This Week In Crypto: April 27, 2018

Bull Run? Bull Trap? Bull Crap?

Opening this Friday with a $415bln market cap, the market has three straight weeks of gains in the bag. April’s been a good month for investors. Ever since that $1,000 leap Bitcoin took on April 12, we’ve been on a steady uptrend ever since, and all the positive price actions have some analyst postulating a bull run.

Not to be a downer when everything’s up, but don’t get too hasty. We saw something similar back in February where the market grew to over $500bln in less than two weeks after crashing below $280bln. This growth has been longer and (seemingly) more organic, but we’ll have to keep an eye on price resistance. If Bitcoin and the other big boys can’t break the resistance levels they rejected this week (for Bitcoin, $9,700), we could see a double top like we did in February and be headed back down. If these resistance levels are broken, though, we could be in for higher prices still.

Not trying to spook anyone–just trying to present both sides of the coin. Stay savvy out there, folks.

Bitcoin: At $9,220, Bitcoin has recorded a comfortable 7% increase on the week.

Ethereum: Ethereum saw some especially impressive growth this week, up 12% with a price of $672.

Ripple: No doubt in response to its substantial gains last week, Ripple is actually down 1% at $0.84.

Domestic News

Nasdaq Willing to Open Cryptocurrency Exchange When “people are ready for a more regulated market”: In a Squawk Box interview this Wednesday, Nasdaq CEO Aden Friedman told CNBC that “Nasdaq would consider becoming a crypto exchange over time.” Friedman continues to imply that Nasdaq would only enter the market when proper regulations are in place: “If we do look at it and say ‘it’s time, people are ready for a more regulated market,’ for something that provides a fair experience for investors.”

Winklevoss’s Gemini Exchange Partners with Nasdaq to Monitor its Markets: Perhaps Nasdaq is testing the markets before jumping in. On the same day as Friedman’s interview, Gemini exchange, owned and operated by the Winklevoss twins, announced that would be implementing Nasdaq’s SMARTS Markets Surveillance to policing market manipulation on its platform. “Our deployment of Nasdaq’s SMARTS Market Surveillance will help ensure that Gemini is a rules-based marketplace for all market participants,” Tyler Winklevoss, Gemini’s CEO, said in a comment.

Introducing Marketplace Surveillance Technology with @Nasdaq https://t.co/giHwJtseRu

— Gemini (@Gemini) April 25, 2018

Goldman Sachs Grabs Crypto Trader to Serve as VP of Digital Assets: Reversing the trend of wall street executives running off to join blockchain projects, Goldman Sachs has sniped talent from the cryptocurrency realm. The new VP of Digital Assets, Justin Schmidt, has a masters degree in Computer Science from MIT and previously held VP positions at WorldQuant LLC and Seven Eight Capital. Goldman Sachs created the position “in response to client interest in various digital products,” though the firm has “not reached a conclusion on the scope of our digital asset offering,” Goldman Sachs spokeswoman Tiffany Galvin-Cohen said in regards to the hire.

MIT Technology Review Publishes “Let’s Destroy Bitcoin,” an Essay on How Bitcoin Could Fall: Author Morgan Peck is in no way advocating that Bitcoin should be destroyed; she’s merely outlining how it could be destroyed. According to her argument, a government and its central bank could issue it’s own cryptocurrency in lieu of Bitcoin, Facebook could launch an ICO and usurp Bitcoin’s popularity–a troubling scenario if not highly unlikely–or Bitcoin could merely be rendered irrelevant by a multitude of cryptocurrencies that are used to pay for variety of goods and services.

Blockchain Business Bill Makes its Rounds in the California State Senate: California State Senator Bob Hertzberg (D) has introduced legislation that would be “a first step in introducing the technology in California in a limited capacity,” according to an official press release. If enacted into law, SB 838 “would enable the use of blockchain technology for certain business practices in California. Blockchain is an emerging technology that allows records to be stored and updated on multiple computers using a distributed ledger technology.”

Don’t Rush Regulation, Says US Congressman Patrick McHenry: How do you fight fraud in an unregulated market? Well, some might say regulations are a good place to start, but North Carolina Congressman Patrick McHenry says not so fast. While he believes blockchain technology has immense potential, he doesn’t want legislators and officials to feel pressured into adopting rash policy: “It’s my fear that Congress and other policymakers get wrapped up in the hype of bitcoin and feel like doing something – anything – is better than nothing,” he told CoinDesk.

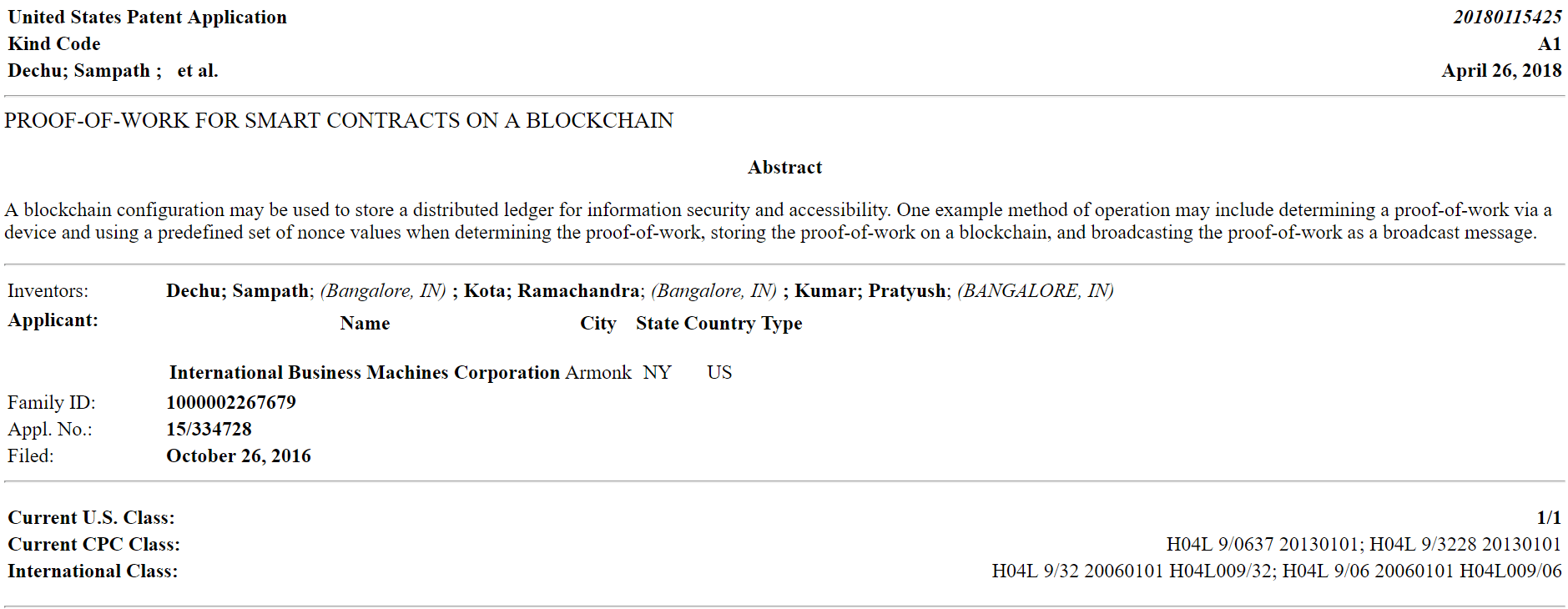

IBM Files Patent for IoT Protocol that Utilizes Proof of Work: Joining a growing list of legacy tech companies that have filed patents for distributed ledger technology, IBM has filed a patent with the US Patent and Trademark Office for a proof of work protocol built for the Internet of Things. According to the official document, the patent is a “method, comprising: determining a proof-of-work via a device; using a predefined set of nonce values when determining the proof-of-work; storing the proof-of-work on a blockchain; and broadcasting the proof-of-work as a broadcast message.”

What’s New at CoinCentral?

Why 2FA Matters & the Best Types of 2FA: Two factor authentication is an essential security measure to keep your funds safe, so you’ll want to make sure that your 2FA methods are airtight.

What is Po.et (POE)? | Beginner’s Guide: Po.et is an Ethereum-based, universal ledger designed to track ownership and attribution for the world’s digital creative assets developed by BTC Media.

How Developers are Turning Old Electronics into Bitcoin Mining Rigs: Bitcoin mining often gets a bad rap for being ecologically unfriendly; what if we turned this reputation on its head by building rigs with recycled hardware?

Common Mistakes to Avoid While Cryptocurrency Trading: Whether it’s fat fingering an order or panic selling, try to avoid careless errors when playing with magical math money.

Top Cryptocurrency Exchanges in 2018: The markets and trading scene has changed drastically in the past year, so stay on top of your options with our guide to the best exchanges.

Bitcoin Censorship Resistance Explained: With complete immutability comes great responsibility, and for Bitcoin, that means you can’t hide from what the blockchain publicizes.

What is Radar Relay Decentralized Exchange: The Radar Relay decentralized exchange enables peer-to-peer trading of cryptocurrencies per other first-generation decentralized exchanges like the OasisDEX, EtherDelta, and IDEX.

The Impact of Upcoming Cryptocurrencies on the Financial Industry: Blockchain and cryptocurrencies are often touted for their disruptive potential, and the legacy financial industry isn’t precluded from this disruption.

Mining the Future of Money: Building a GPU Mining Rig: Have you ever wanted to start GPU mining but didn’t know where to start? We can help you out.

My Ether Wallet Suffers Phishing Attack After Hackers Hijack Google Public DNS: Roughly 515 ETH as stolen as a result of the phishing attack.

John McAfee Thinks it’s Time for Jamie Dimon to Surrender: John McAfee is at it again, and he’s calling the JP Morgan CEO asking for “terms of surrender.”

How to Evaluate a Cryptocurrency: Before buying up r/cryptocurrency’s shill of the week, you might want to consider the objective value of your investment.

Neil Patel on KindAds, Crypto Advertising, Entrepreneurship, and Regulations: We had the pleasure of sitting down for a chat with renowned marketer and entrepreneur Neil Patel, touching on topics like big tech’s crypto ad ban and the evolution of blockchain entrepreneurship.

How Hardware Wallets Can Secure Your Cryptocurrency: Seriously guys, hardware wallets are important–if you need convincing, just look at the MyEtherWallet phishing attack we just covered.

How to Become a Cryptocurrency Trader: Before you start trading and investing in cryptocurrencies, you’ll want to set some investing guidelines and get outfitted with the proper tools.

Codex Protocol’s Jess Houlgrave on the Blockchain Art World and Crypto Entrepeneurship: Jess Houlgrave is the Co-founder & COO at Codex Protocol and borrows from her experiences in everything from spending a few years in the finance industry and being a blockchain and art consultant.

ICO Review: Solve.Care: Solve.Care is offering a global blockchain solution for the coordination, administration, and payments systems in healthcare.

[thrive_leads id=’5219′]

Cryptocurrency News from Around the World

ERC-20 Bug Forces OKEx to Halt Token Deposits: According to an OKEx support page post, hackers found a way to exploit an ERC-20 smart contract flaw, “BatchOverFlow,” allowing them to mint tokens out of thin air and deposit them directly onto the exchange. “We are suspending the deposits of all ERC-20 tokens due to the discovery of a new smart contract bug – ‘BatchOverFlow’. By exploiting the bug, attackers can generate an extremely large amount of tokens, and deposit them into a normal address. This makes many of the ERC-20 tokens vulnerable to price manipulations of the attackers,” the post reads. The exchange suspended all ERC-20 token deposits in response.

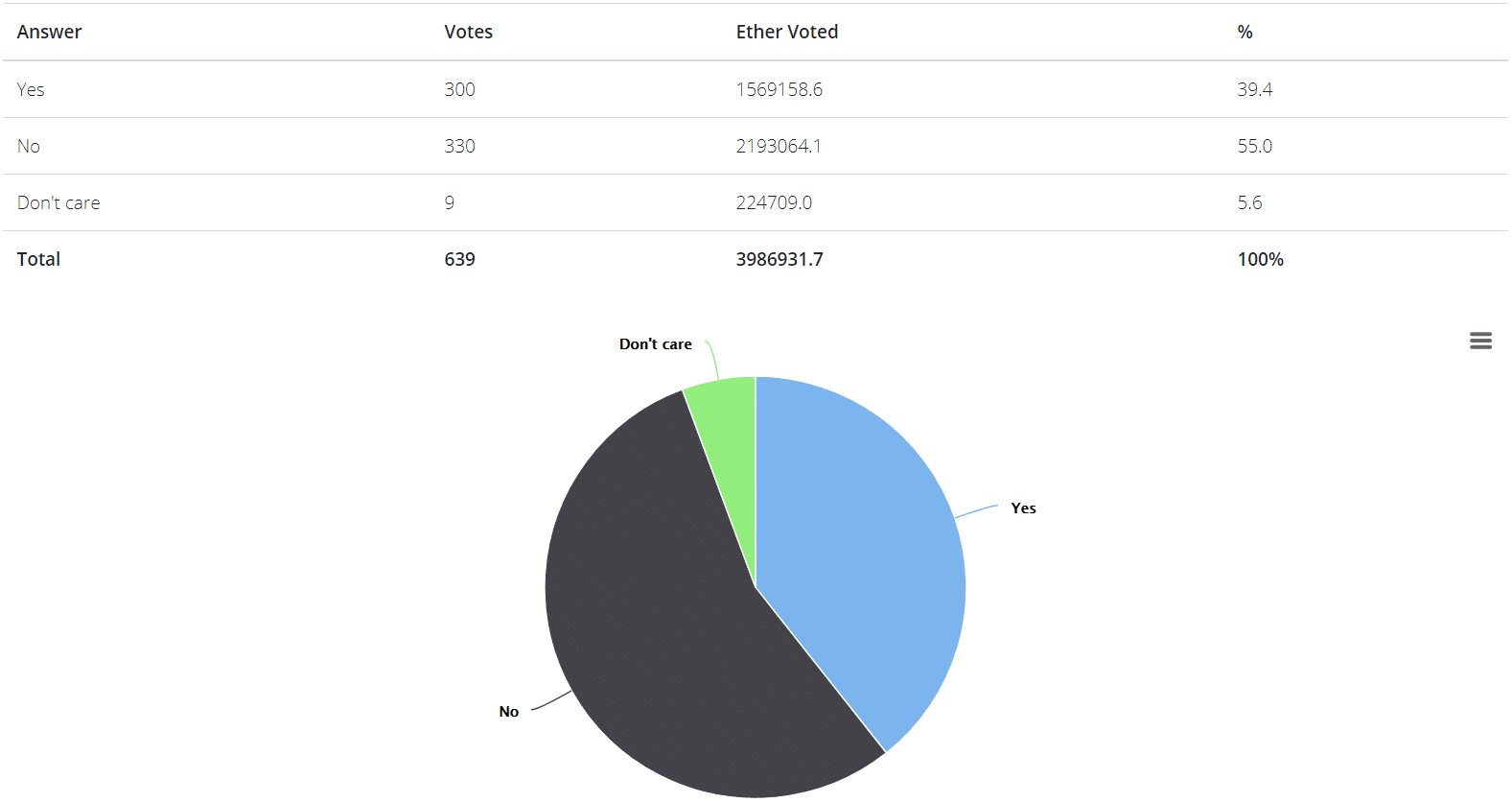

Proposal to Unlock Frozen Parity Wallet Funds Breeds Community Controversy: Last November, an unknown individual exploited a vulnerability the popular Etherum wallet Parity, accidentally killing Parity’s multisignature wallet library and leaving 513,777.16 ETH inaccessible to 587 wallets. Now, a proposal on Github (EIP-999) has introduced a code change that could allow those affected to re-access their funds, but an etherchain.org vote involving the affected individuals shot down the proposal 330-300. Still, some community members are saying that the vote does not adequately reflect the community’s sentiments, and the discussion has resurfaced debates over the blockchain’s immutability and the consequences of changing code to restore funds.

More on Vulnerabilities: MyEtherWallet Users Have Funds Phished from Fake DNS: Early in the morning on April 24, hackers hijacked MyEtherWallet’s Google Public DNS, redirecting traffic from the popular Ethereum wallet service to a fake site. Despite caveats popping up warning users that the destination had an invalid SSL certificate, some users accessed the faulty website and attempted to log into their wallets with private keys. As a result of the phishing attack, some 515 ETH (~$350,000) was stolen.

Alleging Stolen Electricity, Chinese Police Seize 600 Pieces of Mining Hardware: A mining operation in the northeastern port city of Tianjin was busted this week for allegedly robbing a local power supplier of its electricity. Police seized the outfits equipment after the grid operators noticed sharp spikes in its consumption, sometimes as high as 28% above average levels. An investigation reveals that the miners may have been sapping energy through a short circuited junction box in an ongoing heist that the police called “the largest case of power theft in recent years.”

Thomas Reuters Poll Reveals that One in Five Financial Institutions Have Considered Crypto Trading: This Tuesday, Thomas Reuters published a survey indicating that one out of five sampled financial institutions have plans to launch cryptocurrency trading within a year’s time, while 70% of those who want to begin trading have plans to start within the next three to six months. According to an article on Reuters, “[the] survey covered more than 400 clients across Thomson Reuters Corp TRI.O (TRI.N) platforms including large asset managers, hedge funds and trading desks at the biggest banks.”

Spanish Bank Delivers First Blockchain-Issued Loan: The Banco Bilbao Vizcaya Argentaria (BBVA) has made history by becoming the first bank to issue a loan using blockchain technology. The entire loan process, according to the Spanish multinational bank, was overseen using a distributed ledger whose information was available both to the bank and the borrower. “Blockchain can offer clear advantages for all sides in the corporate loan market in terms of efficiency, transparency, [and] security, CEO Carlos Torres Villa commented on the developments, calling it “another strong example of how disruptive technology can be used to add value to financial services, something that is central to our strategy.”

Treasure Trove of Mt. Gox Funds on the Move, Batten Down the Hatches, Bucko: Crypto Ground data reveals that 16,000 BTC and 16,000 BCH has migrated out of cold wallets under the control of Nobuaki Kobayashi, Mt. Gox’s bankruptcy trustee. This doesn’t necessarily mean that the funds have been moved to sell on an exchange, but it’s enough money (a collective $165mln) for the action to catch the eye of the cryptocurrency community.

Looks like 16k BTC from Mt Gox were consolidated to this address

We obviously don't know if they were sold or just moved for some other reasonhttps://t.co/rr05Vn7Fnv pic.twitter.com/eMS1vMCG3l— Alistair Milne (@alistairmilne) April 26, 2018