ASIC Mining: The Early Days

January 2013 marked the beginning of a new era for cryptocurrency mining: the rise of ASIC miners. Around this general date, ASIC mining rigs began to enter the consumer market. Before January 2013, most cryptocurrency miners used relatively basic, much cheaper GPU or CPU mining rigs to mine cryptocurrency. These operations made it easier for individual hobbyists to earn cryptocurrency by supporting Proof-of-Work consensus algorithms.

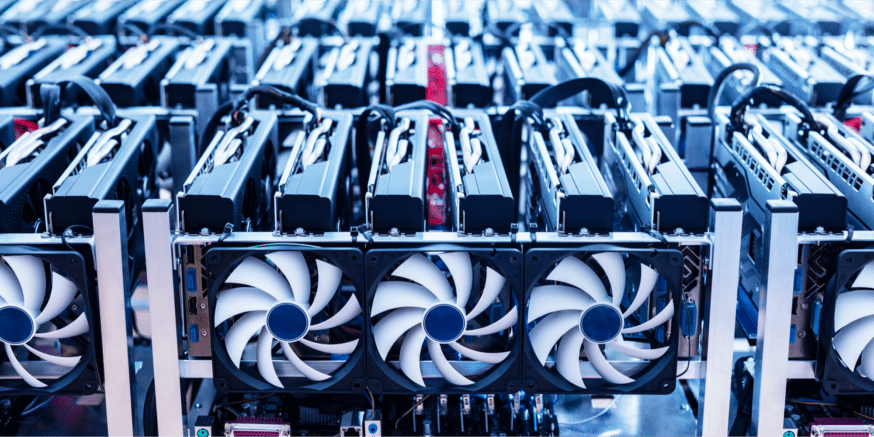

The rise of ASIC mining rigs not only increased the barrier to market entry for hobbyist miners but also made it much easier for enterprises to launch massive mining operations.

Impact of ASICs on Cryptocurrency Projects

From a cryptocurrency project’s perspective, this advancement in mining technology presented both clear advantages and disadvantages.

One advantage of ASIC mining rigs was that Proof-of-Work consensus algorithm-based cryptocurrencies were able to mine at much faster hash rates, making transaction processing times much quicker than ever before. By cutting down on the transaction verification times, P2P cryptocurrency payments became a bit more practical than the days of GPU and CPU mining.

While the higher transaction speeds helped cryptocurrency gain more real-world marketplace adoption, ASICs also brought one major disadvantage: the centralization of mining. Because it was possible to run large-scale ASIC mining operations, mining became a way for a few small groups of people to essentially control the monetary supply of various cryptocurrencies.

Impact of ASICs on Cryptocurrency Adopters

The fact that mining became more centralized with the rise of ASIC rigs became a major concern amongst the early adopters of cryptocurrency. After all, most people who had originally adopted coins like BTC did so because they originally promised a new, decentralized monetary system. ASIC mining rigs were viewed by many early adopters of cryptocurrency as a threat to the core principles of blockchain and cryptocurrency.

Even though some people created businesses around ASIC mining and invested large amounts of time, energy, and money into buying ASIC mining rigs, a large segment of cryptocurrency users began to question whether ASIC mining should be allowed due to the increasing centralization of monetary supply created by the advent of ASIC mining operations.

The Cat and Mouse Game

Since the start of the ASIC mining era around January 2013, PoW-based cryptocurrency projects have approached changes to mining technology in a variety of ways. For example, projects like Bitcoin (BTC) have continued to ignore this issue.

Essentially, the Bitcoin community (and many other crypto projects) was split on how exactly to handle the rise of ASIC mining. For the Bitcoin community, this led to the creation of the BTC hard fork called Bitcoin Gold (BCG) in 2017, which uses the Donald Trump-esque slogan “make Bitcoin decentralized again.”

How did BCG and other major cryptocurrency projects try to stop ASIC mining? Several projects began to use ASIC-resistant PoW consensus algorithms that basically marked any attempts to mine with ASIC rigs as spam. This has created a game of cat and mouse. Projects that haven’t changed their algorithms to be ASIC-resistant face scrutiny from their communities.

For projects that fear the centralization of their monetary supplies due to large-scale mining, algorithm changes have been very time-consuming. Moves to new algorithms in hopes of stopping ASIC mining have also created a lot of tension between mining rig manufacturers and cryptocurrency project teams. This rift became fully apparent in the Monero-Bitmain spat that occurred in March 2018. An even bigger concern is the fact that miners will create new mining hardware and mining software which circumvent newer ASIC-resistant algorithms, making the centralization of mining possible again and making the efforts put forth by cryptocurrency project teams essentially all for naught.

What Will Happen to ASIC Mining in 2018 and Beyond?

Bitmain and other mining rig manufacturers will continue to produce mining rigs for miners who want to mine cryptocurrency. However, it’s still unclear who will come out on top of the ASIC/large-scale mining debate. Even the co-founder of Bitcoin.org and Bitcointalk wrote an open letter in February 2018 pleading for an ASIC-resistant algorithm for BTC. As more project teams continue to update their algorithms and mining rig manufacturers adapt to these changes, the entire industry is likely to see perpetual changes and more of the same cat-and-mouse game.

GPU and CPU mining could become the only options for mining, but with the high profitability of mining equipment and large-scale mining, it’s more likely that mining rig manufacturers will continue to try to keep ahead of algorithm changes. Even a move from PoW to PoS can’t be done quickly. It takes time and planning as Ethereum’s project team has shown. For now, it appears that the debate over the centralization of mining will continue to rage on.

[thrive_leads id=’5219′]