- The Basic Blockchain Billionaire HODLer

- The Innovator Blockchain Billionaire

- The Disrupter Blockchain Billionaire

- Blockchain Billionaire Future Potential

Given the growth of both the cryptocurrency and wider blockchain space over the past several years, it’s more than likely that we’re going to see a new class of billionaires emerge who have made their fortunes off the backs of blockchain technology.

Let’s look at the many routes that these individuals might follow.

The Basic Blockchain Billionaire HODLer

If the cyberpunks and hard money advocate’s vision of a cryptocurrency dominated world comes to fruition, then some of those currently HODLing and accumulating cryptocurrencies are set to become billionaires. It’s even conceivable in the case of parties such as Satoshi Nakamoto, that we may see the world’s first trillionaire.

The potential existing capital that these coins could absorb is truly astonishing. Currently, the world’s narrow money supply is estimated at $36.8 trillion. More astonishingly, the broad money supply stands at $90.4 trillion. The current capitalization of the entire cryptocurrency market stands at just $118 billion. There is a 766 fold difference between the current crypto market cap and the global broad money supply.

From Whales to Titans

Let’s take our example of Satoshi Nakamoto then and extrapolate some figures.

Sergio Lerner estimated Nakamoto’s bitcoin holdings at 1.149 million Bitcoin. Of course, you then need to add all the forks he would be entitled to such as Bitcoin Cash, Bitcoin SV, Bitcoin Gold, among others. Nakamoto, with his combined Bitcoin and forks, would today have a portfolio worth $4.372 billion. To become a trillionaire, he would need this amount to multiply 263 times. While seemingly outlandish, if crypto does eventually become the dominant form of currency, this is not an inconceivable scenario. It does seem quite possible that just one party could control over $1 trillion of capital in the future.

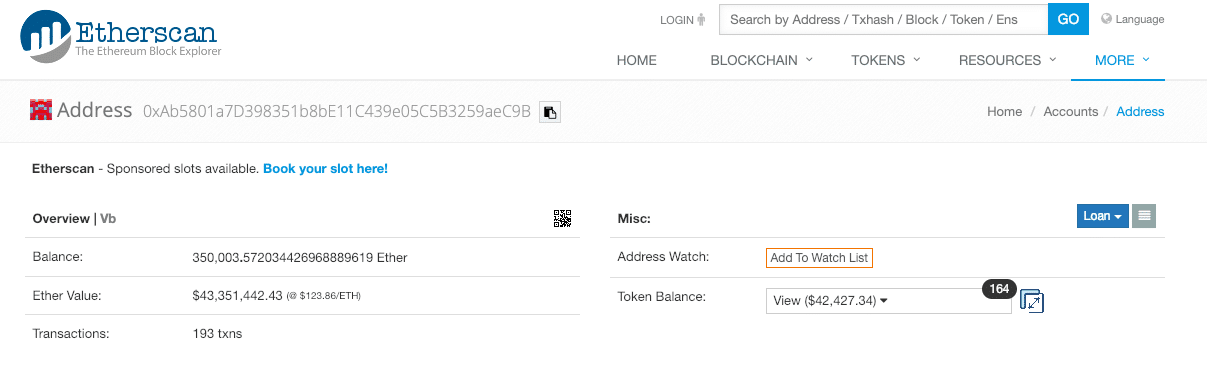

Vitalik Buterin is another major holder of crypto assets, with his portfolio unsurprisingly being heavily focused on the asset he helped create, Ether. Buterin’s EtherScan address currently displays a balance of 350,000 ETH. To be a billionaire in US dollars, he would need to see ETH rise to a price of $2,857. Given a previous all-time high of $1,431, it’s quite likely that after another market cycle Buterin’s holdings could surpass $1 billion.

An Emerging Blockchain Billionaire Class

There are of course many other major holders of crypto assets such as Joseph Lubin, the Winklevoss twins, and Chris Larsen, among many others. These investors, assuming they do not dispose of their cryptocurrency, are probably the surest to net huge amounts of wealth should we see another wave of adoption in the crypto space.

In this situation, even comparatively small investments today could create future billionaires. If there was say a 250 fold increase in the crypto markets and an individual today invested $4 million evenly distributed across various crypto assets, then they would join the billionaire class. In this scenario, we would likely see a brand new class of the super-rich emerge.

The Innovator Blockchain Billionaire

Aside from a potential movement of capital by way of currency and money, the application of blockchain technology could conceivably create entire new industries and sub-industries. These are very difficult to foresee. No one outside of Apple could have predicted the iPhone or how successful it would be. Oftentimes, consumers do not know what products or services they want before they are presented with them.

In this regard, we are likely going to have to see many entrepreneurs bring blockchain based products and services to market before we really know what will be truly groundbreaking.

The Wallet Kings

One of the more obvious examples is crypto asset wallets. These wallets are a new technology and industry, rather than one that has been repurposed. Both software and hardware wallets play an essential role in the cryptocurrency ecosystem. The success of companies who innovate new wallets is a much surer thing than any hypothetical application of blockchain. This is because they are an essential part of the crypto ecosystem and infrastructure.

Hardware wallet manufacturers such as Ledger, Trezor, and KeepKey are at the forefront of the cold storage wallet service. They are in a strong place to position themselves as a service, viewed as essential by commercial and personal clients. In a crypto friendly world, the market is likely to view these businesses as providing necessities rather than luxuries.

Similarly, designers and builders of software wallets that provide excellent user experience, secure architecture, and low friction and fees are very likely to enjoy enormous success. This space is less developed than the hardware wallet space. Although, providers such as Pillar, Ethos, and others could perform extremely well over the coming years if they can effectively capitalize on the potential.

In a world where cryptocurrency plays a major role, the wallet and storage space is almost certain to prosper. These companies could well be some of the first to reach multi-billion dollar valuations as a result.

[thrive_leads id=’5219′]

The Disrupter Blockchain Billionaire

The final category of those likely to profit most heavily from blockchain are the disruptors. These are the folks who are able to shake up an existing industry and successfully insert their blockchain-based products and services into the market. The most likely case is with those who can disintermediate. Disintermediation refers to the reduction or removal of middlemen from a business environment. Blockchain, of course, is offering promising avenues for this in its use of smart contracts to replace current man-driven operations.

Blockchain Takes On Wall Street

People often see Bitcoin as the antithesis or nemesis of the banks. However, taking on Wall Street and the financial industry extends beyond just the cryptocurrencies. Companies that can disrupt the current functions of financial institutions through blockchain could profit enormously.

Invoice Financing

Let’s take invoice financing as one such example. This industry revolves around offering small and medium-sized businesses the opportunity to monetize their invoices and open up cash flow. By offering this service, providers typically charge very high fees. These fees result from both the lack of external competition and the manpower required for administration. Companies like Populous and PayPie, however, are providing services that replace human administrators, bankers, and managers. They do this with Ethereum-based smart contracts and code. This industry is currently valued at $2.8 trillion and is a bread and butter revenue source for banks around the world. If companies like these can successively replicate and improve on existing services at lower fees, then they are in a prime position to become multi-billion dollar companies.

Capital Markets

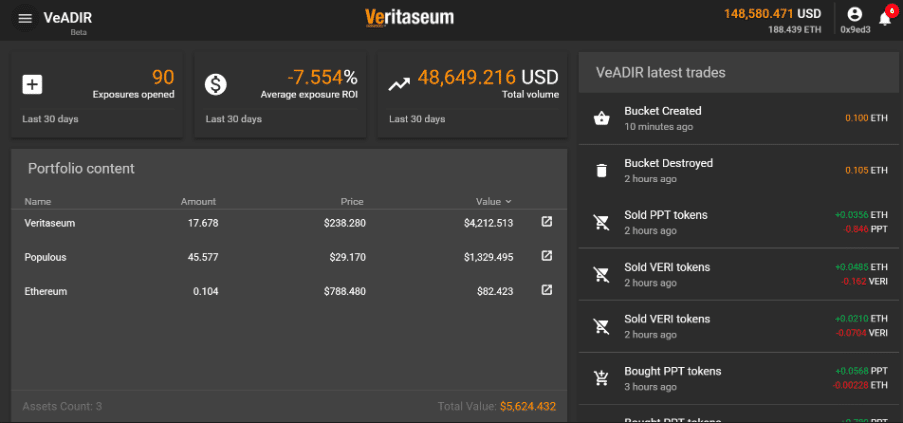

Another sub-industry within finance that blockchain companies are targeting are the operators of capital markets themselves. Currently, investment banks, brokerages, and clearing houses stand in between investors and traders anywhere in the world. In fact, we are lucky in the cryptocurrency ecosystem to have access to P2P exchanges and markets. Companies like Veritaseum are looking to take out these existing middlemen altogether. They allow users to trade in a P2P manner at much lower costs and with a broad range of assets. They do this all through Ethereum based smart contracts. Of course, companies like Veritaseum need to prove a lot more before anyone can bet on them being a potential billion-dollar valued company. However, if successful, these financial services focused businesses could be wildly disruptive.

Blockchain Billionaire Future Potential

Assuming that cryptocurrency and blockchains continue their impressive growth over the coming decades, we are going to see a new class of billionaires and the super-rich. These individuals, much like those who capitalized on the potential of the internet during the 1990s, will either have to accumulate these crypto assets in sufficient amounts or find a highly valuable use case for blockchains, either in an existing or brand new industry. Predicting individual cases is difficult, although the potential industries they might emerge from is more clear.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.