Down We Go

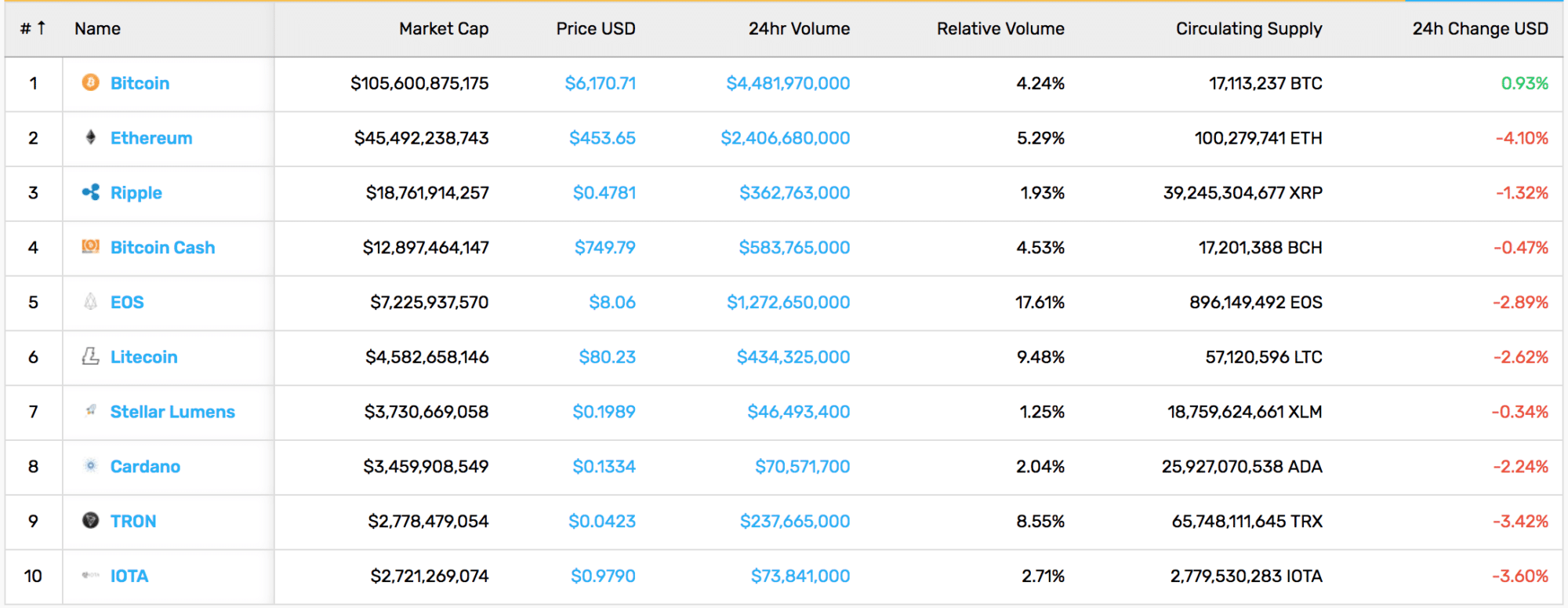

We’re still trending downward, folks. It was looking last night like we might close this week out on a green candle. But that was before Bitcoin shed about $600, dragging the rest of the market down with it.

Currently, crypto’s overall market cap is resting in the realm of $258 bln, a 7% decrease from where it was at the end of last week. At its current price, Bitcoin has broken the support it established on its nosedives in early February and April, sporting a new all-time-low for 2018.

If Bitcoin can maintain support at ~$5,800, then we could bounce still from this latest drop. If not, we could be in for $5k or lower in the near future.

Bitcoin: With a price of $6,130, Bitcoin has lost 5% of its value over the week.

Ethereum: Ethereum has practically mirrored Bitcoin’s losses; at $472, it’s down 4%.

Ripple: Even with its slick new logo, Ripple shed 7% off its price this week, and it’s currently trading at $0.49.

Domestic News

Tether is Fully-Backed By USD, Law Firm Claims After Conducting Financial Review: The Freeh, Sporkin & Sullivan (FSS) law firm conducted a financial review of Tether’s bank account at the beginning of this month, and this week, the firm released a report claiming that Tether has a 1:1 dollar reserve for each USDT in circulation. The makeshift audit–which FSS disclaims is not an official audit–is Tether’s latest attempt to legitimize its business model. Last September, the company contracted Friedman LLP to conduct a similar unofficial audit in a bid to appear more transparent. The company has repeatedly shied-away from subjecting itself to a formal audit, a process it argues is not an available option given the stigma surround cryptocurrency companies.

A Conflicting Account: Academics Argue That Tether Was Used to Manipulate Bitcoin’s Bullrun: Tether needed the good publicity FSS’s report brought, mainly because another report from this week gave damning credence to a long-held suspicion within the cryptocurrency community. Professors John M. Griffin and Amin Shams at the University of Austin, Texas published a 66-page long study this week that finds “Tether is used to provide price support and manipulate cryptocurrency prices,” specifically Bitcoin. The academics found a positive correlation between Bitcoin’s downward price movements and the issuance of fresh Tethers. They found that Bitfinex, who shares a CEO in Jan Ludovicus van der Velde with Tether, was responsible for the majority of Tether’s purchasing power and monetary flow during these episodes.

Stanford Established Blockchain Research Center in Collaboration With Ethereum Foundation: A group of Standford computer scientists and professors have banded together to launch the Center for Blockchain Research, a five-year research program with funding and support from the Ethereum Foundation, Protocol Labs, the Interchain Foundation, OmiseGO, DFINITY Stiftung, and PolyChain Capital. Two professors of computer science at the university, Dan Boneh and David Mazières, are spearheading the initiative. “Blockchains will become increasingly critical to doing business globally,” Boneh stated in a Stanford School of Engineering blog post. “Stanford should be at the forefront of efforts to improve, apply and understand the many ripple effects of this technology,” he concluded.

Excited to be supporting this initiative!https://t.co/CmaVpBxjrf https://t.co/RJHm1pVbWX

— Vitalik "Not giving away ETH" Buterin (@VitalikButerin) June 21, 2018

Nasdaq Successfully Pilots Blockchain Platform for Margin Calls, Collateral Processing: In a successful proof-of-concept, Nasdaq launched a pilot of its blockchain this week. Working jointly with ABN AMRO Clearing, EuroCCP, and Euroclear, the American stock exchange operator used the platform to clear an over-seas collateral transfer. “We are excited to be partnering on a proof of concept that is extremely useful for transactions that are not already well-served by market infrastructures. With a solution like this in place, we will be able to efficiently provide counterparty risk protection of equity trades after hours while reducing operational complexities. Today we are limited by European banking hours or arrangements in other time zones,” EuroCCP CEO Diana Chan stated in the official press release.

United States Federal Employees Must Now Disclose Crypto Holdings Under New Mandate: In a move that will affect some 2 mln employees, the US Office of Government Ethics now requires that federal employees disclose their crypto investments. The new guidance will affect federal executive branch employees, and though it asks for full disclosure of crypto investments, it does not recognize cryptocurrencies as legal tender. “Filers report their holdings in a virtual currency if the value of the virtual currency holding exceeded $1,000 at the end of the reporting period or if the income produced by the virtual currency holding exceeded $200 during the reporting period. Filers are required to identify the name of the virtual currency, and, if held through an exchange or platform, the exchange or platform on which it is held,” the policy reads.

Denver Post Journalists, Editor Ditch Paper to Start Blockchain-Based Publication: A crew of writers and editors from the Denver Post are fed-up with a work environment in decline and a change of management. So they decided to start their own online publication with assistance from Civil, a ConsenSys-backed project. The Colorado Sun hopes to become “a community-supported, journalist-owned team focused on investigative, explanatory and narrative journalism for a state in the midst of a massive evolution.” To achieve this goal, it will use Civil’s blockchain to store data, run on an ad-free revenue model, and will rely on subscriptions and local support to subsist. The publication has a Kickstarter campaign that has already superseded its goal of $75,000.

SEC Receives Additional Court Orders to Freeze Funds Linked to PlexCoin: The United States SEC has received yet another emergency court order to freeze the account of Dominic Lacroix, PlexCorps’ owner and the founder of the PlexCoin ICO. The SEC sued Lacroix in December of last year for securities fraud after the PlexCoin ICO raised $15 mln and promised investment returns upwards of 1,000% in under a month. Now, the SEC is probing Lacroix’s use of secret bank accounts he may have used to scatter the funds he received from investors.

What’s New at CoinCentral?

BotChain and Digital Currency Group to Host Blockchain/AI Conference in NYC: BotChain and Digital Currency Group are hosting their first ever Brains and Chains conference on June 28th at the InterContinental in Times Square.

Tron Acquires BitTorrent in $140 mln Buyout: Justin Sun’s Tron has purchased file-sharing giant BitTorrent in a deal valued at $140 mln.

Each Tether is Backed By USD, Unofficial Audit Claims: FSS, a law firm founded by a former FBI Director, conducted an unofficial financial review of Tether’s bank account, and it claims that the stablecoin is completely backed by dollar reserves.

Is Riot Blockchain Still a Good Investment a Year After Pivot?: Riot Blockchain (RIOT), formerly a biotech company that produced medical devices, shifted its business model to focus on cryptocurrency last October.

All You Need to Know About the Future of Blockchain Wealth Management: What is likely to be the impact of blockchain wealth management, and how will it affect the broader discipline of wealth management?

What is CEEK VR? Creating Exclusive Virtual Experiences with Blockchain: CEEK is a company that primarily focuses on building AR/VR headsets that recently raised $17M (22K ETH) in a 2018 ICO to explore a tokenized component for musicians to create virtual worlds around their music.

Quantum Computing | Bitcoin’s Doomsday Maker: Quantum computers have the potential to make Bitcoin’s security measures obsolete, effectively destroying the once dominant cryptocurrency.

Meanwhile North of the Border, Canada is Stepping Up Its Cryptocurrency Mining: Step aside, China; there’s a new hotshot making moves on the international mining scene.

What Is Digital Asset Holdings? | Distributed Ledgers for Financial Institutions: Digital Asset Holdings LLC provides a flexible infrastructure for regulated financial institutions to share processes and data securely.

[thrive_leads id=’5219′]

Cryptocurrency News From Around the World

South Korean Government Unveils Multi-Year, Multi-Million Dollar Blockchain Strategy and Fund: The Ministry of Science and ICT for South Korea announced this week that it would be launching its Blockchain Technology Development Strategy, a fund that will look to raise over $200 mln by 2020 to fund blockchain initiatives and companies. Some 10,000 industry professionals and 100 projects are in the ministry’s fiscal scope, and the strategy will also foster projects to develop South Korean smart cities and factories, as well as fund pilots for blockchain application in real estate, online voting, logistics, customs clearance, and others.

Bank of International Settlements in Switzerland Releases Withering Report on Cryptocurrencies: In a show of expected bias, the central bank of central banks, the Swiss-based Bank of International Settlements, included a chapter in its annual economic report entitled “Cryptocurrencies: looking beyond the hype.” Among other critiques, the report downplays blockchain’s ability to revamp financial transaction systems, citing numerous challenges as they relate to scalability, environmental impact, and other related stigmas. The report has, obviously, drawn flack from the crypto community. Circle CEO Jeremy Allaire called it “very shallow,” as the report contains outdated information and treats Bitcoin’s protocol and function synonymously with the rest of the market’s assets.

Bithumb Hacked for Upwards of $30 mln: South Korean exchange Bithumb, one of the most popular cryptocurrency exchanges in the world, was hacked this week for roughly $32 mln worth of assets. The hackers tapped into hot wallet reserves for Ripple, among others. Responding to the incident, Bithumb salvaged remaining funds to cold wallets while promising those affected full compensation for their losses. South Korean authorities launched an investigation into the heist shortly after the incident.

[Jun 20th Incident Report]

We would like to share with you the events that took place on June 20, 2018 and the steps we're taking to ensure that your asset is safe and secure with Bithumb.— Bithumb (@BithumbOfficial) June 21, 2018

You Can Now Trade Litecoin Futures Using This UK Exchange: The United Kingdom-based Crypto Facilities exchange launched its inaugural Litecoin futures this Friday. The futures will allow users to trade long-term and short-term positions with weekly, monthly, and quarterly contracts. CEO Tim Schlaefer indicated that the new market product is in response to high demand from the exchange’s customers. “We believe our LTC-dollar futures contracts will increase price transparency, liquidity and efficiency in the cryptocurrency markets.”

Toronto Stock Exchange Launches New Blockchain ETF: This Thursday, the Toronto Stock Exchange (TSX) sent a new blockchain ETF to market. The Horizons Blockchain Technology and Hardware Index ETF will invest in companies that deal with blockchain-related services and applications, such as Nvidia Corp. and Digital Realty Trust Inc. It will join the ranks of two other blockchain ETFs, the Harvest Portfolio Group Inc., which went live in February of this year, and Evolve Funds Group Inc. The newest fund will focus on hardware and services, Steve Hawkins, its co-CEO told Bloomberg, and it will avoid any company with a sub-$20 mln market cap to effectively manage risk. “Investors need to be investing in the well-established global infrastructure to blockchain, not necessarily taking risks on the startup blockchain development companies,” he said in an interview.

Turcoin, the Self-Purported National Cryptocurrency for Turkey, Exposed as Ponzi: Turns out that Turcoin, a cryptocurrency project with zero ties to the Turkish government, is not actually a national coin for the Turkish nation. Run by a company out of Istanbul called Hipper, Turcoin advertised itself as Turkey’s national cryptocurrency. The company has come under legal pressure after it stopped issuing coins to investors in June. One of its partners, Muhammed Satıroğlu, alleges that he “was only a mediator” and that “Hipper does not even have a single dollar in the bank.” Sadun Kaya, the company’s other partner, he claims, ran off with $21 mln of investor money, stashing it in a bank account link to another company in Cyprus. Attempting to wash himself of guilt, Satıroğlu, who owns a 49% share in Hipper, claims that he “will return all the money to the [investors] if authorities unblock [his] bank accounts.”

Filipino Bank Announces Remittance Platform to Japan With Help from IBM: The Rizal Commerical Banking Corp (RCBC) in the Philippines is poised to launch a blockchain-based remittance platform in partnership with IBM and two Japanese Banks. The initiative will make use of IBM’s blockchain pilot platform to make it easier for Filipino citizens working in Japan to send money back home. “We want to serve the OFWs in Japan through this technology and we’re doing it in partnership with two Japanese banks,” RCBC First Senior Vice President Manny T. Narciso said in regards to the developments. “For the OFWs in Japan, it will make remittance faster and cheaper as we will collect less [sic] fees,” he continued.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.