- Celsius vs. Nexo Key Information

- Feature #1: Interest Rates — Who Has Better APY, Celsius or Nexo?

- How Do Celsius and Nexo Make Money?

- Feature #2: Payouts and Withdrawals

- Feature #3: Security

- Feature #4: Promos and Bonuses

- Feature #5: Ease of Use

- Celsius vs. Nexo: Standout Features

- Customer Service

- The Court of Public Opinion: Celsius vs. Nexo Reddit

- Celsius vs. Nexo Final Thoughts: Which is the Best Crypto Interest Account?

Celsius vs. Nexo is a comparison you may have to make if you’re looking to earn relatively passive APY on your cryptocurrency assets. Celsius and Nexo are both UK-based companies and are both actively competing for their slice of the global market of cryptocurrency holders.

The following Celsius vs. Nexo review examines the nuances of each platform, standout features, interest offerings, security, and community trust.

Founded in 2017, Celsius is a London-based company with $20.6B+ in assets under management from 1M+ users. Celsius users in the US can earn 6.20% APY on up to 1 BTC and 3.51% on deposits above that. The company offers 5.35% APY on up to 100 ETH, then 5.05%. Celsius users can also earn 3% on LINK, 4.08% on LTC, 8.88% on GUSD and USDC, and 5.50% on PAXG.

Celsius users outside the US can earn APY more across the board if they choose to receive their interest earnings in Celsius’ native token, CEL.

Nexo is also based in London and was founded in 2017. It has over $15 billion in AUM from 2M+ users, who earn 6% APY on BTC, ETH, LINK, and LTC. The company also offers 10% on DAI and USDC and 6% on PAXG.

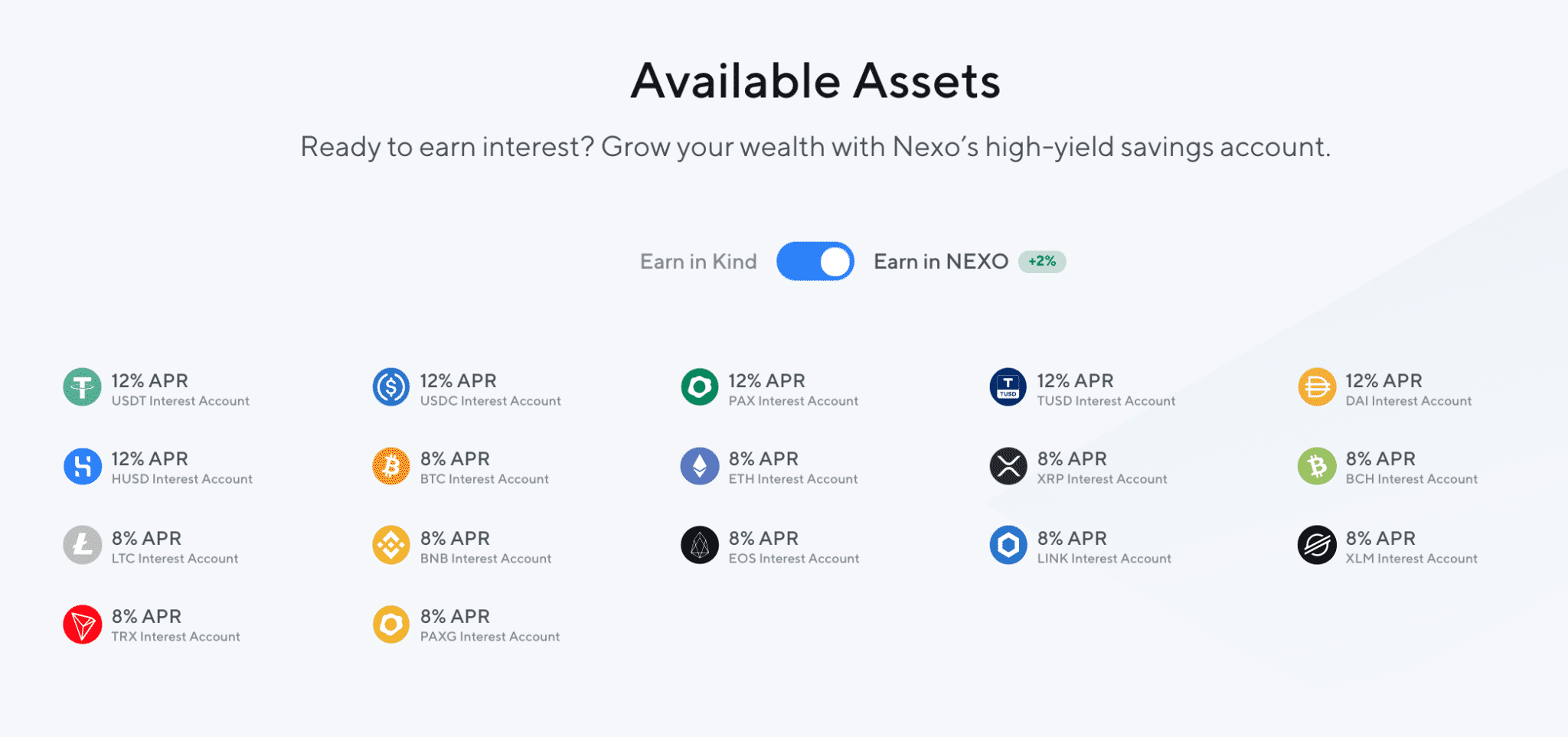

Nexo users can earn 2% more in APY across the board if they choose to receive interest in Nexo’s native token, NEXO.

Both Celsius and Nexo are accessible via web and mobile apps.

So, both platforms have strikingly similar value propositions, but there are some distinctions worth considering.

Celsius vs. Nexo?– which one is right for you? Let’s dig in.

Celsius vs. Nexo Key Information

Item |

Celsius |

Nexo |

|

Location |

London, UK |

London, UK |

|

Beginner-Friendly |

Yes |

Yes |

|

Mobile App |

Yes, on Android and iOS |

Yes, on Android and iOS |

|

Available Cryptocurrencies |

40+ coins including BTC, ETH, LTC, GUSD and USDC |

20+ coins including BTC, ETH, LTC, DAI, and USDC; 40+ fiat currencies including EUR, USD |

|

Company Launch |

2017 |

2017 |

|

Community Trust |

Great |

Good |

|

Security |

Great |

Great |

|

Customer Support |

Great |

Good |

|

Fees |

Low |

Low |

|

Reviews |

||

|

Site/Promotions and Signup Bonuses |

Get $10 when signing up and depositing $100 or more on Nexo. |

Feature #1: Interest Rates — Who Has Better APY, Celsius or Nexo?

Bitcoin

Celsius offers tiered rates on BTC. Users can earn:

- 6.20% on 0 – 1 BTC

- 3.51% on >1 BTC

Nexo’s Bitcoin rates are a flat 6% APY for users in the US, and 8% for international users who receive their interest in NEXO.

Ethereum

Celsius offers:

- 5.35% on 0 – 100 ETH

- 3.05% on 100+ ETH

Nexo’s APY rates are 6% for US users, and 8% for international users earning in Nexo.

Stablecoins

Celsius offers 8.8% APY on TUSD, GUSD, PAX, USDC, USDT ERC20, TGBP, TAUD, THKD, TCAD, BUSD, ZUSD, and 4.60% on MCDAI.

On the flip side, Nexo offers 10% APY on USDT, DAI, USDC, TUSD, GBPX, HUSD, and USDX, and 6% on PAXG.

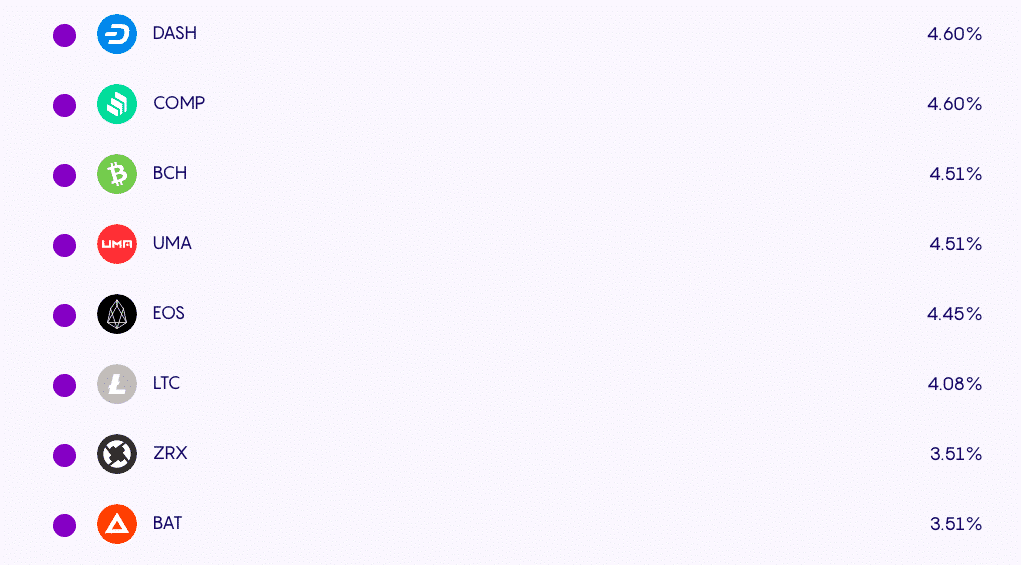

Here are Celsius rates on cryptocurrencies;

Celsius offers interest on a wide variety of digital assets, including DeFi tokens Aave and Compound.

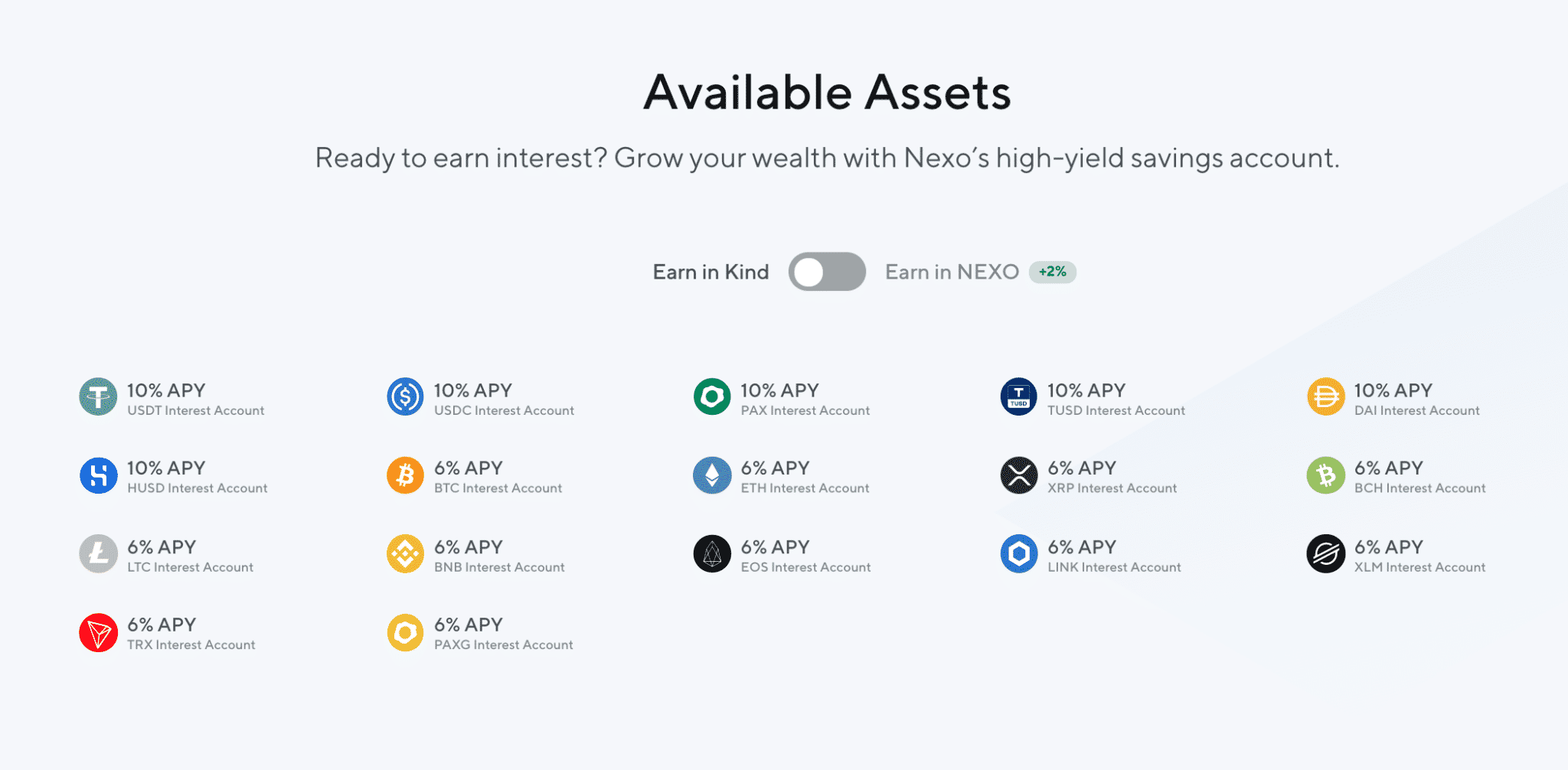

Here are Nexo’s rates when users choose to earn their interest in the currency deposited, or “In-Kind.”

Here are its rates when users earn in NEXO.

Winner: Nexo offers higher rates on Bitcoin, Ether, altcoins, and stablecoins across the board, earning it the win in this category. It is worth noting that Celsius does have a wider range of supported assets.

How Do Celsius and Nexo Make Money?

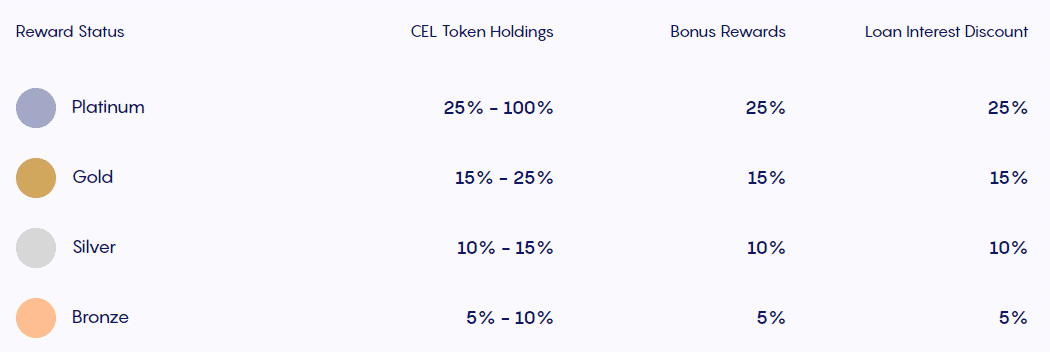

Celsius makes money by providing loans to corporate institutions and exchanges. The company redistributes revenue to its users via rewards depending on their loyalty tier (or the amount of CEL they hold) and has paid upwards of $508M in rewards to its users in the past year.

To secure these loans, Celsius requires users to hold collateral of at least 50% LTV (loan-to-value). In other words, to get a loan, borrowers must hold crypto assets at least twice the value of the sum they’d like to borrow within a Celsius account. This collateral can go up to 150% LTV.

Like Celsius, Nexo makes money from the difference between what it pays the users it borrows from (or offers interest to) and what it charges borrowers. The platform makes loans to both its consumers and institutional borrowers.

Nexo shares 30% of profits to NEXO holders as dividends. Since 2017, Nexo has paid out over $29.8M as dividends to its token holders.

Consumers can borrow from Nexo using credit lines accessible through a fiat transfer or the Nexo card. These loans are collateralized at a minimum of 50% LTV.

Feature #2: Payouts and Withdrawals

Celsius lets users withdraw their funds at any time without fees. However, it has a soft cap on withdrawals of $50,000+ within 24 hours, and larger withdrawals can take up to 48 hours to process. Celsius interest is compounded each Monday.

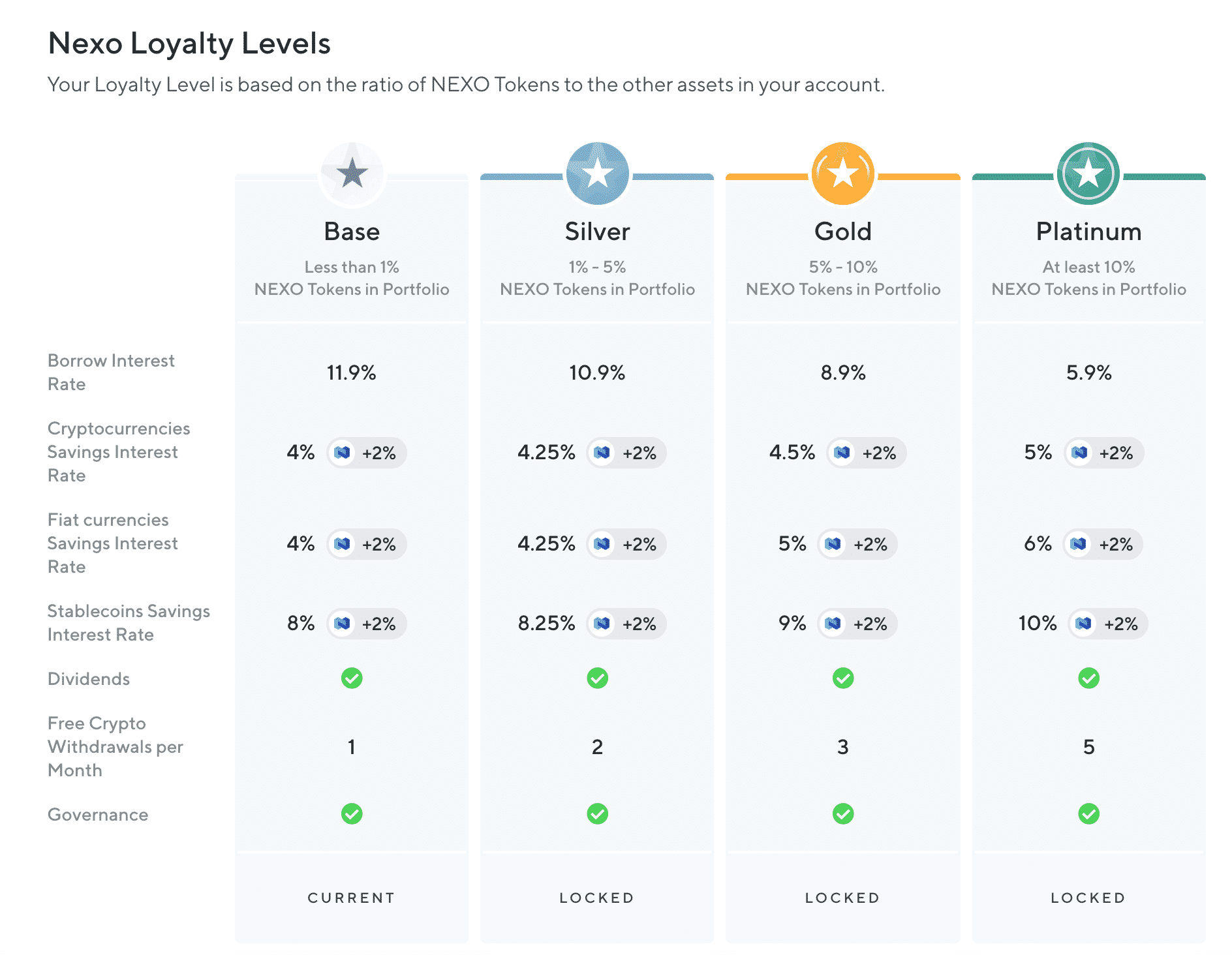

On Nexo, interest is compounded daily, and users can make 1-5 free withdrawals depending on their loyalty tier or the amount of NEXO they hold. Nexo users can also make unlimited free fiat deposits, transfers, and withdrawals.

Winner: Celsius. Users can make unlimited withdrawals and not pay any withdrawal, transfer, transaction, or early termination fees.

Feature #3: Security

Celsius and Nexo are both custodial platforms, meaning they take possession of their users’ private keys. Crypto loans and deposits cannot be FDIC insured, and one should adequately research the risks of using crypto interest products.

However, both companies have demonstrated a high degree of security when it comes to ensuring deposits are never within reach of prying hacker hands.

Platform Safety

Celsius has a slew of user-facing security features, such as 2-factor authentication, a pin, biometric security, and some confirmation features like email verification when changing your wallet address and manual verification when attempting to withdraw assets worth over $150,000.

Celsius also has an inbuilt security feature called HODL mode. In HODL mode, users must complete a 24-hour waiting period before their withdrawals are confirmed, so there’s more time for you (and Celsius) to respond if your account has been hacked.

Nexo’s platform employs security procedures including 2FA, a password, biometric security, and email confirmation features.

Fund Safety

Celsius keeps user assets in third-party custodians Fireblocks and PrimeTrust.

Cryptocurrency assets on platforms like Celsius are often on the move to be loaned and received to generate interest; the above insurance doesn’t cover your assets when they’re loaned to Celsius creditors to generate yield.

In April 2021, Celsius’ email distribution servers were hacked, and the contact info of some performed an email and SMS phishing attack that resulted in the loss of some users’ funds.

In a blog post, CEO Alex Mashinsky stated, “ We have always communicated to our customers and will continue to reinforce that Celsius will never ask for passwords, private keys, seed phrases, and other confidential user credentials.”

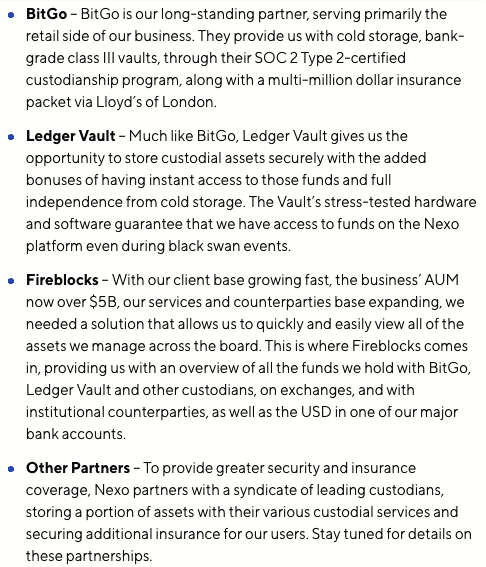

On the flip side, Nexo keeps user assets safe in cold wallets secured with multi-signatures, with private keys stored offline in Class III bank vaults for physical protection. This substantial protection is possible through several custodians. Here’s a breakdown;

Again, Nexo’s user assets are insured by its custodians. This insurance comes up to around $375 million, which is only about 3% of Nexo’s total AUM.

As of this writing, Nexo has never been hacked.

Winner: Celsius gives its users many options to keep their accounts safe. Its extensive user-side protection against hacks gives it the win in this section, though Nexo’s ample protection against custodial hacks is worth noting.

Feature #4: Promos and Bonuses

CoinCentral readers can earn up to $50 in BTC by signing up for a Celsius account and making a deposit of up to $100,000. The company also offers up to $50 on each successful referral.

CoinCentral readers can get $10 when depositing $100 or more on Nexo for the first time.

Feature #5: Ease of Use

Both Celsius and Nexo are beginner-friendly and accessible via web, iOS, and Android apps.

Celsius vs. Nexo: Standout Features

Celsius’ main standout features include its token CEL. Users who choose to earn interest with CEL can qualify for up to 25% discounts on loan interest payments.

Celsius’ HODL Mode is also pretty neat. By letting users disable any outgoing activity on their account, Celsius helps people who don’t make frequent withdrawals double their protection. Celsius’ CelPay, is a handy inbuilt crypto payment feature that lets users make purchases by transferring crypto from their accounts.

Nexo’s standout features include its exchange, which lets users swap seamlessly between 100+ crypto and fiat pairs. Its card is accepted by over 40M merchants worldwide and lets users receive instant 2% cashback with no monthly or annual fees.

Holders of the Nexo token also earn some valuable perks, like higher APY rates and reduced rates on crypto loans.

Customer Service

Celsius has a dedicated Help Center containing FAQs on deposits, withdrawals, and security. Users can also submit a help request and receive support via email.

Nexo also maintains detailed FAQs in its Help Center, and users can access 24/7 support.

The Court of Public Opinion: Celsius vs. Nexo Reddit

Support for both Nexo and Celsius is immediately apparent on Reddit. Users favor both companies for their interest rates, but support leans towards Celsius for its perceived transparency and openness. Generally, most Redditors advise that users diversify by using both platforms.

Celsius vs. Nexo Final Thoughts: Which is the Best Crypto Interest Account?

It’s a very close race between Celsius and Nexo for the best cryptocurrency interest account.

Celsius lets users earn on 40+ cryptocurrencies, with up to 6.20% APY on Bitcoin, up to 5.35% APY on Ether, and 8.8% APY on most stablecoins, including USDC, USDT, and GUSD.

On the flip side, Nexo users can earn 6% on Bitcoin and Ether and 10% APY on stablecoins like USDT, BUSD, USDC, and more.

Celsius takes several user-side precautions such as HODL mode.

Nexo’s expansive fund safety measures mean that assets kept in its custody seem relatively secure from hacks.

Nexo’s 24/7 customer support and higher rates on cryptocurrencies (particularly through its loyalty program) may attract potential users.

However, Celsius wins in this review with a broader amount of supported assets, and well-thought-out user-side protection features.

CoinCentral readers can get up to $50 in BTC when they sign up for a Celsius account, and get $50 by referring a friend to the platform.

CoinCentral readers can get $10 when depositing $100 or more on Nexo for the first time.

For a deeper dive, we suggest reading our individual Celsius review and Nexo reviews.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.