- Binance Burns BNB Every Quarter

- Binance Coin Now Has an Actual Utility

- Binance’s Reputation Precedes Itself

- The Future of Binance Coin

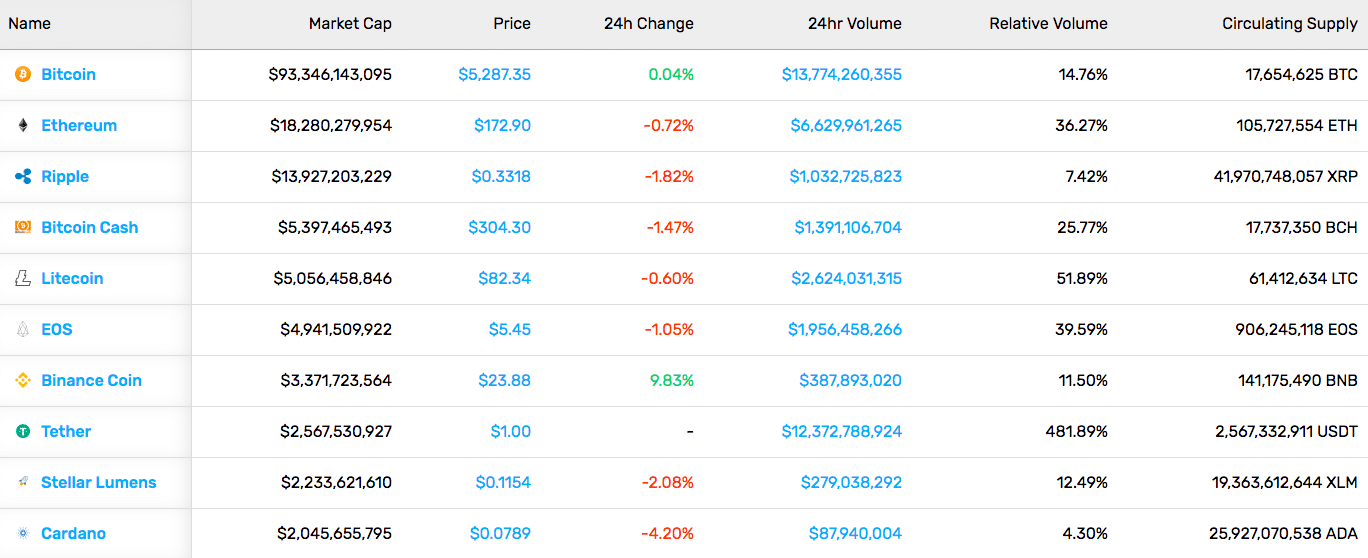

Since the start of 2019, Binance Coin (BNB) has led the cryptocurrency pack, growing over 200 percent in three short months. It has demolished the performance of Bitcoin (38.9%), Ethereum (30.7%), Litecoin (187.8%), and almost every other cryptocurrency so far this year.

The native coin of the world’s largest crypto exchange is back to its previous all-time high while others remain under by 80 to 90 percent. So, it should come as no surprise that it’s quickly risen to hold the seventh largest market cap in the market.

To what can we attribute this rapid growth, though? Market manipulation? Strong fundamentals? Blind luck? As always, the answer isn’t so straightforward. While no one knows for sure why Binance Coin has performed so well, there are a few factors that definitely had a positive impact.

Binance Burns BNB Every Quarter

At least, it does for now. Every quarter, Binance burns 20 percent of the BNB it collects in fees from the exchange platform. Doing so removes them from circulation permanently. Binance will continue to burn Binance Coins until 100 million coins are removed from circulation.

Token burns tend to have some interesting effects on the price of a coin. By lowering the circulating supply, the burns shift the supply/demand balance. Kicking it back to Econ 101, reducing the supply while keeping a constant demand pushes prices higher.

More magnetic, though, is the psychological effect that coin burns have on the market. In a rational world, each token burn would cause minimal changes to the Binance Coin price. The exchange is only removing one to two percent of the supply from circulation, yet the price improves substantially more than that almost immediately after the burn. Supply changes, especially of such a small magnitude, would take longer to be felt in a rational world.

[thrive_leads id=’5219′]

Binance Coin Now Has an Actual Utility

Now, before all the BNB fanboys chase us down with their pitchforks, let us explain. Binance Coin technically had some utility already. You could pay your Binance fees with it to receive a discount, spend it like transactional cryptocurrencies, and earn it through rewards on a couple of different platforms.

However, Binance Coin isn’t unique in its ability to perform those activities.

The actual utility of Binance Coin came with the launch of the Binance Chain and will continue with the eventual release of the associated decentralized exchange (DEX). The Binance Chain mainnet went live on April 18. And the Binance team will switch BNB from an ERC20 token to a native token on the new chain on April 23.

Then, it’ll be required “as payment for every transfer that goes on the network.” Judging by Binance’s current volume, this change should lead to a significant increase in BNB demand.

But Why Now?

The Binance Chain announcement isn’t anything new. The company made its plans public in March 2018.

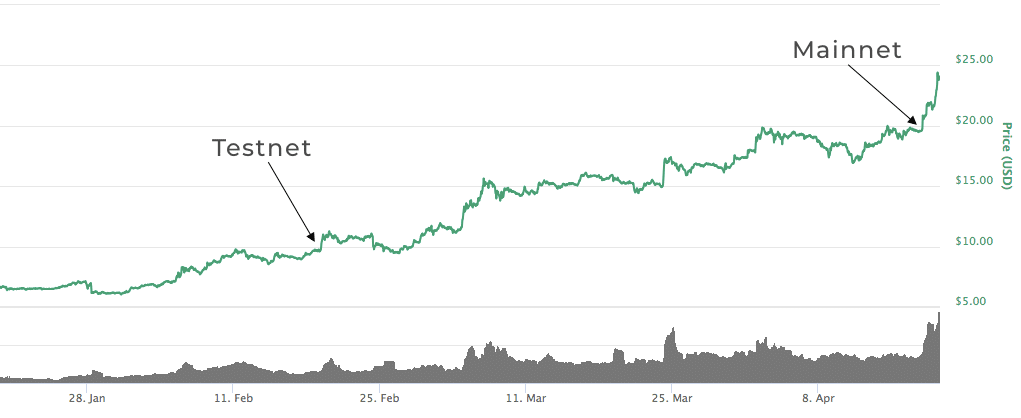

But now, the team has produced something tangible. Towards the end of February this year, they launched the Binance Chain testnet. And, now they’ve got the mainnet release under their belts.

Following news of both the testnet launch and the mainnet launch, the BNB price moved another couple legs up.

Binance’s Reputation Precedes Itself

Perhaps the most impactful (yet difficult to measure) factor is Binance’s stellar reputation within the crypto community. With speculation being a healthy part of cryptocurrency investing, sometimes unrelated determinants can change a token’s price.

Binance is often an investor’s first foray into altcoins. So it makes sense that Binance Coin would be one of the first altcoins they purchase.

CZ, Binance’s CEO, is a well-known figure in the crypto space with a cult-like following on Twitter. Many praise him as an example of how to ethically run a cryptocurrency exchange. (Although, some think he may not be as generous as he lets on.) Either way, his presence continues to bring Binance Coin into the limelight.

Funds are #SAFU. (origin of the word #SAFU…)https://t.co/Q7rCRspNW5

— CZ Binance (@cz_binance) February 11, 2019

Although we don’t like to admit it, reputation and notoriety weigh heavily on a coin’s price. The more investors that know about a token, the better chance it has of swinging in the right direction.

Finally, a positive experience using the platform brings confidence in the underlying token. And most people have nothing but glowing remarks in regards to the exchange.

The Future of Binance Coin

Don’t take this article as gospel. There are plenty of risks in a BNB investment. When it comes to utility, Binance Coin really is a one-trick pony. It doesn’t include any smart contract capabilities, so Binance-based DApps are pretty much a no-go.

Add on to that its potential status as a security. The company behind the exchange has already gotten into some regulatory troubles, forcing a move to a different country. Future legal issues could cause plummeting prices if severe enough.

As with any investment, especially cryptocurrency, it’s essential to do your own research and stay vigilant of any new findings. While Binance Coin may look like a tasty investment opportunity today, anything can happen tomorrow.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.