This Week in Cryptocurrency – January 26th, 2018

Is it Safe to Come Out?: Well, it certainly looked like the dip was turning into a bounce. But whether that was a moon bounce or a dead cat bounce, we can’t really say. Either way, the market is much healthier than it was after it lost more than 40% of its market cap the other week, but it’s still treading some water right now after so many hands jumped ship.

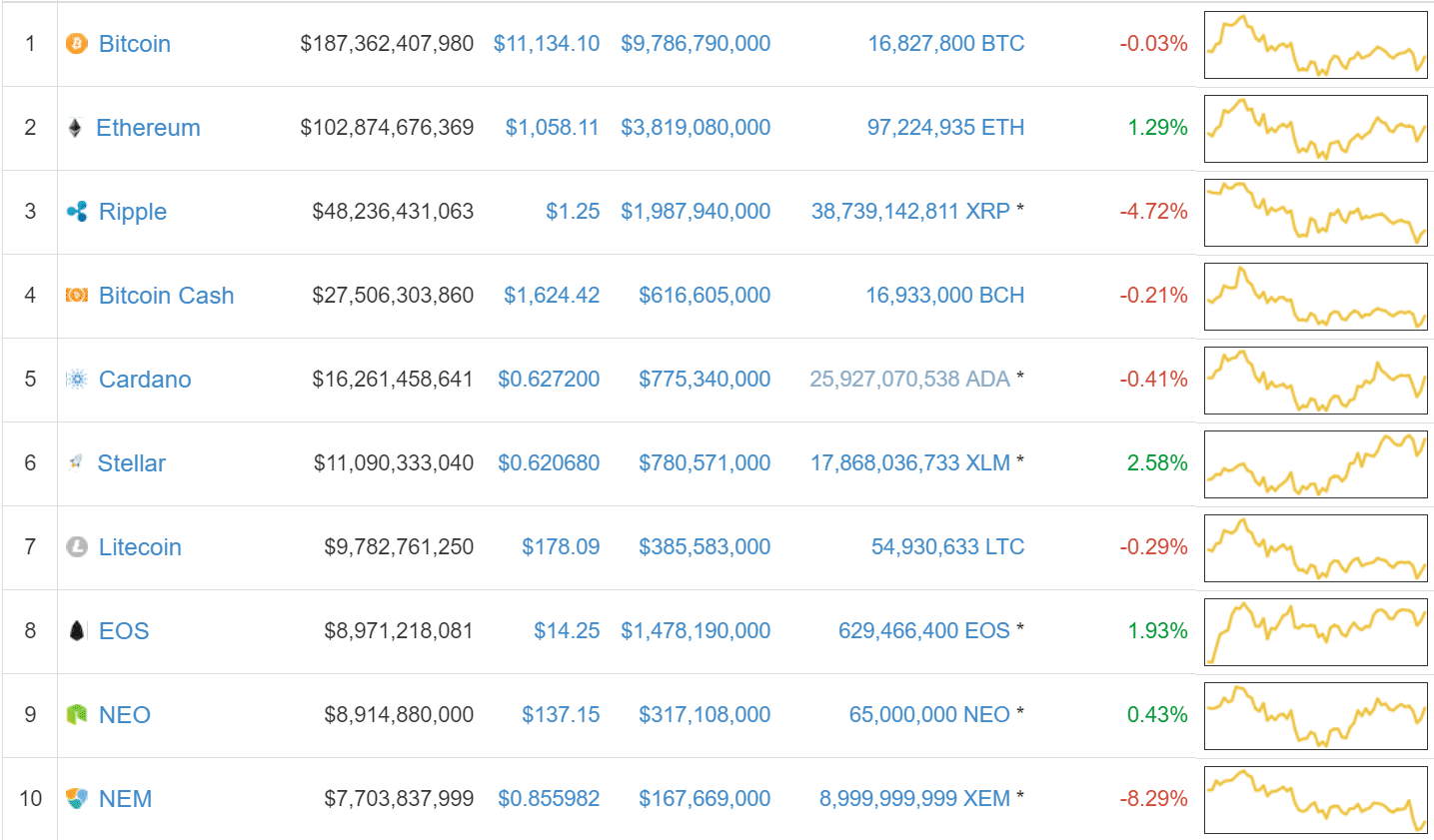

Bitcoin: Ole grandaddy Bitcoin has seen better days, but it’s loads healthier as of this writing than it was at the lowest point in the market’s latest correction ($9,500). As it stands, daddy BTC is floating at just above $11,000, which is unfortunately lower than the $13,000 price it wore shortly after the correction, the highest since. Still, BTC is only down 5% in from its opening price last Friday, and that’s pretty good all things considered.

Ethereum: Ethereum appears to be a semblance of stability in a market that’s still trying to find its footing. This past Saturday, it bounced to $1,160 in a post-dip rise much like Bitcoin. It has since fallen, but with its current price at $1,050, it’s only changed 1.8% from its last Friday price.

Ripple: Sorry XRP fans, but Ripple’s coming in last, its price being the biggest loser of the bunch. At $1.23, its down a whopping 24% from its entry price into Friday of last week. Its week was nothing but a downtrend, hitting a low of $1.16

Honorable Mentions: We’ve got a couple of new additions to the Market Cap top 100 that deserve a shout out. One such addition, IOStoken, is up 140% from last Friday, sitting at $0.096. Pretty prodigal for a token that was only listed on CMC on the 16th of January.

Next up, we’re giving props to Cindicator. After peaking at an all time high of $0.34, its resting at a comfortable $0.27, up 22% from its position last week.

Popular Payments Firm Stripe Ends Bitcoin Support: Stripe, one of the biggest online payments platform for businesses, announced Wednesday its ending of Bitcoin support. With long transaction times and growing fees, the firm states there are “fewer use cases for which accepting or paying with Bitcoin makes sense.”

Ethereum Gets a “B” in Weiss Ratings First Grades on Cryptocurrencies: On Wednesday, Weiss Ratings issued a list of roughly 80 cryptocurrencies from “A” (excellent) to “E” (very weak). Ethereum received a “B” and Bitcoin a “C”, with none among the list receiving an A or above. According to founder Martin D. Weiss, “many cryptocurrencies are murky, overhyped and vulnerable to crashes. The market desperately needs the clarity that only robust, impartial ratings can provide”.

Coinbase is Raking in The $$$, and Outside Investors Want a Piece of the Pie: Mammoth exchange Coinbase made $1 billion in revenue in 2017, a dramatic 66% more than their original revenue forecast of $600 million. While outside investors urge the company to list Coinbase on the stock market, the company will continue to remain private. With over 13 million users, the popular exchange holds more users than bank and brokerage firm Charles Schwab.

Speaking of Pie, the Lightning Network Had Its ‘Pizza Moment’ : The much anticipated Lightning Network is live, and it’s already been used in a real-world purchase. Reddit user btc_throwaway1337 posted to r/btc earlier this week that he had used the Bitcoin Lightning Network to order a VPN router from TorGuard. Risky business, that, as the network, while in main net, still has some kinks it needs ironed out. In a comment section full of fanfare and jubilee, users couldn’t help but compare the purchase to the famous pizza purchase of 2010, wherein Bitcoin changed hands for a real-world purchase for the first time on record.

In Vermont, Buying a House on the Blockchain: Thanks to a company from Palo Alto, CA, Vermont residents can record their real estate documentation on blockchain. Propy, Inc. revealed their pilot program earlier this week, which looks to streamline purchase agreements, government title records, and buyer/seller matching. This is only the latest in a series of blockchain-friendly real estate efforts across the United States, as Miami and New York have seen property purchased with cryptocurrencies

It’s Not a Phase, Mom–Low Stock Market Volatility Drives Investors to Crypto Markets: Turns out, people aren’t put-off by crypto’s high volatility and wild fluctuations–quite the opposite. Crypto’s growing pains have attracted investors unimpressed with the stock market’s minor fluctuations. Deutsche bank global financial strategist Masao Muraki argues that, as stock market volatility shrinks, expect investors to turn to Bitcoin and friends for potentially more promising returns.

Does Someone Need a Time Out? CNBC Pundit Tells Colleague to “piss off” on Live TV: Avid crypto-enthusiasts and investors have likely come to rue mainstream coverage of cryptocurrencies. But sifting through the institutional FUD and, at times, uninformed opinions, you can find a few nuggets of comedy. In a CNBC Fast Money segment turned sitcom, Dan Nathan told Rich Ross to ‘piss off’ after Ross challenged Nathan’s long-term calls. Things got testy as Nathan called Ross ‘glib’ for calling BTC a poor investment choice in 2017, after which Ross scrutinized Nathan’s investment choices, prompting the comment.

Robinhood Stock Trading App to Open Options for Bitcoin, Ethereum: It won’t be stealing from the rich, but Robinhood wants to give cryptocurrency options to the needy. The mobile investment app, with its emphasis on opening investment opportunities to the average joe, announced on Thursday that it will open up Ethereum and Bitcoin pairs for customers in California, Massachusetts, Missouri, Montana, and New Hampshire. With a user base that’s 78% millennial, Robinhood has the the potential to attract more youngins to its platform of 3mln active traders.

[thrive_leads id=‘5219’]

What’s New at CoinCentral?

Cryptocurrency Fees and Litecoin Soft Fork: There’s no need to waste money. Learn how to stop overpaying in cryptocurrency transaction fees.

What is EthLend?: Find out how this project is removing power and control held by traditional banks through decentralized lending.

Mobile Stock Trading App Robinhood Welcomes Crypto: This mammoth stock trading app just opened its doors to cryptocurrency trading. Dare to enter?

What is Binance Coin?: The world’s biggest crypto exchange went from zero to hero real quick, and it’s not stopping there. Find out more about how this coin saves traders from heavy transaction fees.

Weiss Cryptocurrency Ratings Unveiled: Would you trust one of the most reputable, independent rating agency in the world? Whether would or not, take a peek at how cryptos fared in this grading list, where no one gets an A.

Who is Da Hongfei? Find out more about the founder of NEO and his revolutionary cryptocurrency makings waves in the crypto scene

Off to the Races: Check out the 4 coins competing for crypto’s top spot

What is CoinDash?: Find out how this coin can maximize your trading potential by allowing you to copy accomplished traders exact moves.

3 Easy Tax Planning Tools for Cryptocurrency Investors: Avoid the headache of an audit and use the tools provided in this guide to help you not mess with the IRS.

What is GAS?: Like the rice to your beans, GAS complements NEO and powers the smart contracts and tokens built on the NEO blockchain.

From Gaming to Music: From digitized furballs to a band of luchadora-masked Japanese sweethearts, cryptocurrencies have begun permeating entertainment industries.

US Congress Attempts to Fight Cryptocurrency-funded Terrorism: Learn more about why this new anti-terrorism bill has cryptocurrencies in its sights.

How to Get Coins From Bitcoin Forks: The choice is yours – sell or HODL. Explore good opportunities to make a little extra cash while supporting the original crypto-king.

What is Kyber Network?: Learn why Kyber brings speed, security, and liquidity to the cryptocurrency exchange process.

What is LUXCoin (LUX)?: An introduction to this hybrid cryptocurrency that could significantly shake up the world of traditional banking services.

Cryptocurrency News from Around the World

Withdrawals Frozen After $723 Million Disappears From Japanese Exchange: According to NEM Foundation president Lon Wong, one of Japan’s largest exchanges, Coincheck, has experienced “the biggest theft in the history of the world”. Long continued to say that the security measures Coincheck used were “very relaxed”, making Coincheck an easy target for cyber hackers.

Disagreements in Russian Government Arise Over Crypto Regulations: On January 25th, the Russian Ministry of Finance revealed the Digital Assets Regulation Bill, a holistic legislative attempt to accommodate cryptocurrencies, mining, ICOs, trading, and the like. Russia’s Central Bank disagrees with this legislation, as they think that utility tokens–which function, they find, as financial investments like securities–should only be permitted for trading. The bill was clear that all tokens and coins, however, are financial assets, not legal tender that can be used for payments in the country.

South Korea Bans Foreigners and Anonymity, Legalizes Exchanges: According to comments by the Financial Services Commission, “establishment of the system for ‘real name verification of deposit and withdrawal accounts’ for settlement will be completed by January 30, 2018”. Essentially, the move prohibits foreign citizens from trading on exchanges and forces traders to hold bank accounts that match their names.

OneCoin Offices Raided by Bulgarian Police: As reported by the Prosecutors Office of [the] Republic of Bulgaria, “OneCoin” had its servers seized by Bulgarian Police last week in a string of allegations claiming the project a “Ponzi scheme”. OneCoin promoted itself as a cryptocurrency making “payments easier, faster and at a low cost”, but thanks to authorities is no longer able to fool eager investors with false promises.

North Korean Hackers Continue to Hack South Korean Exchanges: North Korea seems unfazed by international reprimand by carrying forward attacks on South Korean cryptocurrency exchanges. Running off with valuable digital assets, American cybersecurity firm Recorded Future claims the Lazarus Group is behind many of the security breaches. Last year, popular exchange Bithumb lost nearly $7 million to North Korean hackers.

Indian Banks Siphon Customer Access to Cryptocurrencies: Big banks in India want nothing to do with Bitcoin and its cousin currencies, and that means limiting customer access. So far, Axis Bank, ICICI Bank, HDFC Bank, the State Bank of India (SBI), and Yes Bank have all either closed accounts linked to cryptocurrency exchanges or reigned them in. Taking their strategy from the international playbook, they’ve cited fraudulent/suspicious transactions as their excuse for taking such actions.

Internationally, a Call for a Global Strategy Towards Crypto: While some nations would rather ignore and restrict crypto’s growth altogether, the International Monetary Fund would rather address the subject head-on. The United Nation’s financial mouthpiece has called on the international community to come together to accommodate the phenomenon. IMF spokesman Gerry Rice that there is a pressing need for “international discussion and cooperation,” lest governments ignore what the IMF believes to be series assets at the expense of their populaces.