- BlockFi vs. Holdnaut: Key Information

- Feature #1: Interest Rates — Who Has Better APY, BlockFi or Hodlnaut?

- How Do BlockFi and Hodlnaut Make Money?

- Feature #2: Payouts and Withdrawals

- Feature #3: BlockFi vs. Hodlnaut Security

- Feature #4: BlockFi vs. Hodlnaut Ease of Use

- BlockFi vs. Hodlnaut: Bonuses/Standout Features

- The Court of Public Opinion: BlockFi vs. Hodlnaut Reddit / Customer Support

- BlockFi vs. Hodlnaut: Which is the Better Crypto Interest Account?

A BlockFi vs. Hodlnaut comparison is one of a well-funded, reputable “blue chip” crypto interest account staple versus an up-and-coming scrappy startup that has arguably held its weight with many top contenders in the space.

BlockFi and Hodlnaut are both quite appealing cryptocurrency interest accounts; they offer products that allow token holders to earn passive interest on their crypto assets.

The following BlockFi vs. Hodlnaut review will cover the differences between the APY differences, platform safety, usability, customer service, and unique features of both platforms.

Enter BlockFi, a New Jersey-based company founded in 2017 that has rapidly grown to market leader. With over $15 billion assets under management, BlockFi offers users up to 7.40% APY on DAI and GUSD and up to 4% APY on BTC and ETH. BlockFi has over 265,000 users.

After a Series D in March 2021, the company is valued at $3 billion, having raised over $508.7M from over 45 investors.

In contrast, Hodlnaut is a bit newer to the crypto interest block. The Singapore-based company was founded in 2019 and raised about $100,000 in funding from a single pre-seed funding round (it raised the funds from Antler, a venture capital and early-stage accelerator firm. Hodlnaut has over $500M in AUM from about 5,000 users.

Hodlnaut users can earn up to 7.46% APY on BTC and ETH, up to 8.32% on DAI, and up to 12.73% APY on USDT and USDC. It supports six cryptocurrencies and has indicated it plans to add support for more in the future.

So, BlockFi vs. Hodlnaut? Let’s explore.

BlockFi vs. Holdnaut: Key Information

Item |

BlockFi |

Hodlnaut |

|

Location |

New Jersey |

Singapore |

|

Beginner-Friendly |

Yes |

Yes |

|

Mobile App |

Yes, on Android and iOS |

Yes, on iOS |

|

Available Cryptocurrencies |

BTC, ETH, LINK, LTC, GUSD, PAX, PAXG, USDT, BUSD, DAI, UNI, BAT |

BTC, ETH, DAI, USDT, USDC, WBTC |

|

Company Launch |

2017 |

2019 |

|

Community Trust |

Great |

Good |

|

Security |

Great |

Great |

|

Customer Support |

Good |

Great |

|

Fees |

Low |

Low |

|

Reviews |

||

|

Site/Promotions and Signup Bonuses |

Earn up to $250 by signing up for and depositing up to $100,000+ into a BlockFi account. |

Earn up to $20 by signing up for and depositing up to $100 into a Hodlnaut account. Users can then earn up to $300 by making referrals. |

Feature #1: Interest Rates — Who Has Better APY, BlockFi or Hodlnaut?

Bitcoin

Both BlockFi and Hodlnaut offer tiered rates on BTC. On BlockFi, users can earn:

- 4% on <0.25 BTC

- 1.5% on <5 BTC

- 0.25% on >5 BTC

Holdnaut offers significantly more competitive rates:

- 7.46% on <2 BTC

- 4.08% on <8 BTC

- 2.02% on <90 BTC

- 1% on 100+ BTC

Ethereum

BlockFi offers:

- 4% on 0 – 5 ETH

- 1.5% on 5 – 50 ETH

- 0.25% on >50 ETH

Again, Hodlnaut’s APY offerings are significantly better. Users earn:

- 7.46% on <20 BTC

- 4.08% on <80 BTC

- 2.02% on 100+ BTC

Stablecoins

BlockFi users can earn on six stablecoins: GUSD, DAI, USDT, BUSD, and USDC at up to 7.5% APY, and PAXG at up to 2% APY.

On Hodlnaut, users can earn up to 12.73% APY on USDC and USDT and up to 8.32% APY on DAI.

Holdnaut users can also earn up to 7.43% on WBTC, while BlockFi users can earn on LTC, LINK, UNI, and BAT.

Overall, Hodlnaut delivers higher rates across the board, although BlockFI supports more tokens. If you were looking to earn on your LTC, for example, you’d be better served taking a look at BlockFi. It’s also important to note that these interest rates may fluctuate due to the nature of cryptocurrencies.

Winner: Hodlnaut. With solid rates across the board, Hodlnaut offers higher APY at higher margins to its users. However, BlockFi offers a wider range of supported assets, although its offerings are still less than those of Celsius and Gemini.

How Do BlockFi and Hodlnaut Make Money?

BlockFi makes money by offering institutional and consumer loans, while Hodlnaut makes loans to corporate entities. This works by taking loans from users (the interest rates they offer) and then using user assets as collateral to provide borrowers with loans at higher interest.

BlockFi and Hodlnaut earn from the difference between the interest they pay users and the interest they ask from their borrowers.

It’s helpful to note that as crypto can not be FDIC insured, crypto interest accounts have a unique set of risks. Earning interest on crypto is not the same as holding fiat in a savings account.

Most crypto interest accounts require creditors to stake collateral to combat the risk of borrower defaults. BlockFi is one such platform, requiring 50% loan-to-value on all crypto-backed loans. While managing over $15 billion in crypto, BlockFi has 0% losses across its lending portfolio and is regarded for safer lending practices.

In an interview with CoinCentral, Hodlnaut CEO, Juntao Zhu commented the following about the company’s lending habits:

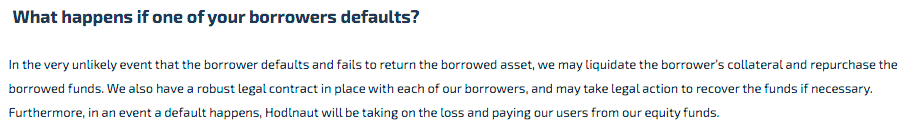

Furthermore, the company details its process in the event that a borrower defaults:

Winner: BlockFi. While it makes money the same as Hodlnaut (although the company does not loan to consumers) it also requires loans to be collateralized at a minimum of 50% LTV and has a history of practicing safe lending methods.

Feature #2: Payouts and Withdrawals

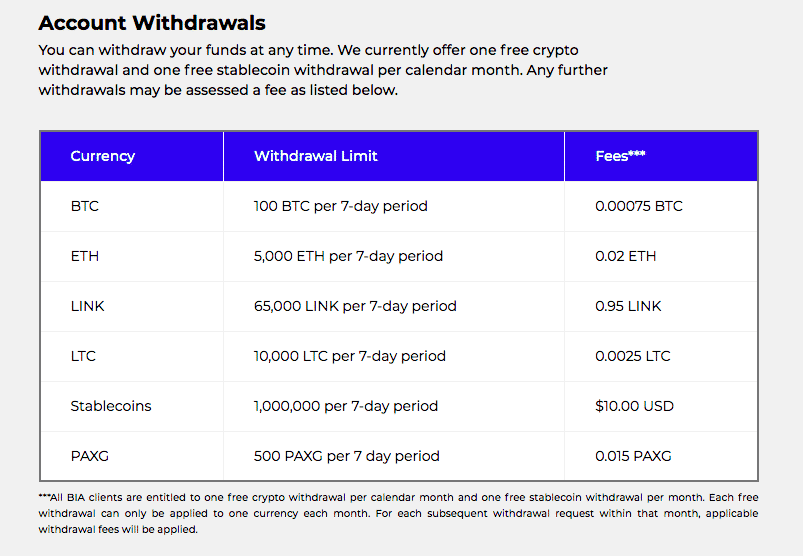

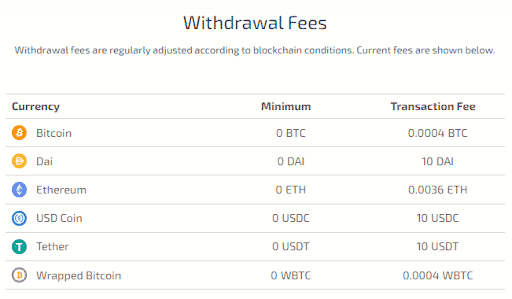

BlockFi users receive interest payouts each month, with one free stablecoin withdrawal and one free cryptocurrency withdrawal monthly. This withdrawal can only be applied to one coin, and further withdrawals attract a withdrawal fee. BlockFi has withdrawal caps for each cryptocurrency. Here’s what that looks like:

Hodlnaut users can withdraw their crypto earnings (for a fee) at any time, with a daily cap of 100 BTC for accounts that have been verified through completing KYC requirements. Once you’ve funded your account, you’ll begin earning interest immediately. This interest is paid each Monday.

Winner: BlockFi’s free stablecoin and fixed coin withdrawals, as well as their lower fees for withdrawing BTC, are all positives. However, with unlimited withdrawals, no caps, and much lower withdrawal rates on ETH, Hodlnaut wins over BlockFi in this category.

Feature #3: BlockFi vs. Hodlnaut Security

Your assets held in BlockFi are only as safe as BlockFi’s primary custodian, Gemini Trust. Gemini secures 95% of BlockFi’s AUM in cold storage wallets insured by Aon and 5% in insured hot wallets. Furthermore, US dollars in Gemini Trust are FDIC-insured up to $250,000 per individual.

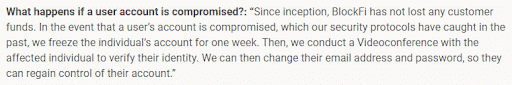

What happens during a hack? BlockFi announced a security breach on its platform in May 2020. Clients lost no funds, and the hacker was able to gain access to an employee’s phone and credentials, bypassing their two-factor authentication through a sim-swapping attack.

In an exclusive interview with CoinCentral, a BlockFi representative said the following about its methods in the event of a security breach:

Holdnaut uses industry-standard encryption and requires users to set up 2FA before making withdrawals. Hodlnaut’s primary custodian is Fireblocks, which holds assets in a mix of offline cold storage and insured hot wallets, claiming that the entirety of a given user’s deposit is never in the same place at once.

Uniquely, Hodlnaut also gives users the option to purchase insurance on their crypto through a partnership with Nexus Mutual. This is notable as most platforms in the cryptocurrency interest space don’t offer insurance options for user assets after being deployed (loaned.)

Since these interest platforms are constantly lending and receiving deposits, funds are in constant motion, making them tricky to insure. Hodlnaut’s insurance with Nexus currently caps at $22M and is anticipated to grow as the companies gain traction.

Hodlnaut is certified by the Singapore Fintech Association, which the Monetary Authority of Singapore recognizes. As of this writing, Hodlnaut is undergoing a license application to become the first regulated entity in Singapore’s crypto borrowing and lending space.

Winner: BlockFi. A U.S. based company with extensive security protocols both on its platforms and courtesy of its custodian, BlockFi has made many moves to securing its platform. However, its worth noting that Hodlnaut’s optional Nexus Mutual insurance coverage can provide an extra level of safety to Hodlnaut users interested in it.

Feature #4: BlockFi vs. Hodlnaut Ease of Use

BlockFi is accessible via web and a mobile app that is available on Android and iOS.

Holdnaut is currently available via web and an iOS app released in mid-2021.

Winner: BlockFi. The platform is accessible via Android and iOS apps for users who prefer to manage their stack on the go, and a web app for users who prefer a broad look at all their assets. Although Hodlnat’s iOS app has been launched, Android users can only access the platform via its web app.

BlockFi vs. Hodlnaut: Bonuses/Standout Features

BlockFi also offers a trading account and a crypto credit card that users can use to earn an unlimited 1.5% cashback on each transaction, 3.5% back in BTC within a users’ first three months, and more rewards.

Hodlnaut’s Token Swap lets users exchange currencies directly in the app. The platform supports WBTC, so users can use the token swap feature to wrap and unwrap their BTC.

CoinCentral readers can earn up to $250 by signing up for and depositing up to $100,000+ into a BlockFi account, and up to $20 when they signup to Hodlnaut and deposit up to $100. When you refer a friend, they’ll receive a $20 signup bonus after making a deposit equal to $1000.

Hodlnaut users can also earn up to $300 if their referrals sign up using Hodlnaut’s iOS app, and earn 10% commission on their referrals’ interest. Hodlnaut bonus payouts are in the same asset deposited.

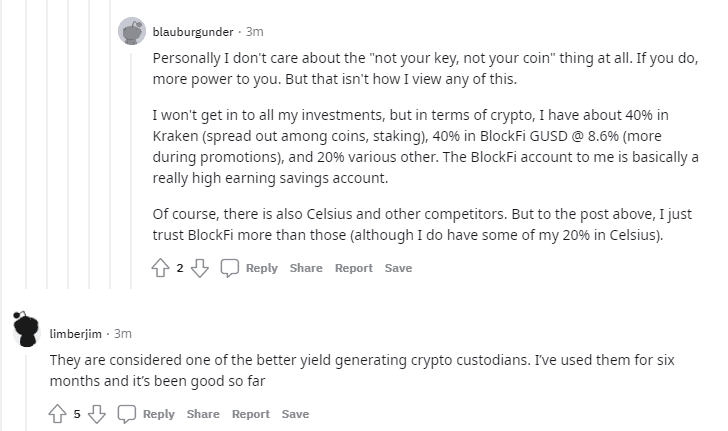

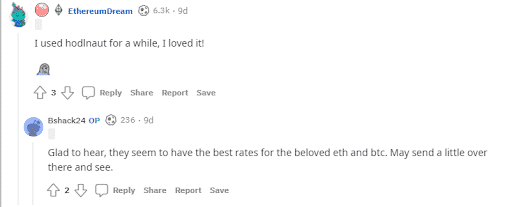

The Court of Public Opinion: BlockFi vs. Hodlnaut Reddit / Customer Support

BlockFi has an above-average customer support and is favored in many Reddit reviews for its safety procedures, stablecoin rates, and 50% LTV policy. BlockFi customer service can be reached at [email protected].

Reddit reviews of Hodlnaut customer support are generally positive, and comments on its APY offerings are supportive across the board. You can contact Hodlnaut support via a support ticket or at [email protected].

Both companies maintain FAQ pages.

BlockFi vs. Hodlnaut: Which is the Better Crypto Interest Account?

BlockFi has been around the crypto interest block. With a larger audience, an over $3bn valuation, and 15bn AUM, it certainly seems to be ahead of Hodlnaut regarding customer trust and company profile.

BlockFi offers a broader range of supported assets than Hodlnaut, which is still less than the 40+ assets supported by competitors like Celsius and Gemini.

Despite this, Hodlnaut wins in the cryptocurrency interest offering department, with up to 7.46% APY on BTC and ETH, instead of BlockFi’s 4%. Hodlnaut also wins with stablecoins, offering up to 12.73% APY on USDC, USDT, and BUSD.

Hodlnaut also has higher rates on DAI (up to 8.32%) as opposed to BlockFi’s up to 7.5%, but doesn’t support GUSD, for which BlockFi offers 7.5% APY.

Hodlnaut boasts an impressive value proposition for its size: its customer service is impressively quick, and its insurance option is a direct attempt to mitigate some of the risks that come with cryptocurrency interest accounts.

CoinCentral readers can earn up to $250 when signing up for BlockFi, and up to $20 when signing up for Hodlnaut.

BlockFi takes the lead in the BlockFi vs. Hodlnaut comparison for a few reasons:

- BlockFi is a U.S.-based company and is forced to work within the confines of U.S. regulations, whereas Hodlnaut is based in Singapore and must work within the confines of its respective government. This is a matter of preference, but if you’re one of our readers located in the United States, BlockFi may be a better choice.

- BlockFi has raised more venture capital money to invest in a better product experience.

However, BlockFi must continue to innovate its product to keep pace with a rapidly evolving crypto interest account ecosystem.

As Hodlnaut grows, we will likely see the product develop to support more assets and improve features. However, Hodlnaut has much less funding and, with over $500M in AUM, will inevitably have to demonstrate more explicit certifications to be responsible with user funds.

For a more detailed dive, we suggest reading our BlockFi Review and Hodlnaut Review.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.