- What is HOT?

- What does it do?

- How does the Hydro Protocol work?

- Who's behind HOT?

- Where can you buy HOT?

- Where can you store HOT?

- Will HOT be a hot token?

- Additional Resources

What is HOT?

HOT is the token of the Hydro Protocol. It has nothing to do with heat or fire. Forgive the etymologist in you for thinking the protocol has something to do with water as well. The Hydro Protocol was designed to improve liquidity for new decentralized exchanges.

Liquidity is a very desirable attribute for a new exchange to possess because it is one indication of market activity and thus how favorable it is to buy or sell cryptocurrency at any particular point in time. When new exchanges are starting out, market activity is low unless takes steps are taken to improve liquidity. HOT provides a solution to this classic chicken or the egg problem.

Token Summary

Symbol: HOT

Specification: ERC20

Network: Ethereum

Total Supply: 1,560,000,000 HOT

Circulating Supply: 230,169,301 HOT

What does it do?

HOT improves liquidity by providing incentives for professional market makers. Professional market makers also referred to as liquidity providers, have inventories of cryptocurrencies to trade. Takers remove that liquidity when they trade with a liquidity provider. Liquidity providers can make money buying a particular cryptocurrency at certain a price and selling it later for a higher price. These liquidity providers are now able to also receive HOT-denominated rewards for providing liquidity to the new exchange. There is a catch though. In order to be eligible for the periodic HOT distribution, the liquidity provider needs to hold HOT.

Background

Market makers usually hold large quantities of the particular cryptocurrency that they want to provide liquidity for. They then specify a price that they are willing to pay for the cryptocurrency. That price is the bid price. They also establish a price for which they are willing to part with it. That is called the ask price. Traditionally, they profit from the difference between the ask and bid prices. That profit is called the spread.

Token Economics

When a market maker wants to receive the periodic HOT distribution in addition to the spread, the Hydro Protocol first requires the market maker to hold HOT. According to the white paper, the more HOT the liquidity provider holds in reserve, the greater the periodic HOT payment received. Also, the more transaction activity the market maker is responsible for, the more they will receive in the periodic HOT distribution.

Market makers are incentivized to reserve a lot of HOT if they anticipate that they will be a major contributor to the overall transaction volume in any given period.

Individual traders may also benefit from holding HOT. For individual traders, it functions just like an exchange token, like the Binance token. The only difference is that HOT holders select the exchange to reap the rewards of token ownership from and each exchange may specify what rewards are offered.

How does the Hydro Protocol work?

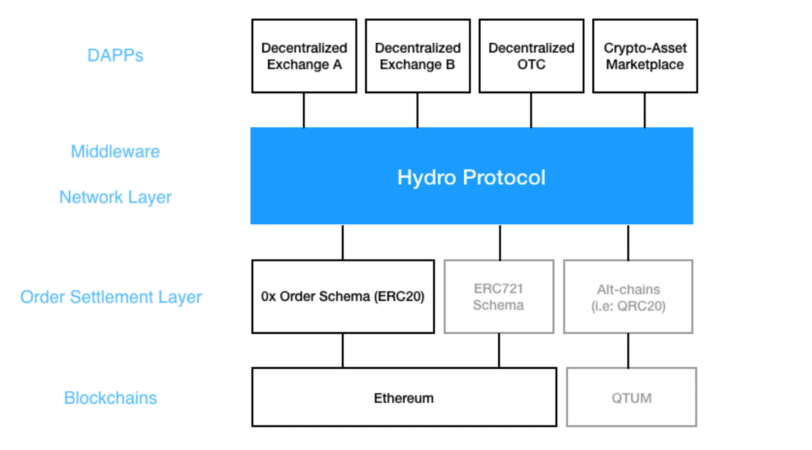

The Hydro Protocol is part of a protocol stack. It operates at the network layer of the decentralized exchange. There is a decentralized application, or dApp, that sits on top of it and provides the user interface. The 0x Protocol resides below it and provides order settlement to the blockchain.

It functions by keeping a database of liquidity provided by makers and removed by takers. This data is used to determine periodic HOT distributions.

Additionally, the protocol controls which exchanges have permissions to fill an order. By managing a permission list, the protocol allows cooperating exchanges to share liquidity. When exchanges decide to combine their liquidity it is called a liquidity pool.

In order to gain access to a liquidity pool, new decentralized exchanges can also hold HOT. This is called staking. Once staked, tokens are only returned to exchanges after the new exchanges themselves have contributed a certain amount of liquidity over time.

This pooling of liquidity is also possible without the Hydro Protocol through the 0x Protocol’s open order model. However, front-running and order collisions will occur without the additional management provided by the Hydro Protocol. Technically front-running is still possible within the liquidity pool. However, such behavior can be punished through the HOT governance mechanism.

This governance mechanism is also used for managing membership in the liquidity pool. It is used to determine contribution thresholds for membership to liquidity pools.

Lastly, the Hydro Protocol handles distribution of transaction fees. DDEX is an operating example of a decentralized exchange using the Hydro Protocol at the network layer. The DDEX transaction fee is 0.1%. The Hydro Protocol is responsible for distributing the 0.1% transaction fee.

[thrive_leads id=’5219′]

Who’s behind HOT?

Tian Li, Kevin West, David Qin, Bowen Wang, Scott Winges, and Shanchuan Yin are the team behind the Hydro Protocol.

The team has received backing from Draper Dragon, Consensus Capital, and most recently Alexis Ohanian, of Reddit fame, at Initialized Capital. Learn more about the team, advisors like Ohanian, and the hydro protocol here: https://thehydrofoundation.com/.

Where can you buy HOT?

According to CoinLib.io, HOT is only available on OKEx. However, it’s also available at DDEX.

Where can you store HOT?

HOT is supported by the MetaMask browser extension and Parity. It’s also supported by MyEtherWallet, so you can also store it on the Ledger Nano S and Ledger Blue hardware wallets.

Will HOT be a hot token?

The Hydro Protocol proposes a novel solution to bootstrapping exchange liquidity and has strong support. Anyone can hold HOT. In fact, the token has something to offer everyone in the ecosystem. Exchanges, traders, and liquidity providers are all incentivized to hold HOT.

There is a token dilemma, however. Unfortunately, the token trades on secondary markets. Consequently, its value is always determined by speculation and not by the liquidity actually contributed by exchanges, professional market makers, and individual traders.

Given the recent downward pressure on cryptocurrency prices, HOT is decidedly cool for now. There is no incentive to hold HOT in any period when prices are trending down.

https://files.coinmarketcap.com/static/widget/currency.js

Additional Resources

Website

Telegram

Medium

Twitter

Facebook

Reddit

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.