- About Bodhi - The Basics

- A Rising Star in the Prediction Market Universe

- Bodhi Trading History

- Bodhi Team and Community

- Where Can You Buy Bodhi?

- Final Thoughts

What is Bodhi?

Bodhi is a decentralized prediction market platform that focuses primarily on the Chinese market. Bodhi users can create and trade based on the outcome of sports, finance, politics, or other global events. It is powered by the Bodhi token (BOT).

Bodhi aims to build an autonomous, credible, and scalable prediction market that integrates the application of a functional prediction market on a global scale to further optimize the making of decisions.

Bodhi is also one of the first and largest decentralized applications running on the Qtum blockchain.

This article will help serve as a foundational introduction to Bodhi, as well as its potential strategic advantages in the current cryptocurrency landscape. For further research, I recommend checking out the Bodhi whitepaper.

About Bodhi – The Basics

Bodhi seeks to become the world’s most popular prediction market platform. The advent and application of blockchain substantially increased the reach and efficacy of prediction market platforms, as well as the velocity of innovation.

An interesting component of Bodhi is that’s one of the first and largest DApps (decentralized apps) on the Qtum blockchain.

Why Qtum? The Bodhi team decided to go the Qtum route because it combines the Bitcoin Core infrastructure with the Ethereum Virtual Machine. This combination helps provide a modularity, stability, and interoperability for decentralized applications on the Qtum platform. Qtum also allows developers to build DApps that are executable on mobile devices, and that is still compatible with other major blockchain ecosystems.

Bodhi became the first DApp running on the Qtum testnet on December 26th, 2018, and the team plans to launch the product on the Qtum mainnet in February 2018.

A Rising Star in the Prediction Market Universe

Prediction markets are created for the purpose of trading the outcome of events. The concept borrows from the idea of crowdfunding a general perceived probability about certain outcomes. Prediction markets are used for everything from sports betting lines to strategic evaluations.

Prediction markets also lead to a phenomenon referred to as “The Wisdom of Crowds”, where a group of people with a broad range of experiences and opinions provide a more accurate prediction than a single individual. This “Wisdom”, however, is also prone to groupthink, peer pressure, bias, and panic, which could pose a significant threat to the accuracy of the prediction market.

[youtube https://www.youtube.com/watch?v=6k6eEn7SlNY]

Bodhi combines the concept of a prediction market with blockchain. This way, Bodhi is able to create the infrastructure for potentially tens of thousands of users to engage and place prediction bets, while also hedging against certain risks.

Bodhi, however, is not without its competition.

Augur, followed by Gnosis, currently lead Bodhi in terms of market cap, but the Bodhi whitepaper outlines several advantages over the two platforms. In order to fully grasp the advantages, let’s do a quick run-through of Augur and Gnosis.

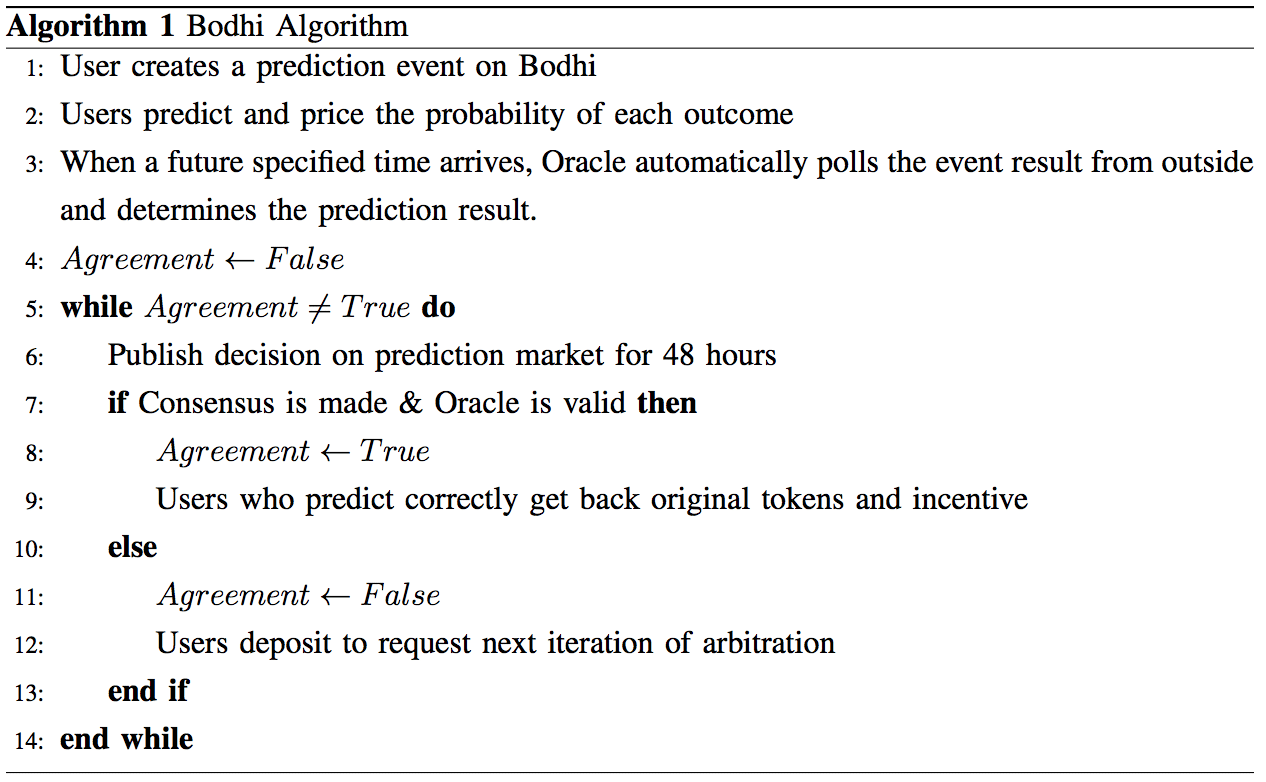

Augur allows users to create a prediction event using Ethereum smart contracts. This is followed by users prediction and pricing the probability of every outcome using the native tokens (REP). When the event finally happens, specific REP holders report the correct prediction result. The entire Augur system is built around REP holders, where the holders are responsible for maintenance and arbitration. However, this system has some scaling issues. REP holders are not only limited in number (whereas a much higher quantity of prediction events can be created), and also have different types of domain experience. As a core component of the Augur network, REP holder limitations lead to higher time-cists and a general lower efficiency due to the length of time it takes to reach consensus when a prediction event ends.

Gnosis also uses Ethereum smart contracts, but instead of token holders, it uses a centralized Oracle for judging the results. This helps address the efficiency of judgment. However, using a centralized Oracle also has its limitations. For example, if there were a single point of failure due to a malicious third party or server failure, all predictions would become locked and the Gnosis platform would lose some of its credibility.

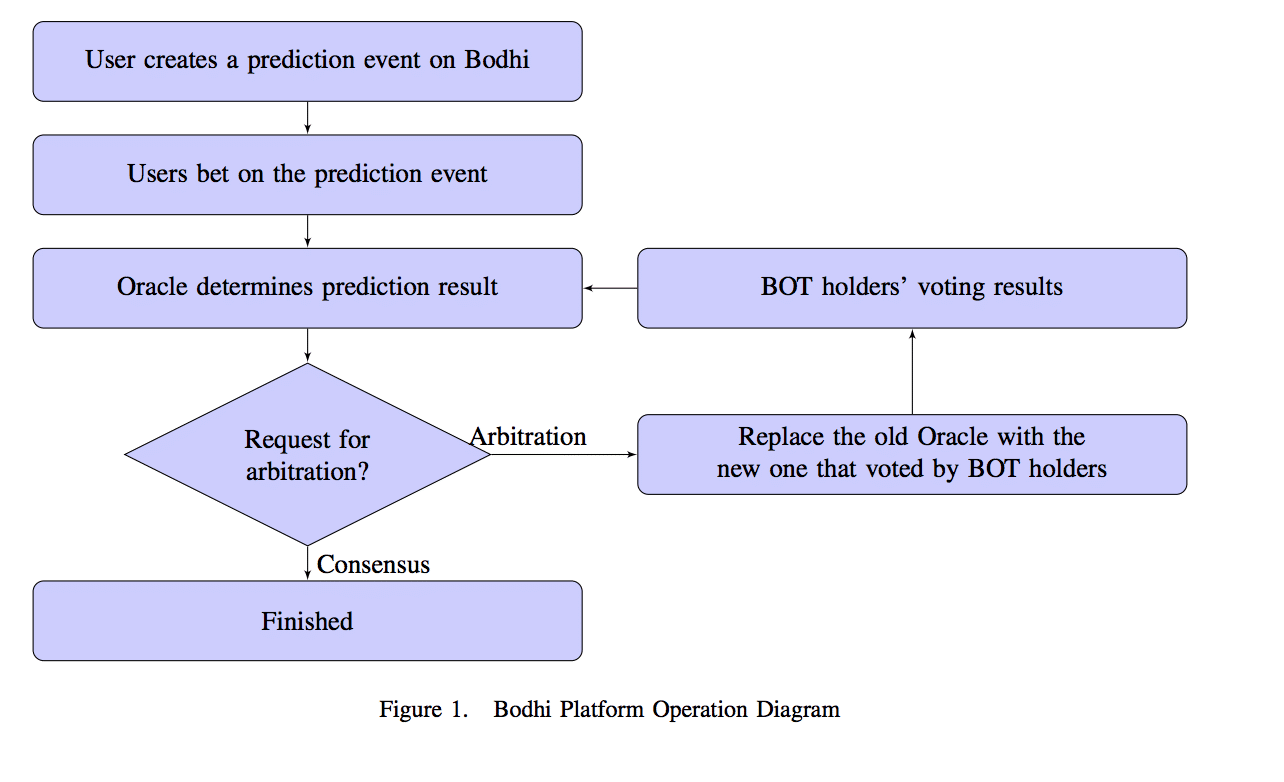

Bodhi’s competitors such as Augur and Gnosis also differ from Bodhi because they can’t revoke a wrong result when it happens, whereas Bodhi makes it possible to do so through a “replaceable oracle” scheme. This scheme allows the public to challenge and even revoke bet results set by single people. This essentially enables Bodhi to make a more autonomous and effective prediction market.

Bodhi utilizes a third-party Oracle to judge prediction results to hedge against the same consensus limitations on the Augur platform. Bodhi also enables BOT token holders to take over the voting process and make the final judgment in case the Oracle fails.

Bodhi Trading History

Bodhi has had several interesting points in its trading history.

After China issued a ban on ICOs in September, Bodhi refunded $12M in pre-sale tokens to its investors. Although this posed a significant threat to Bodhi’s existence, Bodhi can count itself as one of the few projects surviving the ban.

Bodhi was able to circumvent the ban by doing an initial exchange offering (IEO), which is regarded as the first of its kind. The team was able to raise $24M by listing on five different exchanges on November 20th, 2017.

https://files.coinmarketcap.com/static/widget/currency.js

Bodhi Team and Community

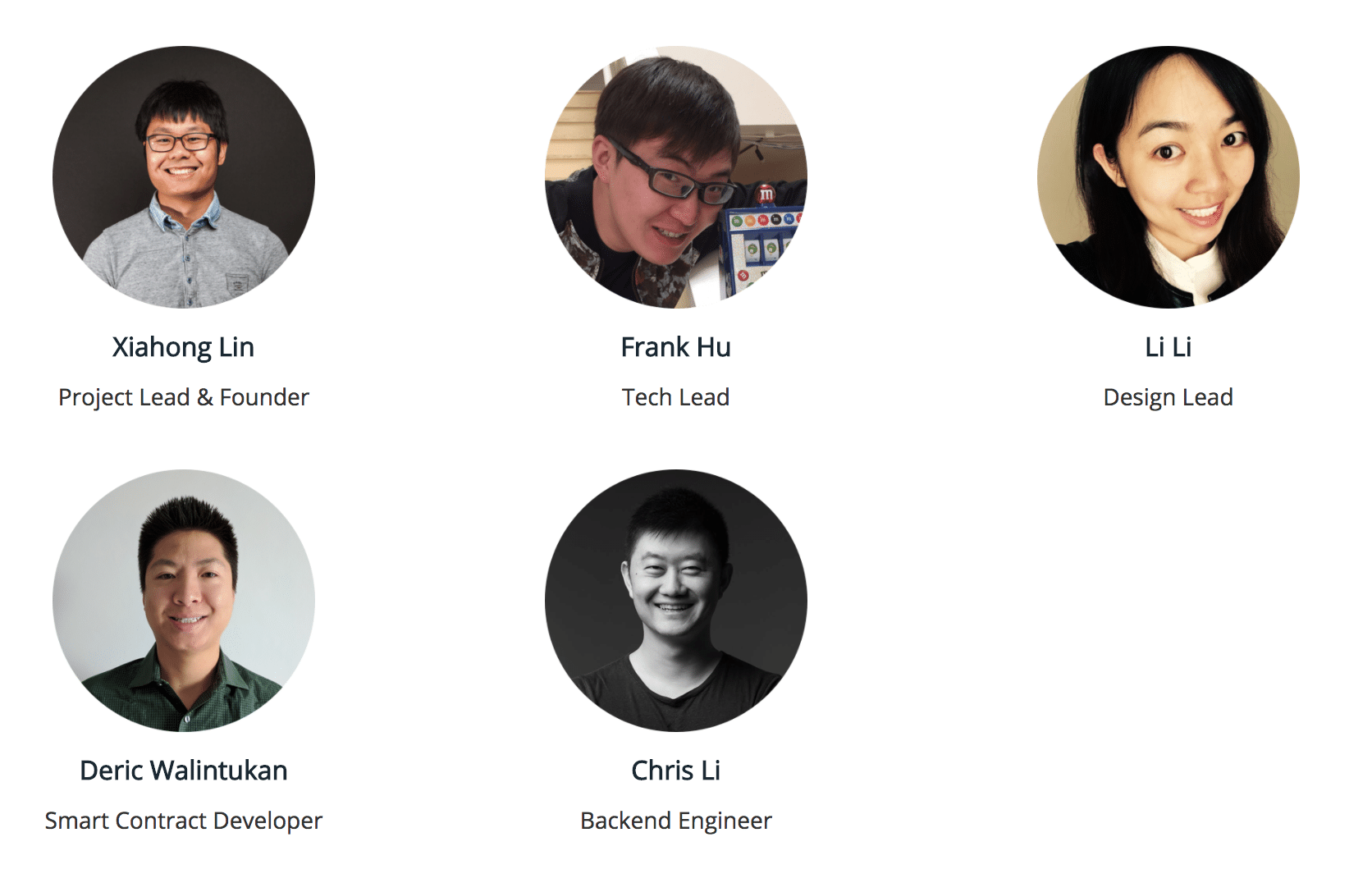

Bodhi’s team consists of Xiahong Lin, Frank Hu, Li Li, Deric Walintukan, and Chris Li. The current team totals ten members: four engineers, two designers, three marketing specialist, and one operation manager.

Founder Xiahong Lin has previously worked for Edmodo, Twitter, Tencent, with internship experience at Microsoft and IBM.

Focusing on the Chinese market, Bodhi is backed by a fairly vibrant Chinese community of over 15,000 members, the majority of which is in their WeChat group (Bodhi official WeChat account:bodhinetwork; Bodhi WeChat group access code:imbodhi). You can also find their community on Twitter and Telegram.

Bodhi is currently backed by Danhua Capital, InBlockchain, FBG, and Aware Capital.

Where Can You Buy Bodhi?

Bodhi is relatively difficult to get your hands on as it’s not listed on many popular exchanges such as Binance and Bittrex.

The whitepaper kicks off with a legal section stating that by accessing the whitepaper, you “acknowledge, understand and agree that you are not eligible to purchase any BOT if you are a citizen, resident or green card holder of the United States of America or a citizen or resident of the People’s Republic of China.”

Isn’t that beautiful – two often clashing countries are both not allowed into the party.

Bodhi is currently listed on Gate.io, Allcoin, Exx, Lbank, and BigOne.

Final Thoughts

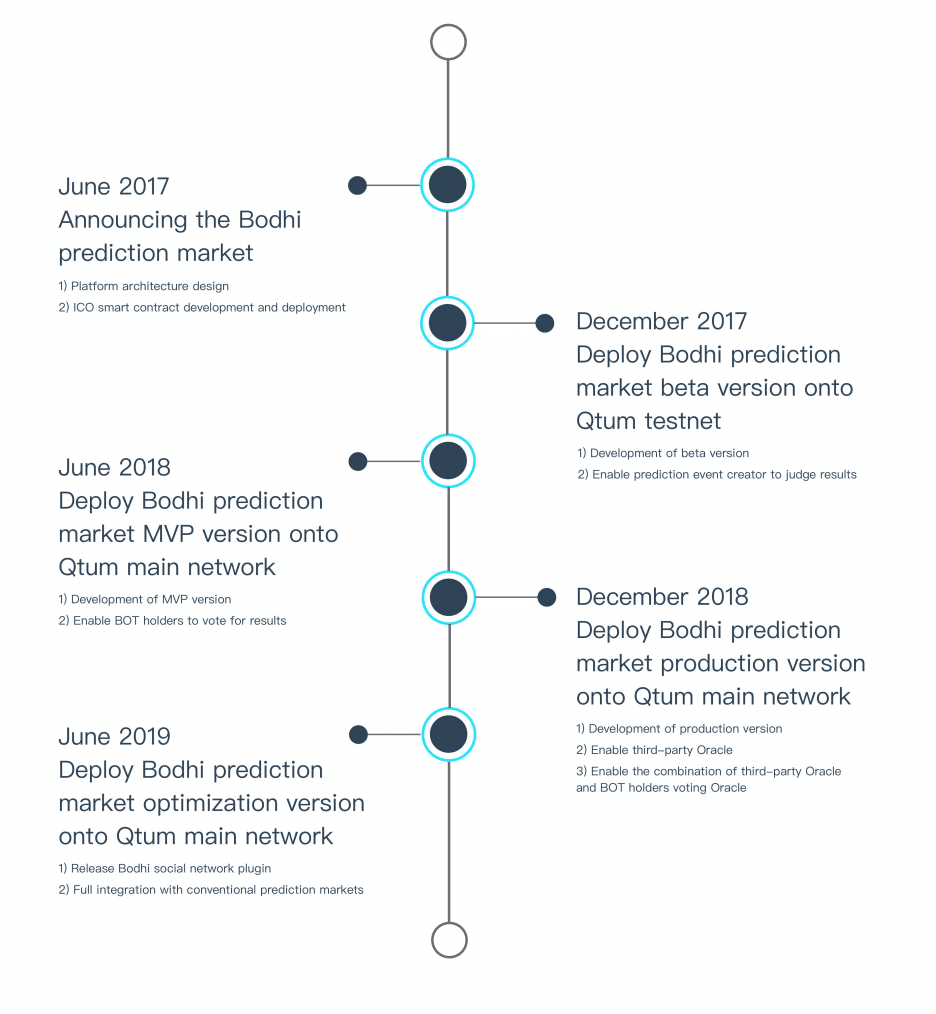

Bodhi ultimately presents a viable contender in the race to a highly effective and functional blockchain-based prediction market platforms. While we won’t see a Bodhi prediction market MVP until June 2018, we’ll likely start seeing Bodhi start making more waves in the cryptocurrency community.

You can see Bodhi’s Founder Xiahong Lin, along with speakers such as Brad Garlinghouse (Ripple) and Charlie Lee (Litecoin), at Blockchain Connect in San Francisco on January 16th, 2018. Get 30% the price with the code “coincentral”.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.