What Is Ardor?

Ardor is the latest in the growing field of contenders for blockchain as a service (BaaS) providers. It provides the blockchain infrastructure for businesses and institutions to leverage the strengths of blockchain technology without having to invest in developing custom blockchain solutions. Instead, Ardor offers a main chain that handles blockchain security and decentralization. It provides customizable child chains that come ready to use, out of the box, for various business applications.

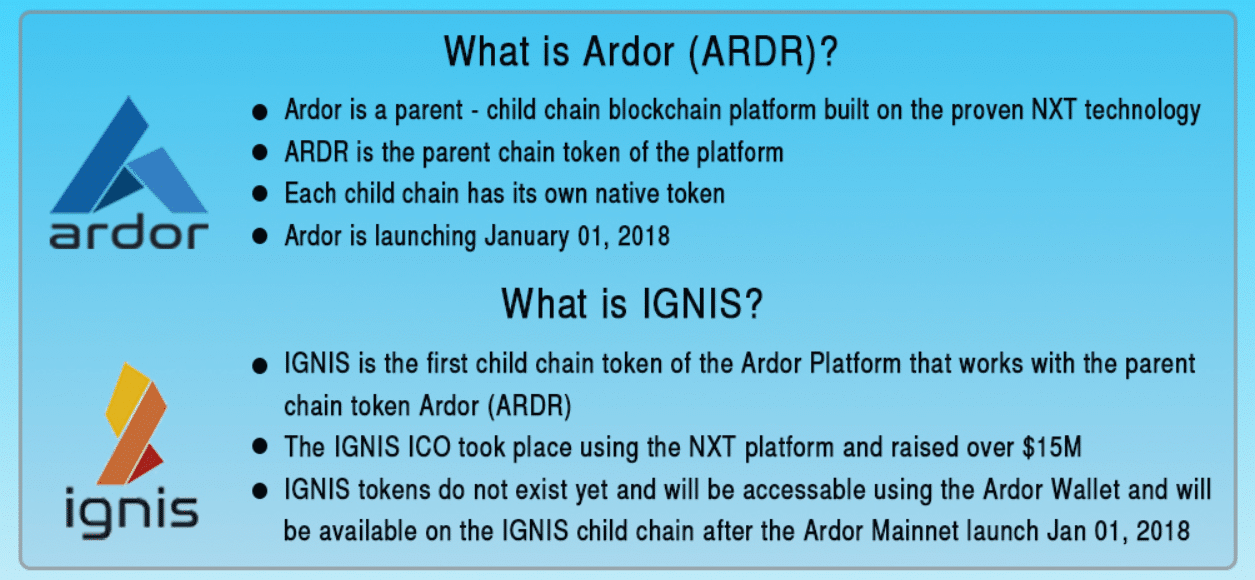

The developers of Ardor are the same company behind the open source Nxt project. Ardor goes beyond Nxt to solve critical issues of blockchain bloat, scalability, and customization.

First, we should take a detailed look at Ardor, its foundations in Nxt, and its first child chain project Ignis. While the project holds a lot of potential for driving blockchain as a service to new levels of usability and accessibility, its success likely depends on the amount of traction the development team can generate for early applications. Nxt has struggled to gain the widespread adoption the developers had hoped for, outside of some significant examples like BNP Paribas and Accenture, and Ardor presents a turning point for the development team to generate excitement.

In this guide we will cover:

- How Ardor Works

- Coin Supply

- Roadmap and Team

- Trading History

- Competitors

- Where to Buy ARDR

- Where to Store ARDR

- Conclusion

- Additional Resources

To Understand Ardor, You Need to Know About Nxt

Before we dive into what makes Ardor unique, it’s worth looking at the Nxt platform and its origins. Ardor has gained the nickname of “Nxt 2.0” since it relies so heavily on the Nxt core programming. In fact, Ardor will contain nearly all the features of Nxt plus additional advanced capabilities.

Nxt started in 2013 and was one of the very first ICOs ever to launch a cryptocurrency. Although the initial ICO only raised $6,000 in donations, the Nxt founders have stuck with the project. Nxt was among the first projects to code a new blockchain from scratch, not borrowing any code from Bitcoin. Its open source code is written in Java, and it was also the first blockchain to fully implement proof of stake.

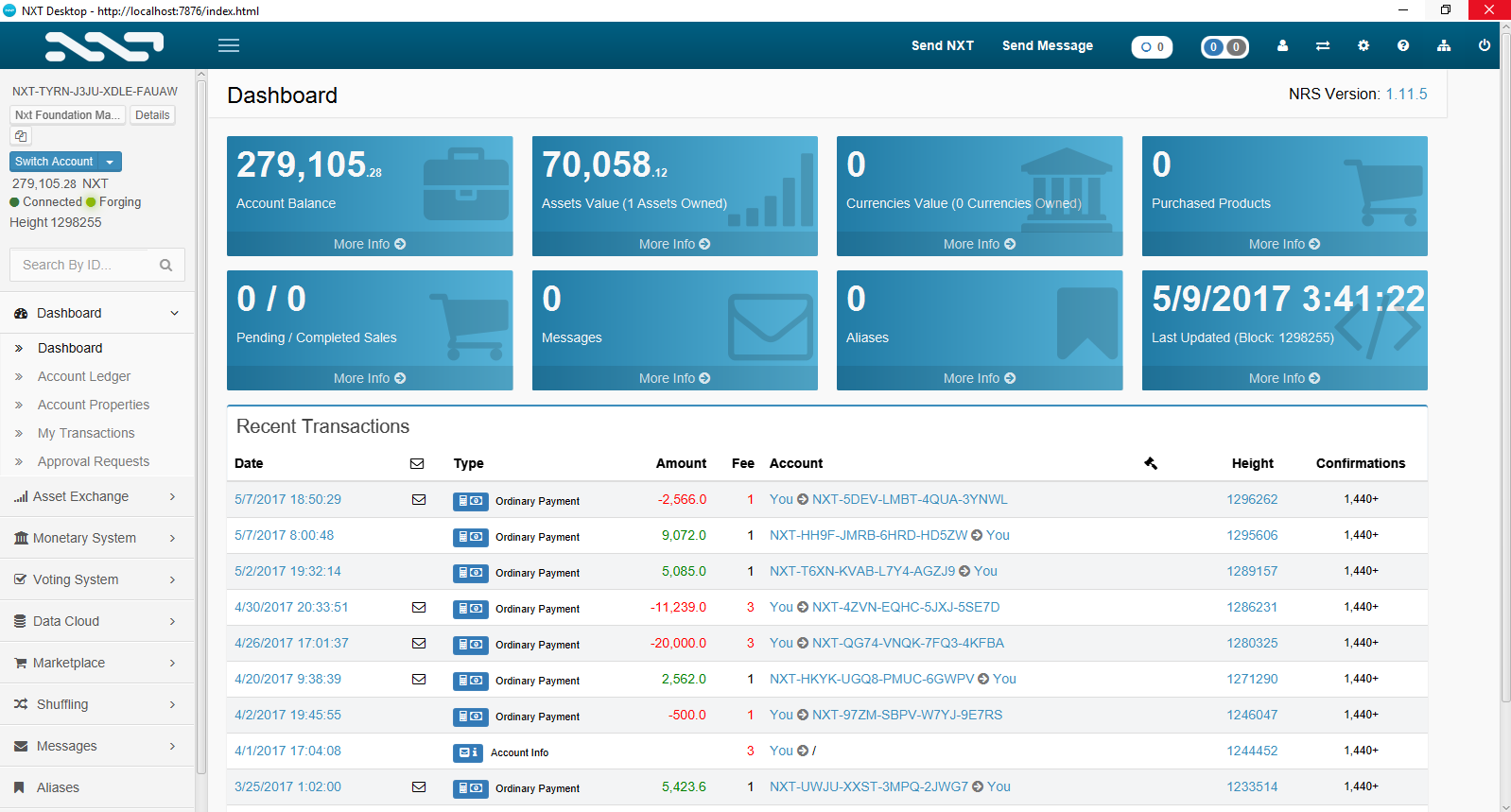

Nxt was designed for experimentation, and the goal was to allow companies and other entities to implement their own blockchain solutions using the API, creating new coins on top of the Nxt blockchain, and even copying/editing the Nxt source code. The development team has created various functionalities that can be activated when a new token is created. These include asset creation, trading, blockchain voting, and the creation of marketplaces. Nxt strives to make it easy for companies and entities to create new tokens and begin using them out of the box.

The Problems with Nxt

Nxt is a well respected, verified, and established blockchain technology with a comparatively long history and an experienced development team. However, as blockchain usage increases over the coming years Nxt, and other blockchain technologies, will face some fundamental problems with payments, scalability, and customization.

Native Tokens

The first and most straightforward problem is the use of native tokens for transaction fees. Nxt uses a forging proof of stake system, meaning that the total token supply has already been created and new tokens aren’t created with each block.

Instead, the forgers that verify the blocks receive a portion of the transaction fees paid on the network. As such, the transaction fees need to be paid in NXT. Even if you’ve created a new currency that’s independent of Nxt, you’ll still need to own NXT in order to pay miners, diluting the value of your own currency. This is also true for currencies that use Ethereum’s ERC20 protocol to build on top of the Ethereum blockchain. They pay fees in Ether.

Blockchain Bloat

Most blockchain technologies, including Nxt, are also encountering some form of blockchain bloat. The root of this bloat is the need to download the entire history of the blockchain in order to operate a full node on the network. The storage requirements for operating a full node increase as more transactions take place.

Soon, operating a node on a blockchain could mean downloading hundreds of gigabytes of transaction data in order to get your node up and running, creating a severe bottleneck for adding new nodes. While Nxt has implemented some pruning of information that isn’t relevant to verifying the transactions, the current system of downloading a complete copy of the transaction history is not sustainable long-term.

Customization Issues

Blockchain as a service solutions that encourage customization, new asset creation, and trading platforms face a challenge when it comes to helping clients maintain their systems. While it’s relatively straightforward to create a clone of the Nxt blockchain, doing so would also require separate servers and ongoing maintenance to keep the customized system running smoothly.

Clones will lag behind on software updates and security protocols, and Nxt would have to invest too much effort in ongoing support for customized solutions based on Nxt.

How Ardor Works and Solves Those Problems

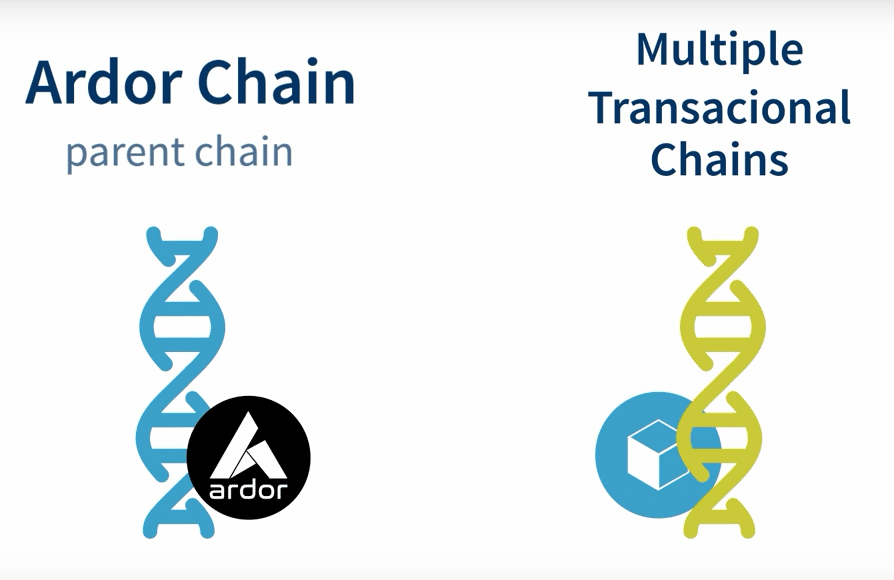

Ardor includes every feature supported by the Nxt blockchain, but it changes the architecture of how new blockchains get implemented. It separates security from functionality by creating multiple chains. The Ardor main chain is a slimmed down bare bones blockchain built for speed and security.

Child Chains

When you want to implement a new project on Ardor, you create something called a child chain. The child chain holds all the functionality and customizability supported on Nxt. However, it is still linked to the main chain and derives its security and decentralization from using the main chain for verification.

This new structure allows the implementation of child chains and features in a matter of minutes or hours. Since the blockchain infrastructure is already in place with the Ardor main chain, child chains can quickly adopt custom use cases. These child chains still receive all the speed, security, and usability upgrades of the main chain, since they’re all integrated on one platform.

Transaction Pruning

Ardor solves the blockchain bloat problem using a transaction pruning system. In the future, it won’t be necessary for every node to hold a complete copy of the transaction history, just the relevant recent transactions that have gotten the blockchain to this point. Ardor will also support archival nodes that will operate to keep full transaction histories should they be needed.

To solve the native token problem, Ardor uses a system of bundlers, nodes on the network that accept fees paid in the child chain token. These bundlers then pay the Ardor main chain forgers in ARDR, essentially acting as conversion clearing houses for transaction fees. This means that the end user can initiate a transaction in a child token and pay the transaction fees in the child token.

In theory, users could be unaware of the existence of Ardor at all. This commitment to the unsexy work of infrastructure development is what makes it so difficult for Ardor to generate buzz and press attention. However, if it gains traction, Ardor could be the foundation for endless new blockchain applications.

Ignis: The First Child Chain Built on Ardor

To test Ardor’s capabilities and serve as an example of an operating child chain, the Ardor developers have created Ignis. Ignis will implement all of the customizable features that come from the Nxt code base. Essentially, Ignis was a proof of concept designed to be the first of many more child chains on the Ardor platform. The Ignis ICO raised $15 million in funding for development.

In the future, equity trading platforms, digital file transfer services, private enterprise blockchain applications, and others could use Ardor child chains. Ardor’s strengths are quick time to set up and wide customizability, making it a great option for companies looking to leverage blockchain without the resources to dedicate to custom development.

Coin Supply

There are just under one billion ARDR coins in circulation. Because Ardor uses proof of stake instead of proof of work, no new coins will be issued. Proof of stake offers various advantages although it also has some disadvantages too.

Roadmap and Team

The Ardor genesis block was confirmed on January 1, 2018. Since then, there have been several notable developments. These include the implementation of lightweight smart contracts on the testnet, which are soon to go live on the mainnet.

Several projects have also launched on the Ardor mainnet. These include Triffic, a tokenized customer loyalty program platform, and Max Crowdfund, a property financing project. Ardor has also presented a proof of concept for a decentralized exchange to Binance.

Pruning of child chains and sharing of snapshots are both currently on the testnet, with a plan to put them live on the mainnet in progress. The team is also currently researching the use of zero-knowledge transactions and user issued side chains.

None of this is particularly sexy to the non-technically minded. However, the point is that there are multiple developments visible at different stages of implementation from research to testing. This points to a strong long-term vision for the project.

[thrive_leads id=’5219’]

Jelurida The Team Behind Nxt, Ardor, and Ignis

Nxt, Ardor, and Ignis are all projects from a private company called Jelurida. The Jelurida team is one of the most experienced blockchain development teams, dating back to Nxt’s launch in 2013.

The team is composed of respected, experienced developers with now over four years of experience creating and maintaining blockchain code. In addition, one of the co-founders has a legal background, and she manages the legal implications of open source architecture and blockchain applications.

Trading History

The value of ARDR tokens has largely followed the same pattern as Bitcoin and other cryptocurrencies. There was huge spike around January of 2018, and a steady falling off over the rest of the year. If we are being generous, then the mainnet launch took place in January. This would have been likely to spark investor interest in ARDR tokens.

There was a small increase in the price of ARDR in May 2018. A few events which may have caused this peak. There were two ICOs announced on the Ardor platform, and the project also launched the Chinese language version of its website, which may have opened ARDR up to a wide base of Chinese investors.

The project was in the top thirty coins at its launch last January. Now, it sits in the top eighty.

Competitors

The New Economy Movement, known as NEM was inspired by Ardor’s predecessor, Nxt, and contains many similarities in its applications. Other projects that are using child or side chains include Lisk and Aelf, although both of these projects use the delegated proof of stake protocol rather than pure proof of stake.

Where to Buy ARDR

You can buy ARDR tokens on many of the major crypto-to-crypto exchanges including Binance, Bittrex, and Huobi. If you want to buy ARDR with fiat, then Changelly offers that option.

Where to Store ARDR

Ardor offers its own wallet with Apple, Windows, and Android operating systems integration. You can also use this wallet to store Ignis tokens or the tokens from other projects on Ardor child chains.

Conclusion

Ardor is doing some pretty important work thinking about new ways to structure blockchain infrastructure and security. If done correctly, the end result could be a solution that any business could implement. It wouldn’t require extensive technical expertise or ongoing maintenance.

However, there are now multiple other development platforms providing stiff competition for Ardor. The team has a lot of work to do if they are going to stay ahead of the curve.

Ultimately, the next year or two will likely prove the most critical time for Ardor. If the project can prove itself as a viable development platform for a few critical projects, it may prove to be a good long-term bet.

Editor’s Note: This article was updated by Sarah Rothrie on Jan 12, 2019, to reflect the recent changes of the project.

Additional Resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.