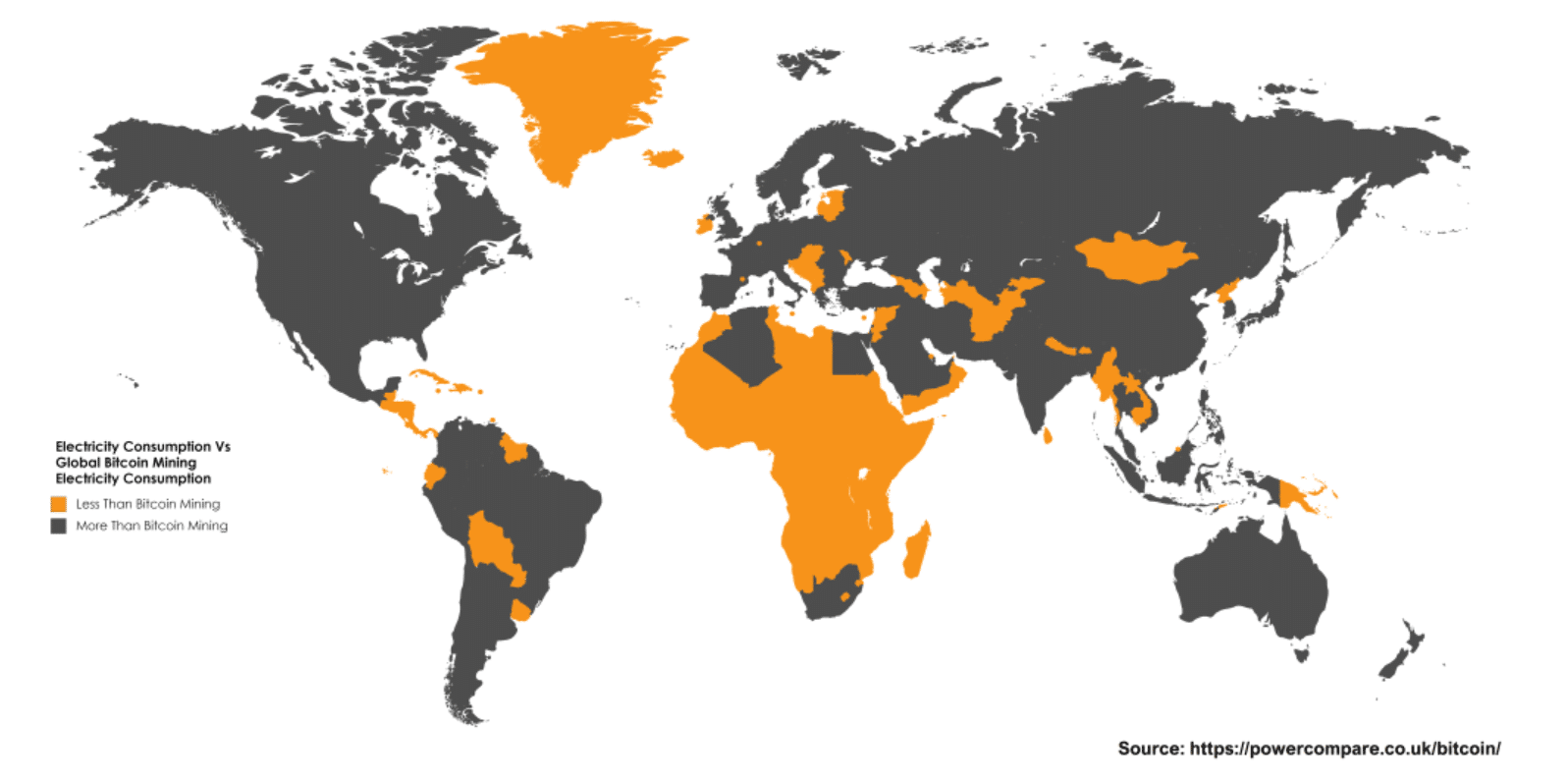

Bitcoin has an energy problem. Thanks to the coin’s proof of work distributed consensus algorithm, Bitcoin mining is creating a massive carbon footprint. Miners use up an estimated 29.05TWh of electricity annually. That’s 0.13% of the world’s annual energy consumption, which is more than 159 countries including nearly all of Africa.

Coupled with the competitive nature of mining, Bitcoin’s exponential growth is largely to blame for this rampant energy consumption. Mainstream public attention and a boom in transaction volume have only exacerbated the problem, as the Bitcoin Energy Consumption Index estimates that mining power expenditures increased by 29.98% from October to November.

At this exponential rate, the cryptocurrency’s meteoric rise has it on pace to consume more energy than the whole of the US by 2019.

The Contributing Factors

In order to properly diagnose the root cause of this energy crisis, we have to dig into the relationship between Bitcoin’s network growth and its mining mechanics.

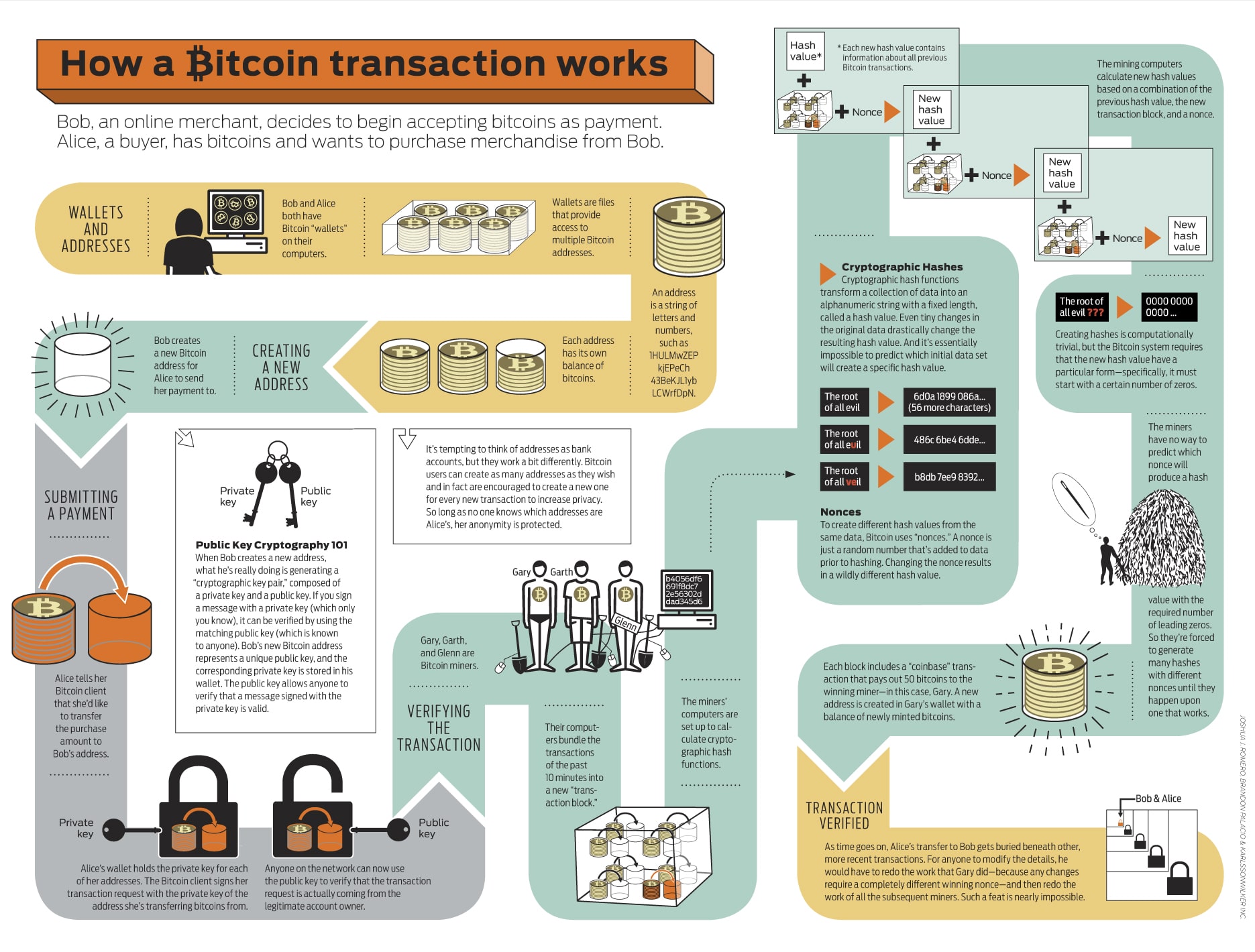

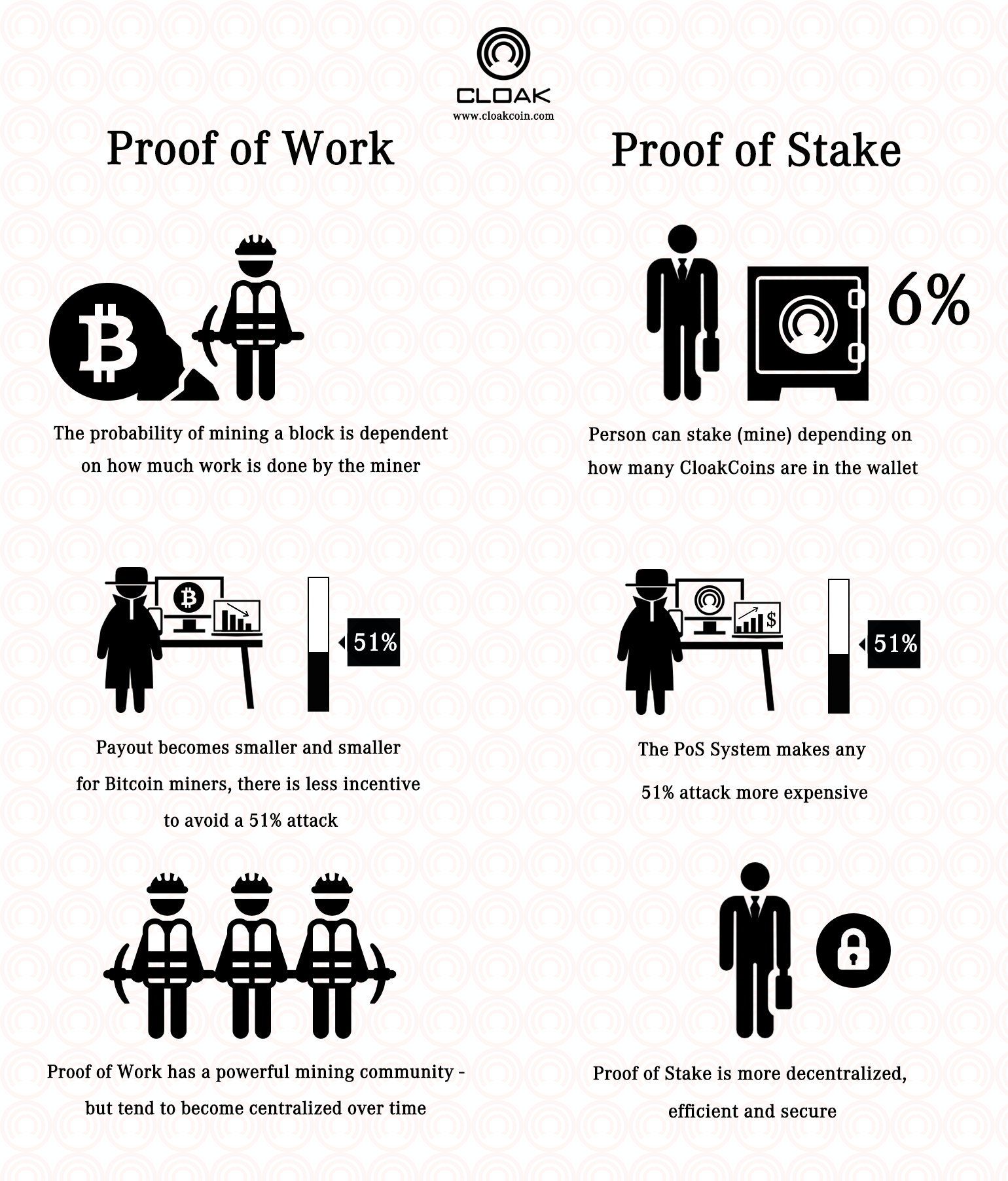

Under Bitcoin’s proof of work model, miners compete with each other to ensure a distributed consensus (the means by which Bitcoin circulates) on the blockchain. Miners commit their computing power to verify the transactions sent through the network.

To do so, the computers solve the encryption puzzles that secure each transaction and, once solved, store them as hashes in the blocks on the public ledger. The first miner to finish the current block receives a block reward in Bitcoin.

As you can see in the image, the competitive nature of proof of work incentivizes miners to commit as much processing power to the blockchain as possible. The more powerful your mining rig, the faster you can solve the transaction encryptions, and the more likely you are to finish a block and receive its rewards.

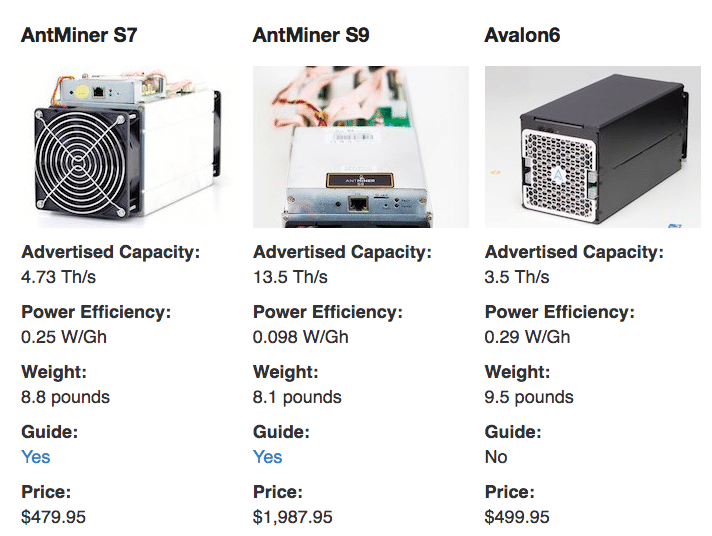

Back in Bitcoin’s infancy, it used to be that you could reliably mine with a graphics card or a run-of-the-mill computer processor. But those days are long gone. As more miners jumped on the Bitcoin gravy train, more sophisticated mining software was developed to give miners an edge. This hardware arms race culminated in application-specific integrated circuit (ASIC) mining. In TLDR terms, ASIC miners are processors that are more efficient and powerful than CPUs or GPUs.

And they left the original mining procedures in the dust. Seriously, if you were trying to compete with ASIC mining rigs using your computer or graphics card, it’d be like trying to win the Monaco Grand Prix with a Vespa.

Even a single ASIC isn’t enough to compete with the big-league mining pools. The biggest mining cooperatives rig up hundreds of ASICs to create massive processor pools. In order to stay competitive with other miners, these pools will add hardware to their rigs’ to increase overall hashing power (output).

You probably see where this is going. Mining rigs obviously require electricity, and the harder they have to work, the more power they consume. As such, proof of work’s competitive incentives invariably lead to an exponential increase in energy consumption.

And this doesn’t even include difficulty increases. Every 2,016 blocks, Bitcoin undergoes a difficulty adjustment. This adjustment is meant to scale block difficulty to match mining hash rates so that no miner solves algorithms too quickly, sucking up all the block rewards in the process. What this means, though, is that the more miners there are on the network, the more difficult it becomes to solve the encrypted algorithms after each adjustment. This would also mean that mining rigs have to work harder to stay competitive, thus consuming even more power.

Starting to get the picture? The more people buy into Bitcoin, the more miners will be attracted to the currency for its valuation. With more miners comes more energy consumption to fuel competition, and with a growing network, each difficulty adjustment will only exacerbate energy consumption by making miners work harder.

Now that we’ve gotten that out of the way, let’s turn this problem on its head and look at a potential solution.

Bitcoin on Proof-of-Stake?

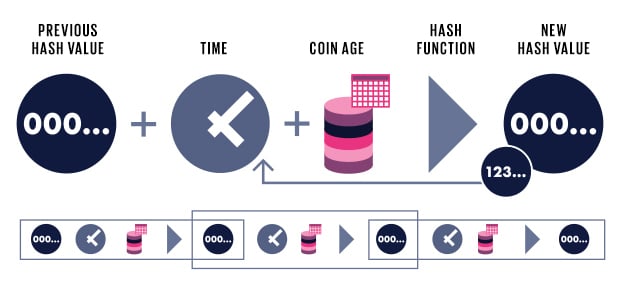

Proof of stake is an alternate algorithm for reaching a blockchain’s distributed consensus. It came onto the scene in 2012, with Peercoin, NXT, and BlackCoin as its primary early adopters.

No miners exist under the proof of stake model. Instead, they are replaced with validators (or forgers) who are in charge of validating transactions. Typically, validators stake a certain amount of proof of stake currency in that blockchain’s core wallet.

That currency’s network may then deterministically select them to construct the next block. The selection mechanism varies by algorithm, as it may be chosen at random or based on a combination of variables, such as total wealth and the amount of time it has been staked.

It’s important to note that proof of stake offers no block rewards, only transaction fees, so theoretically, the model doesn’t engender the same competitive impulse as the proof of work system. While you might receive more frequent selections and greater transaction fees the more you have staked, you aren’t trying to beat anyone to the punch like you would be with Bitcoin.

With proof of stake, you only need enough energy to power a blockchain’s core software. No need to waste energy on an ASIC and a cryptographic hashing program. To return to the racing analogy, it’s akin to being awarded a prize for starting your car instead of using it to race. You wait in line at the starting gate for your participation trophy, and you don’t have to worry about wasting the extra gas to complete the race faster than your fellow competitors.

In a nutshell, proof of stake significantly cuts back on energy use. Not only does it employ a less energy-intensive program, but validators don’t have to up the ante against each other to remain viable as miners do under a proof of work consensus. They don’t receive block rewards, but they also don’t have to face the outrageous energy costs that miners confront. If we weigh proof of stake’s transaction fees without its significant operation costs, it comes out comparable to proof of work’s rewards against its costs, especially for those who can’t maintain expensive mining rigs.

Final Thoughts: Will Bitcoin on Proof of Stake Ever Happen?

In May 2017, Vitalik Buterin unveiled plans to transition the Ethereum blockchain to a proof of stake algorithm called Casper.

Novel at the time, Proof-of-Stake’s launch on the second largest crypto asset was a huge endorsement for the proof-of-stake system; and the ecosystem has largely shifted towards PoS.

Proof of stake may very well be the future for blockchain. Ethereum’s change indicates as much, as Vitalik Buterin sees value in the mechanism’s pros as they capitalize on Bitcoin’s cons.

Bitcoin’s energy crisis is one of the first truly substantial trials facing the cryptocurrency as it marches towards public prominence. Pitfalls and obstacles such as these are to be expected in such a nascent technology, but it’s the responsibility of the community at large to adapt to these tribulations. There’s no reason to think that addressing proof of work’s shortcomings should compromise our belief in Satoshi Nakamoto’s creation–quite the contrary. If we want to see Bitcoin succeed, we must remain vigilant in our criticisms and proactive with our solutions, because as it currently stands, Bitcoin is on track to becoming unsustainable in the near future.

Perhaps proof of stake could avert Bitcoin from self-sabotage. If Ethereum’s algorithm change means anything, it should be a clear signal to the crypto community that proof of work can not persist in its current state.

The question is, will the market adapt?

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.