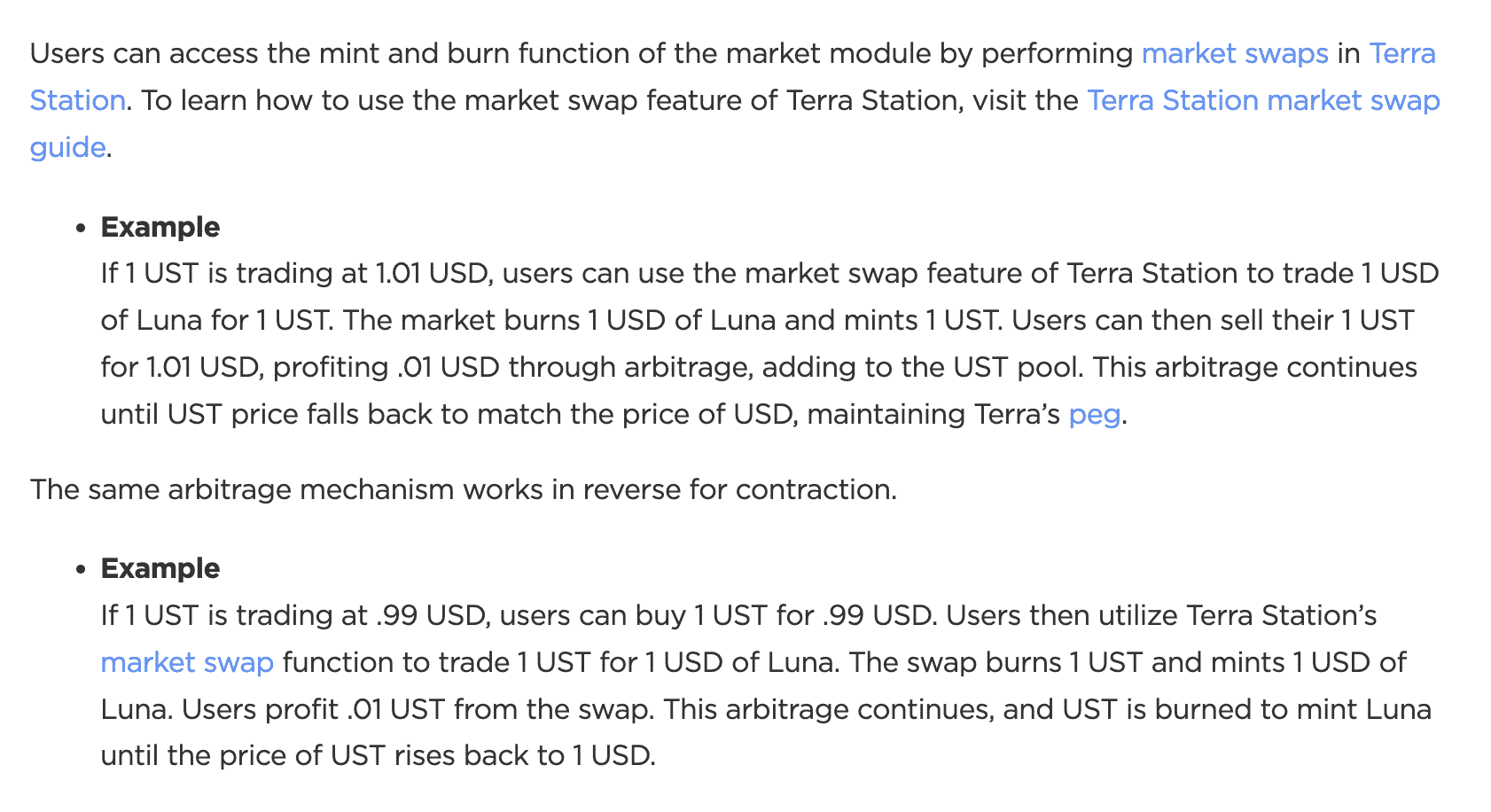

LUNA is Terra’s native staking token designed to keep Terra’s stablecoin products (UST) stable. Luna absorbs volatility from the UST ecosystem. In broad strokes, if demand for UST goes up, more UST is created and LUNA is burned. If demand for UST goes down, more LUNA is created and UST is burned. The actual mechanics of the burning and creation of tokens aren’t completely automatic, as they involve human labor arbitraging price differences.

Terra offers a variety of stablecoins pegged to top fiat currencies, such as:

- TerraUSD (UST): pegged to U.S. Dollar. This is Terra’s main stablecoin.

- TerraCNY

- TerraJPY

- TerraGBP

- TerraKRW

- TerraEUR

In addition to its stablecoin products, Terra also hosts a rapidly growing network of decentralized applications (dApps.) There are currently over 100 dApps in the Terra ecosystem, each of which generates demand for Terra and the $LUNA token.

We’ll get into how each specific token was designed to work below.

What is UST? Exploring the Stablecoin Terra (UST)

Terra’s flagship product is the UST stablecoin, a digital asset theoretically always worth $1.00.

It was designed to find a balance between blockchain’s benefits and everyday utility.

Terra’s blockchain itself, built with the Cosmos SDK (as are Cosmos, Thorchain, and Chronos), is very fast, cheap, and offers nearly immediate settlement times.

Whereas most stablecoins (USDC, GUSD, USDT) are built by third parties on the Ethereum blockchain, Kwon wanted to bundle the blockchain and UST product under the same roof.

One can imagine if Ethereum had full control and ownership of USDC, using it as a stable base of value for all other decentralized applications in its ecosystem.

But that’s about as far as that stablecoin comparison goes– UST is an algorithmic stablecoin, whereas USDC derives its value from fiat reserves of equal value.

Algorithmic stablecoins aim to prevent their value from floating around through a complex series of mechanisms, most often that buy, burn, or release new coins to automatically keep the dollar peg. Think of an algorithmic stablecoin as a constant, automated, calculated, form of quantitive easing; rather than the government just printing out hundreds of millions of dollars (money printer go BRRRR), an algorithmic stablecoin is always either issuing new coins to increase supply or buying & burning already issued coins to decrease supply.

In contrast, a collateralized stablecoin like USDC or USDT will (in theory) have the exact amount of fiat currency in custody in a bank as the issuance of the stablecoin. Each collateralized stablecoin maintains its dollar peg because of its 1:1 parity with the fiat.

The case for algorithmic stablecoins is that if the stablecoin only has its value because of physical assets somewhere, it can’t be decentralized because there is a central point of failure– what does it matter if your stablecoin uses the blockchain if someone robs the bank where the deposits are kept? The market will likely fly away from this husk of a digital asset because its inherent value is now non-existent.

However, algorithmic stablecoins are essentially backed by nothing, so the likelihood of failure is much higher.

Is UST an algorithmic stablecoin? Yes, Terra’s UST is an algorithmic stablecoin– it maintained its price peg through a set of arbitrage opportunities and pre-programmed rules, smart contracts, and software applications, rather than being collateralized by an underlying asset like most other stablecoins. It also incorporates human capital into maintaining the peg which we’ll get into later.

It’s also much easier to create a stablecoin without billions of dollars in the vault somewhere. Algorithmic stablecoins like UST are decentralized money for a decentralized ecosystem.

This “inherent value” thing is a dubious concept for stablecoins, and since the value is determined by the market, algorithmic stablecoins are constantly working to take supply off or add supply to the market.

Now, algorithmic stablecoins are a fairly baby deer-legged innovation, and inherently riskier since they are not collateralized. Detractors of algorithmic stablecoins emphasize that the stablecoin’s value is vulnerably tied to the ongoing interest of individually motivated market actors. Long-term sustainability is often in question. UST proved to fall into the category of failed algorithmic stablecoins.

However, this isn’t the guide for the pros and cons of algorithmic stablecoins (we’re working on that, too, and will link it here when finished.)

Anyway, back to Terra.

Terra (UST) aimed to combine the benefits of fiat currency and the blockchain:

- Unalterable public ledger (blockchain)

- Stable value (fiat)

- Fast final settlement times (blockchain)

- Lower fees (fiat/blockchain depending on the network)

What is LUNA? Introducing Terra’s Native LUNA Token

$LUNA and UST are like a delicate see-saw: more UST means less Luna, less UST means more Luna.

Suppose we want to mint $200 of TerraUSD (UST). First, we must convert an equivalent value of LUNA tokens (let’s assume LUNA is $40). We’d need 5 LUNA to mint the target $200 UST. Our 5 LUNA are burned, we get $200 UST.

Reversely, we can mint 5 LUNA tokens with $200 UST.

Terra itself will always treat UST as equal to $1, even if the peg is slightly off, let’s say $0.97.

So, what’s stopping someone from arbitraging the price difference?

If UST is meant to be $1 but its market price is actually lower or higher, can’t I just swap between LUNA and make a profit on the difference?

In theory, yes, you can, by design. The token burning and issuance mechanism is partially designed to let human arbitrageurs get UST closer to its dollar peg.

Let’s say UST’s market rate is $0.97. An arbitrageur buys $10,000 for $9,700 on the open market and goes to convert it to LUNA on Terra. Since the Terra protocol values UST at $1.00, the trader would get $10,000 in LUNA (250 LUNA if it’s $40 per coin), essentially making $300 on the exchange (less any network fees.)

Terra burns the UST in the process, taking UST supply off the market, creating a deflationary pressure that nudges UST closer to $1.00.

So, UST aimed to maintain its dollar peg with a seemingly infinite resource of human beings aiming to make a quick buck. The demand for UST by the various merchants and dApps also keeps the wheel in motion. The LUNA token is also used for a variety of other functions, such as mining and governance.

Users can stake LUNA to validate the network and receive rewards accrued through transaction fees.

However, when push came to shove, the LUNA token collapsed in value, cratering UST’s value as well.

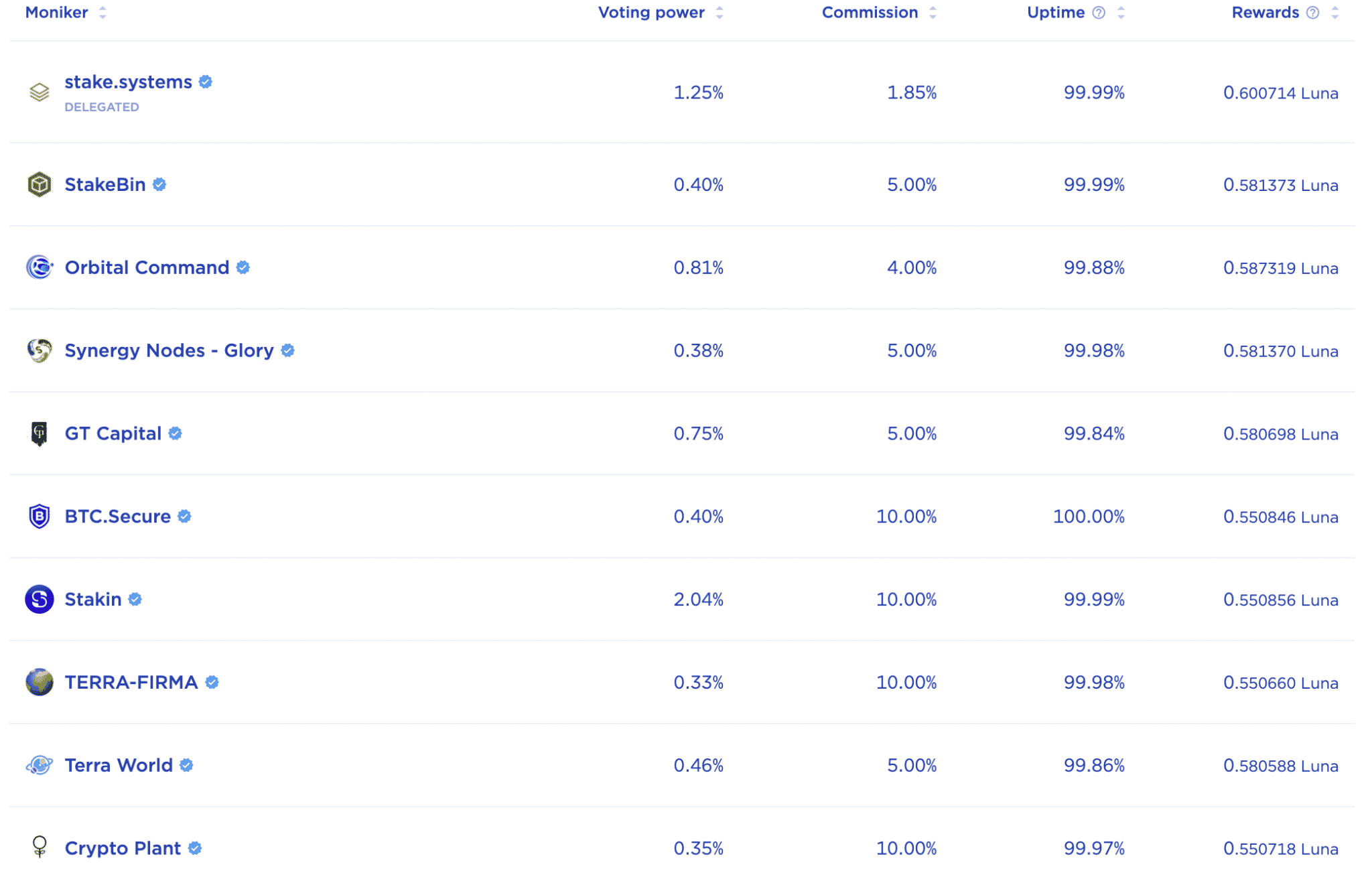

How to Stake LUNA

Like most other proof-of-work coins, staking LUNA means bonding the coin to a validator and receiving staking rewards.

As a staker, your formal title in this dynamic is a delegator– a class of user that wants to support the network and earn rewards, but does not own a full node.

Those who own full Terra nodes are called validators; they uphold the blockchain, as per the rules specified by the Tendermint consensus.

Terra only allows the top 130 validators on its staking platform; the ranks are determined by the amount of LUNA the validator has staked. The people who delegate their LUNA help support each individual validator.

Rewards are generated from:

- Gas fees– validators set the minimum gas prices

- Swap fees– the fees for swapping between stablecoins (like a foreign exchange fee).

- Spread fees– fees for swapping between UST (and other Terra stables) and Luna

The full list of fees in the Terra ecosystem here.

To stake LUNA, you’d deposit LUNA into the Terra Station wallet, go to https://station.terra.money/stake, select a validator, and stake it.

The Terra Station, The Wallet for the Terra Network, and Other Terra Tools

The Terra Station is the gateway for anyone to interact with the Terra network; The Terra Station is to Terra what MetaMask is to Ethereum.

It supports LUNA and other Terra ecosystem assets like Anchor ($ANC) and Mirror Protocol ($MIR). It facilitates interaction with many of the dApps in Terra’s ecosystem, as well as swapping assets, staking $LUNA, and managing wallet balances.

However, Terra Station has an eCommerce bend– merchants can easily set up their own point-of-sale payment integrations on web and mobile applications and leverage the instant settlement benefits of Terra. A freelance designer could integrate Terra Station as their primary payment portal and start accepting payments at a fraction of the costs of standard processors like PayPal.

The Terra Bridge is a tool enabling the cross-chain transfer of native Terra tokens. Similarly, Wormhole, is a multi-chain access tool, enabling Terra transfers between Ethereum, Solana, and BSC. One of these tools would have to be used to “unwrap” WLUNA from Coinbase Pro to be used in Terra Station.

The Terra Ecosystem

We learned Terra’s dApp ecosystem incorporates utility for UST and LUNA. There are over 100 projects built on the Terra blockchain including projects like:

DeFi Ecosystem updated, did we miss anyone? pic.twitter.com/OGbYBgk44o

— Terrians ???? (@Terrians_) March 4, 2022

Anchor Protocol: Anchor was a very popular dApp in Terra’s ecosystem, allowing users to earn upwards of around 18% to 20% APY on UST deposits. Although similar to a crypto interest account, Anchor is distinctly different in that it’s non-custodial and presents greater risks. This is also your friendly reminder that all of this is risky business, and this isn’t financial advice. With the collapse of UST and LUNA, deposits left in Anchor lost upwards of 90% (and counting) of their value.

Anchor is pretty complicated to start with.

Astroport: An automated market maker (decentralized exchange) that has a wide variety of liquidity pools and token swaps.

Mirror Protocol: One of the more controversial dApps that put Terra in the SEC’s crosshairs. Mirror allows for the creation of fungible and synthetic assets that track real-world assets– anyone in the world can trade assets outside of their geography.

In response to the Mirror controversy, Kwon notes that platforms such as Mirror and Anchor have individual governance tokens and are “fair launched” which means Terraform doesn’t have equity or ownership in them. “We’ve built an ecosystem that was, you know, built by us but not necessarily owned by us,” commented Kwon.

Terra (Luna) Price Predictions

Well, if all goes according to the team’s plan, UST would always be $1.00, or at most just a few pennies in either direction. As UST’s demand grows, so would its market cap. As demand for UST goes up, more $LUNA would be burned, decreasing LUNA’s supply. If demand for LUNA remains unchanged, the per-unit price of the LUNA would increase. In theory, a Terra bull would benefit from holding LUNA and hoping the ecosystem around Terra grows in a substantial way.

However, when the rubber hit the road, the exact opposite happened at a catastrophically fast rate. Upon the dollar peg shaking and breaking, UST holders started removing deposits from Anchor, and selling their UST and LUNA for other stablecoins like USDC, crypto like BTC or ETH, or fiat.

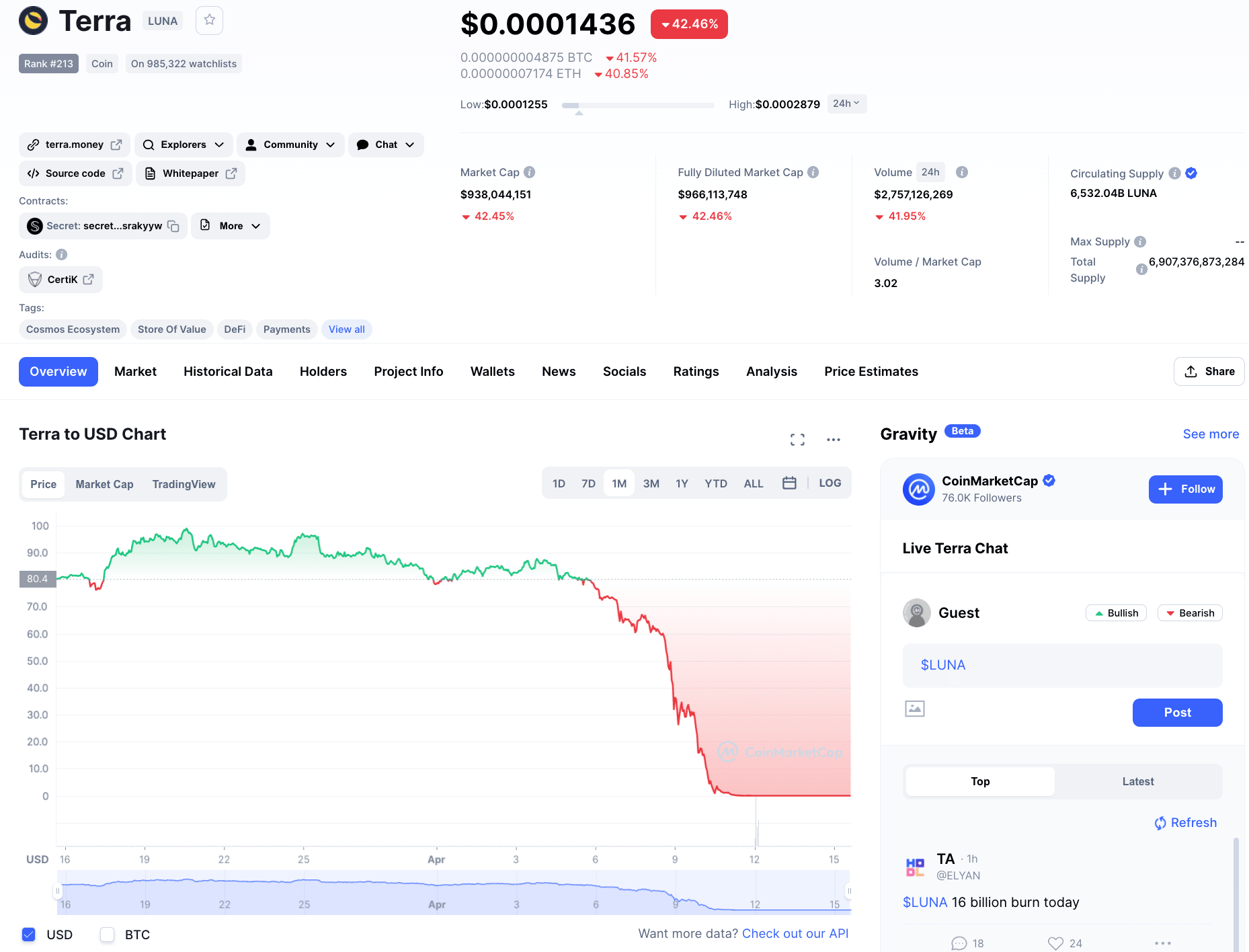

When we first published this guide, May 2nd, 2022:

- UST had a market cap of $18,585,793,989 and a per-unit price of $1.00

- LUNA had a market cap of $29,064,789,028 and a per-unit price of $83.77.

Today,

- UST has a market cap of $1,066,090,156 and a per-unit price of $0.09472- down about 91%.

- LUNA has a market cap of $936,035,099 and a per-unit price of $0.0001419- down about 99.99%.

Editor’s note: Ouch.

Doomsday: How Terra UST and Luna Crashed

Terra became popular because it worked so far– but as we’ve learned in cryptocurrency over the years, so far only goes so far. Things only work until they don’t.

1/ Dear Terra Community:

— Do Kwon ???? (@stablekwon) May 11, 2022

Terra UST crashed when everyone suddenly sold all their LUNA and all their UST. The price of BTC was also falling, further destabilizing UST’s base of reserves (20% of its value was supposed to be collateralized by the price of BTC).

Resurgence: Will UST and LUNA Make a Comeback?

It isn’t clear whether UST or LUNA will ever recover, but only time will tell. The Terra blockchain is currently frozen.

Terra for Developers: The Technical Side of the Moon

Terra runs on its own proof-of-stake blockchain, built on the Tendermint Core utilizing the Cosmos SDK.

Essentially, Tendermint Core and the Cosmos SDK are united in their opinion that other blockchains are inefficient by design:

- Bitcoin’s blockchain is seen as “monolithic” which makes it difficult for decentralized applications to run niche use cases;

- Ethereum’s blockchain limits programmers to coding in languages like Solidity and Serpent, and also prone to network congestion.

Cosmos made a framework for self-sovereign blockchains, meaning projects like Terra can use the Cosmos SDK and set up their own shop without any strings attached to the Cosmos network.

For our more tech-inclined readers, we recommend checking out the Tendermint guide straight from the source– it describes how and why this Byzantine Fault Tolerant software can be advantageous for applications like Terra.

Terra invests in making developing on its platform a pleasant experience; it hosts a wide variety of developer tools, documentation, and guides for anyone who wants to build in the Terra ecosystem.

Here are a few handy Terra developmental links to get you started:

Final Thoughts: Terra, UST, Luna, and Beyond

In our Terra guide, we learned how UST was designed and what its goals were. The project is currently mired in controversy, and people collectively lost hundreds of millions of dollars holding UST, Luna, and using Terra’s dApps like the Anchor Protocol.

However, for all its infamy, people commend Founder Do Kwon for actively working to prevent the collapse, albeit unsuccessfully. In an industry where many catastrophic losses are linked to hacks or malicious founders, Kwon’s intentions seem to have been aligned with creating something sustainably good.

1/ I’ve spent the last few days on the phone calling Terra community members – builders, community members, employees, friends and family, that have been devastated by UST depegging.

I am heartbroken about the pain my invention has brought on all of you.

— Do Kwon ???? (@stablekwon) May 13, 2022

However, we consider Terra as a cautionary tale, with plenty of gems to discover in its post-mortem.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.