- Celsius vs. Linus: Key Information

- Company Bios: How Do They Stack Up?

- Feature #1: Interest Rates -- Who Has Better APY, Celsius or Linus?

- *BTC - 6.2% for the first two BTC, then 3.51%

- How Do Celsius and Linus Make Money?

- Feature #2: Payouts and Withdrawals

- Feature #3: Celsius vs. Linus Security

- Feature #4: Celsius vs. Linus Ease of Use

- Standout Features

- Promos and Bonuses

- The Court of Public Opinion: Celsius vs. Linus Reddit

- Customer Support

- Can You Trust Celsius and Linus?

- Celsius vs. Linus: Which is the Better Crypto Interest Account?

Celsius vs. Linus makes for an interesting comparison between two unique cryptocurrency interest accounts. Both platforms let you earn passive but not-risk-free income, but they accomplish this through distinct approaches.

Celsius accepts cryptocurrency deposits and allows for “in-kind” interest, and it also functions as a lending platform. On the other hand, Linus only accepts and pays out in USD, removing the complications of storing and moving cryptocurrency from the end-user.

Celsius is an established crypto lending platform that offers interest on popular crypto assets like Bitcoin and Ether. It has built a strong reputation due to its robust security features and community engagement.

Linus is a newcomer to the crypto interest space. It lets users deposit their USD to earn crypto-backed interest without having actually to hold any cryptocurrency. It’s a great fit for users who want a high-yield interest account without having to put up with the volatility of the crypto market.

The following review will highlight some of the key differences between two of the industry’s top cryptocurrency interest account options, Celsius vs. Linus, to help you decide which is right for you.

Celsius vs. Linus: Key Information

|

Celsius |

Linus |

|

|

Reviews |

Linus Review (Added soon!) |

|

|

Site Type |

Crypto lending app with borrowing and lending |

Blockchain-based high yield interest account |

|

Beginner Friendly |

Yes |

Yes |

|

Mobile App |

Yes |

In development |

|

Buy/Deposit Methods |

Crypto deposits, debit card, bank transfer |

Bank account transfer or debit card |

|

Sell/Withdrawal Methods |

External crypto wallet transfer |

Bank account transfer |

|

Available Cryptocurrencies |

Bitcoin, Ethereum, Link, and several others |

None |

|

Company Launch |

2017 |

2019 |

|

Location |

London, England |

Brooklyn, NY, USA |

|

Community Trust |

Great |

Still developing |

|

Security |

Good |

Okay |

|

Customer Support |

Great |

Good |

|

Verification Required |

Yes |

Yes |

|

Fees |

Excellent (there are none) |

Great |

|

Site |

Company Bios: How Do They Stack Up?

Linus was created in 2019 by Matt Nemer and Matt Hamilton. The two founders previously worked for companies like IBM and BTC, Inc. Linus doesn’t have any investors at the time of this writing as it’s still in the pre-seed phases of its growth trajectory.

On the other hand, Celsius has been around since 2017. It was created by Alex Mashinsky and Daniel Leon and has raised just under $100 million in funding in private rounds.

Moreover, Celsius boasts more than $16 billion in community assets under management and has paid its users more than $300 million in yield over the past 12 months.

Feature #1: Interest Rates — Who Has Better APY, Celsius or Linus?

Linus pays users in USD and only accepts USD. Its target market is people who don’t want to hold any crypto but still want to benefit from the higher yield interest accounts available to blockchain users.

That being said, here’s the APY that Linus can get you on your cash:

- 4.0% APY for $1.00 to $2,499.99

- 4.25% APY for $2,500 to $9,999.99

- 4.50% APY for $10,000+

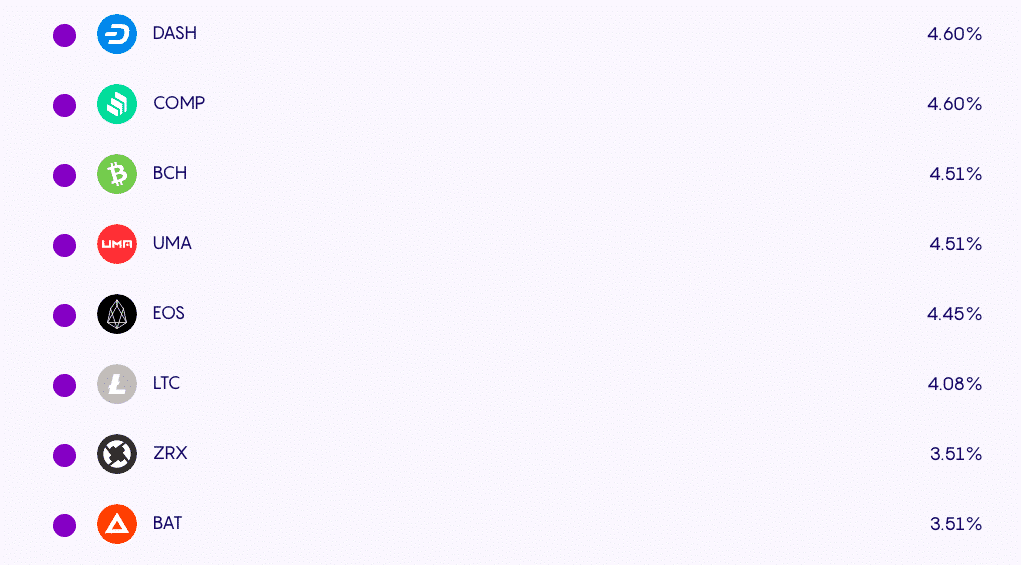

In contrast, Celsius offers flat-rate APYs based on the specific digital asset. These rates can fluctuate as often as weekly, which means the amount you can make from Celsius can vary.

As a point of comparison, here are Celsius’ rates as of the time of this writing:

*BTC – 6.2% for the first two BTC, then 3.51%

Here’s Celsius’s complete rate chart, including stablecoins, offers for international users, and more.

How Do Celsius and Linus Make Money?

Most cryptocurrency interest accounts make their money by offering lower APYs than what they can get for lending their users’ funds on the open market. Both Celsius and Linus follow this model, albeit in slightly different ways.

Celsius earns money by lending the funds that its users deposit to institutional and retail borrowers. The company aims to return 80% of revenues made from this to its users. The loans that Celsius gives out are over-collateralized, which means that the risk of default is relatively low.

Linus does things a bit differently. The company only accepts deposits in USD. It then converts these funds into stablecoins, which it uses to provide liquidity in Ethereum smart contracts.

However, Linus doesn’t disclose what percentage of its revenues it gives back to its users. The company’s APY currently caps out around 4.5%. That’s a good deal lower than many of the cryptocurrencies that Celsius offers interest on.

Celsius and Linus earn their money in similar ways. Nevertheless, Celsius gives a great percentage of its revenues back to its users, so it wins this category.

Feature #2: Payouts and Withdrawals

Linus’ payouts and withdrawals are pretty great. The money you deposit into a Linus account accrues interest daily, and you can withdraw it whenever you want, as many times as you want, without any fees.

Celsius is very similar in this regard and lets its users withdraw their funds at any time without any fee. However, there’s a soft cap on withdrawals of $50,000+ in a 24-hour period, and these large withdrawals can take up to 48 hours to process. Celsius distributes interest to its users every Monday.

Both Celsius and Linus offer solid payout and withdrawal features. However, interest on Linus accrues faster, and there are no withdrawal limits, which makes it the winner in this category.

Feature #3: Celsius vs. Linus Security

Celsius’ security features are similar to what its competitors offer. The company uses something called multiparty computation (MPC) to secure its users’ funds.

Moreover, the Celsius app has a ton of user-facing security features, like:

- 2-factor authentication

- PIN

- Changing wallet addresses requires email confirmation.

- Withdrawing more than $150,000 requires manual verification

- Photo and video certification

- Biometric security

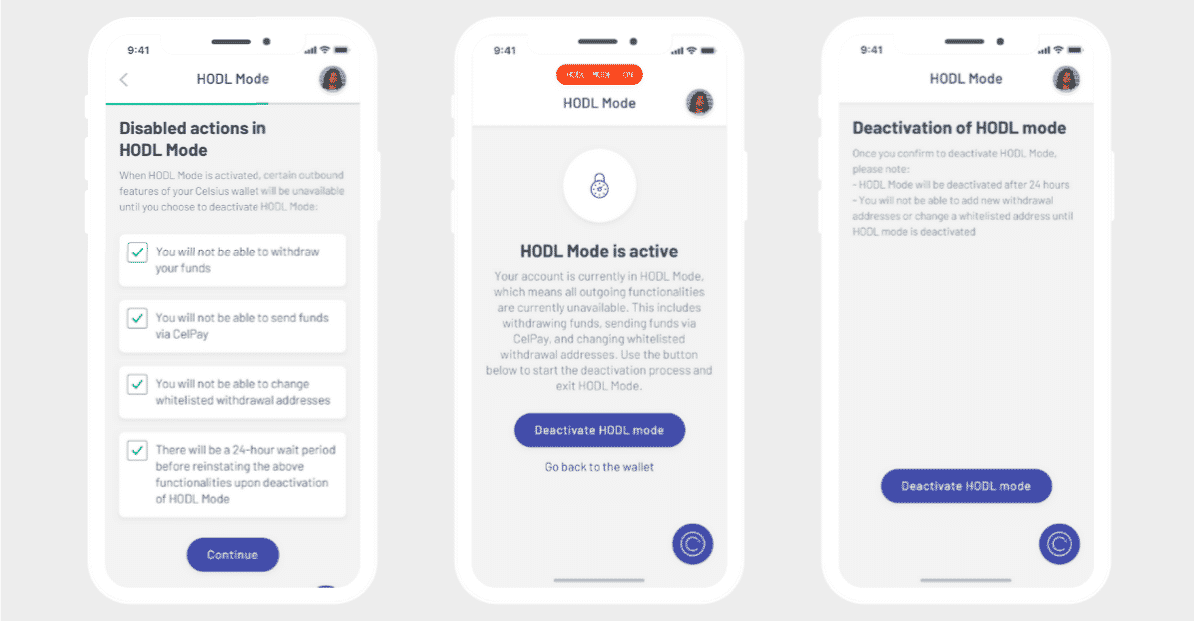

Another cool security feature that Celsius offers is HODL Mode. Essentially, it makes it impossible for users to withdraw funds without first completing a 24-hour waiting period. That gives you a ton of time to respond in the event of a hack.

Linus’ security features are still a work-in-progress. The company claims to protect its users’ funds with digital asset collateral and third-party insurance coverage. So far, Linus hasn’t shared any details about these features, so it isn’t easy to gauge the quality of its security.

Celsius wins this round. Its substantial security features look even better when compared to Linus’ still-in-development ones.

Feature #4: Celsius vs. Linus Ease of Use

Both Linus and Celsius are built to make earning easier for users, but Linus’ no-crypto approach means that its users simply have to make a transfer or deposit to begin earning. Linus is a great fit for people who aren’t very familiar with cryptocurrency or aren’t interested in buying or holding it long-term. Its main benefit is letting these people access blockchain-based high yield interest accounts by just making a cash deposit.

Celsius’ mobile app is great for people who want to manage their accounts on the go, and it has a web app for people who prefer managing their money on a desktop or laptop. Both platforms let users make deposits with bank accounts, debit cards, and external crypto wallets.

Standout Features

Linus’ most impressive feature is the service that it’s bringing to the market. It gives users access to high yield opportunities on the Ethereum blockchain without having to own any crypto. There are very few companies (if any) that are currently operating in the same space.

Celsius’ main standout feature is its native cryptocurrency CEL. Users who choose to earn interest with CEL can qualify for up to 25% discounts on loan interest payments. That’s a massive savings opportunity that could make Celsius one of the cheapest ways to borrow money with crypto collateral.

Promos and Bonuses

Celsius and Linus both offer frequent bonuses ad promotions, such as Celsius’ $50 sign-up bonus and $40 reward for each referral they make. Celsius’ loyalty program also offers users rewards for holding assets in CEL.

Linus offers a $20 sign-up bonus and frequently creates new promotions, some of which have included a referral program and bonuses on transactions.

The Court of Public Opinion: Celsius vs. Linus Reddit

On Reddit, Celsius reviews are flooded with temperature jokes.

However, some Redditors have left serious reviews of the platform. Most seem to view Celsius as a solid crypto interest account, especially valuing its yield-earning opportunities and no-fee approach.

Others note that there are some risks to using any crypto interest account. Still, most of these Redditors note that Celsius isn’t inherently riskier than any of its competitors.

Linus hasn’t received very many Reddit reviews as it’s a relatively new company. Some Redditors have criticized its low APY rates for USD. While it’s true that Linus’ APY is below what users can get by accessing Ethereum smart contracts and DeFi platforms themselves, Linus is meant for people who don’t want to be on the lookout for yield opportunities themselves constantly. In that context, Linus makes much more sense.

Customer Support

Linus has an online FAQ page you can check out to get answers to common questions. You can also email a support agent directly at [email protected].

You can get in touch with Celsius by filling out a contact form on the company’s website. You also have the option of calling their U.S. phone number at 201-824-2888.

Can You Trust Celsius and Linus?

One of the largest crypto interest account providers, Celsius is trusted by over 800,000 users. It’s gone to great lengths to ensure your assets’ safety and offers many security features to help you keep your coins safe.

That being said, Celsius’ third-party marketing server was compromised in 2021. Hackers gained access to a partial Celsius customer list and attempted to send out phishing emails. We should note that users who followed good security practices were never at risk of losing funds even when this happened.

Linus is relatively new to the crypto marketplace. As such, it hasn’t gotten the opportunity to build much of a reputation for itself yet.

However, it completed its public beta without being labeled a scam or losing users’ funds.

Celsius vs. Linus: Which is the Better Crypto Interest Account?

Celsius and Linus address two separate markets.

Celsius is one of the top crypto interest account platforms for users who want to hold crypto assets and earn interest on them while they do. If that describes you, then Celsius will be a better fit for you than Linus.

Linus doesn’t even offer interest on crypto assets. Instead, its main purpose is to give users who don’t want to hold crypto access to high-yield savings opportunities through Ethereum smart contracts.

The bottom line:

- Use Celsius if you want to earn interest on your crypto. It has some of the highest APYs on crypto.

- Use Linus if you want to earn crypto-backed interest on your USD without the difficulties of transporting or holding cryptocurrency.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.