ICO vs. VC: Two Sides of the Same Coin

Among other positive developments for the blockchain space, 2017 was the year of the ICO (Initial Coin Offering). As public interests in cryptocurrencies heated up towards the latter half of the year, newcomers with fresh investment capital fanned the flames of the already white-hot fundraising model.

Throughout 2016-2017, initial coin offerings became the default method for cryptocurrency projects to kick-start their revenue stream. For a time, the ICO model was stupid lucrative, for both entrepreneurs and investors. If you had invested in, say, NEO’s ICO (formerly Antshares), you’d be up nearly 280,000%, and even the most modest ICO returns, as with Lisk, come out to 19,000%.

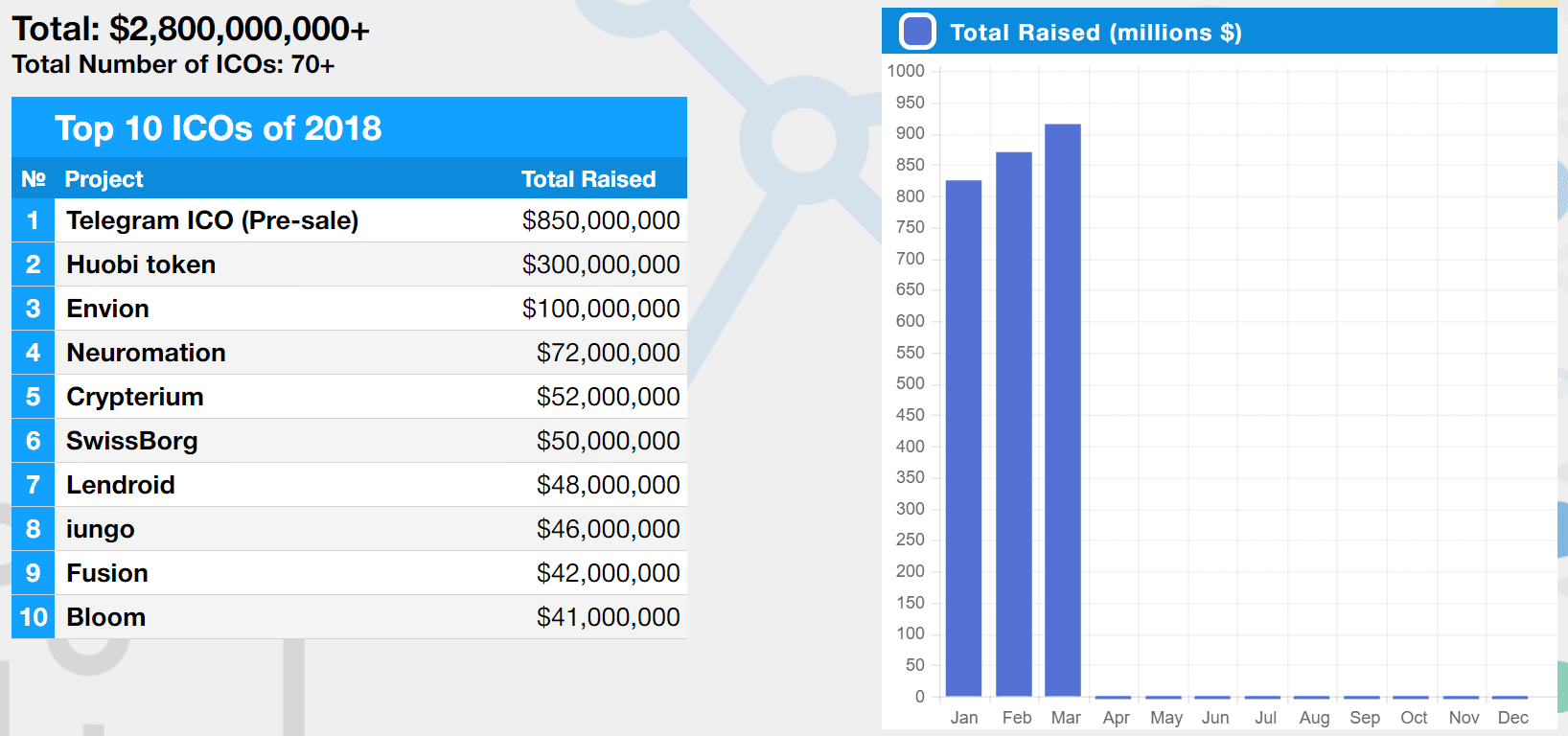

And these profits weren’t limited to the investors. According to Coinschedule, ICOs attracted $95mln in 2016, only to quadruple this figure to $3.8bln in 2017. Even though half of last year’s ICOs are already down for the count, the trend shows no sign of stopping. We’re only two and a half months into 2018, and the $2.9bln raised so far is on pace to eclipse the sum total of investments made in the past two years.

Amazingly, ICOs are still recording exponential investment figures despite 2017s unsavory success rates. Even with the market dragging its feet on a downtrend for most of 2018, startup investments across the board aren’t stopping to pick up any dust. In fact, as 2018’s ICO statistics betray, total cryptocurrency/blockchain-related investments look like they’ll surpass 2017’s record numbers.

This includes an old player in the investing game that we might forget in lieu of the rookie ICO: venture capital.

Venture Capital: The Oldschool Alternative to the ICO

Embellished headlines and articles peppered with fascinated curiosity over ICOs would make you think that they are the preferred–if not only–investment avenue for crypto startups. But this is hardly the case.

Venture capital has had its hands in the cookie jar for as long as initial coin offerings have been around. Perhaps they receive less coverage because they’re less of a novelty, or maybe it has to do with the nature of the investment and who’s doing the investing. By their model, ICOs, like the IPOs they derived from, are open to (most) all investors, regardless of accreditation and net worth.

Venture capital investments, on the other hand, come from hedge funds, private equity firms, or persons of extreme wealth. They’re basically individuals and entities with the resources to pour millions of dollars into young and risky-yet-promising projects with the hopes of quality returns on the original investment.

[thrive_leads id=’5219′]

And ICOs and cryptocurrency, in general, offered more than quality returns. With the right pick, a good investment garnered Wall Street penthouse-worthy ROIs. Still, most venture capital firms have been wary to invest directly into crypto, and with good reason. If you’re playing with millions of dollars, hesitancy is wise in a market whose volatility can just as easily turn an original investment into monopoly money as it can into a digital goldmine.

Rather than a head-on approach, venture capital firms would rather come at crypto from the sides, placing their bets on services or businesses related to cryptocurrencies and blockchain. This could be anything: exchanges, wallet services, development labs, payment solutions, etc.

These are the channels that venture capital is pumping money into, and they’re the same startups that have attracted almost as much attention as ICOs.

Show Me the Money

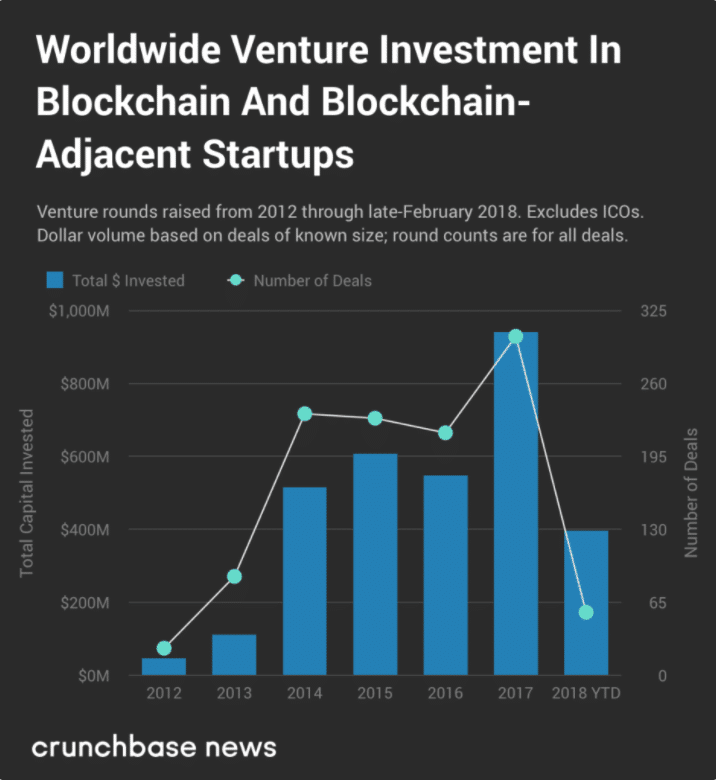

Over the last few years, venture capital investment may not be quite on par with the multi-billion dollars invested in ICOs, but still, the sum of money flowing in is far from trivial.

According to a Crunchbase News study, roughly 1,000 VC deals have been brokered in the blockchain realm since 2012. These 1,000 have racked upwards of $2.5bln dollars in investments from 2012-2017, with about $1bln of this coming in 2017 alone. Even more impressive, it looks like 2018 could be a record-breaking year for venture capital in crypto. At the time of Crunchbase’s report, firms have already pledged $400mln in funds to a variety of projects. That’s 40% of 2017’s total investment sum in two months.

So far for this year’s tally, hardware wallet manufacturer Ledger has received the most attention from investors. The company raised $75mln from 12 investors in its Series B investing round, the largest contribution coming from the pan-European fund Draper Espirit.

In years past, other industry leaders on Ledger’s caliber have secured their own fairly large share of venture capital. 21 Inc., for example, netted a staggering $116mln in its first round of investing in 2015, the single largest VC investment made in the industry to that point. In its third investment round back in 2015, Circle Internet Financial garnered $50mln in capital, another one of the largest venture capital investments in the industry’s nascent lifetime. The next year, Blockstream and Ripple both beat this capital allocation with $55mln investments each, putting Blockstream’s total VC tally at $76mln and Ripple’s at $96mln. Circle received another round of funding in 2016, as well, with this $60mln in fresh money giving it a grand total of $136mln over the years.

Coinbase, however, takes the cake for largest single round and aggregate investment. In 2017 alone, Coinbase accrued $108mln in their Series D investing round, leaving the company’s total venture capital funding in the ballpark of $235mln. Other notable industry leaders who rode out 2017 on a wave of cash are Canaan Creative ($43.45mln) and BitGo ($42.5mln).

Who’s Coughing Up the Dough?

Crypto’s VC big players represent an eclectic group. Alongside seasoned venture capital firms and high-roller individual investors, you have legacy financial and tech corporations, financial institutions/banks, and crypto-specific capital groups.

SBI Holdings, Google, and Overstock are the most active among their corporate peers in blockchain investments, a report by CB Insights reveals. Each company sports a unique and diverse crypto portfolio, including R3, Ripple, and Kraken (SBI Holdings); Storj, Ripple, and LedgerX (Google); and Factom, Ripio, and Peernova (Overstock).

Large banks and financial institutions have, surprisingly (or unsurprisingly depending on who you’re asking), plenty of cards on the table, too. In fact, many banks began investing as early as 2015. Among these include Citi, Goldman Sachs, and JP Morgan and Chase Co., who all hold positions in R3, Axoni, and Digital Asset among others.

There are a handful of industry moving venture capital firms pouring money into crypto, but out of this mix, the highest bidders are those firms that specialize in blockchain investing. Traditional investors like Draper Associates, Andreessen Horowitz, and Union Square Capital all have skin in the game, but their portfolios are dwarfed by the likes of the Digital Currency Group. By the end of 2017, the Group boasted an investment count of 40 different companies, a number they’ve already looked to increase this year. Tied for second, Blockchain Capital and Pantera Capital both held positions in 8 different ventures by the end of 2017.

Some Takeaways

Venture Capital investment in blockchain has steadily ramped-up over the past few years, and if the beginning of 2018 is any indicator, it shows no signs of slowing down.

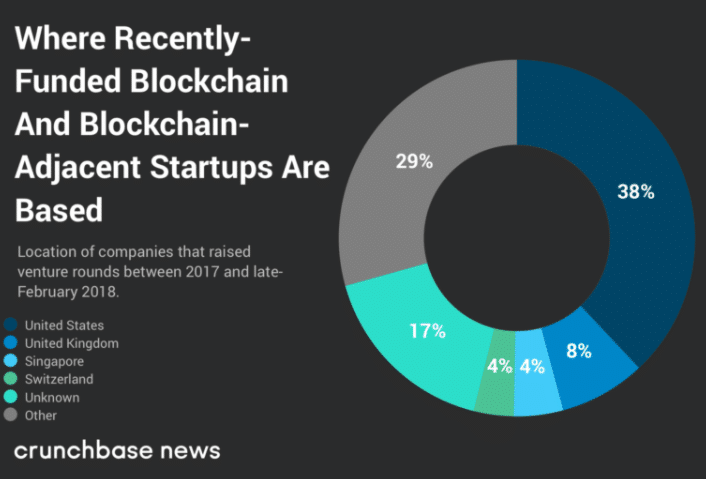

Unsurprisingly, the majority of these investments come from blockchain-specific groups, with big name banks and legacy tech businesses leading the way. Most of this venture capital has been raised for companies located in the United States, according to Crunchbase, with the United Kingdom coming in second and Singapore and Switzerland tied for third.

On a basic level, VC investment rounds allow startups to receive large, lump sums of capital to feed their operating budgets, cash flow that they wouldn’t have access to otherwise. Not every blockchain company launches its own coin, so some of these businesses do not have the luxury of running an ICO.

Still, ICOs have attracted more money in the past half decade than VC fundraisers, and this likely has to do with the ICO’s inclusive, low-barrier to financial entry. As the industry evolves, though, we’ll likely see more venture capital gravitate towards cryptocurrencies and blockchain companies, so we’ll see if this old dog can keep up with the budding industry’s new fundraising tricks.