- Feature #1: Interest Rates– BlockFi vs. Celsius APY

- How Did BlockFi and Celsius Make Money?

- Feature #2: Payouts and Withdrawals

- Feature #3: Security– Is BlockFi or Celsius Network Safer?

- Feature #4: Standout Features

- The Court of Public Opinion: BlockFi vs. Celsius Reddit

- Final Thoughts: BlockFi vs. Celsius

BlockFi vs. Celsius Network was a popular head-to-head comparison between cryptocurrency interest accounts. From 2018 to 2021, both providers were largely considered the blue chips of cryptocurrency interest accounts.

In June 2022, Celsius Network froze all customer withdrawals and transfers, and declared bankruptcy a month later. In November 2022 BlockFi blocked all customers from withdrawing their assets due to its complex financial relationship with FTX and FTX affiliate hedge fund Alameda Research November 2022.

Both BlockFi and Celsius failed for different reasons, preventing depositors from withdrawing their funds and dragging them through lengthy bankruptcy proceedings.

The following comparison piece explores BlockFi versus Celsius as they functioned prior to shutting down in 2022.

Celsius. was a NYC-based company regarded as a cryptocurrency lending and borrowing pioneer. It has raised $93.8M in venture capital, private equity, and an ICO for its native token CEL. Celsius claims it’s “nothing like BlockFi” in a now-deleted blog article.

BlockFi, a New Jersey-based company raised $508.7M in venture capital from over 30 investors.

Both BlockFi and Celsius were centralized companies that use decentralized assets, hence being Centralized Finance “CeFi,” rather than Decentralized Finance “DeFi.” Both companies took custody of user’s cryptocurrency.

So, how did BlockFi and Celsius stack up?

Let’s explore.

You can read a full breakdown of each individual platform on our BlockFi review, Celsius review, & interviews (2018 and 2020) with Celsius CEO, Alex Mashinsky, and an overview of the cryptocurrency interest account industry.

Feature #1: Interest Rates– BlockFi vs. Celsius APY

BlockFi offered 5% on the first 0.5 bitcoin, 2% between 0.5 and 20 BTC, and then 0.5% on any amount over that.

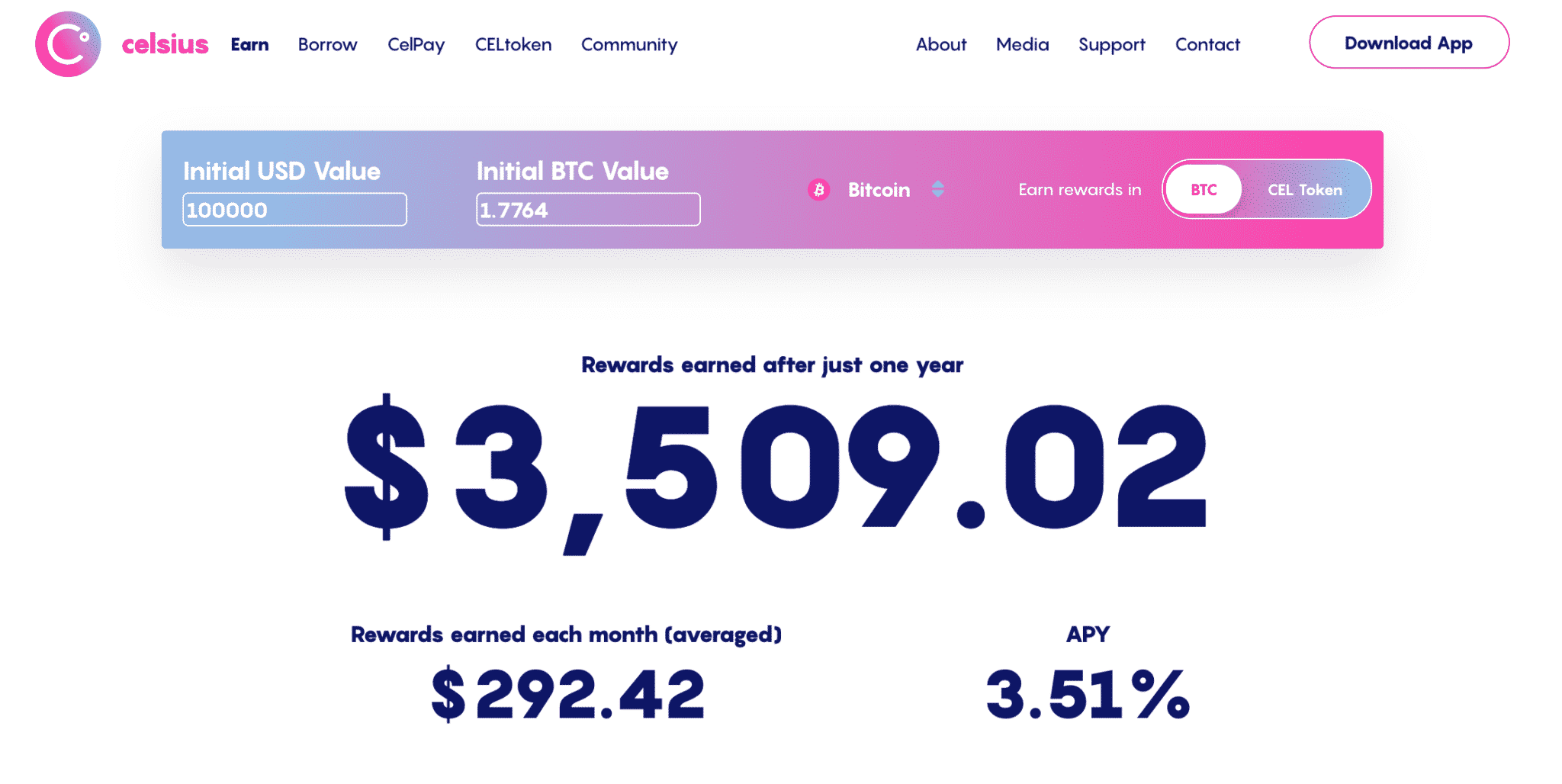

Celsius offered 6.2% for the first 2 BTC, and then 3.51%.

BlockFi offered 4.5% on 15 Ethereum, 2% between 15 and 1000 ETH, and then 0.5% on any amount over that.

Celsius offered 5.5% for any amount of Ethereum.

Stablecoins:

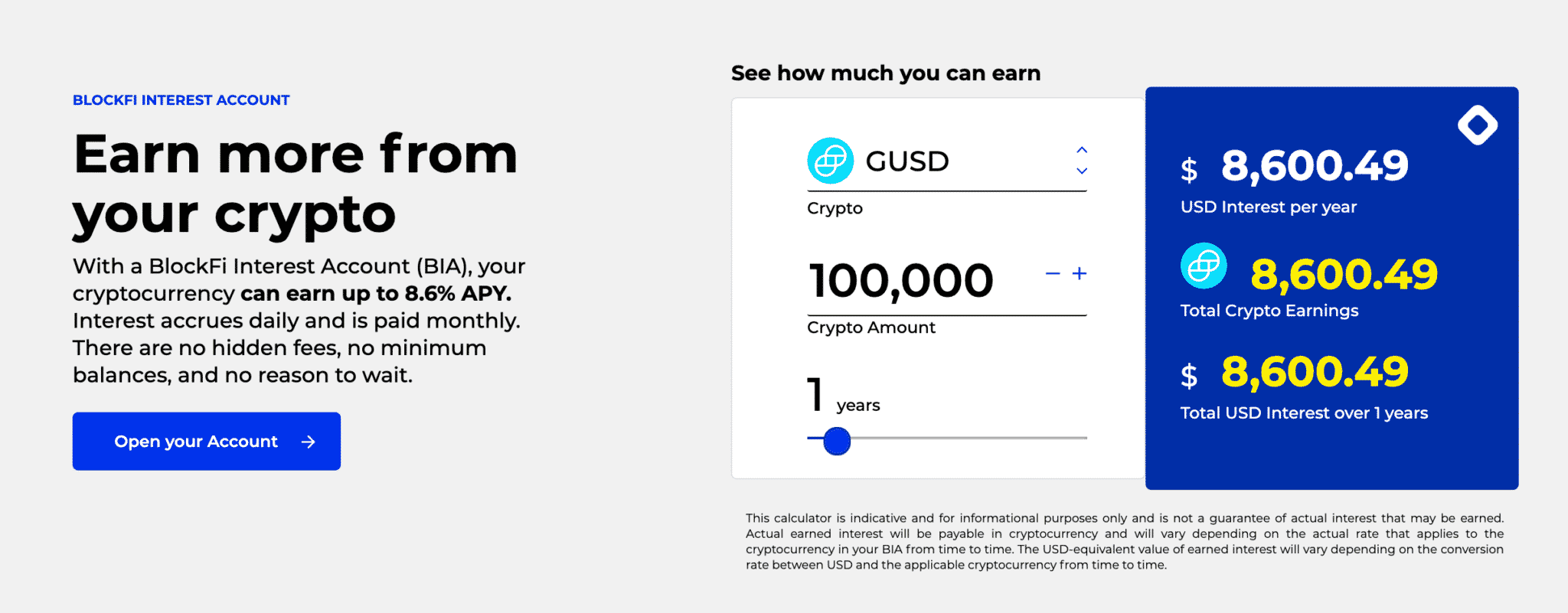

BlockFi offered a flat 8.6% on popular stablecoins like USDC and GUSD, and 9.3% on USDT.

Celsius offered a flat 8.88% on all stablecoins.

How Did BlockFi and Celsius Make Money?

Neither platform disclosed a full transparent breakdown of its lending strategies, with their logic being to avoid the omnipresent threat of competitors leeching off their strategies.

On one hand, Celsius Founder Alex Mashinsky would regularly make claims that Celsius is extremely safe and conservative with customer funds, and all of which was found to be false. In a lawsuit against Mashinsky, the New York attorney general claimed Mashinsky defrauded billions of dollars from investors by concealing the true poor health of the company. Mashinsky was arrested in July 2023.

Comically, in a 2019 Celsius blog post, Mashinsky warned BlockFi customers that BlockFi may use venture capital funds to sustain its interest rates; if the VC money dried up, so would the potential interest rates.

Celsius claimed to lend to cryptocurrency exchanges and hedge funds looking to borrow funds, and it distributes 80% of profits directly to holders of its native token, CEL.

Alternatively, BlockFi’s collapse was less due to the same intentional deceipt as Celsius, but rather a complex relationship with FTX and Alameda Research. BlockFi had also ceased all BlockFi Interest Account offers in February 2022, about 9 months before declaring bankruptcy in November 2022.

Feature #2: Payouts and Withdrawals

BlockFi paid out monthly, while Celsius paid out weekly.

BlockFi allowed for one free cryptocurrency withdrawal per month, Celsius allowed for unlimited free cryptocurrency withdrawals– that is until they suddenly prevented all of their users from withdrawing their money.

Feature #3: Security– Is BlockFi or Celsius Network Safer?

Technically speaking, both BlockFi and Celsius were structurally safe on paper. Celsius used BitGo’s multi-signature wallets to secure user funds. BitGo has a $100M insurance policy spread over all its clients. BlockFi used Gemini and BitGo as its primary custodians. Both Gemini and BitGo have private insurance on their deposits.

However, none of this really helped any users retrieve their funds.

Further, neither BlockFi nor Celsius were covered by FDIC insurance.

Feature #4: Standout Features

Celsius was mobile-only, and BlockFi had both a mobile and web app.

Celsius’s native token CEL rewarded CEL holders with a proportional share of 80% of their profits. International users can also gain an APY boost of around 2%, but this option wasn’t available for U.S. users, who must “Earn in Kind.”

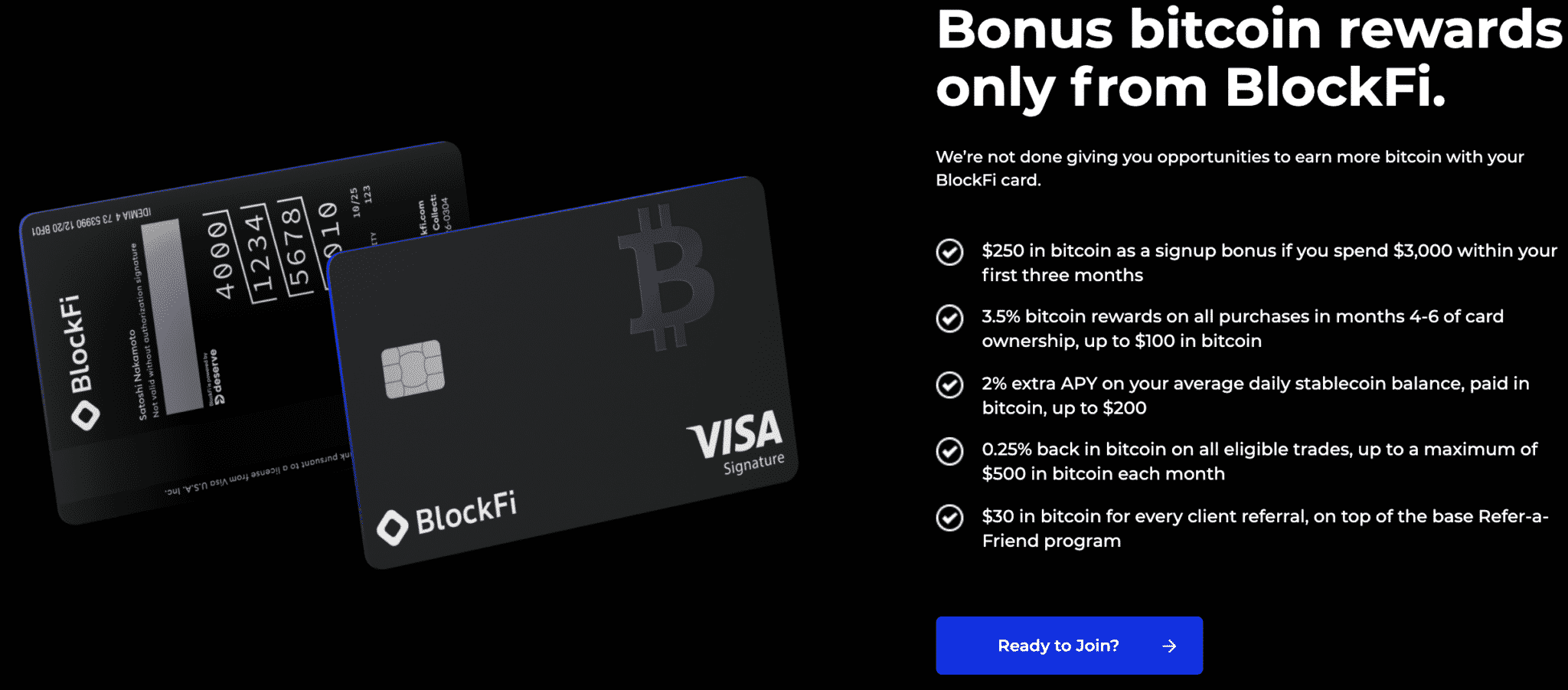

BlockFi was slowly growing its ecosystem beyond just cryptocurrency lending and borrowing. Its most notable standout feature was its BlockFi Credit Card, which got users 1.5% back in bitcoin on all purchases.

The Court of Public Opinion: BlockFi vs. Celsius Reddit

Oof, yeah, you’d be hard-pressed to find anyone with kind words to say about Celsius or its Founder. BlockFi is less-so held in contempt, but both companies are generally viewed as stains on the cryptocurrency industry.

However, during operation, both BlockFi and Celsius had ardent supporter bases, and their comparisons were largely civil.

One popular Blockfi vs. Celsius Reddit thread on r/BlockFi captured the discourse well: many users leaned towards Celsius for its higher interest rates, others prefered BlockFi’s more conservative lending and investment approaches. A

Final Thoughts: BlockFi vs. Celsius

Editor’s note: In June 2022 Celsius Network froze all customer withdrawals and transfers, and declared bankruptcy a month later. We will update this guide as the dust settles. By November 2022, BlockFi had no choice but to block all customers from withdrawing their assets due to its complex financial relationship with FTX and FTX affiliate hedge fund Alameda Research.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.