- This Week in Cryptocurrency – December 15th, 2017

- What’s New at CoinCentral?

- More Cryptocurrency News From Around the World

This Week in Cryptocurrency – December 15th, 2017

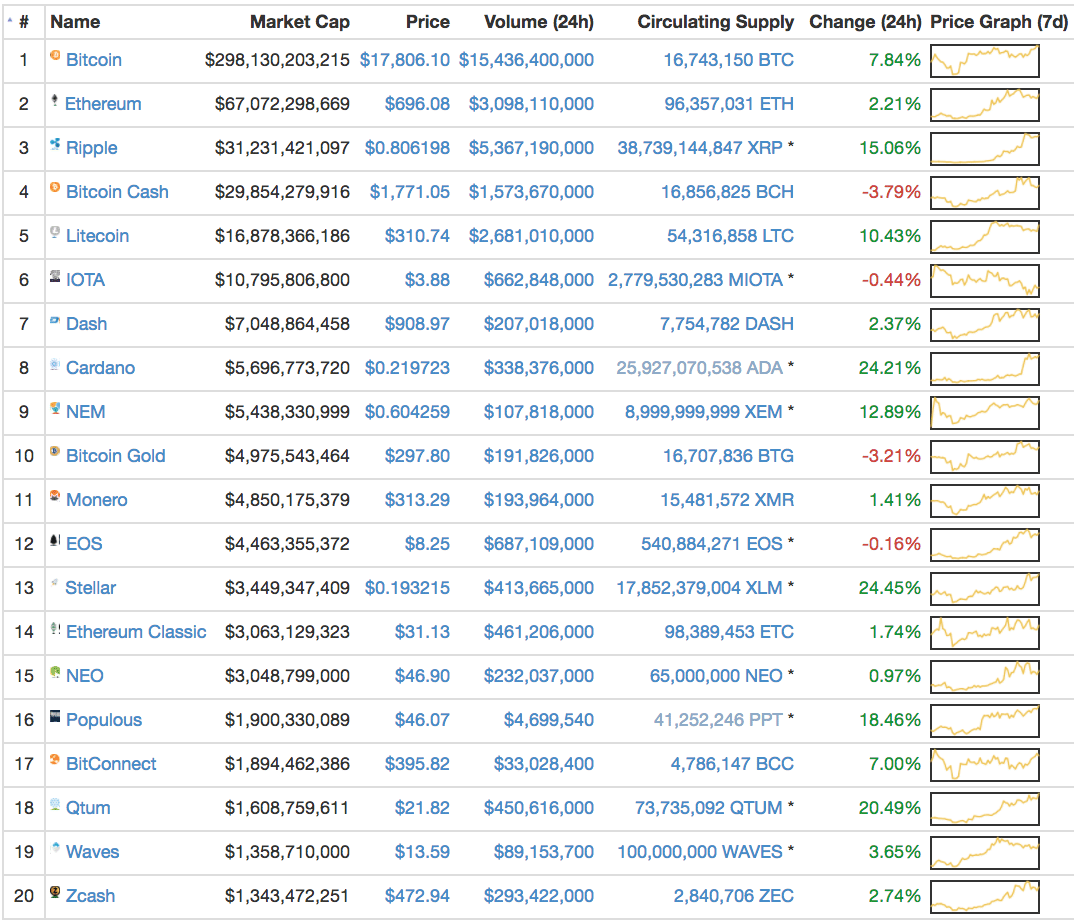

Bitcoin Takes a Breather: Following Bitcoin’s near one month sprint, the flagship cryptocurrency took a break this week and hovered around the $16,500.00 range. It’s worth noting that this is after the release of futures contracts, which many thought would signal a rapid “big short” of the token.

Ripple Goes HAM, Upgrade from Bologna: Ripple (XRP) was relatively dormant for a few months exploded from around $0.24 all the way to an ATH of $0.87, a near 300% jump in only a few days.

Ethereum Keeps Growing: Ethereum hit a new ATH around $750.00 and has been able to maintain a price around that level at the close of this week.

The Rise of Litecoin: The child of @SatoshiLite (Charlie Lee) surged from around $130 to near $350 this week. This lovely jump in price is estimated to be due to the horde of new investors getting access to Coinbase and buying the cheapest option.

SEC Issues Quasi-supportive Crypto Statement?: In a world where many people in the cryptocurrency community look at any regulatory body with weary and suspicious eyes, this piece of news might catch you by surprise. SEC chairman Jim Clayton issued a cautious, yet supportive statement concerning ICOs and cryptocurrency investments. While devoting most of the statement to warning investors of the potential troubles with investing in ICOs that are beyond the SEC’s jurisdiction.

“It has been asserted that cryptocurrencies are not securities and that the offer and sale of cryptocurrencies are beyond the SEC’s jurisdiction. Whether that assertion proves correct with respect to any digital asset that is labeled as a cryptocurrency will depend on the characteristics and use of that particular asset.”

While these words of warning are well-received by a community of people who have themselves become weary with garbage ICOs coming out of the woodwork, the statement ended on a positive note.

“We at the SEC are committed to promoting capital formation. The technology on which cryptocurrencies and ICOs are based may prove to be disruptive, transformative and efficiency enhancing. I am confident that developments in fintech will help facilitate capital formation and provide promising investment opportunities for institutional and Main Street investors alike.

I encourage Main Street investors to be open to these opportunities, but to ask good questions, demand clear answers and apply good common sense when doing so. When advising clients, designing products and engaging in transactions, market participants and their advisers should thoughtfully consider our laws, regulations and guidance, as well as our principles-based securities law framework, which has served us well in the face of new developments for more than 80 years. I also encourage market participants and their advisers to engage with the SEC staff to aid in their analysis under the securities laws.”

This is a huge step towards legitimizing cryptocurrency investment, as well as pushing any potential impending regulatory gavel from landing on a more friendly surface.

RIP Net Neutrality: While not directly crypto-related, the repeal of net neutrality on Thursday was a swift punch to the gut of every Internet nerd and digital entrepreneur. The end of net neutrality means that net service providers will be allowed to charge websites for faster download speeds. What this means for the cryptoworld in general, only time will tell.

Bitcoin’s a Big Boy: With a market cap hovering over $275 billion, the total value of all Bitcoins surpassed the value of Coca-Cola, Toyota, Verizon, Bank of America, Chevron, AT&T, Walmart, Pfizer, and Procter & Gamble, and is nipping at the heels of Alphabet (Google). What’s this mean? Big boys have gravity. As Bitcoin continues to surpass household names, it’s going to keep drawing attention from the general population.

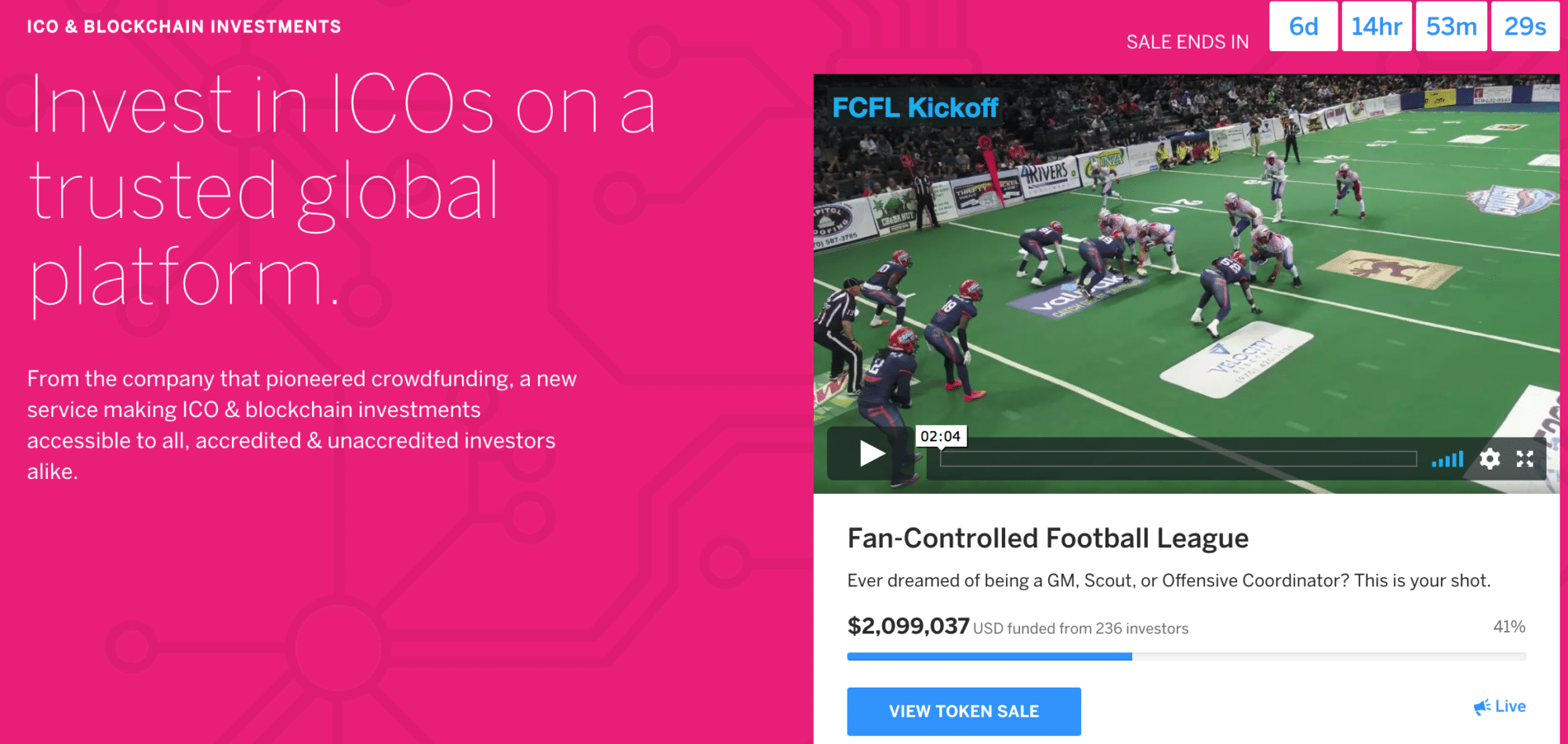

Indiegogo Gogoes ICO: One of the world’s largest crowdfunding platforms announced it’s going to start offering the ability to invest in ICOs to all accredited and unaccredited investors. Indiegogo also listed a strategic partnership with its broker-dealer MicroVentures to handpick quality crypto investments.

Coinbase Adding New Tokens: In an interview with CNBC this week, Coinbase co-Founder and CEO Brian Armstrong likened the exchange to being a Stock Market 2.0. Most notably, he included that Coinbase will be adding new tokens to the platform in 2018.

“The ones that are the most exciting to us that we have on the platform today are bitcoin, ethereum and litecoin, but there’s many more that are going to be added to the platform in 2018 and I think this is going to be a really exciting space for all kinds of institutional investors to make money.”

To really understand the gravity of this statement, it’s important to note that Coinbase currently only has three tokens for users to choose from: Bitcoin, Ethereum, and Litecoin. As THE premier beginner friendly exchange, there are a ton of investors that have limited themselves to these three tokens and not ventured out into other altcoins. Any altcoin that gets added to Coinbase will be immediately available to many of the investors within the Coinbase platform, and it’s not unreasonable to expect at least a minor jump in trade volume and price.

As far as which tokens we’ll be likely to see on Coinbase in 2018, there are a few rumors circulating around. Although purely speculative, two of the frontrunners are Ripple (XRP) and Bitcoin Cash (BCH).

What’s New at CoinCentral?

This was an exciting week at CoinCentral because we got to work on some more sweet guides.

New cryptocurrency guides made this week:

- What is Einsteinium? – A token with a brianiac name that sets the bar high, a beginner’s guide.

- What is Decred? – Learn about a how decentralized governance and decision making on the blockchain token operates.

- What is NEM? – A beginners’ guide to an enterprise-grade solution to power the impending blockchain economy.

- What is Factom? – A guide on the a blockchain protocol that makes it easier and cheaper for businesses to store data on the blockchain.

- What is Stellar Lumens? – Find out more about the token aiming to create “a worldwide financial network open to anyone.”

- Where do Bitcoins come from? – When a papa Bitcoin and a mama Bitcoin really love each other, they make a new Bitcoin. Just kidding, find out here.

- How long do Bitcoin transfers take? – If you’ve ever wondered about the mechanics behind a Bitcoin transaction/transfer.

[thrive_leads id=’3527′]

More Cryptocurrency News From Around the World

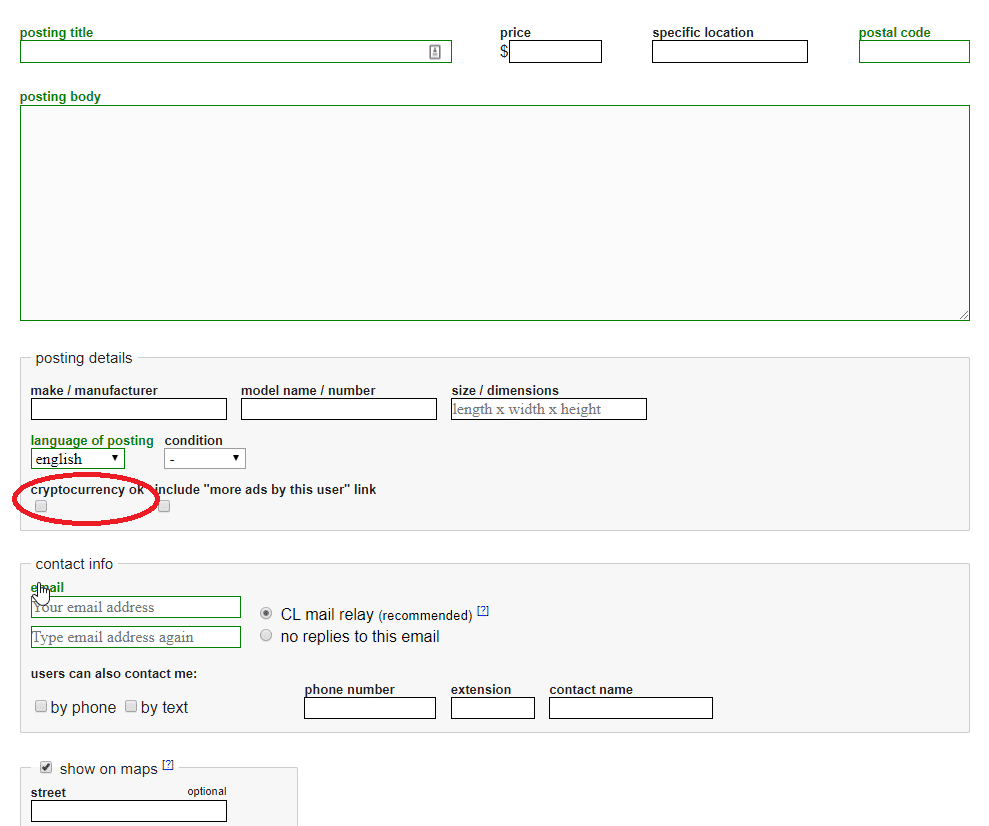

Craigslist Adds Crypto Payments: The massive online classified marketplace Craigslist snuck in a feature that allows users to specify that they accept crypto payments. While the feature only consists of a checkbox that says “cryptocurrency ok”, which isn’t too shabby for the 16th most popular site in the United States. This seems like a technological jump by leaps and bounds, as Craiglist has virtually the same exact website since 1995.

The discovery was originally posted on Reddit and was met with mixed reactions:

- “No more having to use cash and worry about being mugged, it truly is the future.”

- “I don’t feel safe transacting in crypto with strangers. I feel that it would be very easy for skeezers to target someone who potentially carries thousands on them (in their crypto wallet) versus someone who they can only rob for the item they are selling and the $20 paper cash in their pocket.”

- “we did it boys…. we mainstream now.”

BreadWallet Rebrands to Bread, ICOS: The popular Bitcoin wallet chose to rebrand itself from BreadWallet to Bread and announced an ICO campaign. The wallet currently has over 750,000 customers spread over 140 countries.

Bread is looking to raise $20 million from December 15th to 23rd, where a maximum of 160 Bread tokens will be issued (900 BRD = 1 ETH). The details include:

- $12 million raised in presale (sold out in 4 days)

- 106M total tokens for sale

- 32M tokens to be used for administrative cost of the token sale

- 22M tokens to be retained for future development.

Trouble in South Korea: Many of South Korea’s major commercial and state-run banks have started to pull back from cryptocurrencies and have declared that they will no longer be offering accounts for cryptocurrency trading. This is due to South Korean regulators announcing a plan that would ban all South Korean banks from participating in any cryptocurrency-related activity. This naturally has and will continue to affect South Korean top exchanges such as Bithumb, Coinone, and Korbit.

Well, what had happened was: Although IOTA hinted at a partnership with Microsoft in early November 2017, it formally stated that it currently has no formal partnership with the tech behemoth. However, the two companies are collaborating on innovating with IOTA’s Tangle network without any signed agreements. Following the hint of the Microsoft “partnership”, IOTA’s market share 4xed from $2.95 billion to well over $13 billion. It currently sits at around $10 billion, which is interesting to note how reactionary the market was to the first piece of news, but much less (so far) to the clarification.

South Korea Ignites Ripple: Although South Korea could tentatively ban cryptocurrency trading, that hasn’t stopped the South Korean cryptocurrency market from pushing Ripple’s price up 71% within a 24 hour span. Within this 24 hour period, the main South Korean exchanges Bithumb, Korbit, Coinoine processed around $1.7 billion of trades, which is more than the daily trading volume of Bitfinex, Bittrex, Poloniex, Bitstamp, Binance, and Kraken. The catalyst for this massive bull run was the Ripple blockchain-based payment trial ran by South Korean and Japanese banks. There was a point where South Korean exchanges (Bithumb, Korbit, Coinoine) accounted for around 50% of all Ripple trades.

[thrive_leads id=’3527′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.