TLDR

- Nasdaq-listed VisionSys announced a $2 billion Solana treasury strategy, with the first phase targeting $500 million in SOL purchases and staking within six months

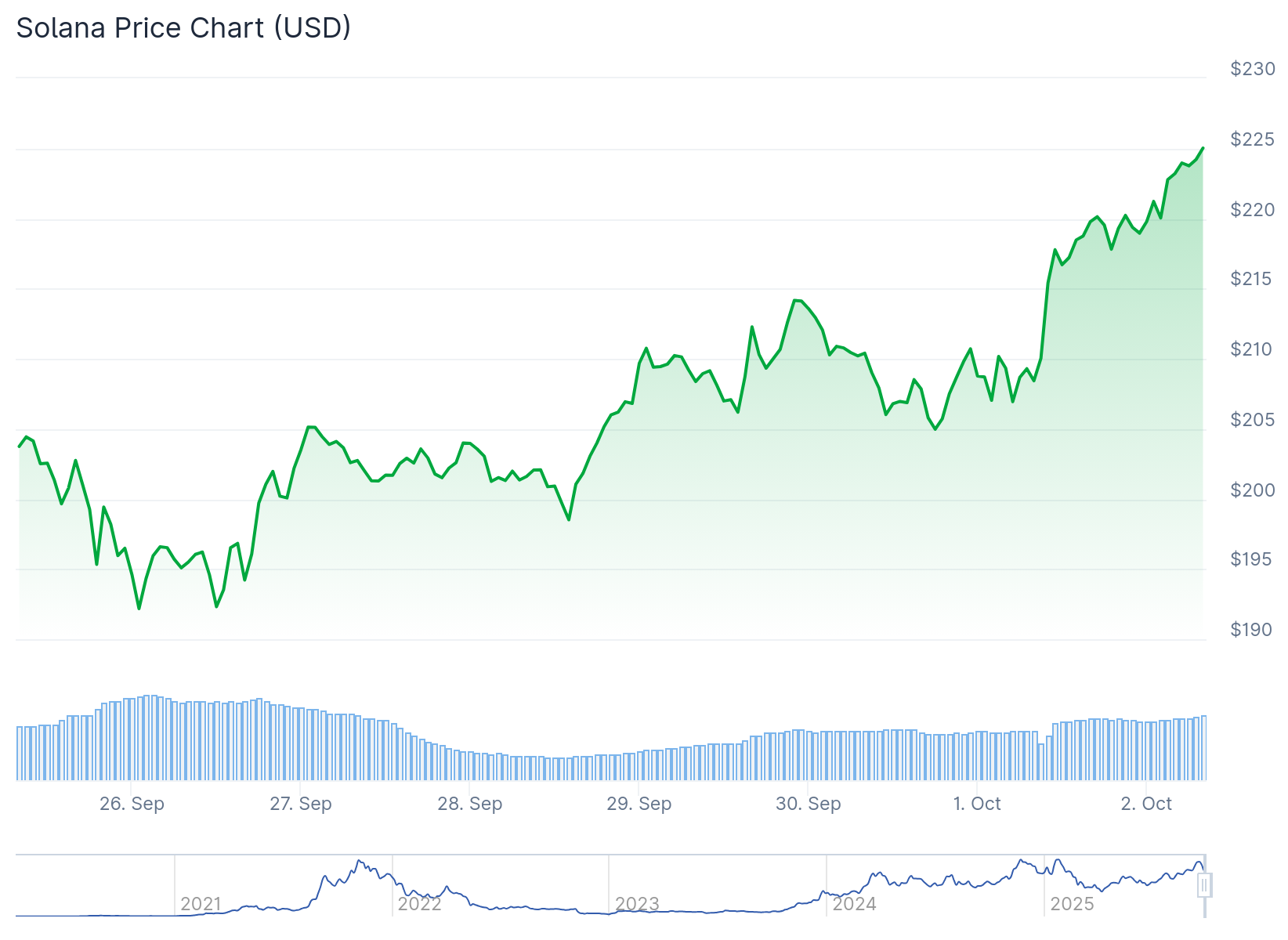

- Solana price increased 5% to $219 following the announcement, continuing its strong performance with 9.32% monthly gains and 87% gains over six months

- Marinade Finance will provide the staking infrastructure for VisionSys’s treasury, offering institutional-grade security and compliance

- VisionSys CEO Heng Wang said the company will combine its AI algorithms with Solana’s blockchain to create new treasury models

- Analysts identify $205 as critical support for SOL, with potential to test $230 if it breaks above $215

Solana price increased 5% to reach $219 following a major announcement from VisionSys. The Nasdaq-listed AI company revealed plans to build a $2 billion Solana treasury over time.

VisionSys said it will acquire and stake $500 million worth of SOL in the first phase. The company expects to complete this initial purchase within six months.

The announcement came through a media statement from VisionSys. The company said the strategy will strengthen its balance sheet and improve liquidity.

Nasdaq’s VisionSys AI is building a $2B #Solana treasury with Marinade Finance. $500M in #SOL will be staked in the first phase. $SOL Full Story Below 👇https://t.co/wHQiKpUwFq

— Blockonomi (@blockonomi) October 2, 2025

Marinade Finance will serve as the staking partner for the treasury program. The partnership aims to ensure secure delegation and regulatory compliance.

Solana traded at a low of $208.74 before climbing past $219. The 5% daily gain added to the token’s strong recent performance.

The token has gained 9.32% over the past month. Year-to-date returns stand at over 16%, placing SOL among the top-performing major cryptocurrencies.

VisionSys CEO Heng Wang described the plan as a rare opportunity. He said the company will integrate its AI algorithms with Solana’s blockchain infrastructure.

The goal is to create new treasury models by combining artificial intelligence with decentralized finance. VisionSys aims to pioneer AI-driven DeFi solutions through the initiative.

Corporate Blockchain Adoption Expands

VisionSys joins other companies exploring blockchain treasury strategies. Forward Industries recently announced a Solana treasury plan with a $1.6 billion raise.

The trend shows growing corporate interest in digital asset reserves. Traditional companies are testing blockchain integration with institutional safeguards.

Scott Gralnick leads institutional growth at Marinade Finance. He called VisionSys a leader in AI integration and said Marinade’s platform offers the necessary liquidity and security.

Marinade Finance operates as Solana’s leading staking protocol. The platform serves more than 154,000 users and maintains SOCII compliance.

The protocol has undergone multiple independent audits. This infrastructure provides institutional-grade security for corporate treasury programs.

Price Analysis and Support Levels

Crypto analyst Kamil identified $205 as a critical support level for Solana. The token has maintained trading above the $200 threshold consistently.

$SOL Price holding the trendline support near $205

As long as this base holds, momentum leans upward

Break above $215 opens path toward the FVG zone around $230

My targets are all above $500 this cycle 🚀 pic.twitter.com/quQcjoqlDW

— Kamil (@KamilShaheen19) October 1, 2025

A breakthrough above $215 could open the path to $230, according to technical analysis. Kamil’s longer-term outlook places targets above $500 for the current cycle.

Trading volume for Solana jumped 30.07% to reach $8.63 billion. The increased activity reflects growing investor interest in the token.

DigitalCoinPrice forecasts suggest Solana could reach its previous all-time high of $294.33. Their year-end projection extends to $482.09.

Changelly offers a more conservative outlook for 2025. Their forecast places Solana between $205.38 and $210.78 by year-end.

CME Group plans to launch Solana and XRP futures options. This expansion of derivatives products provides additional institutional exposure to the blockchain.