XRP has experienced a sharp decline from its January peak, dropping 28.5% from $3.40 to $2.42 as of February 10, 2025. This price movement has occurred alongside a dramatic decrease in futures market activity, with open interest falling by 52% from $7.62 billion to $3.52 billion.

The cryptocurrency’s price decline appears linked to broader market uncertainties, including Donald Trump’s delayed announcement regarding cryptocurrency policies and escalating tensions over China trade tariffs. These factors have created a cautious environment for crypto investors.

Market data shows that traders are increasingly taking bearish positions on XRP. The futures market has recorded negative funding rates, indicating that short-position holders are paying fees to those holding long positions. This represents a shift in market sentiment toward a more pessimistic outlook.

The derivatives market has witnessed a wave of long position liquidations since XRP’s January 16 peak. A major liquidation event occurred on February 3, resulting in the collapse of $74.67 million in bullish positions during a market downturn triggered by Trump-related news.

Technical analysis of XRP’s price movement reveals a bear pennant pattern, which typically suggests continued downward movement. This pattern consists of a sharp decline followed by a consolidation phase. Market analysts suggest that if XRP breaks below the current pattern’s lower trendline, it could trigger a further 30% decline toward $1.63 by March 2025.

Several key support levels are currently being watched by traders. The $2.31 level serves as immediate support, while $2.40 represents another crucial threshold. The Relative Strength Index (RSI) on daily charts indicates oversold conditions, which some analysts interpret as a potential sign of an upcoming price reversal.

Historical price patterns have caught the attention of market experts. Analysis of previous XRP movements shows that similar market conditions in July 2023 led to corrections of 54.65% and 59.73%. If these patterns repeat, some analysts project potential price targets of $1.54 and $1.37 respectively.

The drop in futures open interest from $7.86 billion in mid-January to $3.5 billion in February reflects reduced market participation and declining confidence among traders. This decrease in market activity often precedes further price movements, though the direction remains uncertain.

Despite the bearish indicators, some market participants view the potential price decline as a buying opportunity. They point to previous instances where similar corrections created favorable entry points for investors.

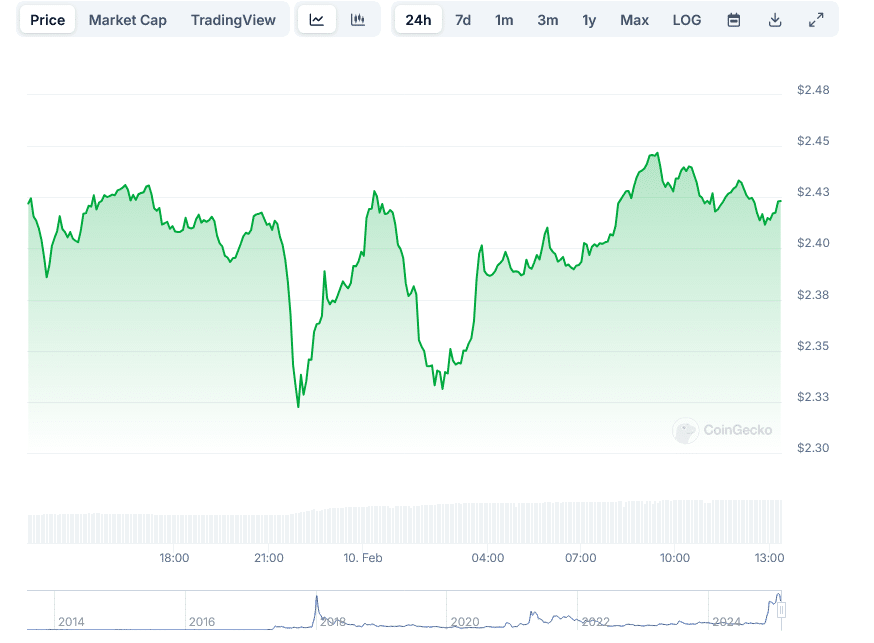

Trading data shows XRP’s daily volume has increased by 40% to $5.49 billion, with the price moving between $2.49 and $2.32 in recent trading sessions. The current RSI reading of 39 suggests the asset is approaching oversold territory.

Technical indicators present multiple scenarios for XRP’s short-term price movement. A recovery above the 50-day simple moving average could signal a potential rally, based on historical patterns. Previous instances of XRP reclaiming this moving average preceded price increases ranging from 29% to 520%.

The bear flag pattern currently visible on price charts developed after XRP’s decline from $3.13 to $1.76 between January 31 and February 3. The price has been trading within an ascending parallel channel, with support at the lower boundary around $2.34.

Short-term price action shows XRP trading in a consolidation phase, with the token maintaining position between established support and resistance levels. The daily trading range has narrowed, indicating a potential buildup to a larger price move.

Market data from February 10 shows continued pressure on XRP’s price, with the token trading at $2.43. The one-day trading volume stands at $5.49 billion, reflecting active market participation despite the overall bearish sentiment.