Binance has announced it will begin providing crypto-as-a-service for traditional financial institutions. This will give banks, brokerages, and exchanges direct access to its spot and futures markets, liquidity pools, custody, and compliance tools.

However, people users are currently looking for projects with high multiples. They are on the quest for the kind of asymmetric upside no ETF can deliver. DeepSnitch AI is emerging as the presale that could be the next crypto to explode. Launched at $0.0151, it has already increased to $0.01701, with over $280,000 raised on Stage 1.

Binance expands into white-label crypto services

Binance is opening its infrastructure to traditional financial institutions through a new white-label solution, the exchange confirmed. The product gives licensed banks, brokerages, and stock exchanges access to its services. These institutions will access Binance’s spot and futures markets, liquidity pools, custody services, and compliance tools without having to build in-house systems.

“Institutions retain full control of the front end, their brand, client relationships, and user experience, while Binance powers the back end: supporting trading, liquidity, custody, compliance, and settlement,” the company said.

The launch comes amid what Binance described as “unprecedented client demand” for digital assets. For major financial institutions, the exchange argued, offering crypto services is “no longer optional.” Instead, it has become a standard expectation for clients.

This move is similar to Coinbase, which announced its own crypto-as-a-service platform back in June.

Top tokens to watch: DeepSnitch AI emerges as the next 1000x gem as XRP price prediction remains average

DeepSnitch AI: The 1000x presale shot

DeepSnitch AI’s appeal lies in solving real problems traders face daily. While most AI coins like TAO or NEAR promise infrastructure concepts far from practical use, DeepSnitch AI is being developed to provide tools that traders can actually use.

These include contract scans, wallet alerts, and risk analysis delivered directly into Telegram. Apparently, Telegram is the hub where over 1 billion people already conduct trading conversations. This direct integration makes adoption easier and demand more likely.

Another narrative driving attention is its bear-proof angle. Most projects only matter in bullish conditions, but DeepSnitch AI is being built for both bullish and bearish conditions. This is because its tools will continue to make it remain relevant even in bearish cycles. Traders will need protection from scams and sharper alerts, whether the market is red or green. Every cycle, people lose billions to hidden traps. Hence, the “scam filter” could become one of its most valuable features.

Finally, the presale structure itself creates a sense of urgency. Early buyers are locking in before the marketing rollout, and the project features a staking program with dynamic, uncapped rewards that adjust as more tokens are staked. Rewards flow continuously, with free withdrawals and no lock-ups. That flexibility has drawn interest from traders who want both upside and passive income.

If DeepSnitch AI gets even a fraction of past AI coin rallies, the returns could stretch into 1000x territory. XRP and Chainlink have established roles, but their size means they can’t deliver those kinds of multiples anymore.

For example, XRP’s current market cap is around $172 billion. For it to deliver a 1000x return, its market cap would need to reach $172 trillion.

That’s almost twice as large as the current global GDP, which stands at roughly $101 trillion USD in annual output. It’s simply unrealistic for any single crypto to reach that scale. That’s why early backers are jumping into DeepSnitch AI and accumulating as many tokens as possible.

XRP price prediction update

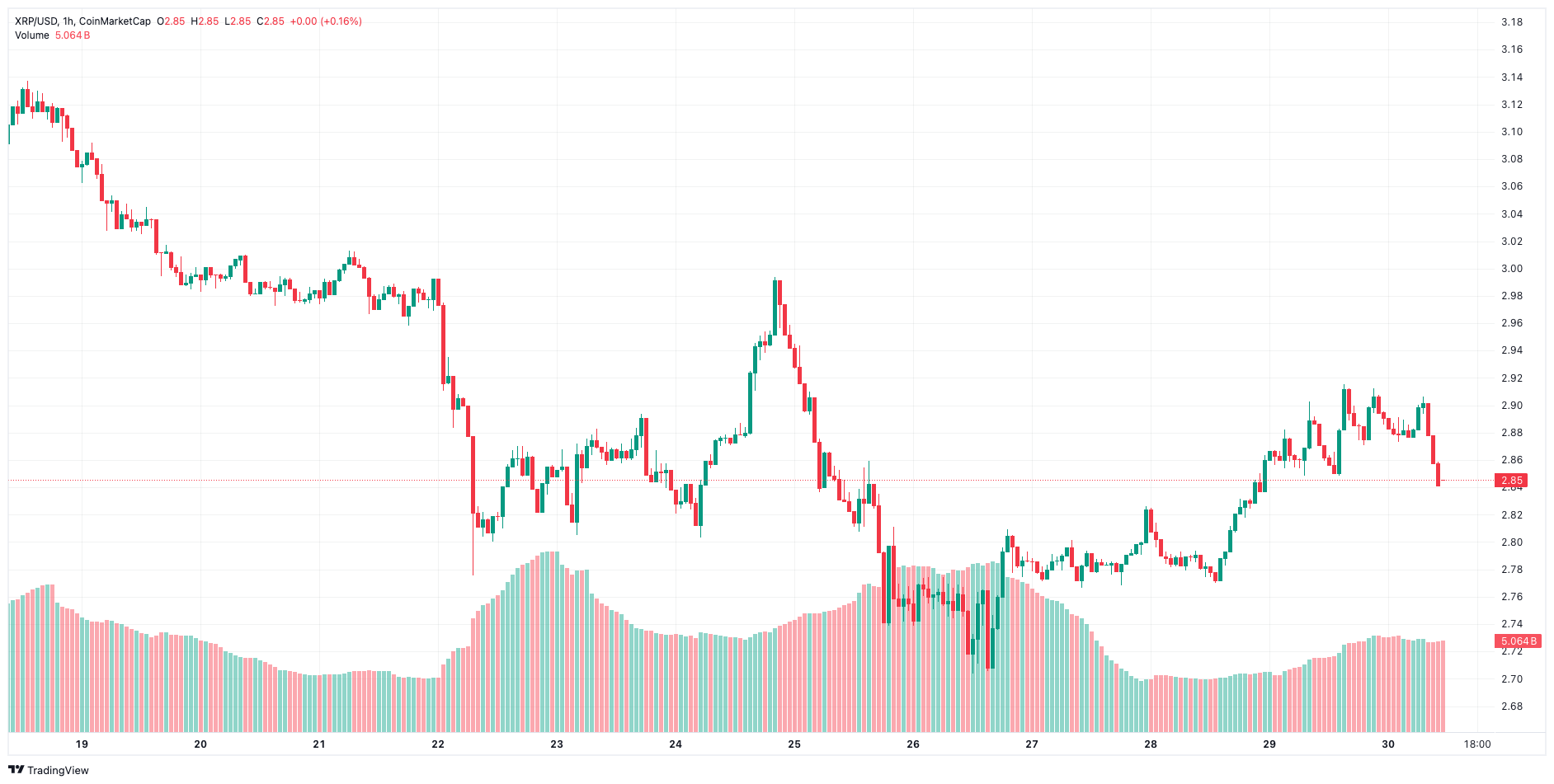

XRP recorded a new milestone after the launch of the REX-Osprey XRP ETF, which saw nearly $38 million in first-day trading volume. The strong debut shows that regulated products for XRP have serious demand, but the price outlook is less exciting.

XRP has gained just 1.7% over the past week, with indicators suggesting a neutral sentiment. Analysts predict that the XRP price outlook could reach around $2.86 by late October, but this would actually mark a slight decline from current levels. With the Fear & Greed Index in neutral territory, the near-term outlook appears limited.

Chainlink outlook

Swift announced a partnership with Chainlink at Sibos 2025 to launch a blockchain-based ledger designed to connect financial institutions. The move shows Chainlink’s role as an infrastructure provider, but it hasn’t led to strong short-term performance.

LINK has declined in recent weeks, with sentiment leaning bearish. Technical indicators show limited upward pressure, though some forecasts point to a possible move toward $23.30 in the coming month.

The final verdict

DeepSnitch AI is becoming an early mover story. The presale has already raised more than $280,000 in its first stage, and its price has increased by 12% since launch. With each stage, the cost rises, and the upside for new entries shrinks.

The combination of meme branding, AI utility, and a staking model designed for flexibility makes DeepSnitch AI different from many other presale projects. People are piling in before marketing ramps up and before exchanges step in.

This could be the entry people talk about for years, one of the last chances at a true 1000x setup.

If you are interested, visit the official DeepSnitch AI presale website and secure your tokens.

FAQs

FAQs

Why is DeepSnitch AI being called the next crypto to explode?

Because its presale has already raised more than $280,000 with fast stage progression, while offering AI tools for traders that most projects don’t deliver.

What makes DeepSnitch AI different from other AI coins?

Most AI tokens promise infrastructure, while DeepSnitch AI is being built to provide real-time tools, such as contract scans and wallet tracking, directly within Telegram.

How does the staking program work?

It’s dynamic and uncapped. Rewards flow every few seconds, withdrawals are free, and early participants benefit from higher relative yields as the pool grows.

Can XRP price predictions still be 1000x from here?

No. The XRP price outlook is already that of a large-cap asset, with ETFs and institutional exposure. Its upside is limited compared to a micro-cap presale like DeepSnitch AI.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.