The odds are that you already own Bitcoin or other cryptos. Long-term, these decentralized, digital currencies may prove to be a profitable investment. However, you may also want to consider real estate for your long-term financial holdings, too.

The more wisely you diversify your financial affairs, the more insulated from risk you may become to unexpected reversals in any given market. Maybe it’s time for you to size up the Bitcoin vs. real estate debate right here and now.

This article will reveal the comparative relative strength (RS) of Bitcoin vs. a key real estate exchange-traded fund (ticker: ITB, the iShares US Home Construction ETF) over six key time periods.

You’ll view how BTCUSD fared against ITB over the past three-, six-, 12-, 24- and 36-month periods. You’ll also see how Bitcoin has dramatically outperformed ITB over the past five years. You’ll see that Bitcoin even outperformed the stocks of two of the largest US homebuilders.

Finally, you’ll gain insights on why investing in Bitcoin and owning your own home (or rental real estate) is still a sound long-term financial strategy.

Bitcoin vs. Real Estate: Key RS Stats

ITB was selected as the proxy for the US residential real estate (RE) market for several reasons:

- It trades all day long (930 to 1600 ET), Monday through Friday (except holidays).

- Like Bitcoin, you can buy, sell or sell it short in real-time, unlike transacting for a home.

- This ETF does a good job (indirectly) of tracking the performance of US RE.

- When home builders are making money and home prices trend higher, ITB will almost always rise, too.

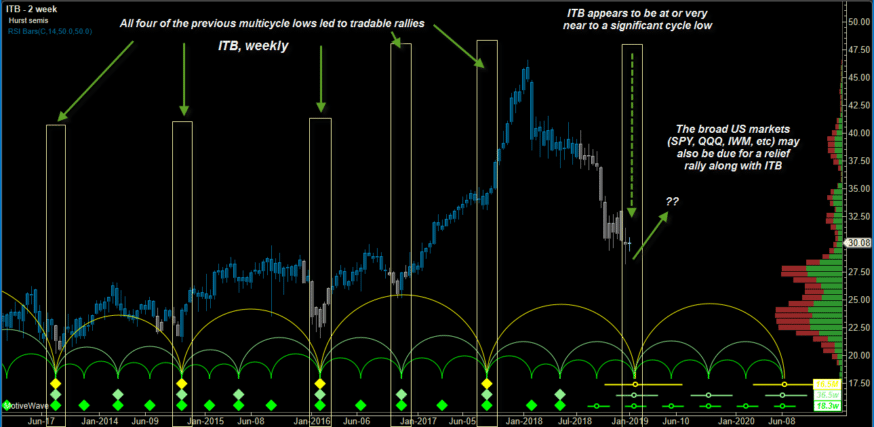

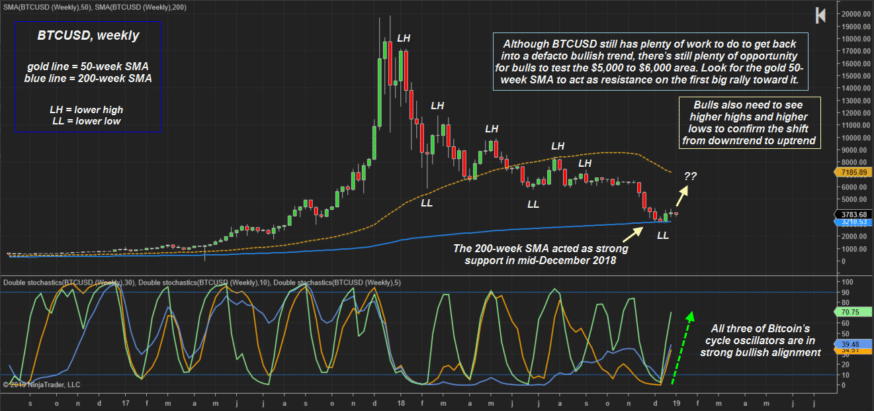

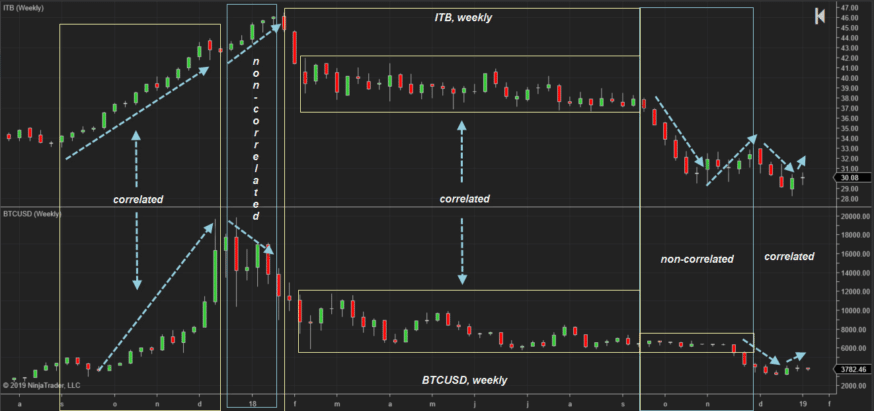

The Bitcoin (BTCUSD) vs. ITB RS stats since the December 2017’s crypto market peak are currently biased in favor of ITB. Both markets have been in a downtrend, but ITB’s has been less severe. Notwithstanding, bullish signs of life continue to appear for BTCUSD. As for ITB, it appears to be homing in on a very reliable multicycle low pattern that often yields tradable gains.

[thrive_leads id=’5219′]

Near-Term Stats (One Year or Less)

3-month BTCUSD performance: (41.76) percent

3-month ITB performance: (13.41) percent

RS winner: ITB

6-month BTCUSD performance: (41.81) percent

6-month ITB performance: (22.13) percent

RS winner: ITB

12-month BTCUSD performance: (75.00) percent

12-month ITB performance: (33.20) percent

RS winner: ITB

Clearly, there’s been no contest in the near-term RS rankings. It’s true ITB declined in value across all three near-term time frames. However, it lost value at a significantly slower pace than did BTCUSD.

Long-Term Stats (Two Years or More)

24-month BTCUSD performance: + 265.07 percent

24-month ITB performance: + 18.67 percent

RS winner: BTCUSD

36-month BTCUSD performance: + 784.12 percent

36-month ITB performance: + 14.42 percent

RS winner: BTCUSD

5-year BTCUSD performance: + 371.97 percent

5-year ITB performance: + 22.28 percent

RS winner: BTCUSD

Key Homebuilder Stocks: Bitcoin Also Wins

If you had invested in shares of DR Horton (DHI) and BTCUSD on January 3, 2016, your crypto holding would be up significantly more than your DHI shares:

36-month BTCUSD performance: + 784.12 percent

36-month DHI performance: + 15.60 percent

RS winner: BTCUSD

Here’s a look at the 3-year performance comparison of Lennar Corp. (LEN) vs. BTCUSD:

36-month BTCUSD performance: + 784.12 percent

36-month LEN performance: (15.33) percent

RS winner: BTCUSD

No matter if it’s compared to ITB, DHI or LEN, BTCUSD’s long-term performance literally steals the show.

All data via TradingView.com The final data cutoff date was January 3, 2019, for BTCUSD, DHI, ITB, and LEN. Commissions, slippage and stock dividends not factored in.

The Investment You Get to Live In

Okay, Bitcoin has been a superior long-term investment to most other asset classes depending on how early one got in due to its astronomical spikes in price, including ITB and key homebuilder stocks. How about home ownership vs. Bitcoin? How has that worked out? In reality, it’s a similar story to that of Bitcoin vs. tech stocks, gold, and RE. Near-term, Bitcoin has been hit very hard, but in the two to ten-year lookback period, Bitcoin has few equals in the financial markets universe.

That’s good news for Bitcoin, and for all anyone knows, Bitcoin may soon enough reclaim the top near-term RS slot vs. all other financial market contenders. However, owning RE as an investment offers you something of value that no crypto, stock, bond or cash-settled commodity can. And that’s the ability to live in and enjoy your investment on a day to day basis.

Even if your $400,000 home loses half its dollar value in the next five years, you still get to live in it and enjoy it as if nothing had happened. Just pay your RE taxes on time, maintain your home and property and relax.

Unless you need to take a job in another city, you can simply wait out the RE market setback. Even if you did need to move to another locale to find work, you can always rent your home out until you sell it.

Inflation Hedge – Usually

During the inflation-plagued era running from 1966 thru 1981, RE gained value in many areas of the US. For example, our family’s home in Long Island rose from $16,490 to $30,000 between October 1964 and August 1972. Another of our homes in New Mexico rose from $19,500 to $52,000 between September 1972 and June 1980. Many of our neighbors and relatives experienced similar RE gains during that same pre-Reaganomics milieu.

Obviously, location played a major factor in these gains (the economies of New York and New Mexico were very healthy back then). Other parts of the US (including the so-called Rust Belt) actually saw RE stagnation (or even decline) during the various recessions that rocked the US between November 1973 and June 1982.

Lower Rates, Big Rallies

Once interest rates peaked in 1981-1982 (remember those 16% interest rates on US Treasury notes?) mortgage rates began to decline, with home prices being major beneficiaries. For example, my parents purchased a three-bedroom, $72,000 home in Hartford, Connecticut in early 1983. The mortgage interest rate was 12% for 30 years. Not long after, interest rates rapidly declined, consistently descending for several more years.

Suddenly, everyone wanted a home, and Hartford-area RE ratcheted relentlessly higher for more than four years. My parents refinanced the note twice, dramatically lowering the monthly payment to the bank. In July 1987, that home was sold for $172,000, a gain of 139% before re-fi and sales commissions. Not a bad return for a 52- month investment!

For many US families and investors, RE has reliably proved to be a sound inflation hedge. It’s also one of the best assets to own as interest rate cycles peak and begin to trend lower. FYI, the long-term interest rate downtrend recently ended when 10-year Treasury notes staged a key technical reversal. It’s possible that the 37-year bear market in interest rates is finally over.

Invest in Crypto and Your Own Home

Here are some of the key advantages of owning your own home even as you invest in Bitcoin and other cryptos:

Your own home:

- Build equity rather than pay rent to your landlord.

- The potential for large capital gains during times of economic expansion (and especially in falling interest rate environments).

- Rent out your home if a better job offer in another city (country) requires an immediate move.

- Enjoy your home regardless of fluctuations in its value.

- One of the few investments you get to live in and potentially profit from.

Your Bitcoin investment:

- Unlike your home, Bitcoin is liquid. You can sell it instantly if you need cash.

- Bitcoin has long-term potential for gains, possibly multiples above that available from home ownership.

- Your Bitcoin investment will never need a new roof, dishwasher, carpeting or termite treatments. You’ll even be spared kitchen remodeling expenses.

- There’s no 30-year mortgage needed to buy Bitcoin. There are no closing costs or 6 percent RE commissions to pay, either.

- Bitcoin’s value isn’t directly affected by interest rate movements.

- Historically much riskier than most other asset classes

Then, Now and the Future

Based on historical data, owning Bitcoin and your own home can often prove to be sound long-term investments. While no one knows what the future holds for Bitcoin or RE, both investments appear to offer major long-term growth potential. Even better, owning a home and Bitcoin can help you enjoy a unique set of advantages that can help offset some of the minor drawbacks of the other.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.