- The Nexo Cryptocurrency Interest Account

- How Does Nexo Keep Its Funds Safe?

- About Nexo: Company Profile

- Is Nexo Legit?

- Is Nexo Safe?

- How Does Nexo Make Money?

- Is Nexo DeFi?

- Nexo Sign Up Bonus

- Final Thoughts: Is Nexo Legit and Worth Your Time?

Nexo is a cryptocurrency interest account and lending platform that offers between 6% and 12% APY for a variety of digital assets, including BTC, ETH, LTC, BCH, EOS, XLM, TRX, and XRP. It’s a unique cryptocurrency interest account offering because it offers daily payouts, as well as upwards of 12% for popular fiat currencies like USD, EUR, and GBP for international users.

Nexo’s home page boasts $12 Billion Assets Under Management for over one million users, making it one of the largest crypto interest account platforms on market.

The following Nexo review will explore its company history, interest account, safety precautions, and an overall analysis of the company’s role in the cryptocurrency industry.

Current Nexo Promo: CoinCentral readers can get $10 when signing up and depositing $100 or more on Nexo.

The Nexo Cryptocurrency Interest Account

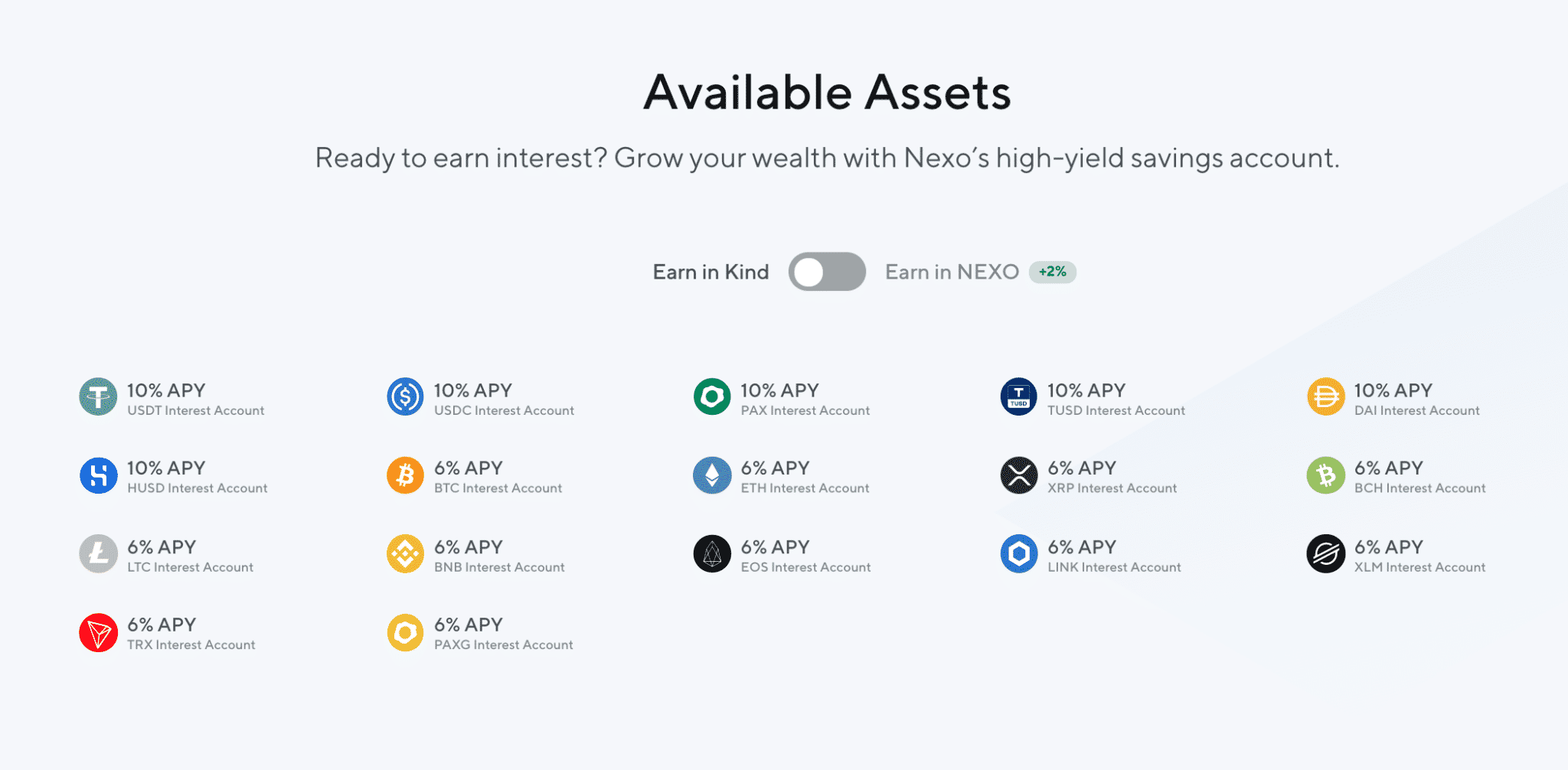

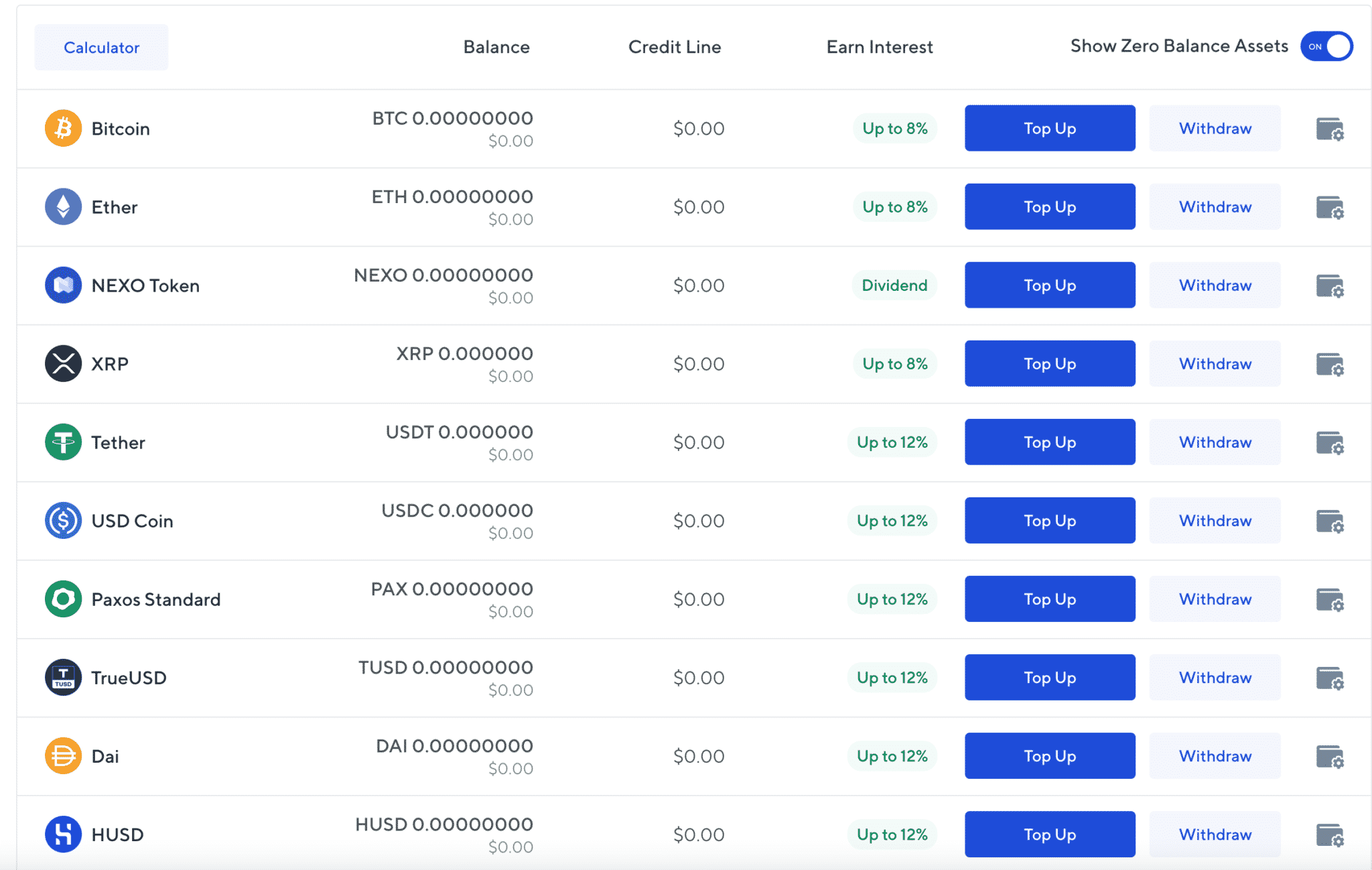

Users can earn 10% on stablecoins like USDT, USDC, PAX, TUSD, DAI, HUSD, and 6% on BTC, BNB, ETH, XRP, LINK, BCH, LTC, TRX, PAXG, and XLM if they elect the “Earn in Kind” option. Earning in Kind means that users will earn their interest in the base currency; BTC deposits will earn in BTC.

- NEXO APY when Earn in Kind option is selected.

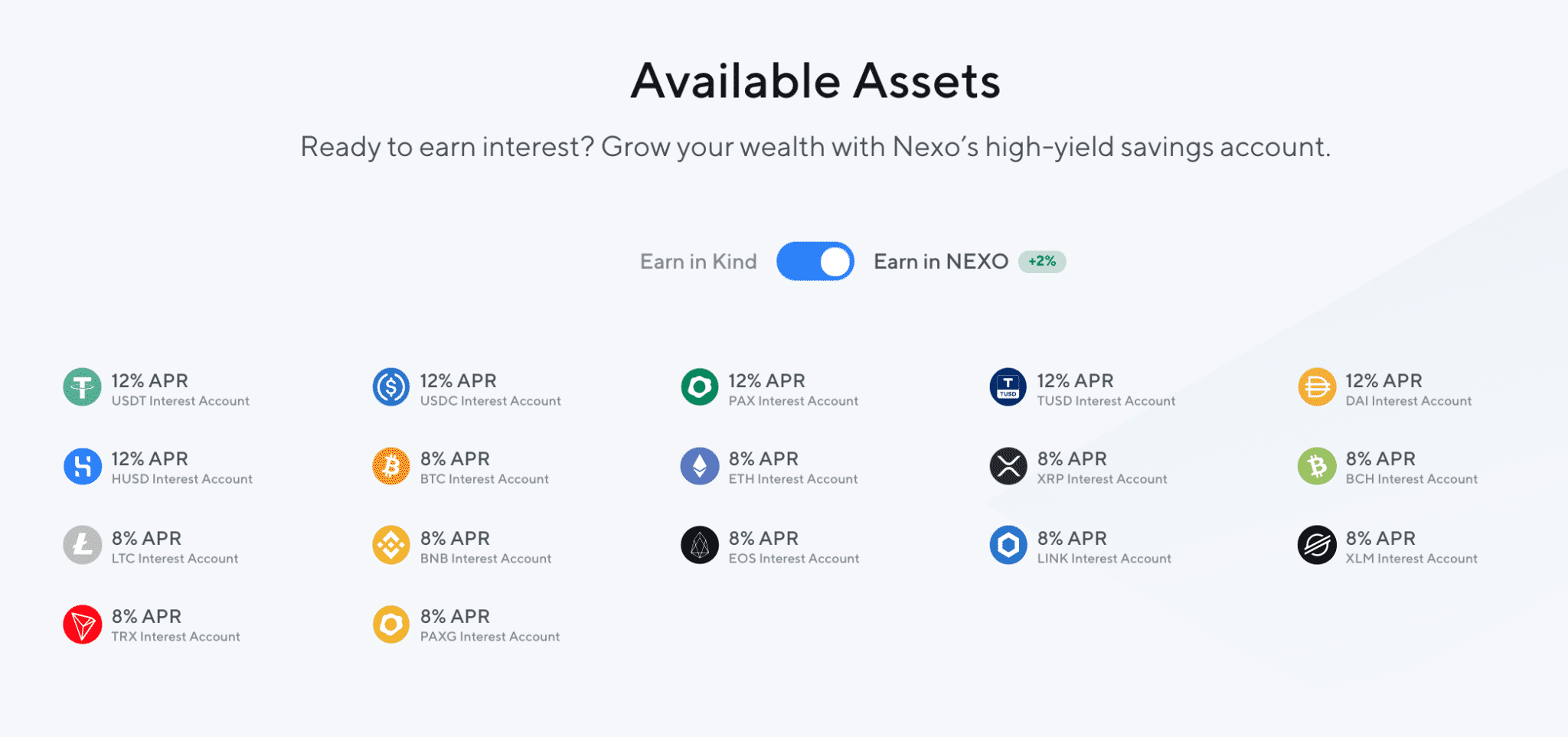

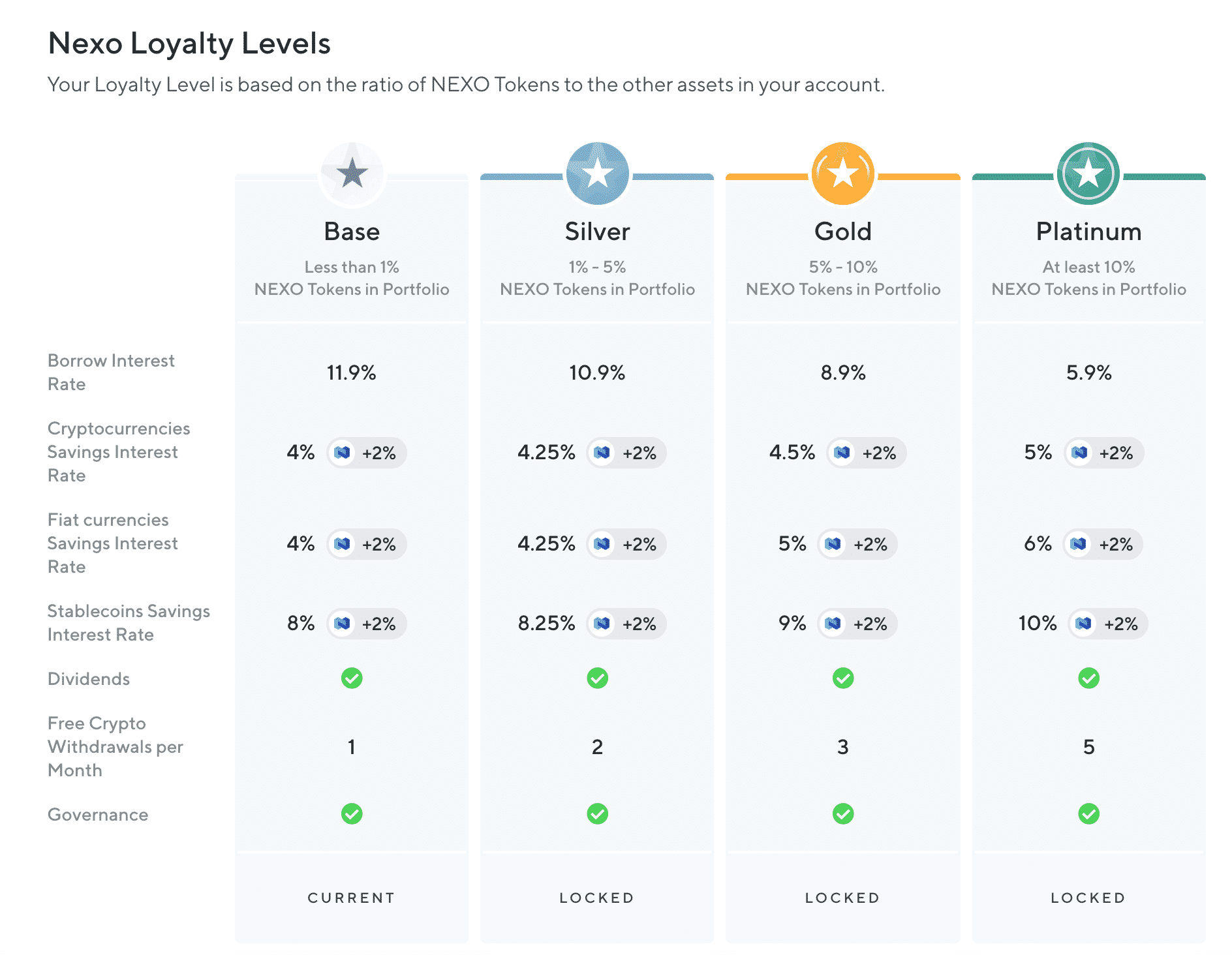

If users elect to Earn in NEXO, Nexo’s native token, their interest rates increase by 2% across the board.

- NEXO APY when Earn in Nexo option is selected

What Does the NEXO Token Do?

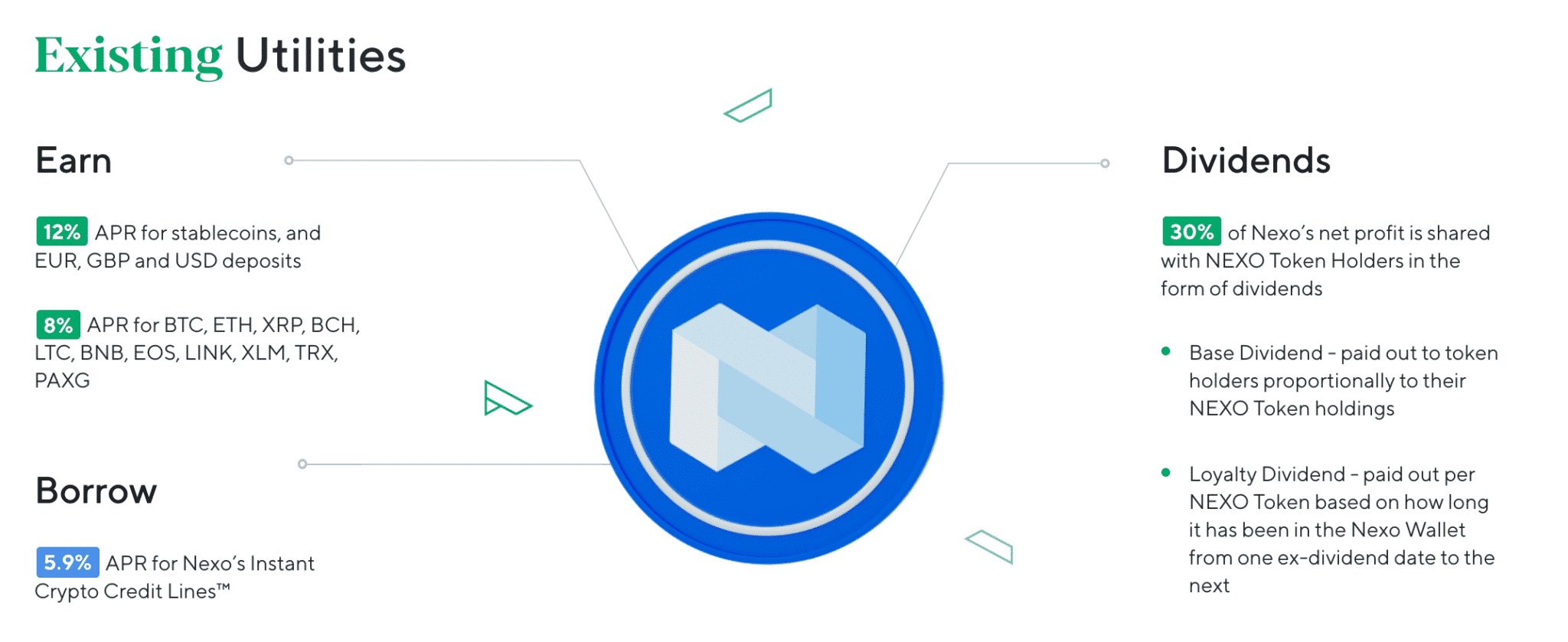

NEXO was created during the ICO, and distributed to the team and early adopters. The firm shares up to 30% of its profits with NEXO holders.

The NEXO token underpins the loan and deposit ecosystem; holding the token entitles buyers to a 30% share of company profits, like a dividend. Nexo claims it has paid over $9 million to tokenholders since 2018.

- Nexo token functionality.

The token also has a few benefits for cryptocurrency interest account customers. If holding NEXO, users can:

- Earn an additional 2% APY on their deposits, bringing stablecoins up to 12% and other cryptocurrencies to 8%.

- Borrow 5.9% for Nexo’s Instant Crypto Credit Lines.

Other cryptocurrency interest account platforms have similar tokens: Celsius has CEL, Crypto.com has CRO. They seem to be a means to anchor and incentivize early adopters to use the platform and hold the token.

Is the NEXO Token a Good Buy?

NEXO’s total supply is pegged to 1 billion tokens, currently, 560 million are in circulation. The token price bounced around $0.09 and $0.50 for the first three years of its existence but exploded to $3.60+ in 2021.

This Nexo review won’t provide investment advice, but it’s worth considering the volatility of the token compared to the longevity of the company. The NEXO token launched right after the 2017 bull market, but saw its sharpest gain in 2021, alongside the 2021 bull run.

Whether or not NEXO is a good buy may come down to whether or not you plan to hold the token to receive company profits or increase your APY in the interest account– outside of pure speculation, of course.

- Nexo token perks

How Does Nexo Keep Its Funds Safe?

Nexo acts as the custodian for all deposits, meaning that the company stores your digital assets. It does so via a partnership with cryptocurrency custodial solution BitGo.

According to Nexo’s Terms and Conditions, Nexo’s wallet services are provided “as is,” and the company’s liability limitations protect it from hacks, tampering, or computer virus transmissions.

These liability limitations are pretty standard among cryptocurrency interest account platforms, as many of them are custodian platforms. That being said, these companies often partner with a dedicated custodian solution specifically designed for keeping user funds safe.

For example, BlockFi uses cryptocurrency exchange Gemini as its custodian.

Nexo’s assets are stored in cold wallets secured with multi-signatures, and the private keys are stored offline (via BitGo) locked in Class III bank vaults for physical protection. These protections given the security of the platform some weight in our Nexo review.

Through its partnerships with BitGo and Ledger Vault, Nexo’s deposits are covered by $375 million in insurance protection.

Before breathing a sigh of relief, remember that Nexo claims $12B in assets under management. It’s unclear what percentage is kept in cold storage and insured, but mathematically Nexo’s insurance would cover about 3% of funds if everything were lost in some doomsday-esque situation.

It’s worth noting that insurance on cryptocurrency assets is still very new, and few platforms offer insurance comparable to Nexo, if any. This is why these types of accounts are called cryptocurrency interest accounts and not cryptocurrency savings accounts– neither your principal nor your interest is guaranteed.

So, are your funds safe on Nexo?

Nexo’s security infrastructure is ISO/IEC 27001:2013 certified. So, your funds are probably safe on Nexo; deposits are likely as safe on Nexo as competitors like BlockFi and Celsius. However, cryptocurrency interest accounts offer a unique set of risks that shouldn’t be ignored. Do your research, speak with your licensed financial advisor.

About Nexo: Company Profile

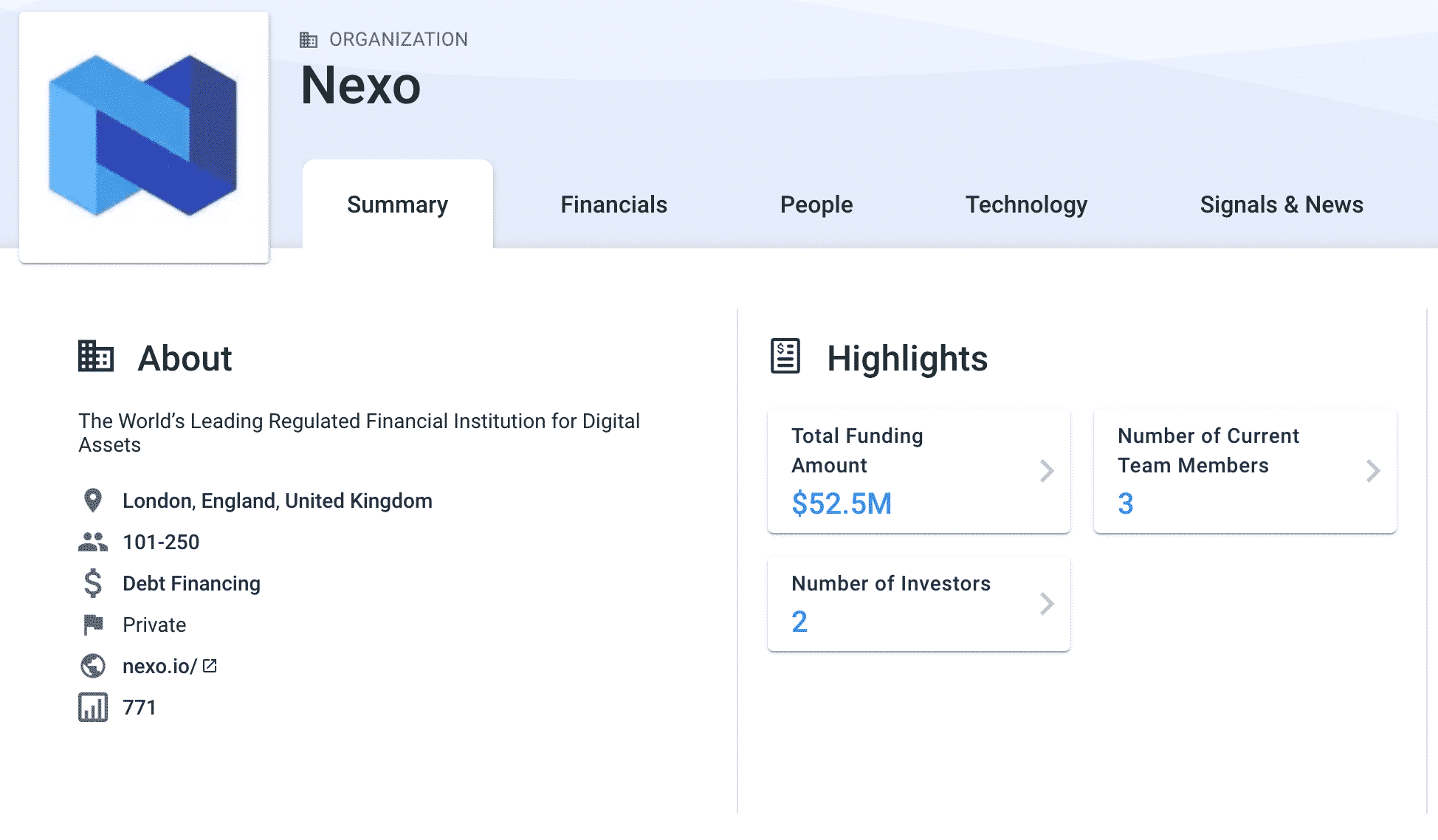

Nexo was founded in 2017 by Antoni Trenchev, Georgi Shulev, and Kosta Kantchev, three Bulgarian founders with experience with various financial institutions around Europe. The company is registered in London, England.

Nexo raised $52.5 million in two funding rounds, counting two investors: Arrington XRP Capital and Erhan Bilici. The platform is available in 200 jurisdictions, claiming over 1 million customers and $12B AUM.

- Nexo on Crunchbase

Nexo’s roots are intertwined with another Bulgarian Fintech startup, Credissimo, a fast-loan company that primarily operates in Europe. The company previously IPO’d on the Bulgarian Stock Exchange, but was delisted for unconfirmed reasons. A Reddit post speculates the founding team found being a public company was “too burdensome” and bought out the public shareholders to take the company private again.

An early version of Nexo whitepaper points to its Credissimo connection, but it has since removed mention:

“Nexo is powered by Credissimo, a leading FinTech Group serving millions of people across Europe for over 10 years. Credissimo has always operated under the highest regulatory requirements and strictest supervision by multiple European Banking and Financial Services Regulators. Now, the same Team and its Board of Advisors, empowered by the ever-growing community of Nexo supporters and enormous demand for the Instant Crypto-backed Loans, are unlocking the value of digital assets in a rapidly expanding token economy that will alter the very fabric of a $5 trillion dollar market.”

Kosta Kantchev is still listed as a Board Member for the project.

Is Nexo Legit?

Nexo’s longevity in the space has earned it some credit towards being a legitimate cryptocurrency interest account pioneer.

Nexo’s cryptocurrency interest account rates are competitive with BlockFi, Celsius, and Crypto.com.

However, Nexo has a streak of poor customer service; several Reddit threads and Twitter posts request more transparency or involvement from the company’s leadership teams in addressing customer concerns.

The elephant in the room for Nexo (and to be fair, a good chunk of cryptocurrency companies) is that it hasn’t published an audited financial statement to support its claims. Dun & Bradstreet claims Nexo makes $417,555 in revenue per year, but this number seems very low compared to unofficial Nexo statistics, which speculate that business is booming for Nexo.

As far as this Nexo review goes, this doesn’t seem like neglect or malice on Nexo’s part– a third party auditing Nexo’s deposits and profits would likely need partial view-only access to BitGo’s vault wallets, which likely aren’t publicized for routine audits for security reasons.

Nexo’s security infrastructure is ISO/IEC 27001:2013 certified, which means the platform has been successfully audited by CISQ, the world’s largest provider of management system certification, and RINA. This audit primarily focuses on security, which is somewhat related to the business metrics Nexo discloses.

Based on our Nexo review, outside of a few peculiarities in reporting, Nexo appears to be a legitimate platform.

CoinCentral readers can get $10 when signing up and depositing $100 or more on Nexo.

Is Nexo Safe?

Nexo faces a multitude of risks unique to cryptocurrency-based projects.

For starters,

- Interest loss in lending in case of a bear market.

- Problems and limitations with withdrawals (Nexo has custody of your funds)

- Inherent risk with stablecoins and the potential loss of their dollar peg, for whatever reason.

- Hacks or otherwise dishonest activity.

However, these are simply blankly stated risks that every cryptocurrency interest account must contend with. To see a full analysis of risks, check out our cryptocurrency interest account guide.

So, can you trust Nexo?

This Nexo review lists the above points for those who tend to distrust as a default– skepticism leads to deep research. Nexo’s unknown profitability carries implications for depositors and NEXO token holders, but the platform has yet to have a significant issue.

Nexo seems like a trustworthy company, but it would greatly benefit from more communications involvement from its leadership.

In contrast, Celsius CEO Alex Mashinsky conducts weekly AMAs, and is effectively putting on a masterclass in leadership involvement and transparency for cryptocurrency interest companies. Signing up for Celsius also gets you $50 in BTC with your first transfer of $400 or more.

How Does Nexo Make Money?

Nexo makes money on the differential between crypto loans and deposits. This is pretty typical for cryptocurrency interest account and lending platforms.

Its cryptocurrency loans may offer rates as low as 5.9%, but those rates may increase in order to pay higher interest to depositors.

For example, suppose we encounter a bull market. Hypothetically, clients would want to borrow more to buy BTC in hopes of benefiting from its rising price. The demand fueled by borrowers would increase interest rates.

- Nexo interest rates

Nexo distributes loans based on cryptocurrency collateral, allowing users to take out a loan by locking some of their coins as collateral. They can unlock their coins once they repay their loan. Let’s say they deposit BTC to take a loan out in USDT. If BTC appreciates, the value of the BTC as collateral increases as well, which increases the loan limit, allowing users to take out a greater loan.

Is Nexo DeFi?

By definition, Nexo is not a DeFi project– it is a centralized platform that retains custody of your digital assets while you use it. In theory, Nexo can hold deposits and limit withdrawals.

Nexo Sign Up Bonus

CoinCentral readers can get $10 when signing up and depositing $100 or more on Nexo.

The following bonuses are also available from competitors.

Celsius: Earn $50 in BTC with your first transfer of $400 or more.

BlockFi: Get up to $250 (starting at $25) in USDC when you open a new BlockFi account with at least $500.

Crypto.com: Get $25 USD as a signup bonus on Crypto.com.

Final Thoughts: Is Nexo Legit and Worth Your Time?

Nexo has a strong presence in the cryptocurrency interest account space. With competitive interest rates for stablecoins, BTC, ETH, other cryptocurrencies, and even fiat, it’s an option worth exploring for those looking to get paid interest on their cryptocurrency. The company has also seen tremendous growth in its userbase, and its token has more than 7xed in price, likely minting a few very wealthy and happy early adopters.

Nexo is a European-based company. As such, our European readers may be more comfortable with Nexo than a United States-based platform. In contrast, U.S. readers may prefer companies that are obligated to operate within U.S. regulations and jurisdictions like BlockFi and Celsius.

However, there is little need for tribalism when it comes to cryptocurrency interest accounts. Readers could benefit from signing up for a multitude of the top interest account providers as a means to diversify away some of the platform risks of using just one.

Our Nexo review comes back positive, but we’d strongly encourage the leadership team to be more active in communicating with the variety of new communities being formed around cryptocurrency interest accounts.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.