Going…Going…Down…

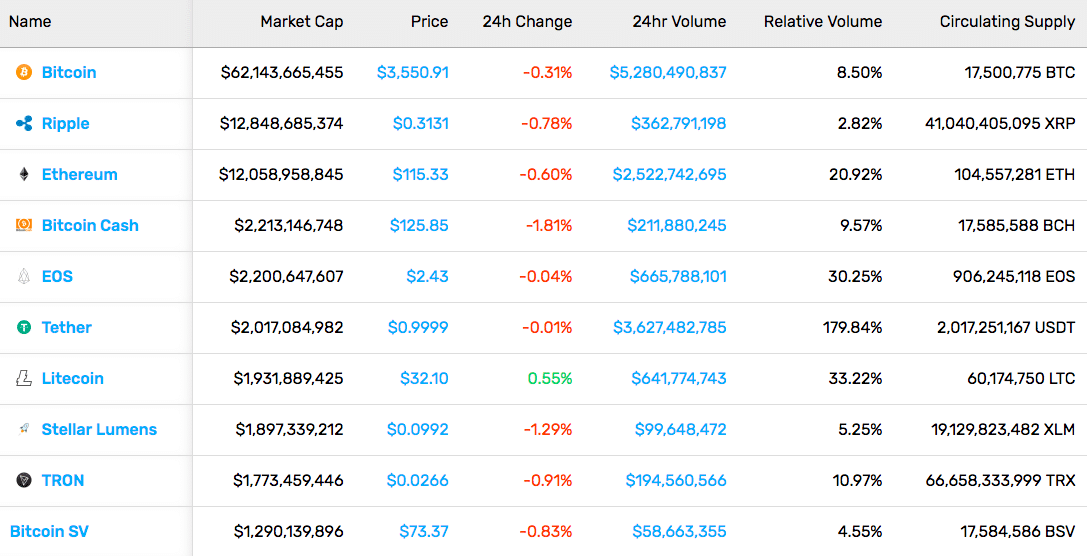

What started as a positive week, ended in disappointment for cryptocurrency prices. On Saturday, the market cap jumped over $3 billion in less than an hour. However, the positive momentum was short-lived. The following day, the market lost nearly $5 billion (~3.8 percent) in about the same amount of time. Over the week, the cryptocurrency market cap dropped about 1.6 percent and currently sits just shy of $120 billion.

As you can probably guess, the majority of coins followed suit. The only coins showing any double-digit movement were Waves (12.99%), Holo (76.98%), and Factom (14.59%) among a few others. As for our top three coins:

Bitcoin fell just 1.86%, even with news of an ETF withdrawal.

XRP dropped 3.30% throughout the past week.

Ethereum took a hit with a 4.59% decline over the last seven days.

Penn Classifies Crypto Positively: In a statement released this week by the Pennsylvania Department of Banking and Securities (DoBS), the organization finally shed some light on the classification of crypto in the state. And, good news: “only fiat currency, or

currency issued by the United States government, is ‘money’ in Pennsylvania.” This classification means that cryptocurrency exchanges and kiosks like Bitcoin ATMs are not required to get Money Transmitter Licenses (MTLs).

According to the DoBS, to require an MTL, “fiat currency must be transferred with or on behalf of an individual to a 3rd party, and the money transmitter must charge a fee for the transmission.” As crypto entities exchange fiat for crypto directly, they do not qualify. Although this is a step in the right direction for crypto businesses in the Quaker State, they still must follow the stricter rules of the federal government and other states in which they wish to operate.

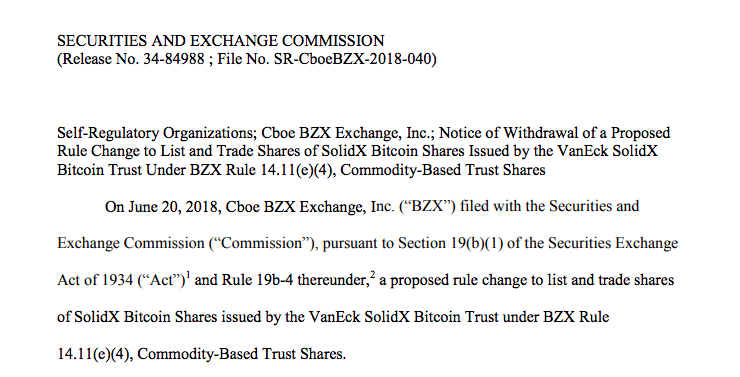

Government Shutdown Stalls Bitcoin ETFs: The Chicago Board Options Exchange (Cboe) withdrew their proposal for a bitcoin ETF this week due partially to the government shutdown. The discussions between the SEC and Cboe were consistently delayed due to government staff furloughs, preventing any progress from being made. With the application decision date (Feb 27) on the horizon, the organization didn’t want to risk a rushed, or possibly no, decision. A representative from Cboe said, however, that they “ plan to resubmit a filing at a later date and look forward to continued discussions with the SEC.”

People Saying Things

Some Doubt in Davos: CNBC hosted a panel in Davos, Switzerland this week featuring notable names from the startup world, cryptocurrency space, as well as traditional finance. Here’s what they had to say regarding Bitcoin, cryptocurrency, and blockchain technology as a whole:

Jeff Schumacher (Founder, BCG Digital Ventures): “I do believe [bitcoin] will go to zero. I think it’s a great technology but I don’t believe it’s a currency. It’s not based on anything.”

Glen Hutchins (Chairman, North Island): “The way to think about the value of the tokens is as a derivative of the use value of the protocols they enable.”

Brad Garlinghouse (CEO, Ripple): “The long-term value of any digital asset is derived from the utility it delivers.”

Edith Yeung (Partner, 500 Startups): “I think it’s a really good thing that now the crypto secondary market has, in some way, fizzled out because the people who are here now building are the ones that really believe in the technology.”

Hackers Still Favor Cryptojacking Malware Despite Bearish Cryptocurrency Market Conditions: Even with a market as dismal as the current one, you still need to be wary of cryptojackers.

Blockchain Billionaire | The Upcoming Class of the Mega-Wealthy: The next wave of blockchain adoption could produce the world’s first trillionaire. But who could it be?

What is Blockfolio? How Does the Cryptocurrency Portfolio Tracker Stack Up?: If you’ve got any type of crypto portfolio, this tracking app should be on your radar.

A Comprehensive Guide to the Different Ethereum Token Standards: ERC20, ERC721, ERC1644, and a whole bunch in between. We’ve got you covered on what they mean.

[thrive_leads id=’5219′]

From zk-SNARKs to zk-STARKs: The Application of Zero-Knowledge Proofs: They may have funny nicknames, but these cryptographic proofs are vital for something not so funny – your privacy.

20 Active Crypto Influencers to Follow on Social Media: Learn about the (sometimes) unsung heroes, dropping knowledge daily on social media.

Blockchain vs. PayPal: Understanding the Difference and Evolution: They’re both just peer-to-peer payment systems, right? Wrong.

Lessons from the Dotcom Era – The Blockchain First Mover Advantage: The blockchain industry shares a whole slew of similarities with the doctom era. And, there’s a lot we can learn from the past era’s mistakes as well.

Coinstar? More Like BitCoinstar, Amiright?: Everyone’s favorite grocery store change converter now allows you to purchase bitcoin at any of their over 20,000 kiosks. Late last week, Coinstar announced a partnership with Coinme, the first state-licensed bitcoin ATM in the US. With this new partnership, getting your hands on some BTC is as easy as finding a Coinme-integrated machine, handing over some cash (up to $2,500), and redeeming the Bitcoin voucher that you receive.

Unfortunately, if you’re looking to turn your piggy bank into a digi-bank, you’re out of luck. Coinstar currently only accepts paper currency for its bitcoin transactions.

Interested in acquiring Bitcoin but not sure how? Now it is as easy as buying groceries. Coinme launched a service that allows consumers to buy Bitcoin with cash at select Coinstar kiosks! Learn more: https://t.co/NUl9K8sT2c @CoinmeATM pic.twitter.com/n5zNsCv3jM

— Coinstar (@coinstar) January 23, 2019

The SET Sets Sights on Crypto: The Stock Exchange of Thailand (SET) is planning to apply for a digital asset operating license sometime soon, reports the Bangkok Post. The organization’s goal is to open up a new digital asset exchange separate from its current stock exchange. If approved by the Finance Ministry, the SET would become one of just a handful of global stock exchanges to have a separate, regulated cryptocurrency exchange as well.

Additionally, security company members of the SET are preparing to become regulated brokers and dealers upon SET license approval. Last May, the Thai government issued a royal decree, regulating cryptocurrency. With the SET’s stellar reputation and support, it shouldn’t have a problem getting approval under the new decree.